Question

Required information Problem 10-6A Record equity transactions and prepare the stockholders' equity section (LO10-2, 10-3, 10-4, 10-5, 10-7) [The following information applies to the questions

Required information

Problem 10-6A Record equity transactions and prepare the stockholders' equity section (LO10-2, 10-3, 10-4, 10-5, 10-7)

[The following information applies to the questions displayed below.]

Major League Apparel has two classes of stock authorized: 5%, $10 par preferred, and $1 par value common. The following transactions affect stockholders equity during 2021, its first year of operations:

| January | 2 | Issue 100,000 shares of common stock for $58 per share. | ||

| February | 14 | Issue 48,000 shares of preferred stock for $11 per share. | ||

| May | 8 | Purchase 10,000 shares of its own common stock for $48 per share. | ||

| May | 31 | Resell 5,000 shares of treasury stock for $53 per share. | ||

| December | 1 | Declare a cash dividend on its common stock of $0.60 per share and a $24,000 (5% of par value) cash dividend on its preferred stock payable to all stockholders of record on December 15. The dividend is payable on December 30. (Hint: Dividends are not paid on treasury stock.) | ||

| December | 30 | Pay the cash dividends declared on December 1. |

Problem 10-6A Part 2

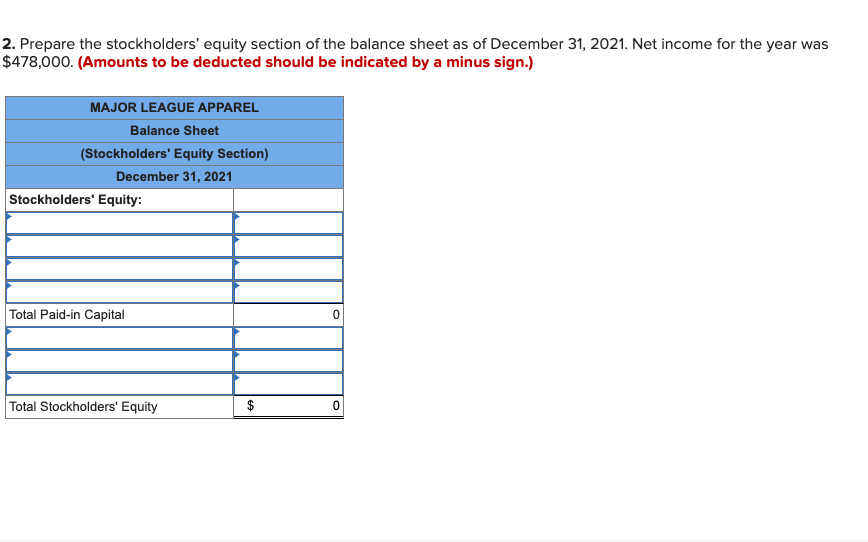

2. Prepare the stockholders equity section of the balance sheet as of December 31, 2021. Net income for the year was $478,000. (Amounts to be deducted should be indicated by a minus sign.)

2. Prepare the stockholders' equity section of the balance sheet as of December 31, 2021. Net income for the year was $478,000. (Amounts to be deducted should be indicated by a minus sign.) MAJOR LEAGUE APPAREL Balance Sheet (Stockholders' Equity Section) December 31, 2021 Stockholders' Equity: Total Paid-in Capital Total Stockholders' Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started