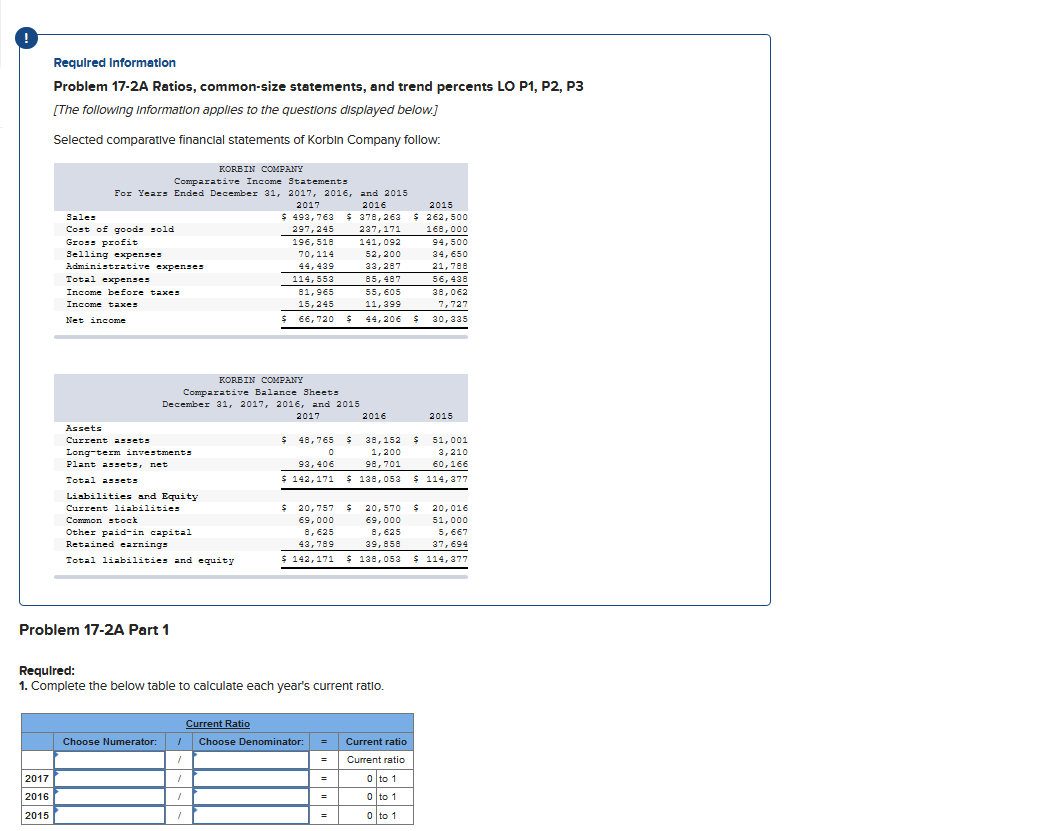

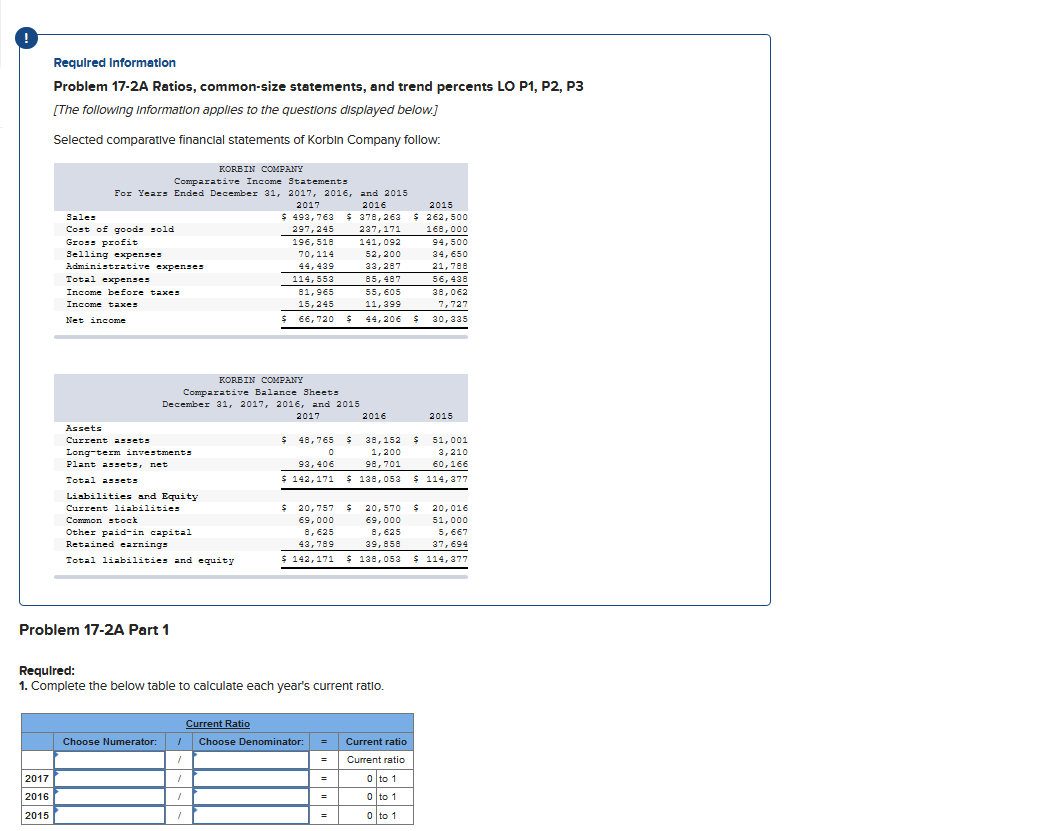

Required Information Problem 17-2A Ratios, common-size statements, and trend percents LO P1, P2, P3 [The following Information applies to the questions displayed below.] Selected comparative financial statements of Korbin Company follow: KORE IN COMPANY Comparative Income Statements For Years Ended December 31, 2017, 2016, and 2015 2017 2016 Sales $ 493,763 $ 378,263 Cost of goods sold 297,245 237,171 Gross Profit 196.518 141,092 Selling expenses 70,114 52,200 Administrative expenses 44,439 23, 297 Total expenses 114,553 85,487 Income before taxes 81,965 55, 605 Income taxes 15,245 11,399 Net income $ 66, 720 $ 44,206 2015 $ 262,500 168,000 94,500 34,650 21,788 56, 438 38,062 7,727 $ 30,335 2017 KOREIN COMPANY Comparative Balance Sheets December 31, 2017, 2016, and 2015 2016 2015 Assets Current assets $ 48,765 $ 38,152 $ 51,001 Long-term investments 01, 2003, 210 Plant assets, net 93,406 98,701 60,166 Total assets $ 142, 171 $ 138,053 $ 114, 377 Liabilities and Equity Current liabilities Common stock Other paid in capital Retained earnings Total liabilities and equity $ 20,757 69,000 8, 625 43,789 $ 142, 171 $ 20,570 69,000 , 625 39, 858 $ 138,053 $ 20,016 51,000 5,667 3 7, 694 $ 114, 377 Problem 17-2A Part 1 Required: 1. Complete the below table to calculate each year's current ratio. Current Ratio 1 Choose Denominator: Choose Numerator: = Current ratio Current