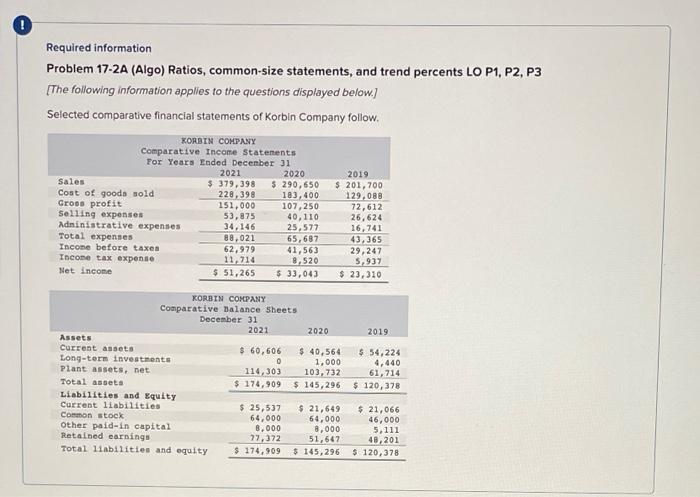

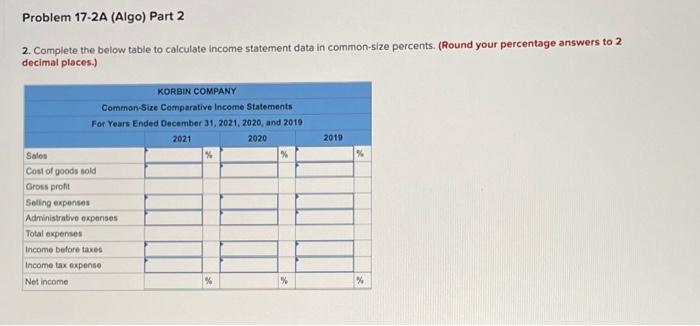

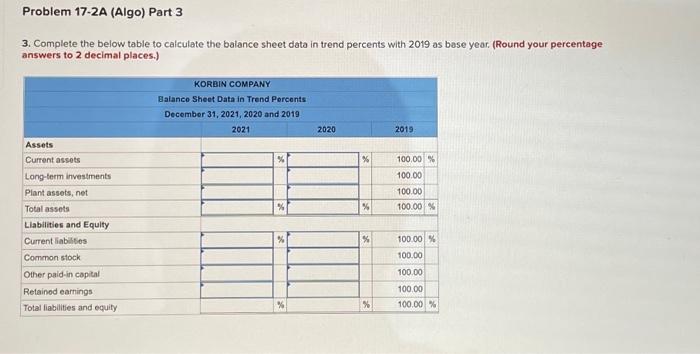

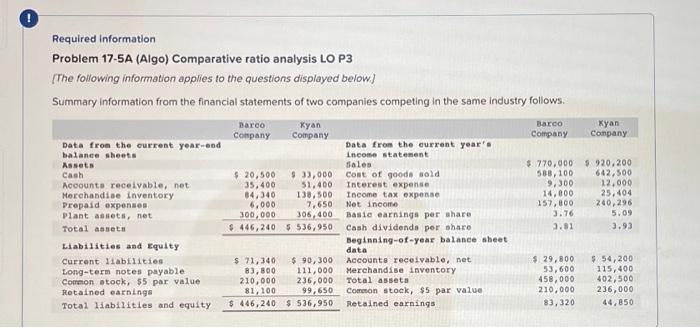

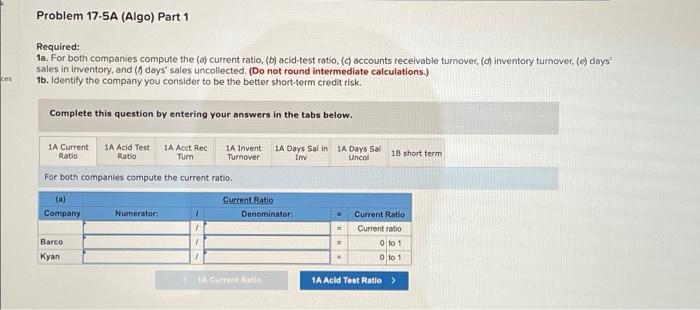

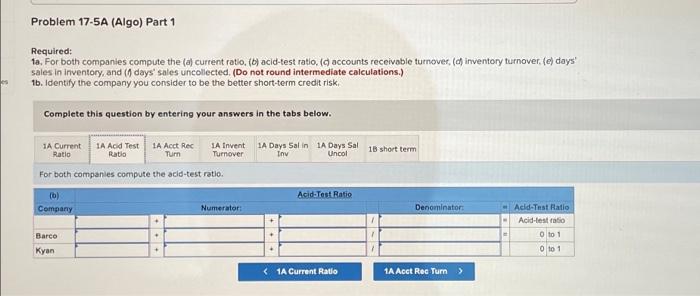

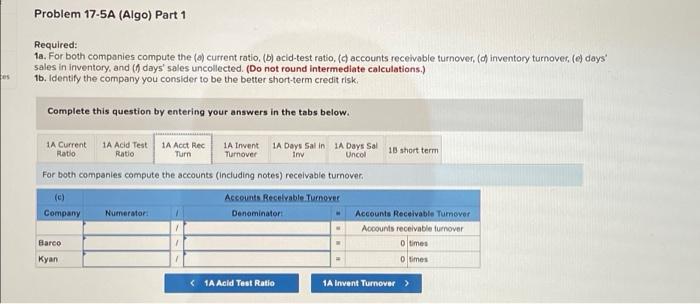

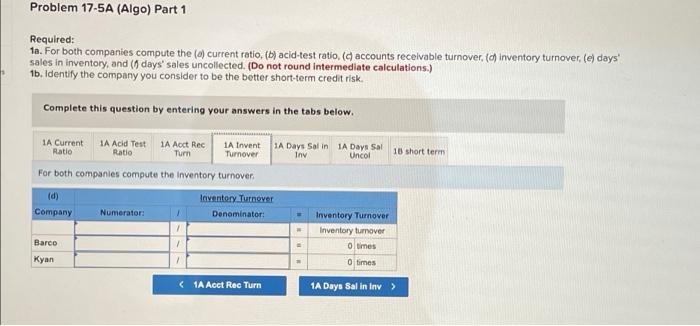

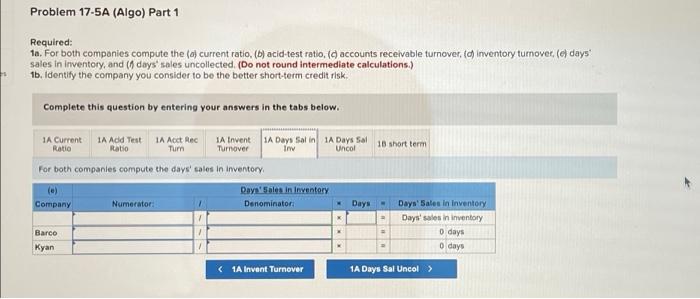

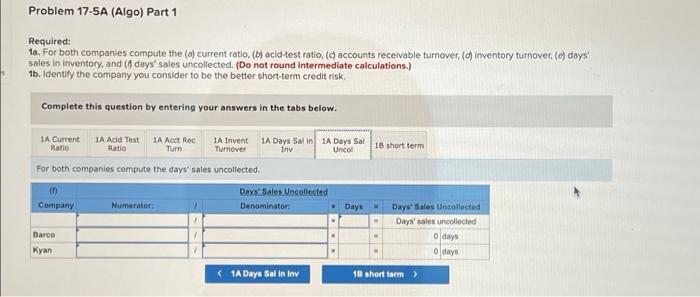

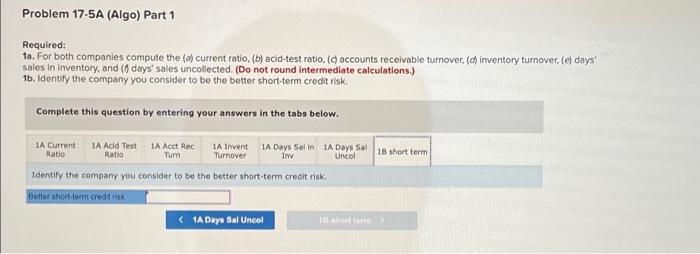

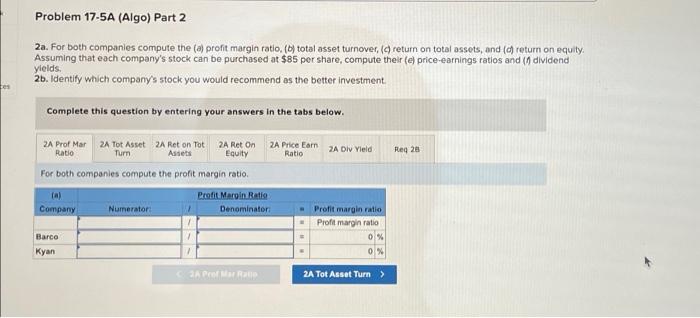

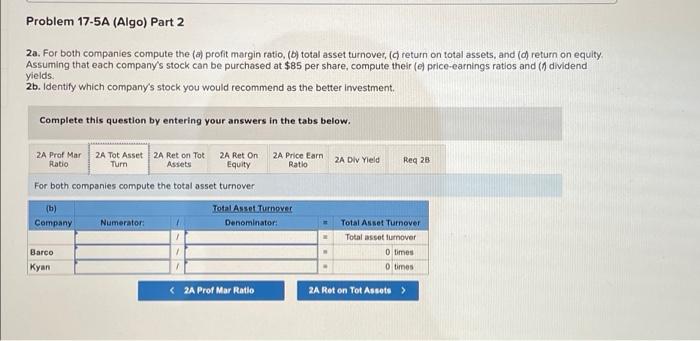

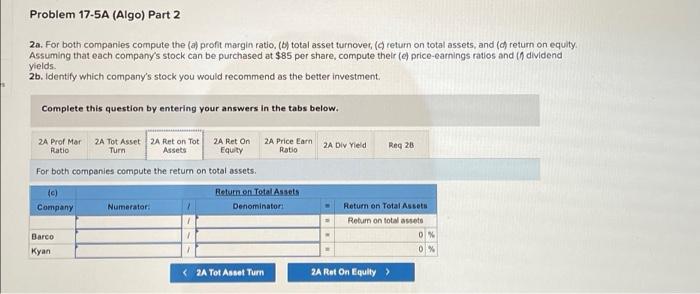

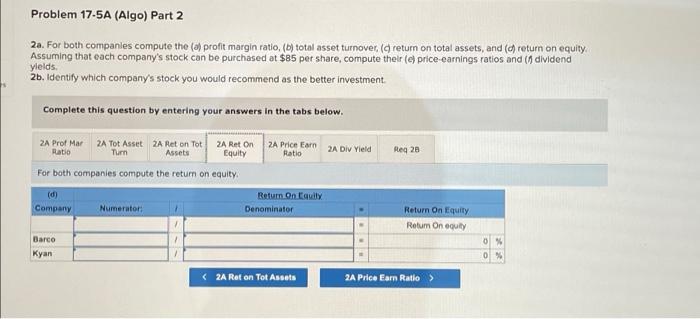

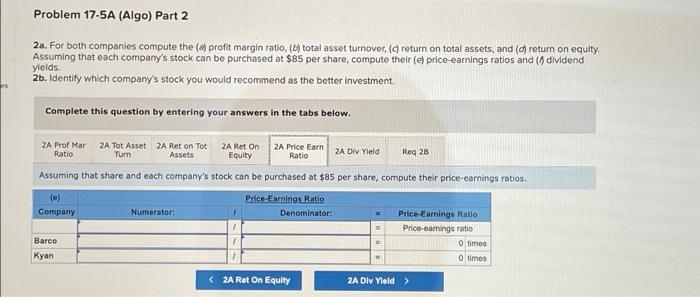

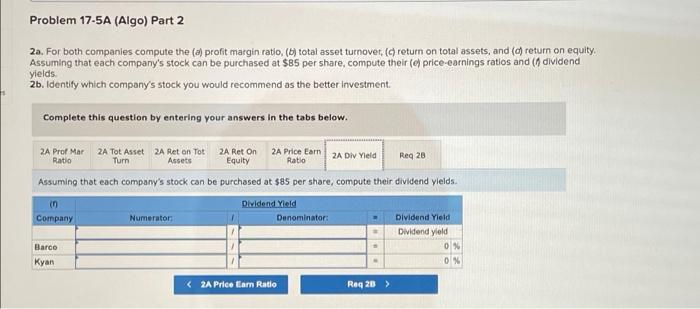

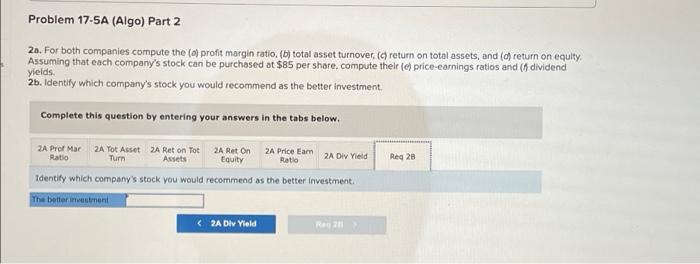

! Required information Problem 17-2A (Algo) Ratios, common-size statements, and trend percents LO P1, P2, P3 [The following information applies to the questions displayed below.) Selected comparative financial statements of Korbin Company follow, KORBIN COMPANY Comparative Income Statenents For Years Ended December 31 2021 2020 2019 Sales $ 379,398 $ 290,650 $ 201,700 Cost of goods sold 228.398 183,400 129.088 Gross profit 151,000 107,250 72,612 Selling expenses 53,875 40,110 26.624 Administrative expenses 34,146 25,577 16,741 Total expenses 88,021 65,687 43.365 Income before taxes 62,979 41,563 29,247 Income tax expense 11,714 8,520 5,937 Net Income $ 51,265 $ 33,043 $ 23,310 KORBIN COMPANY Comparative Balance Sheets December 31 2021 2020 2019 Assets Current assets $ 60,606 $ 40,564 $ 54,224 Long-term investments 0 1,000 4,440 Plant assets. net 114,303 103,732 61,714 Total assets $ 174,909 $ 145,296 $ 120,378 Liabilities and Equity Current liabilities $ 25,537 $ 21,649 $ 21,066 Common stock 64,000 64,000 46,000 Other paid-in capital 8.000 8,000 5,111 Retained earnings 77,372 51,647 48,201 Total liabilities and equity $ 174,909 $ 145,296 $ 120,378 Problem 17-2A (Algo) Part 2 2. Complete the below table to calculate income statement data in common-size percents. (Round your percentage answers to 2 decimal places.) 