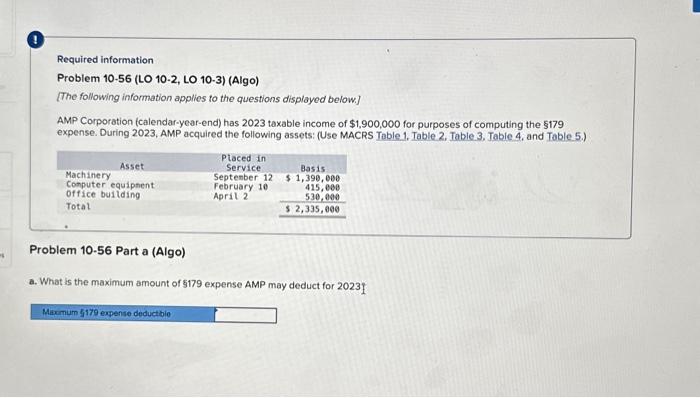

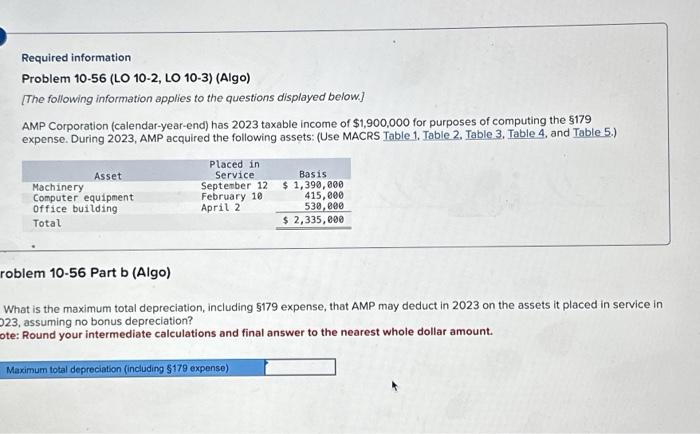

Required information Problem 10-56 (LO 10-2, LO 10-3) (Algo) [The following information applies to the questions displayed below.] AMP Corporation (calendar-year-end) has 2023 taxable income of $1,900,000 for purposes of computing the $179 expense. During 2023, AMP acquired the following assets: (Use MACRS Table 1, Table 2, Table 3. Table 4, and Table 5.) Problem 10.56 Part a (Algo) a. What is the maximum amount of $179 expense AMP may deduct for 20231 Required information Problem 10-56 (LO 10-2, LO 10-3) (Algo) [The following information applies to the questions displayed below.] AMP Corporation (calendar-year-end) has 2023 taxable income of $1,900,000 for purposes of computing the $179 expense. During 2023, AMP acquired the following assets: (Use MACRS Table 1. Table 2. Table 3. Table 4, and Table 5.) oblem 10-56 Part b (Algo) What is the maximum total depreciation, including 5179 expense, that AMP may deduct in 2023 on the assets it placed in service in 23, assuming no bonus depreciation? te: Round your intermediate calculations and final answer to the nearest whole dollar amount. Required information Problem 10-56 (LO 10-2, LO 10-3) (Algo) [The following information applies to the questions displayed below.] AMP Corporation (calendar-year-end) has 2023 taxable income of $1,900,000 for purposes of computing the $179 expense. During 2023, AMP acquired the following assets: (Use MACRS Table 1, Table 2, Table 3. Table 4, and Table 5.) Problem 10.56 Part a (Algo) a. What is the maximum amount of $179 expense AMP may deduct for 20231 Required information Problem 10-56 (LO 10-2, LO 10-3) (Algo) [The following information applies to the questions displayed below.] AMP Corporation (calendar-year-end) has 2023 taxable income of $1,900,000 for purposes of computing the $179 expense. During 2023, AMP acquired the following assets: (Use MACRS Table 1. Table 2. Table 3. Table 4, and Table 5.) oblem 10-56 Part b (Algo) What is the maximum total depreciation, including 5179 expense, that AMP may deduct in 2023 on the assets it placed in service in 23, assuming no bonus depreciation? te: Round your intermediate calculations and final answer to the nearest whole dollar amount