Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information Problem 19-1A Variable costing income statement and conversion to absorption costing income (two consecutive years) LO P2, P3 [The following information applies to

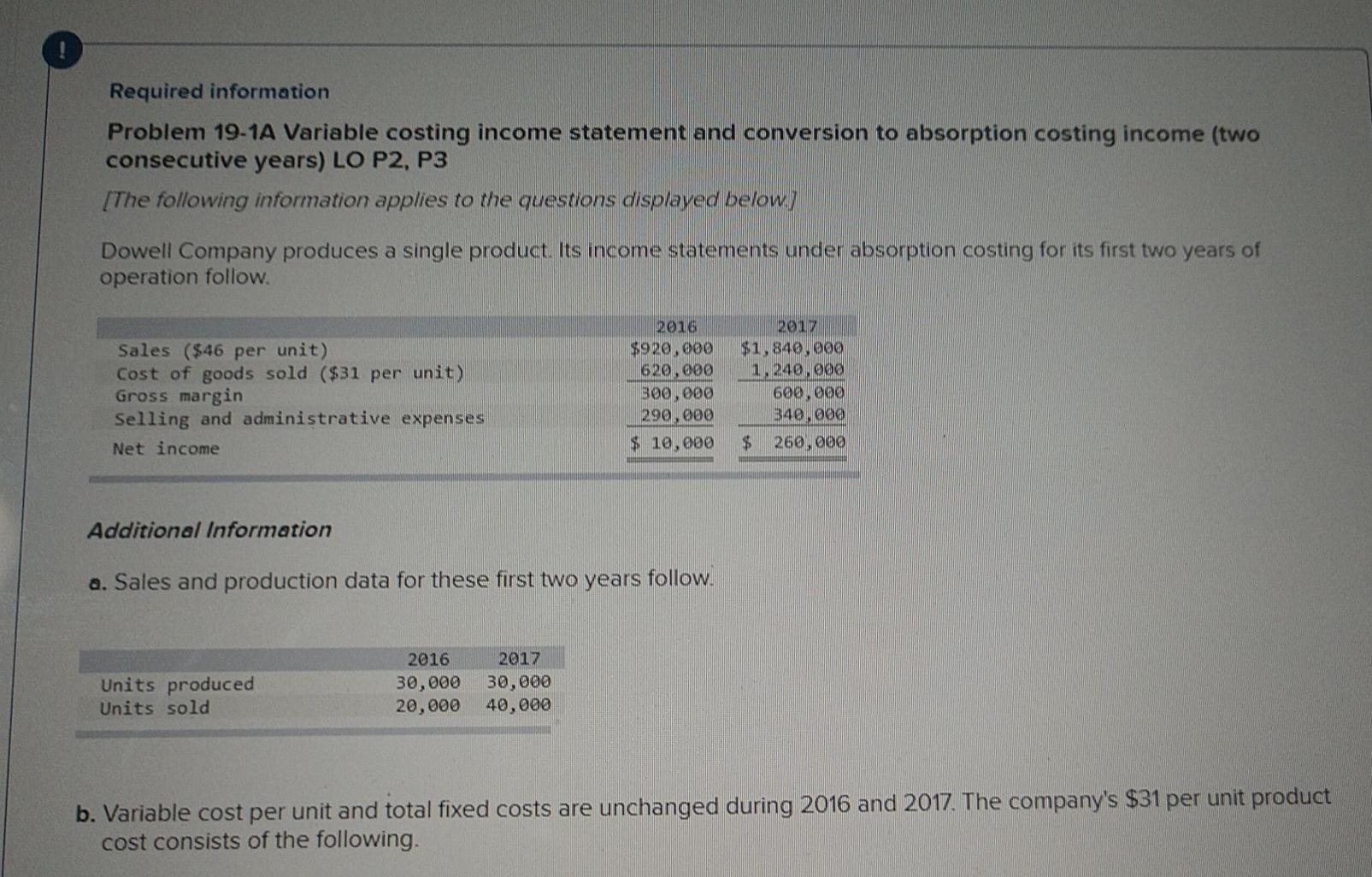

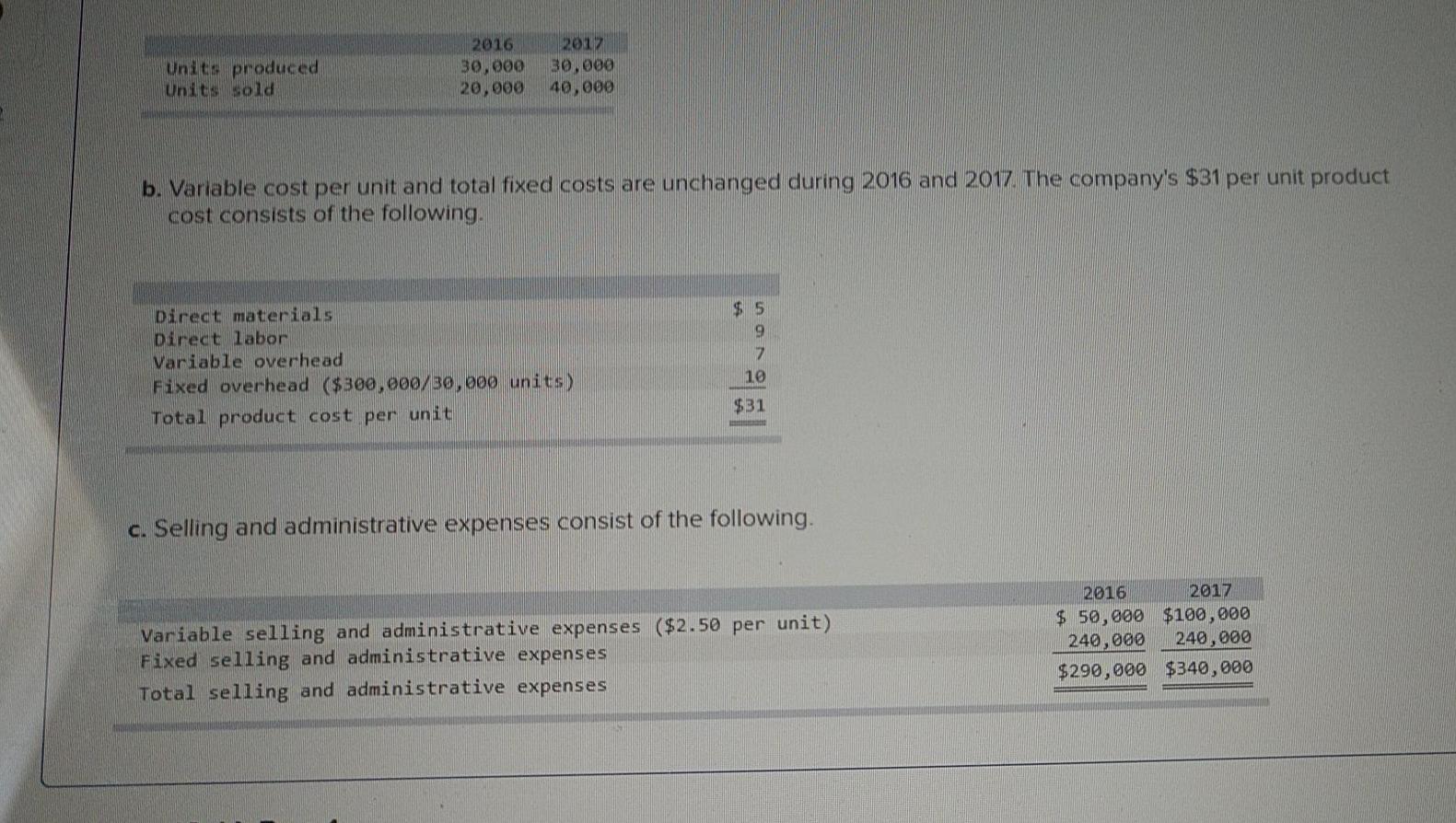

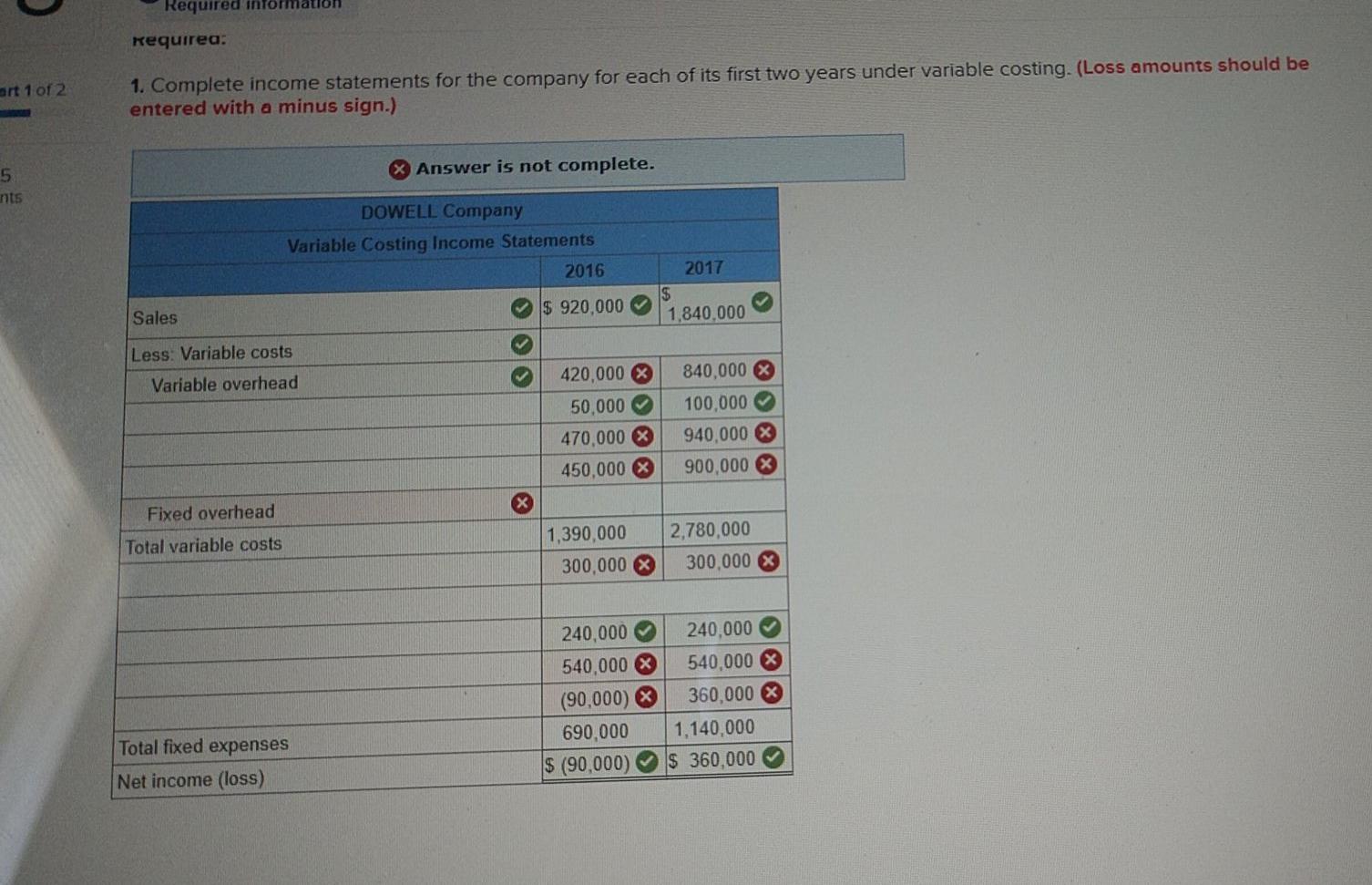

Required information Problem 19-1A Variable costing income statement and conversion to absorption costing income (two consecutive years) LO P2, P3 [The following information applies to the questions displayed below) Dowell Company produces a single product. Its income statements under absorption costing for its first two years of operation follow Sales ($46 per unit) Cost of goods sold ($31 per unit) Gross margin Selling and administrative expenses Net income 2016 $920,000 620,000 