2010 Sales % KORBIN COMPANY Common-Size Comparative Income Statements For Years Ended December 31, 2021, 2020, and 2010 2021 2020 % Cost of goods sold Gross profit Seling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income % % % Problem 17-2A (Algo) Part 3 3. Complete the below table to calculate the balance sheet data in trend percents with 2019 as bese year. (Round your percentage answers to 2 decimal places.) KORBIN COMPANY Balance Sheet Data in Trend Percents December 31, 2021, 2020 and 2019 2021 2020 2019 % % 100,00 % 100.00 100.00 100.00 % % % Assets Current assets Long-term investments Plant assets, net Total assets Liabilities and Equity Current liabilities Common stock Other paid in capital Retained earnings Total liabilities and equity % 100.00% 100.00 100.00 100.00 100,00 % % % O Required Information Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below) Summary Information from the financial statements of two companies competing in the same Industry follows. Barco Kyan Barco kyan Company Company Company Company Data from the current year-end Data from the current year'. balance sheets Income statement Assets Sales $ 770,000 $920,200 Cash $ 20,500 $ 33,000 Cost of goods sold 588,100 642,500 Accounts receivable, net 35.400 51,400 Interest expense 9.300 12.000 Merchandise inventory 84,340 138,500 Income tax expense 14,000 25,404 Prepaid expenses 6,000 7,650 Net income 157,800 240,296 Plant assets, net 300,000 306,400 Basie earnings per share 3.76 5.09 Total assets $ 446,240 5 536,950 Cash dividende per share 3.81 3.93 Liabilities and Equity Beginning-of-year balance sheet data Current liabilities $ 71,340 $ 90,300 Accounts receivable, net $ 29,800 $ 54,200 Long-term notes payable 83,800 111,000 Merchandise inventory 53,600 115,400 Common stock, 55 par value 210,000 236,000 Total assets 458,000 402, 500 Retained earnings 81.100 99,650 Common stock, $5 par value 210,000 236,000 Total liabilities and equity $ 446,240 $ 536,950 Retained earnings 83,320 44,850 Problem 17-5A (Algo) Part 1 Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio. (c) accounts receivable turnover, (d) Inventory turnover. (e) days! sales in inventory, and (7 days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk. ces Complete this question by entering your answers in the tabs below. 