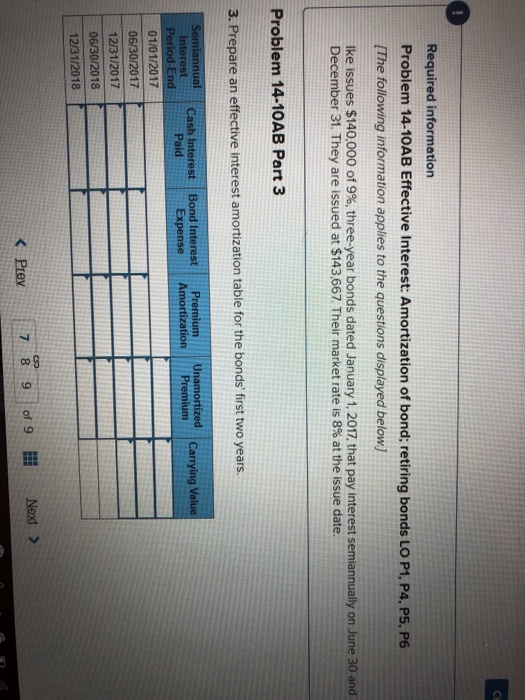

Required information Problem 14-10AB Effective Interest: Amortization of bond; retiring bonds LO P1, P4, P5, P6 [The following information applies to the questions displayed belowj Ike issues $140,000 of 9%, three-year bonds dated January 1, 2017, that pay interest semiannually on June 30 and December 31. They are issued at $143,667. Their market rate is 8% at the issue date. Problem 14-10AB Part 3 3. Prepare an effective interest amortization table for the bonds' first two years. Cash Interest Bond Interest Premium Unamortized Carrving Value Expense Amortization Premium Paid Period-End 01/01/2017 06/30/2017 12/31/2017 06/30/2018 12/31/2018

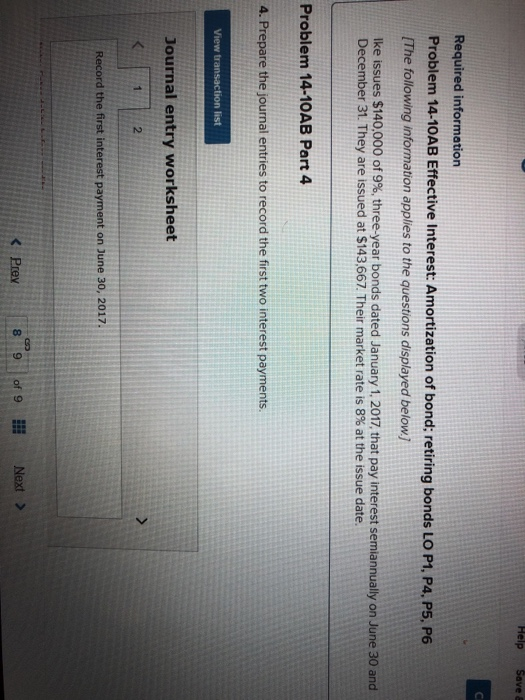

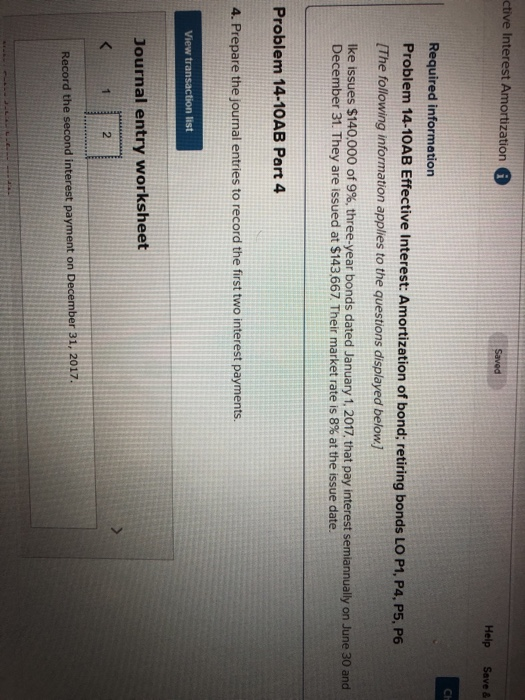

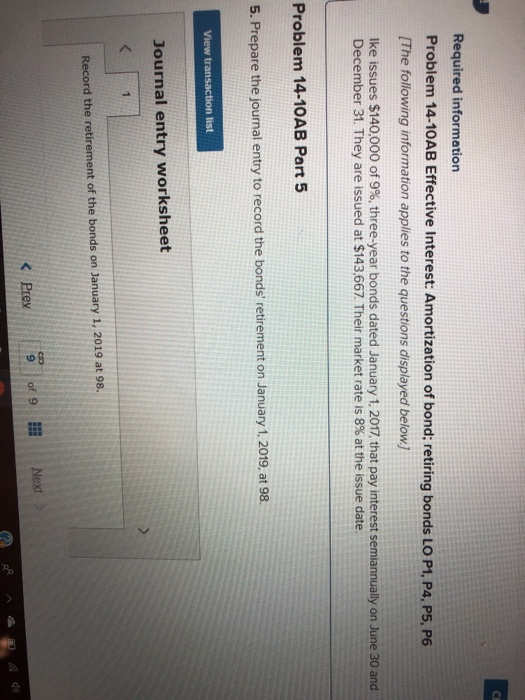

Required information Problem 14-10AB Effective Interest: Amortization of bond; retiring bonds LO P1, P4, P5, P6 The following information applies to the questions displayed below Ike issues $140,000 of 9%, three-year bonds dated January 1, 2017, that pay interest semiannually on June 30 and December 31, They are issued at $143,667. Their market rate is 8% at the issue date. Problem 14-10AB Part 4 4. Prepare the journal entries to record the first two interest payments. Journal entry worksheet 2 Record the first interest payment on June 30, 2017. K Prey 8 9 | of 9 ll Next > ctive Interest Amortization Help Save& Ch Required information Problem 14-10AB Effective Interest: Amortization of bond; retir The following information applies to the questions displayed below] Ike issues $140,000 of 9%, three-year bonds dated January 1, 2017, that pay interest semiannually on June 30 and ing bonds LO P1, P4, P5, P6 December 31. They are issued at $143,667 Their market rate is 8% at the issue date. Problem 14-10AB Part 4 4. Prepare the journal entries to record the first two interest payments. Journal entry worksheet erest payment on ber 31, 2017 Required information Problem 14-10AB Effective Interest: Amortization of bond; retiring bonds LO P1, P4, P5, P6 IThe following information applies to the questions displayed below) Ike issues $140,000 of 9%, three-year bonds dated January 1, 2017, that pay interest semiannually on June 30 and December 31, They are issued at $143,667 Their market rate is 8% at the issue date. Problem 14-10AB Part 5 5. Prepare the journal entry to record the bonds' retirement on January 1,2019, at 98. View transaction list Journal entry worksheet Record the retirement of the bonds on January 1, 2019 at 98. K Prev9 of 9 Next do