Answered step by step

Verified Expert Solution

Question

1 Approved Answer

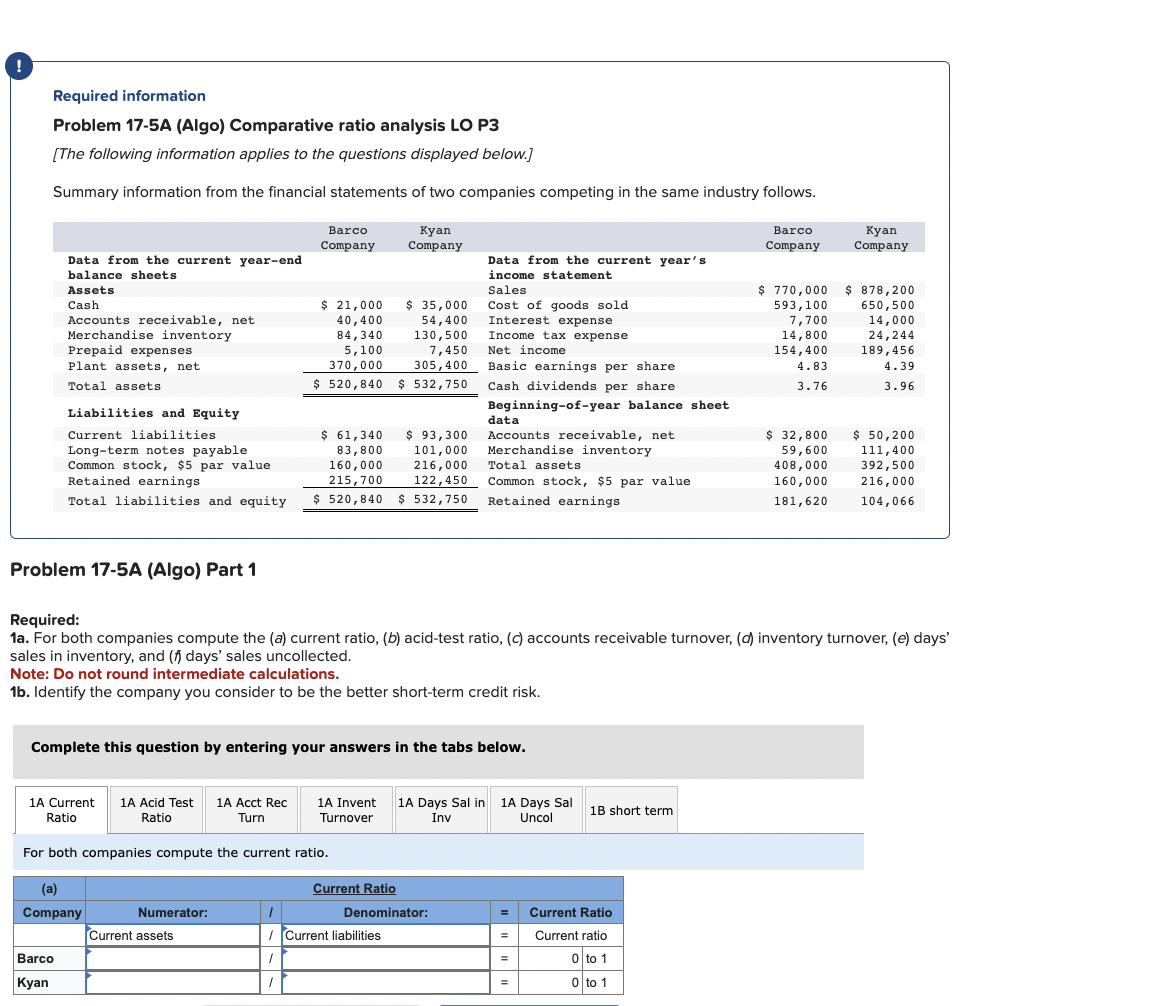

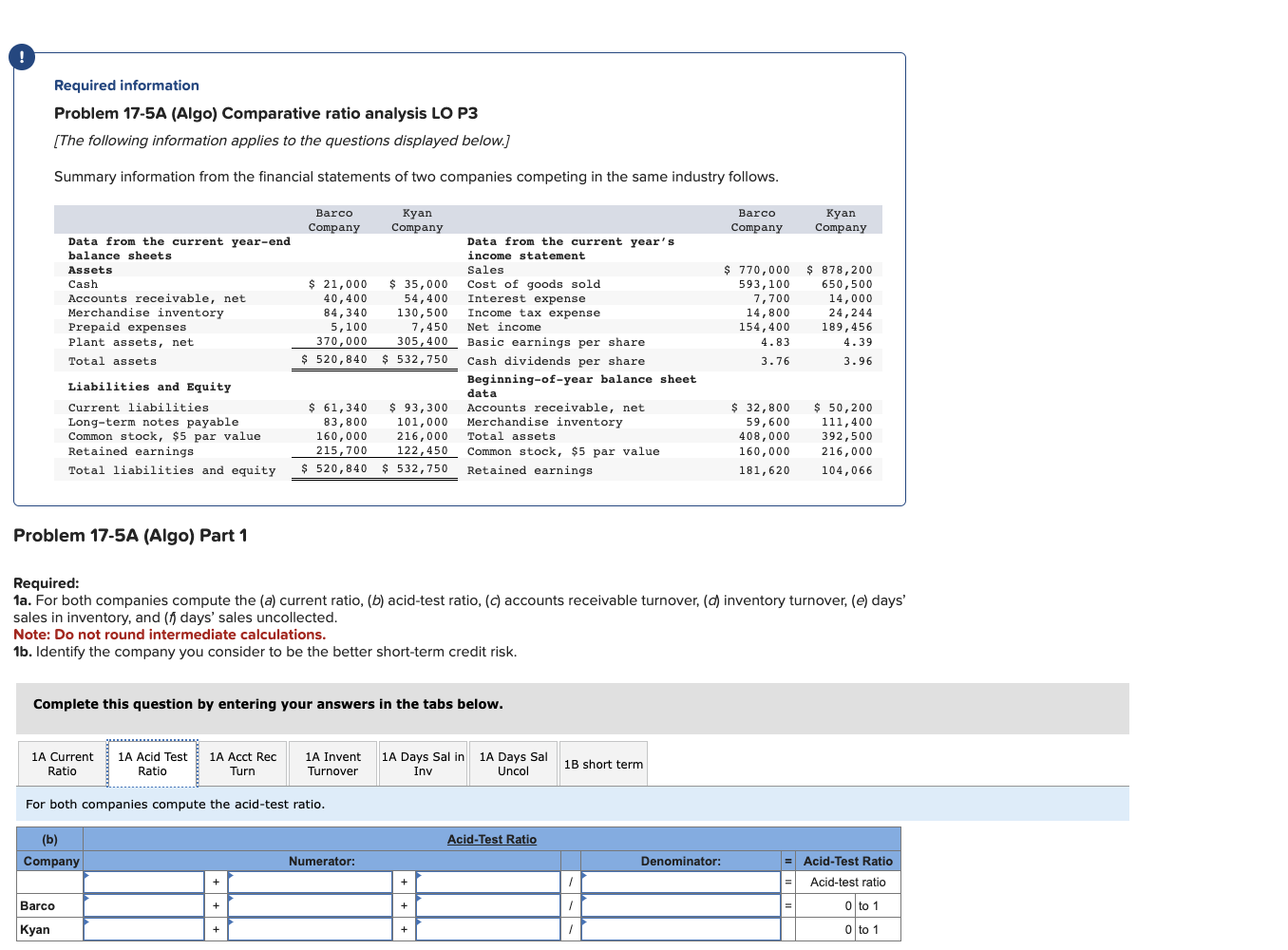

