Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information Problem 15-63 (LO 15-3) (Static) [The following information applies to the questions displayed below.] Haruki and Bob have owned and operated SOA

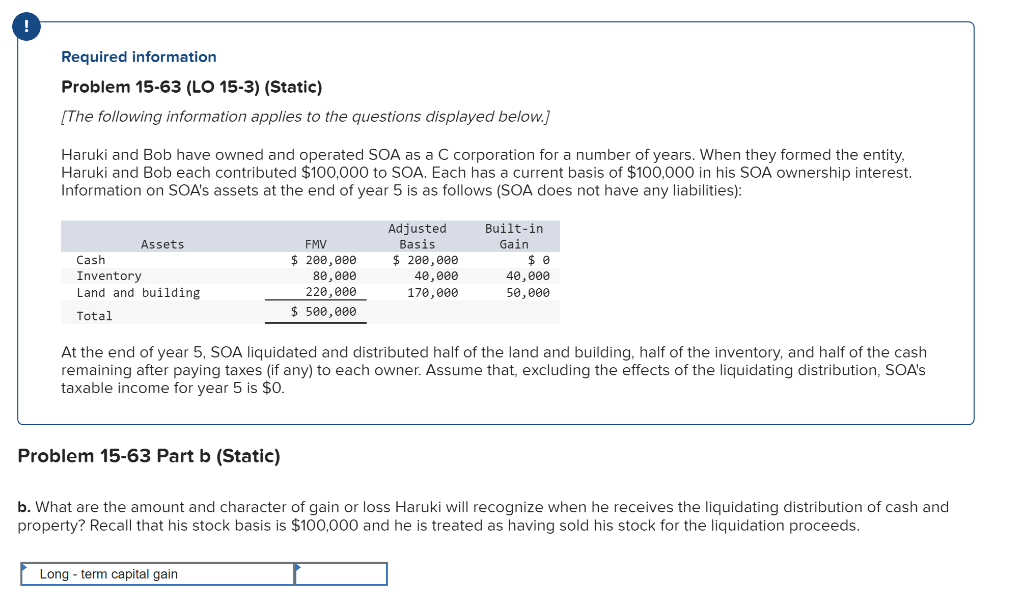

Required information Problem 15-63 (LO 15-3) (Static) [The following information applies to the questions displayed below.] Haruki and Bob have owned and operated SOA as a C corporation for a number of years. When they formed the entity, Haruki and Bob each contributed $100,000 to SOA. Each has a current basis of $100,000 in his SOA ownership interest. Information on SOA's assets at the end of year 5 is as follows (SOA does not have any liabilities): Cash Inventory Assets Land and building Total FMV $ 200,000 80,000 220,000 $ 500,000 Adjusted Basis Built-in Gain $ 200,000 40,000 170,000 $ 0 40,000 50,000 At the end of year 5, SOA liquidated and distributed half of the land and building, half of the inventory, and half of the cash remaining after paying taxes (if any) to each owner. Assume that, excluding the effects of the liquidating distribution, SOA's taxable income for year 5 is $0. Problem 15-63 Part b (Static) b. What are the amount and character of gain or loss Haruki will recognize when he receives the liquidating distribution of cash and property? Recall that his stock basis is $100,000 and he is treated as having sold his stock for the liquidation proceeds. Long-term capital gain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started