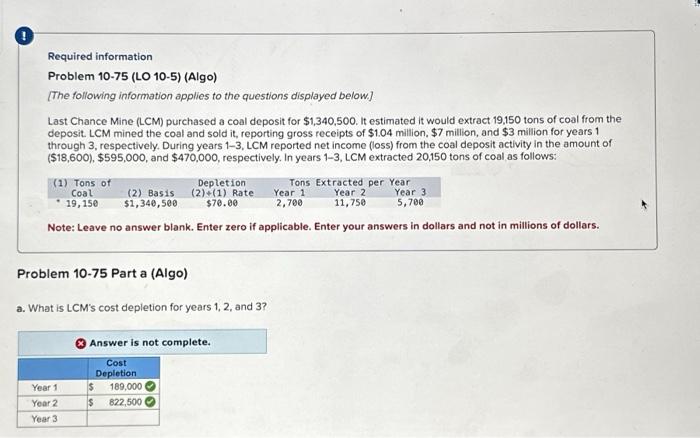

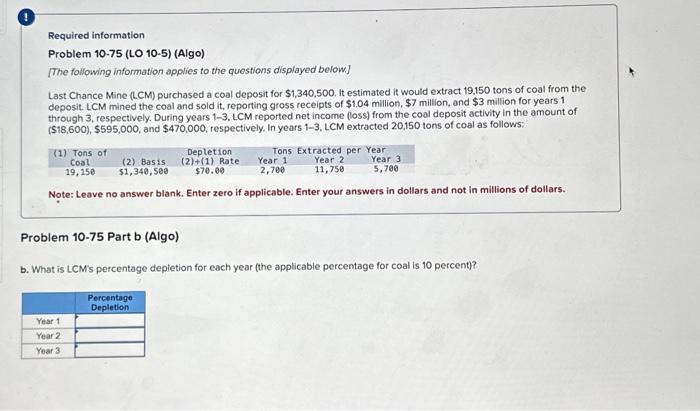

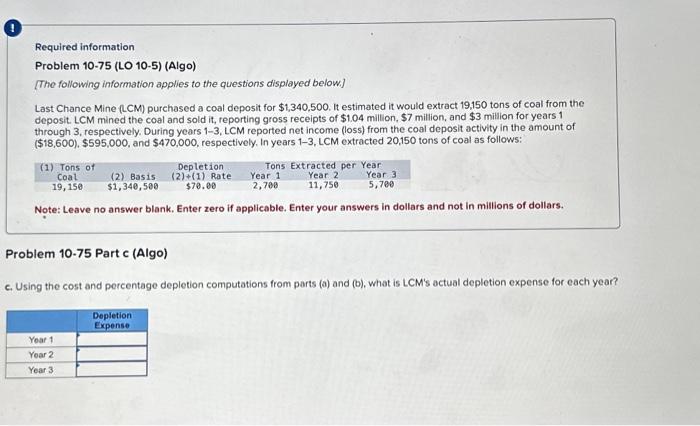

Required information Problem 10-75 (LO 10-5) (Algo) [The following information applies to the questions displayed below] Last Chance Mine (LCM) purchased a coal deposit for $1,340,500. It estimated it would extract 19,150 tons of coal from the deposit. LCM mined the coal and sold it, reporting gross receipts of $1.04 million, $7 million, and $3 million for years 1 through 3, respectively. During years 13, LCM reported net income (loss) from the coal deposit activity in the amount of ($18,600),$595,000, and $470,000, respectively. In years 13, LCM extracted 20,150 tons of coal as follows: Note: Leave no answer blank. Enter zero if applicable. Enter your answers in dollars and not in millions of dollars. Problem 10-75 Part b (Algo) b. What is LCM's percentage depletion for each year (the applicable percentage for coal is 10 percent)? Problem 10-75 (LO 10-5) (Algo) [The following information applies to the questions displayed below] Last Chance Mine (LCM) purchased a coal deposit for $1,340,500. It estimated it would extract 19,150 tons of coal from the deposit. LCM mined the coal and sold it, reporting gross receipts of $1.04 million, \$7 million, and $3 million for years 1 through 3, respectively. During years 13, LCM reported net income (loss) from the coal deposit activity in the amount of ($18,600),$595,000, and $470,000, respectively. In years 13, LCM extracted 20,150 tons of coal as follows: Note: Leave no answer blank. Enter zero if applicable. Enter your answers in dollars and not in millions of dollars. Problem 10-75 Part a (Algo) a. What is LCM's cost depletion for years 1,2 , and 3 ? Required information Problem 10-75 (LO 10-5) (Algo) [The following information applies to the questions displayed below] Last Chance Mine (LCM) purchased a coal deposit for $1,340,500. It estimated it would extract 19,150 tons of coal from the deposit. LCM mined the coal and sold it, reporting gross receipts of $1.04million,$7 million, and $3 million for years 1 through 3, respectively. During years 13, LCM reported net income (loss) from the coal deposit activity in the amount of ($18,600),$595,000, and $470,000, respectively, In years 13, LCM extracted 20,150 tons of coal as follows: Note: Leave no answer blank. Enter zero if applicable. Enter your answers in dollars and not in millions of dollars. roblem 10-75 Part c (Algo) Using the cost and percentage depletion computations from parts (a) and (b), what is LCM's actual depletion expense for each year