1A Current Ratio 1A Acid Test 1A Acct Rec Ratio Turn 1A Invent 1 Days Salin 1A Days Sal Turnover Inv Uncol 18 short term For both companies compute the current ratio. (a) Company Current Ratio Denominator Numerator Current Ratio Current ratio 0 to 1 oto 1 Barco Kyan 1 Current to 1A Acid Test Ratio > Problem 17-5A (Algo) Part 1 Required: 1a. For both companies compute the (a) current ratio. (b) acid-test ratio, ( accounts receivable turnover, (d) inventory turnover, (e) days! sales in inventory, and (1 days sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. 1A Current Ratio 1A Acd Test 1A Acct Rec Ratio Turn 1A Invent Turnover 1A Days Salin A Days Sal 10 short term Uncol For both companies compute the add-test ratio. Acid-Tost Ratio (6) Company Numerator Denominator . Acid-Test Ratio Acid-test ratio Oto 1 0101 Barco Kyan Problem 17-5A (Algo) Part 1 Required: 1a. For both companies compute the (a) current ratio. (b) acid-test ratio, (accounts receivable turnover, (d) inventory turnover (@days sales in inventory, and (1 days' sales uncollected. (Do not round Intermediate calculations.) 16. Identify the company you consider to be the better short-term credit risk, Fes Complete this question by entering your answers in the tabs below. 1A Current 1A Acid Test 1A Act Rec 1A Invent 1A Days Salin 1A Days Sal Ratio Ratio Turn Turnover Inv Uncol 10 short term For both companies compute the accounts (including notes) receivable turnover (c) Accounts Receivable Tumore Company Numeratori Denominator Accounts Receivable Tumover Accounts receivable turnover Barco O times Kyan O times Problem 17-5A (Algo) Part 1 Required: 1a. For both companies compute the (m) current ratio, (b) acid-test ratio ( accounts receivable turnover (c) Inventory turnover (e) days' sales in inventory, and (days' sales uncollected. (Do not round Intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. 