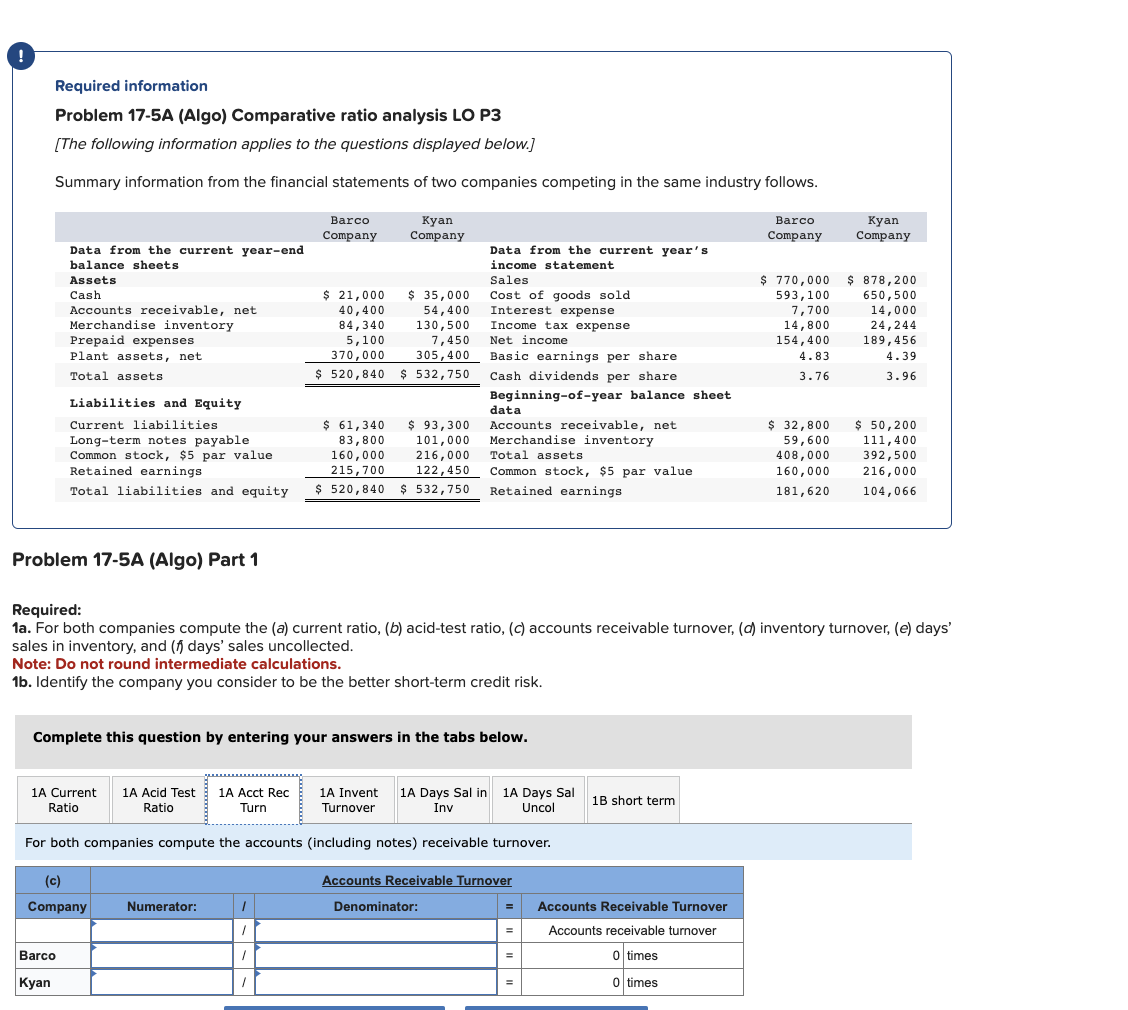

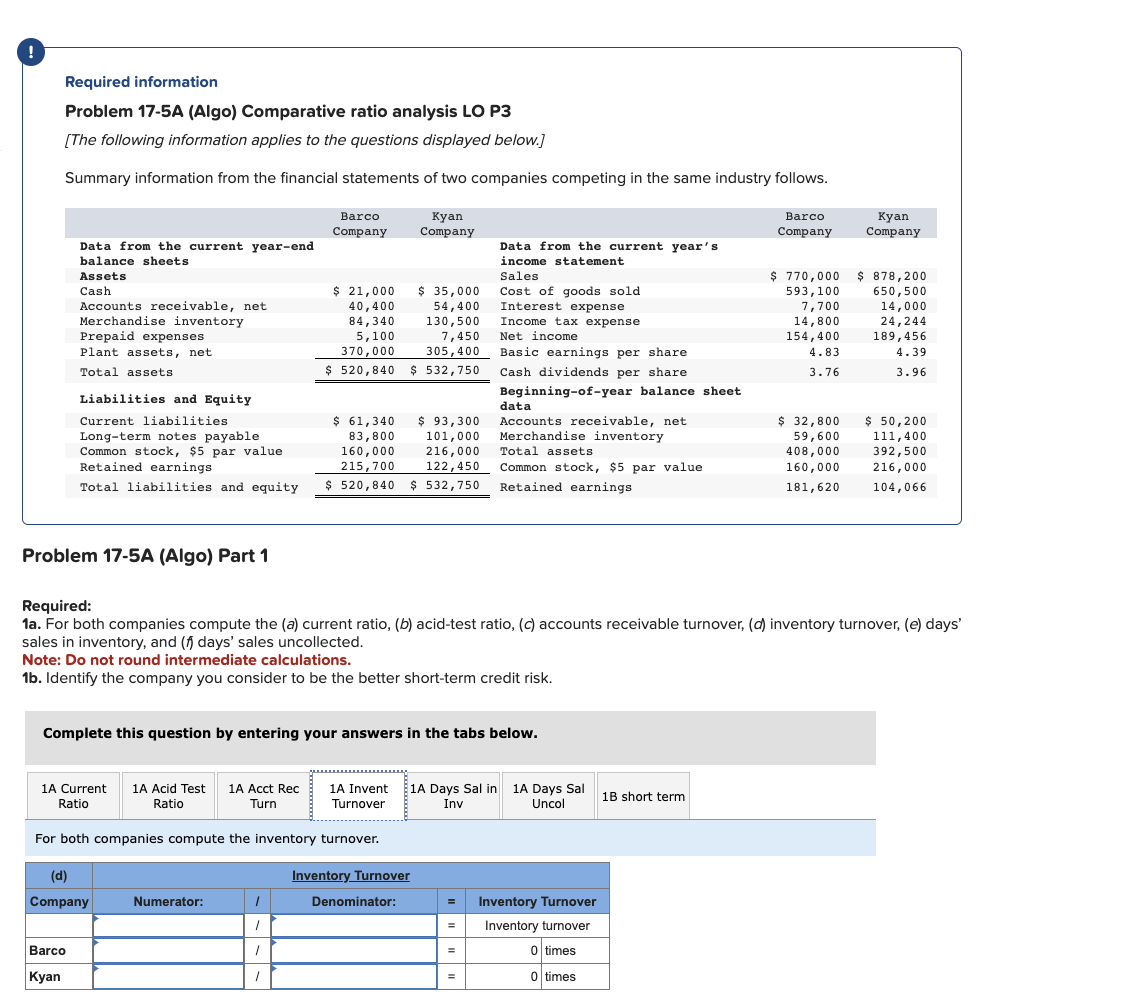

