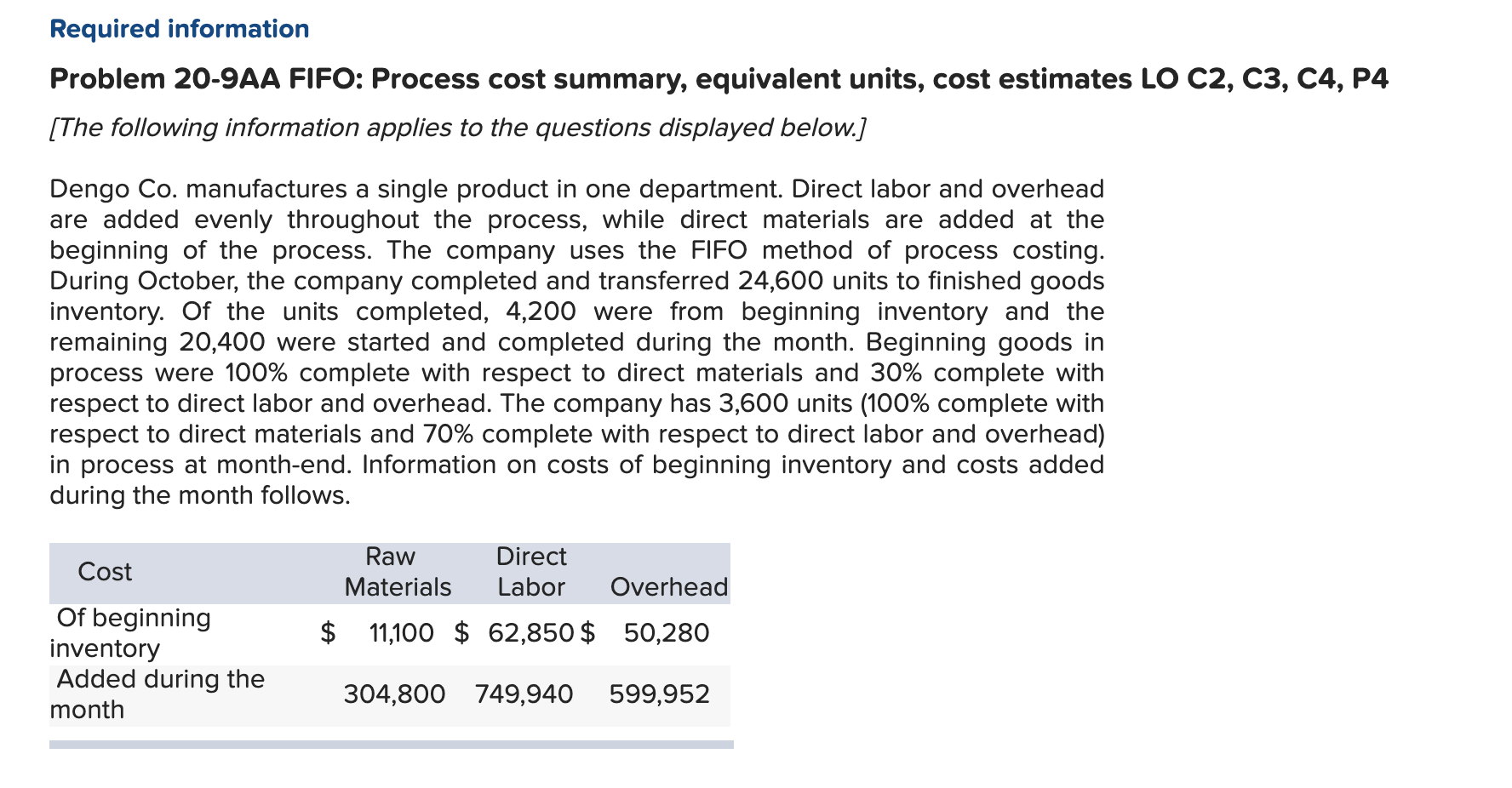

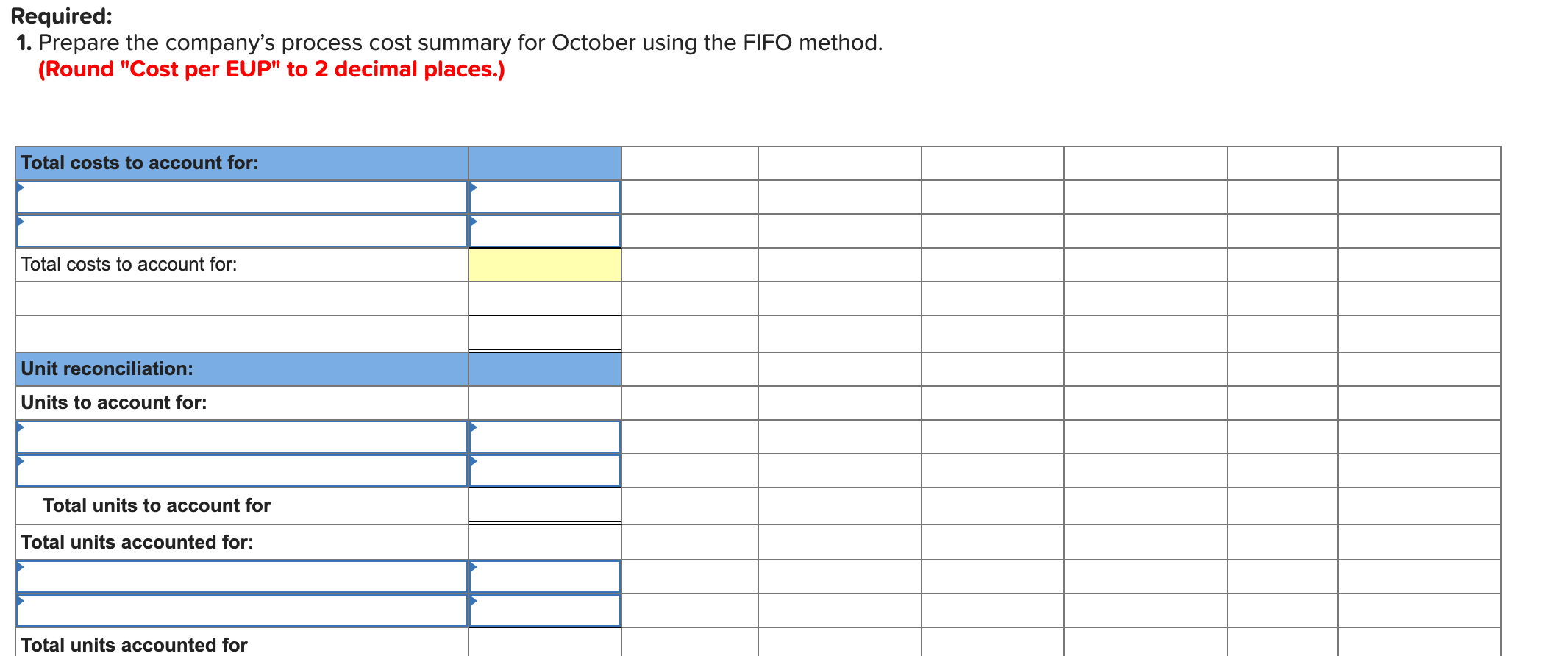

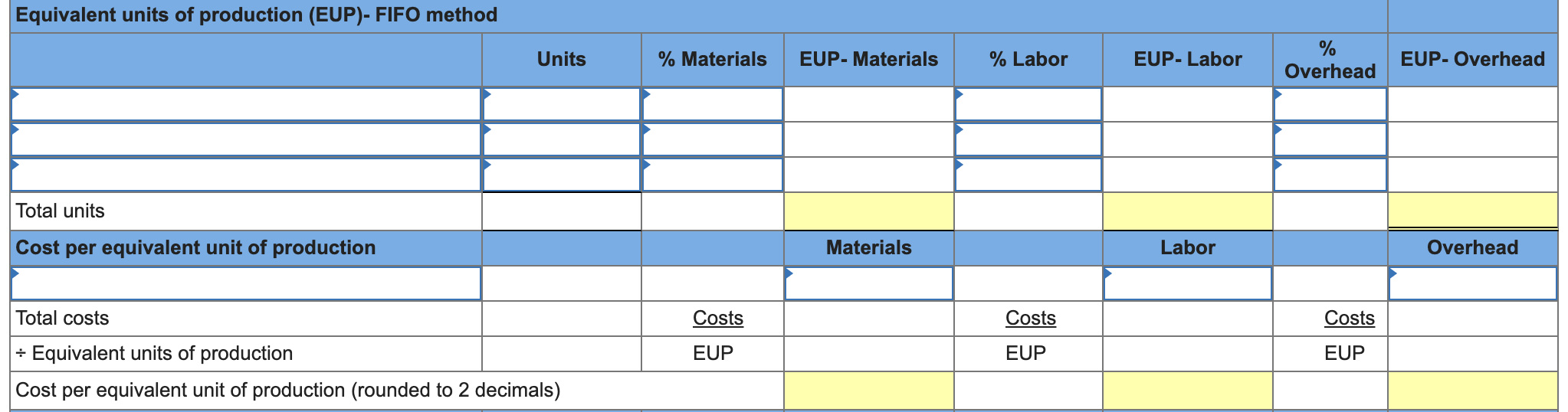

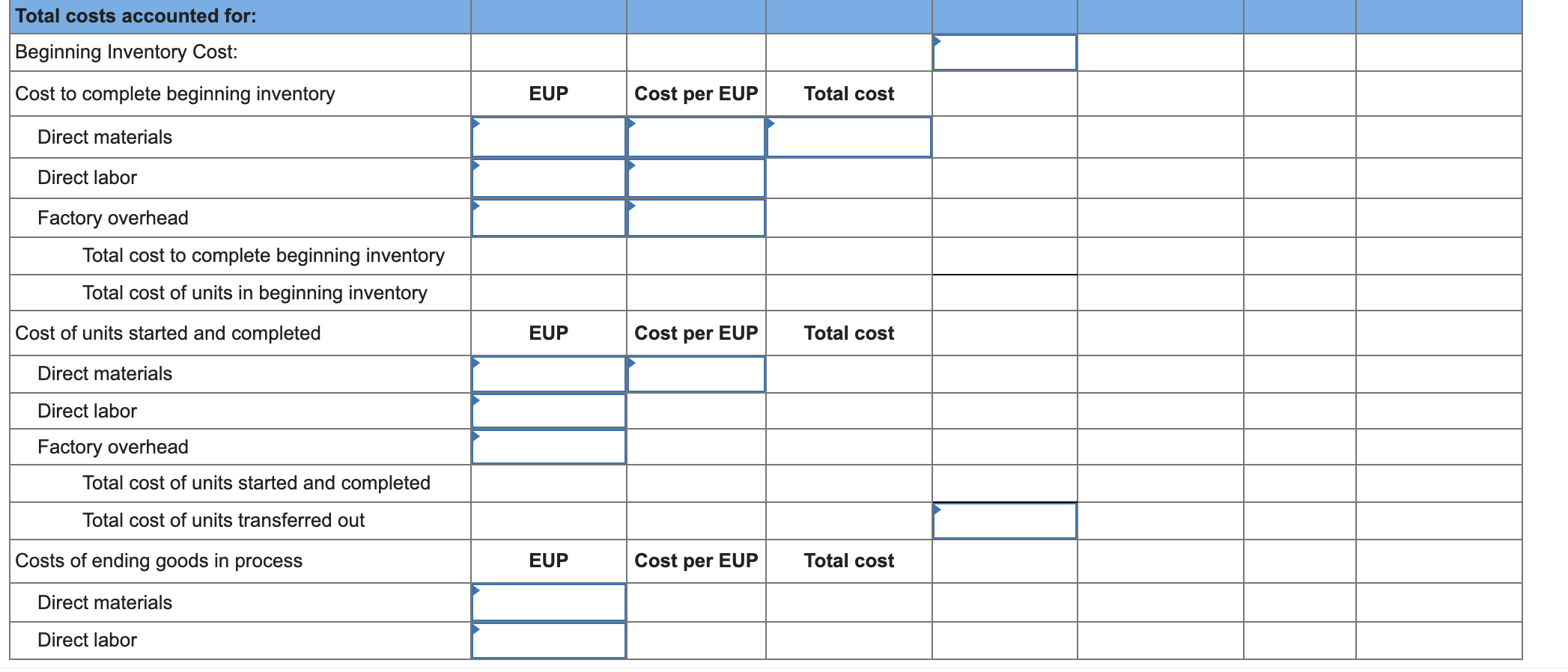

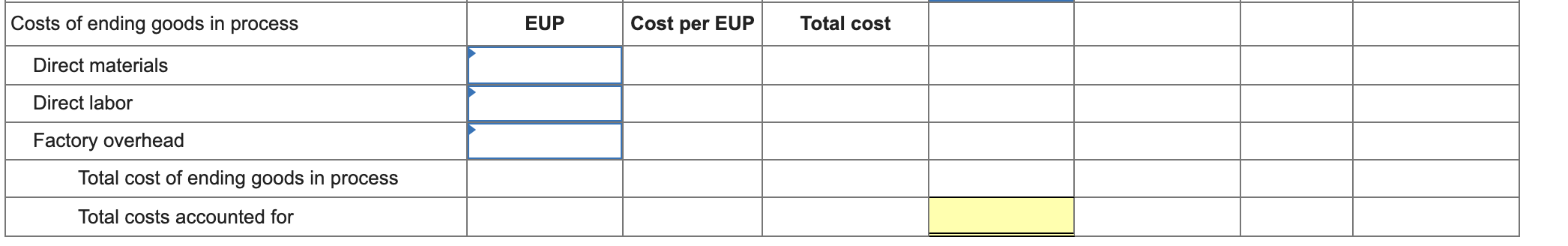

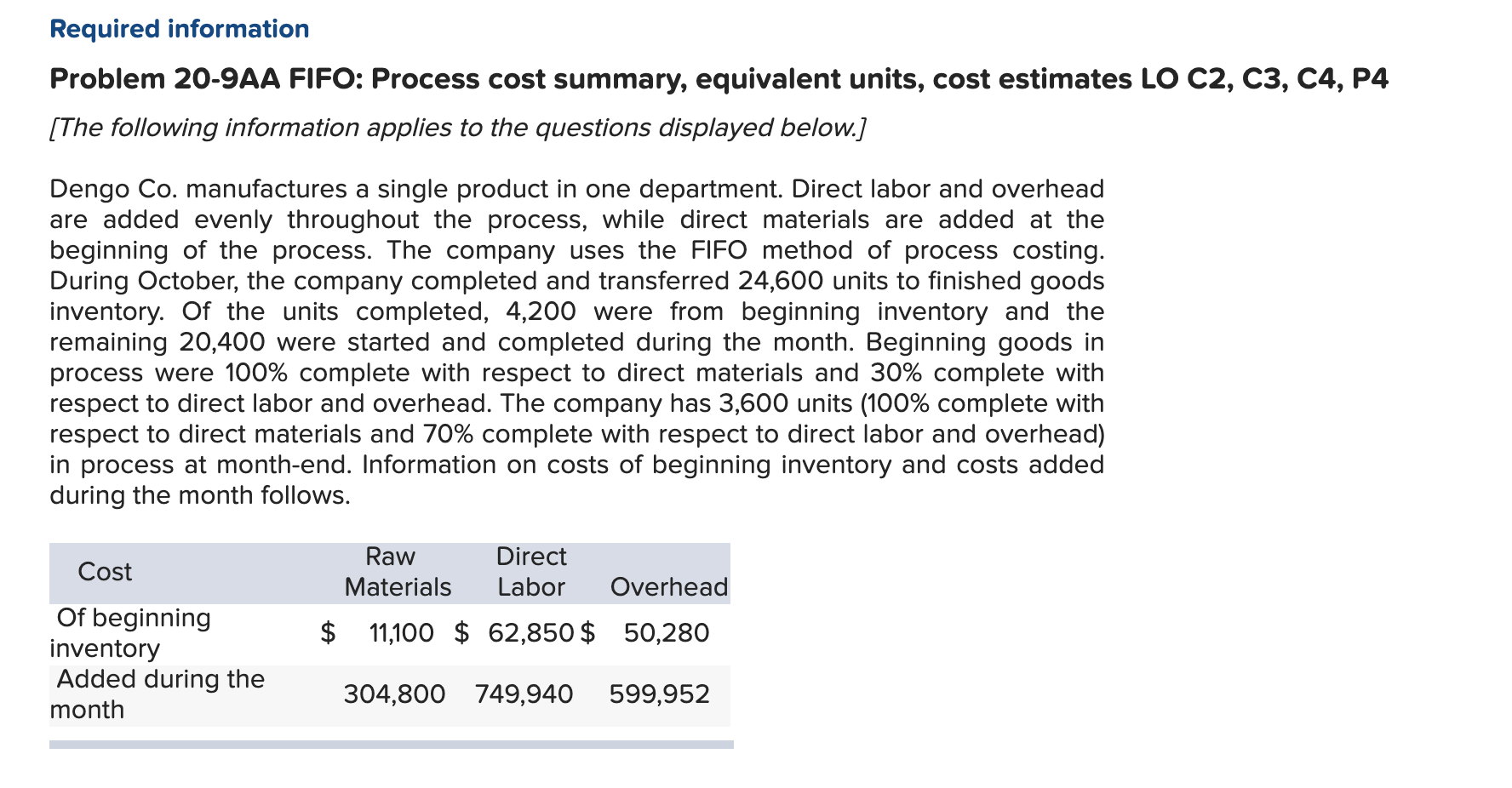

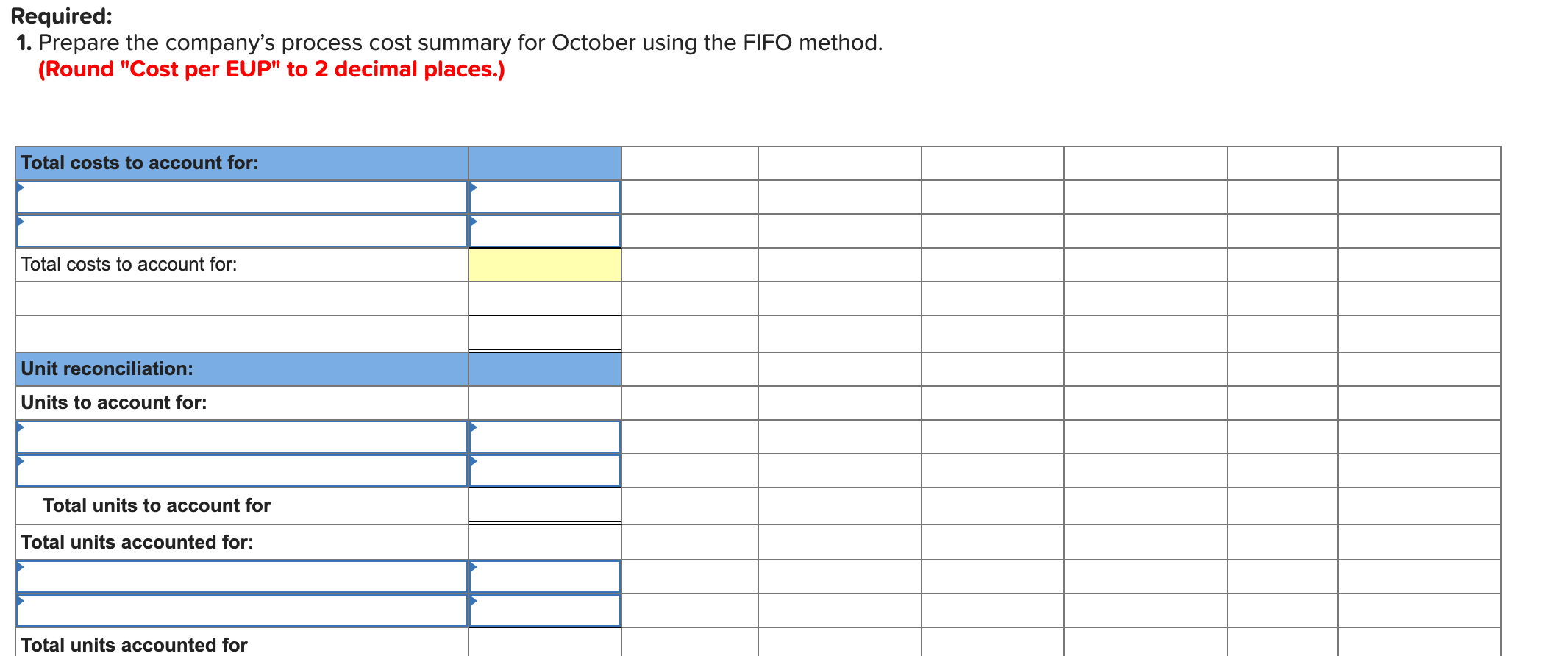