1A Current Ratio 1A Acid Test Ratio 1A Act Rec Turn 1A Invent Turnover 1A Days Sal in 1A Days Sal Inv Uncol 10 short term For both companies compute the inventory turnover (d) Company Inventory Turnover Denominator: Numerator Inventory Turnover Inventory tumover o times O times Barco Kyan 1 1 Problem 17-5A (Algo) Part Required: 1a. For both companies compute the(a) current ratio, (b) acid-test ratio, (accounts receivable turnover, (d) inventory turnover, (c) days sales in inventory, and (days' sales uncollected. (Do not round intermediate calculations.) 15. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. 1A Current 14 Add Test 11 Aoct Rec 1A tevent 1A Days Salin 11 Days Sal Ratio Ratio Tum Turnover Inv Uncol 10 short term For both companies compute the days' sales In Inventory (e) Days Sales In Inventory Company Numerator: Denominator Days - Days' Sales In Inventory Days' sales in inventory Barco o days Kyan o days Problem 17-5A (Algo) Part 1 Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (accounts receivable turnover, (a) inventory turnover (c) days' sales in Inventory, and (days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk Complete this question by entering your answers in the tabs below. 1A Current 1A Acid Test 1A Acct Rec 1A Invent 1A Days Salin 1A Days Sal 18 short term Ratio Ratio Turn Turnover Inv Uncol For both companies compute the days' sales uncollected. Das Soles Uncollected Company Numerator Denominator Days Days' Sales Uncollected Days salos un collected Barco 1 o days Kyan 7 O days Problem 17-5A (Algo) Part 1 Required: 1a. For both companies compute the (8) current ratio. (b) acid-test ratio, (coccounts receiveble turnover (ch inventory turnover (e days! sales in Inventory, and (days' sales uncollected. (Do not round Intermediate calculations.) 15. Identify the company you consider to be the better short-term credit risk Complete this question by entering your answers in the tabs below. 1A Current 1A Acid Test 1A Acct Rec IA trivent A Days Salin 1A Days Sat 10 short term Ratio Ratio Turn Turnover Inv Uncol Identify the company you consider to be the better short-term credit risk Better short term credit risk Problem 17-5A (Algo) Part 2 2a. For both companies compute the (a) profit margin ratio, (b) total asset turnover, () return on total assets, and (c) return on equity Assuming that each company's stock can be purchased at $85 per share, compute their (el price-earnings ratios and (y dividend yields. 