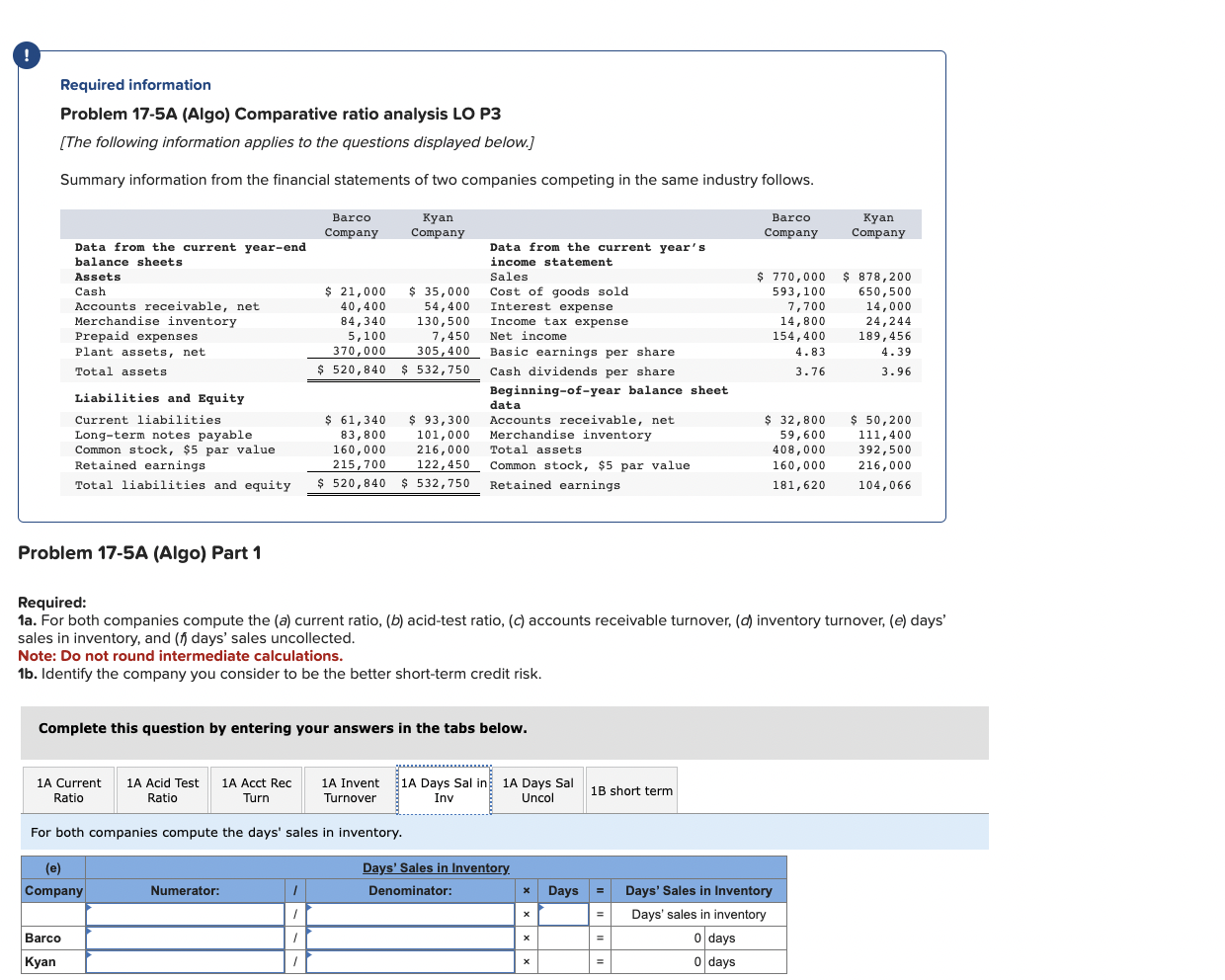

Required information Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below.] Summary information from the financial statements