300,000 290,000 $ 10,000 2017 $1,840,000 1,240,000 600, eee 340,000 $ 260,000 Additional Information a. Sales and production data for these first two years follow. Units produced Units sold 2016 30,000 20,000 2017 30,000 40,000 b. Variable cost per unit and total fixed costs are unchanged during 2016 and 2017. The company's $31 per unit product cost consists of the following. Units produced Units sold 2016 30,000 20,000 2012 30.000 40,000 b. Variable cost per unit and total fixed costs are unchanged during 2016 and 2017. The company's $31 per unit product cost consists of the following. Direct materials Direct labor Variable overhead Fixed overhead ($300,000/30,000 units) Total product cost per unit $ 5 9 7 10 $31 c. Selling and administrative expenses consist of the following. Variable selling and administrative expenses ($2.50 per unit) Fixed selling and administrative expenses Total selling and administrative expenses 2016 2017 $ 50,000 $100,000 240,000 240,000 $290,000 $340,000 Required in Required: art 1 of 2 1. Complete income statements for the company for each of its first two years under variable costing. (Loss amounts should be entered with a minus sign.) X Answer is not complete. 5 nts DOWELL Company Variable Costing Income Statements 2016 2017 $ 1,840.000 $ 920,000 Sales Less Variable costs Variable overhead 420,000 50,000 470,000 X 450,000 X 840,000 $ 100,000 940,000 X 900,000 x Fixed overhead Total variable costs 1,390,000 300,000 X 2,780,000 300,000 X 240,000 540,000 (90,000) 690,000 $ (90,000) X X 240,000 540,000 360,000 1,140,000 $ 360,000 Total fixed expenses Net income (loss)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started