2b. Identify which company's stock you would recommend as the better Investment. Complete this question by entering your answers in the tabs below. 2A Prof Mar 2A Tot Asset 2A Ret on Tot 2A Ret On A Price Earn ZA DIV Yield Reg 28 Ratio Turn Assets Equity Ratio For both companies compute the total asset turnover (b) Total Asset Turnover Company Numerator: Denominator: Total Asset Turnover Total asset turnover Barco O times Kyan O times 2A Prof Mar Ratio 2A Rot on TotAssets > Problem 17-5A (Algo) Part 2 2a. For both companies compute the (a) profit margin ratio. (b) total asset turnover (dreturn on total assets, and (c) return on equity Assuming that each company's stock can be purchased at $85 per share, compute their (el price-earnings ratios and in dividend yields. 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below. 2A Prof Mar 2A Tot Asset 2A Reton Tot 2A Ret On 2A Price Earn 2A DIV Yield Ratio Turn Assets Equity Ratio Reg 28 For both companies compute the return on total assets, (c) Return on Total Assets Company Numerator Denominator Return on Total Assets Return on totalets Barco 0 Kyan 0 % Problem 17-5A (Algo) Part 2 2a. For both companies compute the (a) profit margin ratio, (b) total asset turnover (return on total assets, and (return on equity Assuming that each company's stock can be purchased at $85 per share, compute their (c) price earnings ratios and ( dividend yields 2b. Identity which company's stock you would recommend as the better investment Complete this question by entering your answers in the tabs below. 2A Price Earn 2A DIV Yield Reg 20 2A Prof Mar 2A Tot Asset 2A Reton Tot 2A Ret On Ratio Turn Assets Equity Ratio For both companies compute the return on equity (d) Return On Cauly Company Numerator Denominator Return On Equity Return On equity Barco Kyan 1 0 % 0 % Problem 17-5A (Algo) Part 2 2a. For both companies compute the profit margin