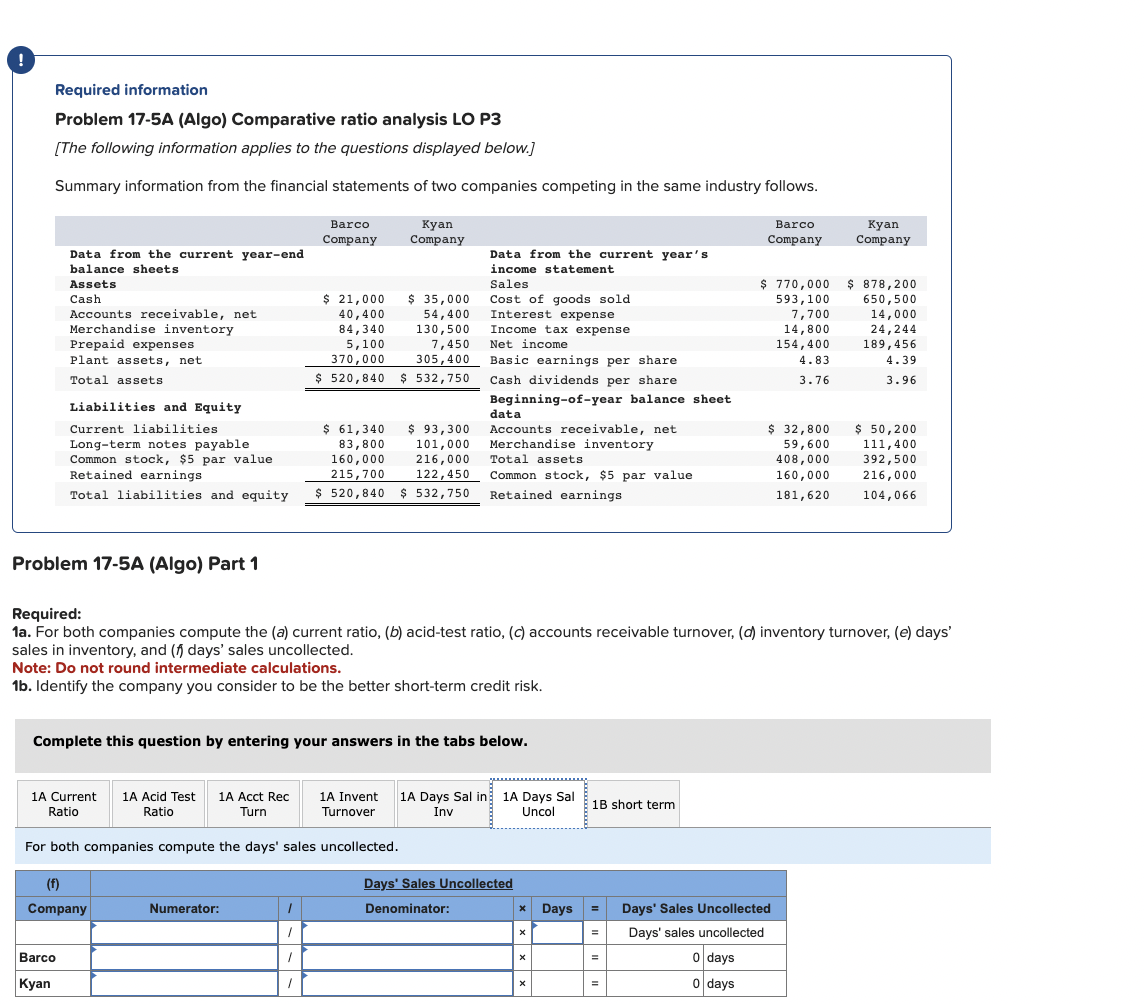

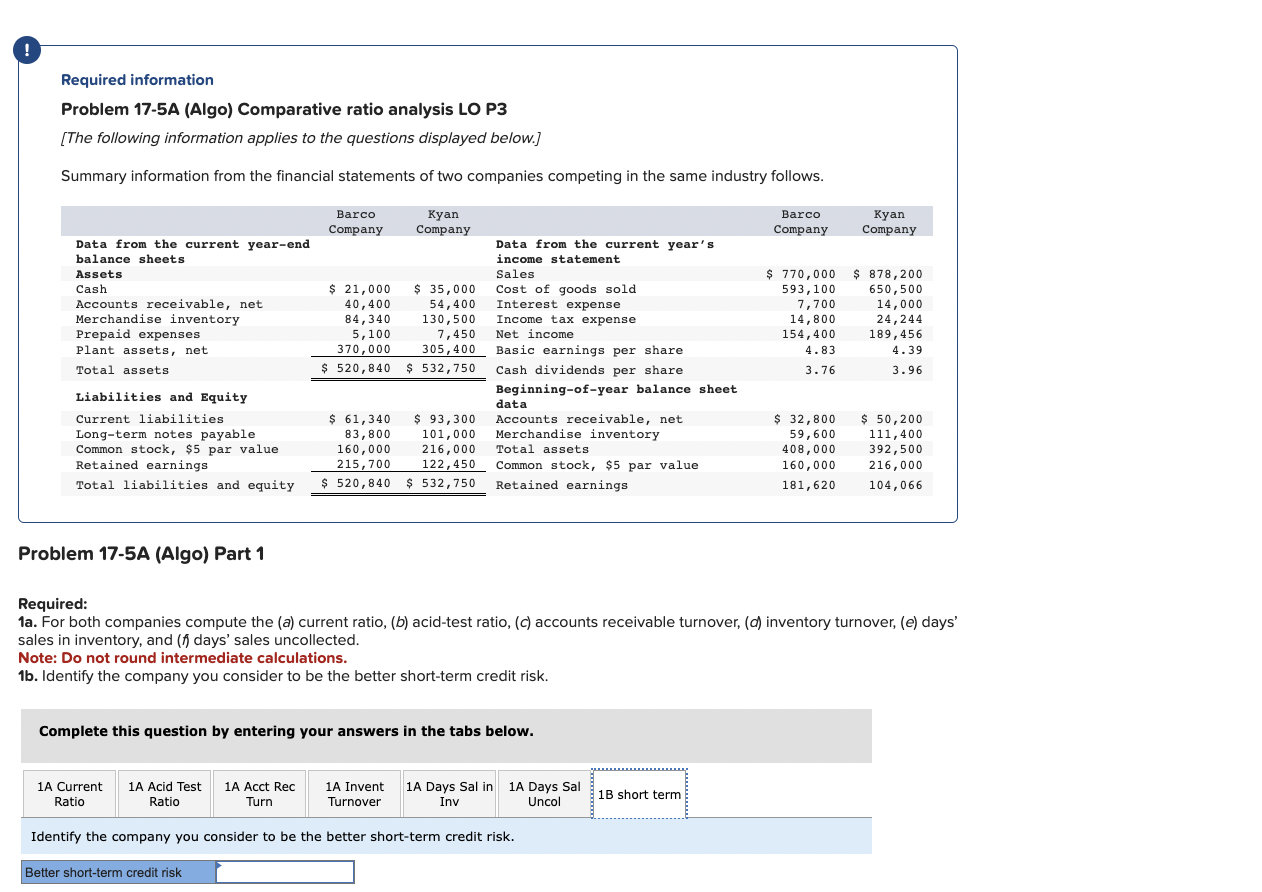

Required information Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below.] Summary information from the financial statements of two companies competing in the same industry follows. Problem 17-5A (Algo) Part 1 Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) inventory turnover, (e) days' sales in inventory, and (f) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the current ratio. Required information Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below.] Summary information from the financial statements of two companies competing in the same industry follows. Problem 17-5A (Algo) Part 1 Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) inventory turnover, (e) days' sales in inventory, and (f) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the acid-test ratio. Required information Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below.] Summary information from the financial statements of two companies competing in the same industry follows. Problem 17-5A (Algo) Part 1 Required: la. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) inventory turnover, (e) days sales in inventory, and ( f days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the accounts (including notes) receivable turnover. Required information Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below.] Summary information from the financial statements of two companies competing in the same industry follows. Problem 17-5A (Algo) Part 1 Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) inventory turnover, (e) days' sales in inventory, and ( f days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the inventory turnover. Required information Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below.] Summary information from the financial statements of two companies competing in the same industry follows. Problem 17-5A (Algo) Part 1 Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) inventory turnover, (e) days' sales in inventory, and (f) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the days' sales in inventory. Required information Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below.] Summary information from the financial statements of two companies competing in the same industry follows. Problem 17-5A (Algo) Part 1 Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) inventory turnover, (e) days' sales in inventory, and (f) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the days' sales uncollected. Required information Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below.] Summary information from the financial statements of two companies competing in the same industry follows. Problem 17-5A (Algo) Part 1 Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) inventory turnover, (e) days' sales in inventory, and (f) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. Identify the company you consider to be the better short-term credit risk