ratio 0 to 1 0 to 1 2017 2016 2015 0 to 1 Required Information Problem 17-2A Ratios, common-size statements, and trend percents LO P1, P2, P3 [The following Information applies to the questions displayed below.] Selected comparative financial statements of Korbin Company follow: KORE IN COMPANY Comparative Income Statements For Years Ended December 31, 2017, 2016, and 2015 2017 2016 Sales $ 493,763 $ 378,263 Cost of goods sold 297,245 237,171 Gross Profit 196.518 141,092 Selling expenses 70,114 52,200 Administrative expenses 44,439 23, 297 Total expenses 114,553 85,487 Income before taxes 81,965 55, 605 Income taxes 15,245 11,399 Net income $ 66, 720 $ 44,206 2015 $ 262,500 168,000 94,500 34,650 21,788 56, 438 38,062 7,727 $ 30,335 2017 KOREIN COMPANY Comparative Balance Sheets December 31, 2017, 2016, and 2015 2016 2015 Assets Current assets $ 48,765 $ 38,152 $ 51,001 Long-term investments 01, 2003, 210 Plant assets, net 93,406 98,701 60,166 Total assets $ 142, 171 $ 138,053 $ 114, 377 Liabilities and Equity Current liabilities Common stock Other paid in capital Retained earnings Total liabilities and equity $ 20,757 69,000 8, 625 43,789 $ 142, 171 $ 20,570 69,000 , 625 39, 858 $ 138,053 $ 20,016 51,000 5,667 3 7, 694 $ 114, 377 Problem 17-2A Part 1 Required: 1. Complete the below table to calculate each year's current ratio. Current Ratio 1 Choose Denominator: Choose Numerator: = Current ratio Current ratio 0 to 1 0 to 1 2017 2016 2015 0 to 1