ratio. (b) total asset turnover, (return on total assets, and (d) return on equity. Assuming that each company's stock can be purchased at $85 per share, compute their (el price-earnings ratios and (1 dividend yields 2b. Identity which company's stock you would recommend as the better investment, Complete this question by entering your answers in the tabs below. 2A Price Earn 2A DIV Yield 2A Prof Mar ZA Tot Asset 2A Ret on Tot 2A Ret On Ratio Turn Assets Equity Ratio Reg 28 Assuming that share and each company's stock can be purchased at $85 per share, compute their price-earnings ratios, (o) Price-Earnings Ratio Company Numerator: Denominator: Price-Earnings Ratio Price camnings ratio Barco O times Kyan O times Problem 17-5A (Algo) Part 2 2a. For both companies compute the (a) profit margin ratio, (b) total asset turnover (c) return on total assets, and (c) return on equity. Assuming that each company's stock can be purchased at $85 per share, compute their (price-earnings ratios and (dividend yields 2b. Identify which company's stock you would recommend as the better investment Complete this question by entering your answers in the tabs below. 2A Prof Mar 2A Tot Asset 2A Ret on Tot 2A Ret On A Price Earn 2A DIV Yield Ratio Turn Assets Equity Ratio Reg 28 Assuming that each company's stock can be purchased at $85 per share, compute their dividend yields. in Dividend Yield Company Numerator Denominator: Dividend Yield Dividend yield 0 % Kyan 0 % Barco . Problem 17-5A (Algo) Part 2 20. For both companies compute the (a) profit margin ratio. (b) total asset turnover (a return on total assets, and (c) return on equity Assuming that each company's stock can be purchased at $85 per share, compute thelr (e price-earnings ratios and ( dividend yields. 2b. Identify which company's stock you would recommend as the better investment Complete this question by entering your answers in the tabs below. 2A Price Earn 2A Div Yield Reg 20 2A Prof Mar 2A Tot Asset 2A Ret on Tot 2A Ret On Ratio Turn Assets Equity Ratio Identity which company's stock you would recommend as the better investment. The better investment A Div Yield