Answered step by step

Verified Expert Solution

Question

1 Approved Answer

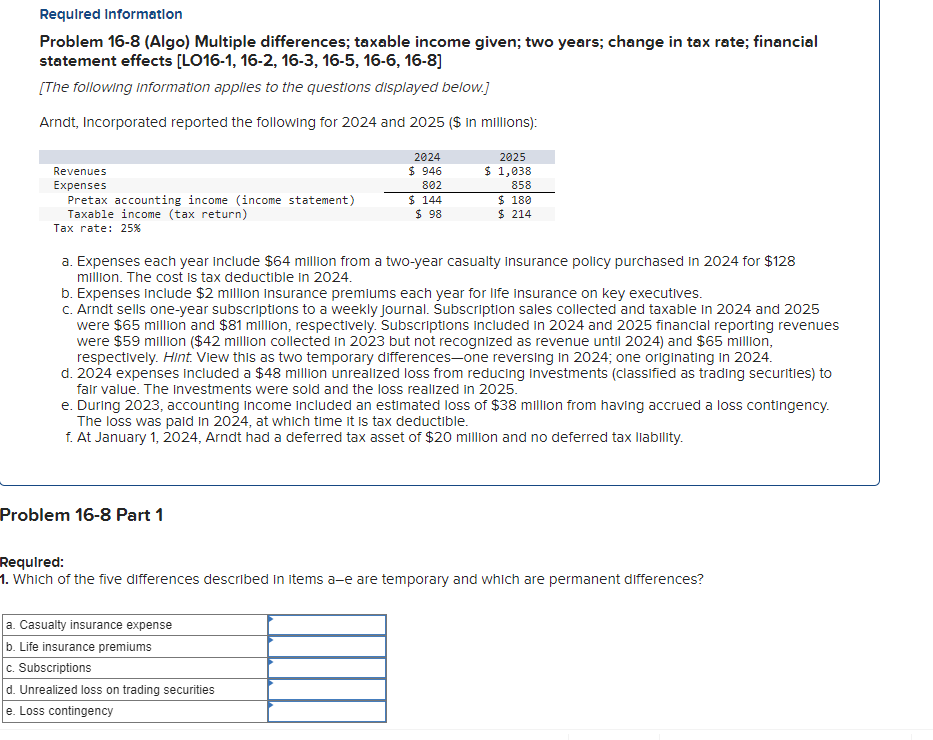

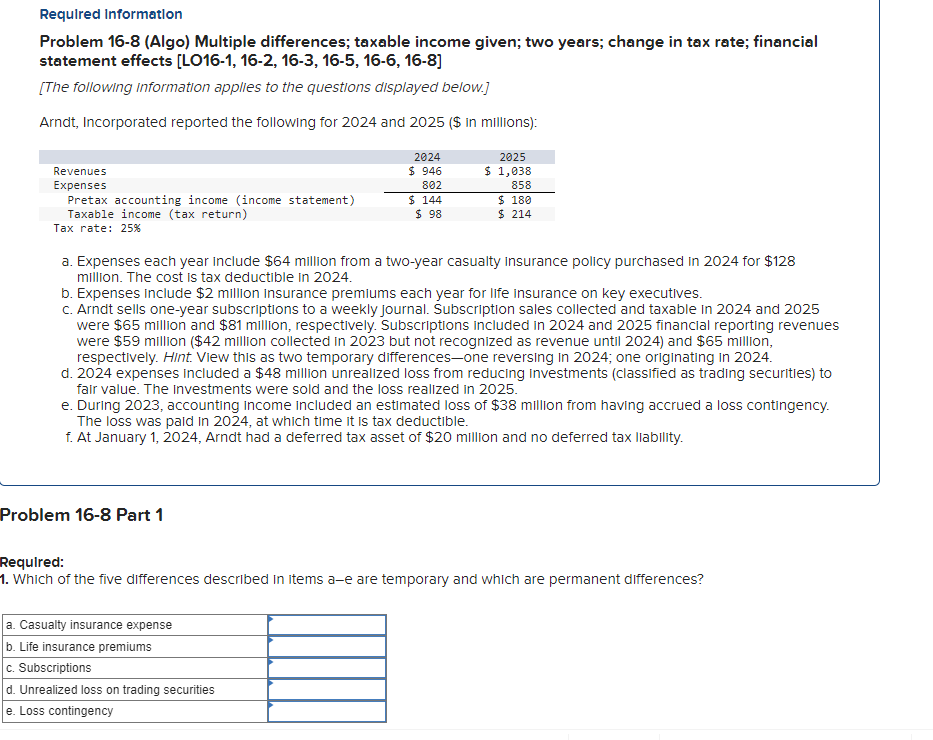

Required Information Problem 1 6 - 8 ( Algo ) Multiple differences; taxable income given; two years; change in tax rate; financial statement effects [

Required Information

Problem Algo Multiple differences; taxable income given; two years; change in tax rate; financial

statement effects LO

The following information applles to the questions displayed below.

Arndt, Incorporated reported the following for and $ in millions:

Tax rate:

a Expenses each year include $ million from a twoyear casualty insurance policy purchased in for $

million. The cost is tax deductible in

b Expenses include $ million Insurance premiums each year for life insurance on key executives.

c Arndt sells oneyear subscriptions to a weekly journal. Subscription sales collected and taxable in and

were $ million and $ million, respectively. Subscriptions included in and financial reporting revenues

were $ million $ million collected in but not recognized as revenue until and $ million,

respectively. HInt. View this as two temporary differencesone reversing in ; one originating in

d expenses included a $ million unrealized loss from reducing investments classified as trading securities to

falr value. The investments were sold and the loss realized in

e During accounting income included an estimated loss of $ million from having accrued a loss contingency.

The loss was paid in at which time it is tax deductible.

f At January Arndt had a deferred tax asset of $ million and no deferred tax liability.

Problem Part

Required:

Which of the five differences described in items ae are temporary and which are permanent differences?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started