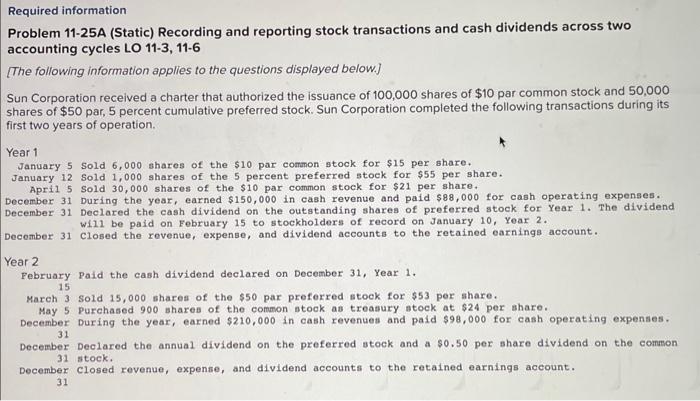

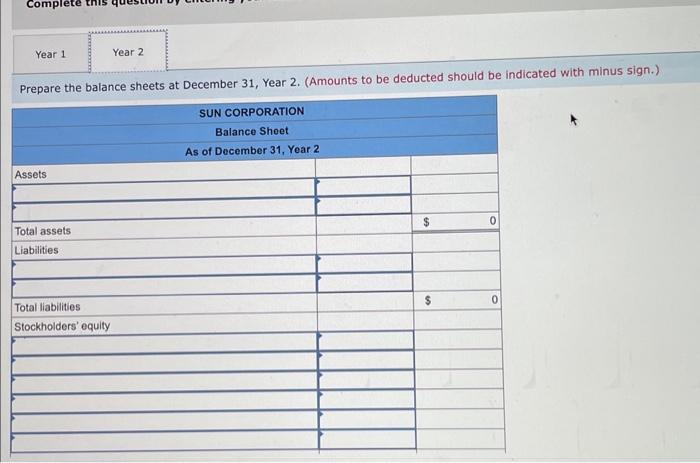

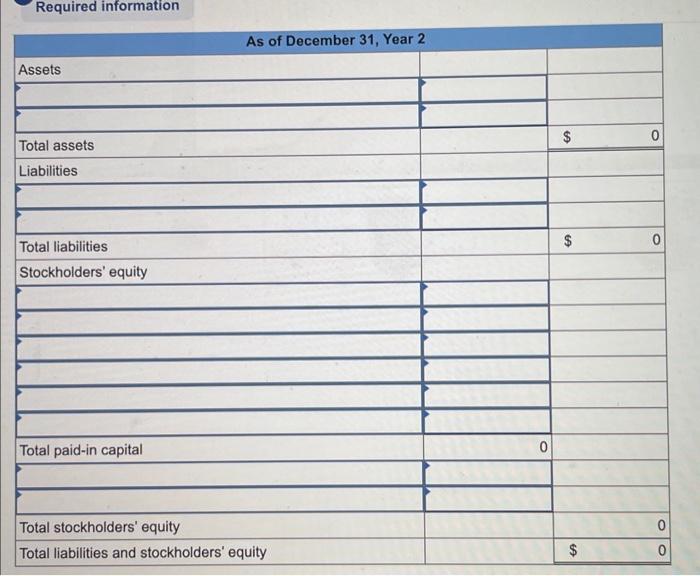

Required information Problem 11-25A (Static) Recording and reporting stock transactions and cash dividends across two accounting cycles LO 11-3, 11-6 [The following information applies to the questions displayed below.] Sun Corporation received a charter that authorized the issuance of 100,000 shares of $10 par common stock and 50,000 shares of $50 par, 5 percent cumulative preferred stock. Sun Corporation completed the following transactions during its first two years of operation. Year 1 January 5 Sold 6,000 shares of the $10 par common stock for $15 per share. January 12 Sold 1,000 shares of the 5 percent preferred stock for $55 per share. April 5 Sold 30,000 shares of the $10 par common stock for $21 per share. Docember 31 During the year, earned $150,000 in cash revenue and paid $88,000 for cash operating expenses. December 31 Declared the cash dividend on the outstanding shares of preferred stock for Year 1 . The dividend will be paid on February 15 to stockholders of record on January 10 , Year 2 . Decomber 31 closed the revenue, expense, and dividend accounts to the retained earnings account. Year 2 February Paid the cash dividend declared on December 31 , Year 1. Mareh 3 sold 15,000 shares of the $50 par preferred stook for $53 per share. May 5 purchased 900 shares of the common stock as treasury stock at $24 per share. December During the year, earned $210,000 in cash revenues and paid $98,000 for cash operating expenses. 31 December Declared the annual dividend on the preferred stock and a $0.50 per share dividend on the common 31 stock. December closed revenue, expense, and dividend accounts to the retained earnings account. 31 Prepare the balance sheets at December 31 , Year 2. (Amounts to be deducted should be indicated with minus sign.) Required information Required information Problem 11-25A (Static) Recording and reporting stock transactions and cash dividends across two accounting cycles LO 11-3, 11-6 [The following information applies to the questions displayed below.] Sun Corporation received a charter that authorized the issuance of 100,000 shares of $10 par common stock and 50,000 shares of $50 par, 5 percent cumulative preferred stock. Sun Corporation completed the following transactions during its first two years of operation. Year 1 January 5 Sold 6,000 shares of the $10 par common stock for $15 per share. January 12 Sold 1,000 shares of the 5 percent preferred stock for $55 per share. April 5 Sold 30,000 shares of the $10 par common stock for $21 per share. Docember 31 During the year, earned $150,000 in cash revenue and paid $88,000 for cash operating expenses. December 31 Declared the cash dividend on the outstanding shares of preferred stock for Year 1 . The dividend will be paid on February 15 to stockholders of record on January 10 , Year 2 . Decomber 31 closed the revenue, expense, and dividend accounts to the retained earnings account. Year 2 February Paid the cash dividend declared on December 31 , Year 1. Mareh 3 sold 15,000 shares of the $50 par preferred stook for $53 per share. May 5 purchased 900 shares of the common stock as treasury stock at $24 per share. December During the year, earned $210,000 in cash revenues and paid $98,000 for cash operating expenses. 31 December Declared the annual dividend on the preferred stock and a $0.50 per share dividend on the common 31 stock. December closed revenue, expense, and dividend accounts to the retained earnings account. 31 Prepare the balance sheets at December 31 , Year 2. (Amounts to be deducted should be indicated with minus sign.) Required information