Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information Prepare the required adjusting journal entry at December 31, 2022, the end of the annual accounting period for the three items below. Assume

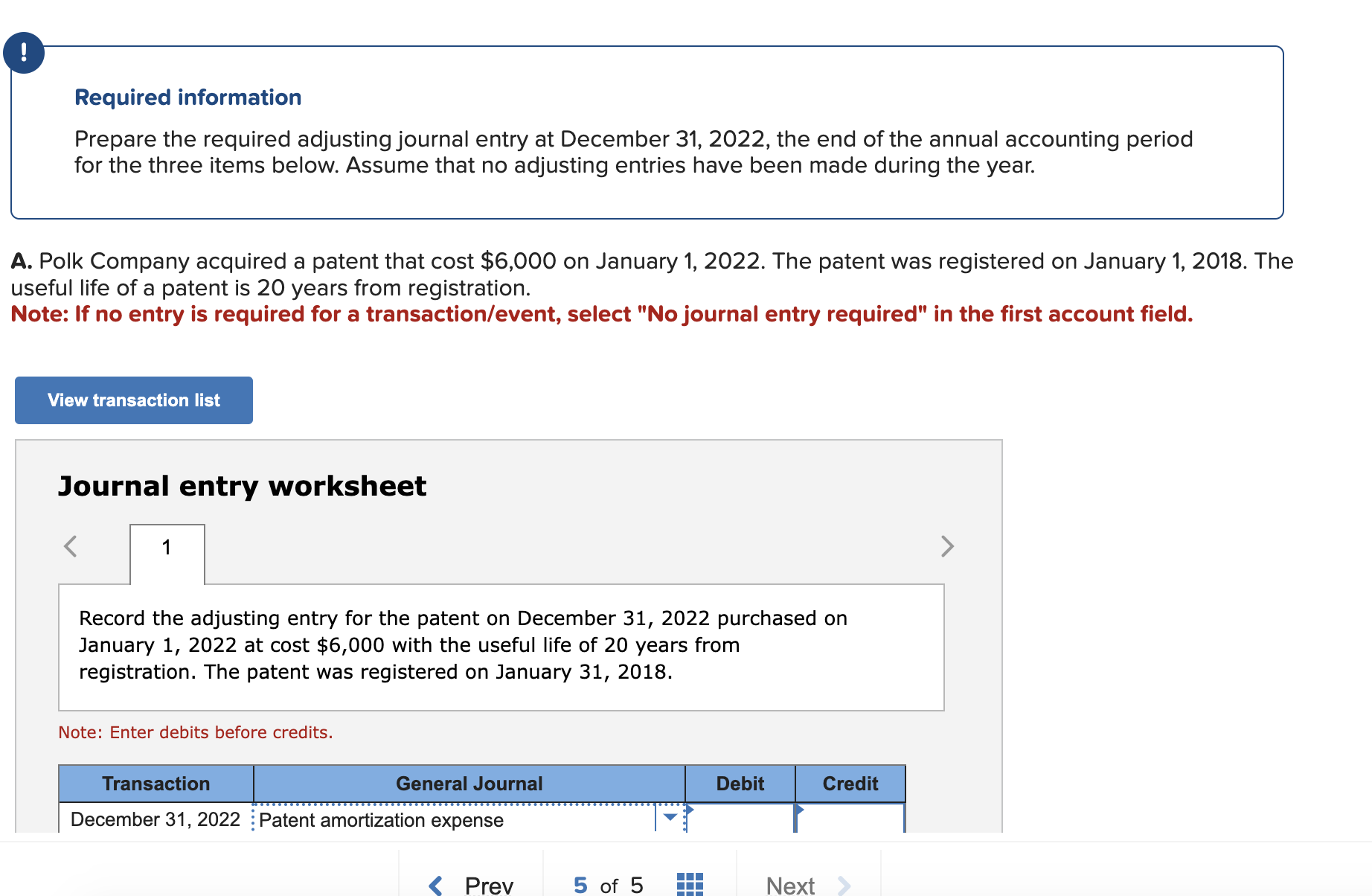

Required information Prepare the required adjusting journal entry at December 31, 2022, the end of the annual accounting period for the three items below. Assume that no adjusting entries have been made during the year. Polk Company acquired a patent that cost $6,000 on January 1, 2022. The patent was registered on January 1,2018 . The useful life of a patent is 20 years from registration. Vote: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the adjusting entry for the patent on December 31, 2022 purchased on January 1, 2022 at cost $6,000 with the useful life of 20 years from registration. The patent was registered on January 31,2018. Note: Enter debits before credits

Required information Prepare the required adjusting journal entry at December 31, 2022, the end of the annual accounting period for the three items below. Assume that no adjusting entries have been made during the year. Polk Company acquired a patent that cost $6,000 on January 1, 2022. The patent was registered on January 1,2018 . The useful life of a patent is 20 years from registration. Vote: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the adjusting entry for the patent on December 31, 2022 purchased on January 1, 2022 at cost $6,000 with the useful life of 20 years from registration. The patent was registered on January 31,2018. Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started