Required information Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below.] Summary information from the financial statements of two companies competing in the same industry follows. Problem 17-5A (Algo) Part 1 Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) inventory turnover, (e) days' sales in inventory, and (f) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the current ratio. Required information Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below.] Summary information from the financial statements of two companies competing in the same industry follows. Problem 17-5A (Algo) Part 1 Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) inventory turnover, (e) days' sales in inventory, and (f) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the acid-test ratio. Required information Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below.] Summary information from the financial statements of two companies competing in the same industry follows. Problem 17-5A (Algo) Part 1 Required: la. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) inventory turnover, (e) days sales in inventory, and ( f days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the accounts (including notes) receivable turnover. Required information Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below.] Summary information from the financial statements of two companies competing in the same industry follows. Problem 17-5A (Algo) Part 1 Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) inventory turnover, (e) days' sales in inventory, and ( f days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the inventory turnover. Required information Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below.] Summary information from the financial statements of two companies competing in the same industry follows. Problem 17-5A (Algo) Part 1 Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) inventory turnover, (e) days' sales in inventory, and (f) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the days' sales in inventory. Required information Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below.] Summary information from the financial statements of two companies competing in the same industry follows. Problem 17-5A (Algo) Part 1 Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) inventory turnover, (e) days' sales in inventory, and (f) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the days' sales uncollected. Required information Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below.] Summary information from the financial statements of two companies competing in the same industry follows. Problem 17-5A (Algo) Part 1 Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) inventory turnover, (e) days' sales in inventory, and (f) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. Identify the company you consider to be the better short-term credit risk Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started