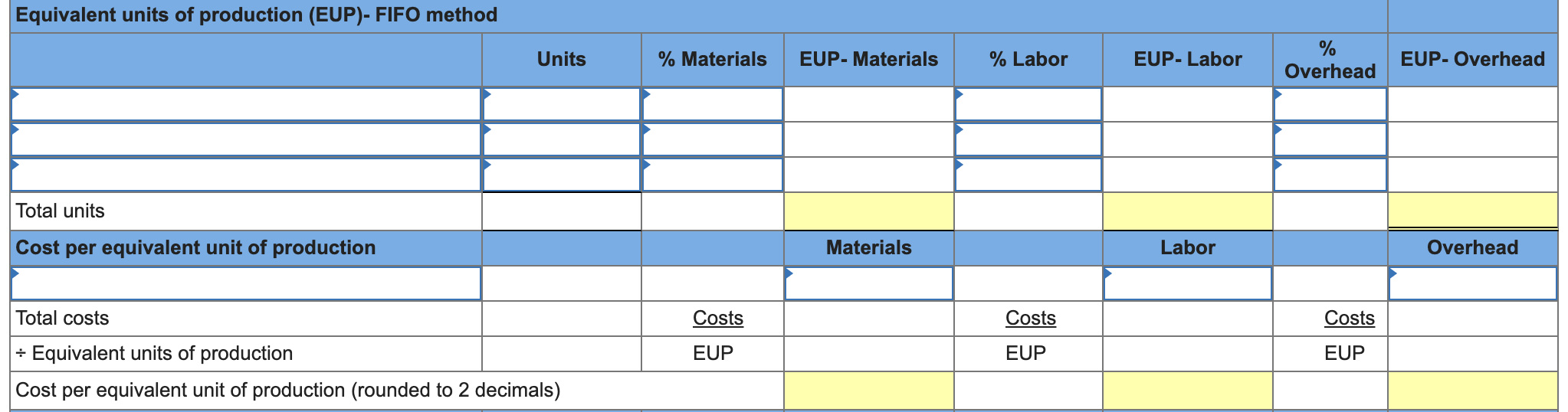

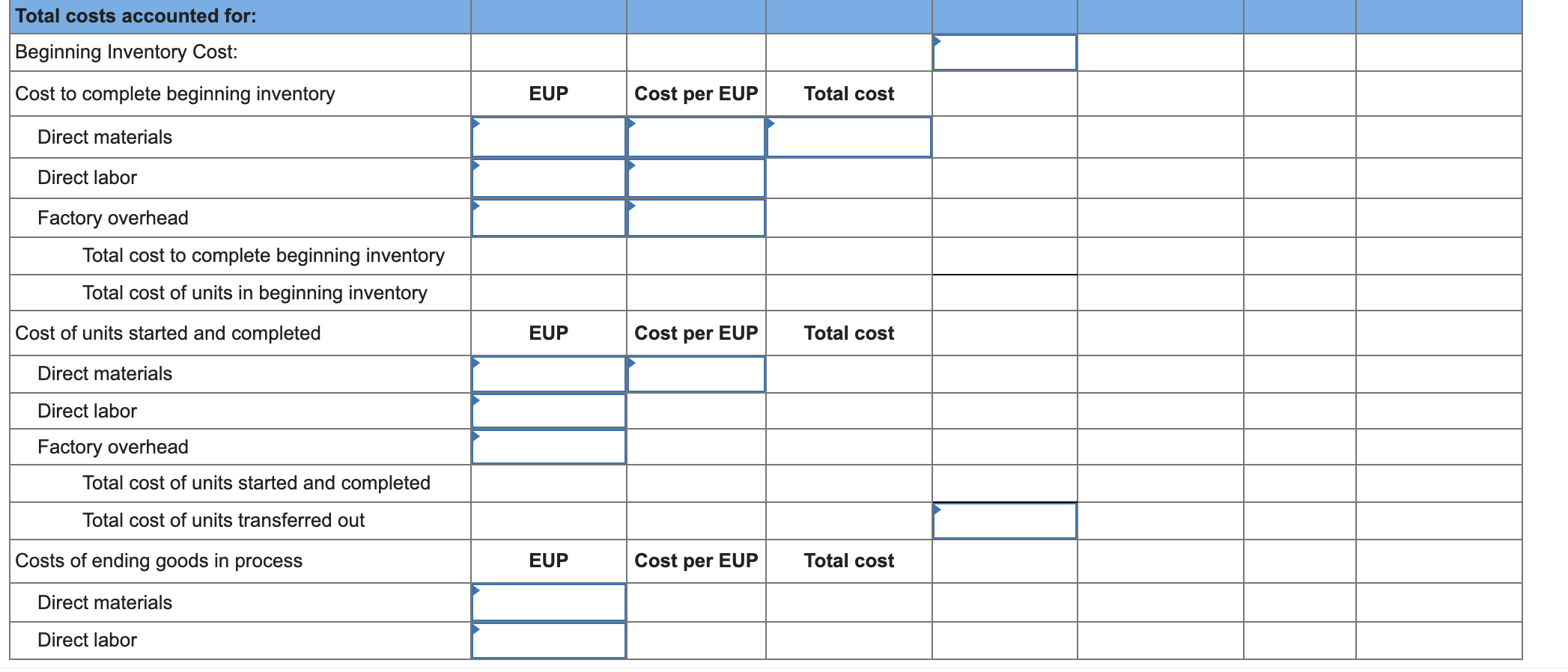

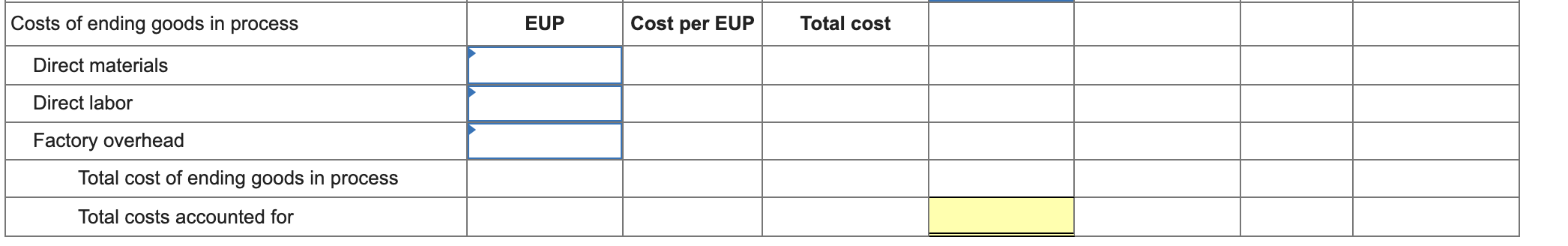

Required information Problem 20-9AA FIFO: Process cost summary, equivalent units, cost estimates LO C2, C3, C4, P4 [The following information applies to the questions displayed below.] Dengo Co. manufactures a single product in one department. Direct labor and overhead are added evenly throughout the process, while direct materials are added at the beginning of the process. The company uses the FIFO method of process costing. During October, the company completed and transferred 24,600 units to finished goods inventory. Of the units completed, 4,200 were from beginning inventory and the remaining 20,400 were started and completed during the month. Beginning goods in process were 100% complete with respect to direct materials and 30% complete with respect to direct labor and overhead. The company has 3,600 units (100% complete with respect to direct materials and 70% complete with respect to direct labor and overhead) in process at month-end. Information on costs of beginning inventory and costs added during the month follows. Cost Of beginning inventory Added during the Raw Direct Materials Labor Overhead $ 11,100 $ 62,850 $ 50,280 304,800 749,940 599,952 month Required: 1. Prepare the company's process cost summary for October using the FIFO method. (Round "Cost per EUP" to 2 decimal places.) Total costs to account for: Total costs to account for: Unit reconciliation: Units to account for: Total units to account for Total units accounted for: Total units accounted for Equivalent units of production (EUP)- FIFO method Units % Materials EUP- Materials % Labor EUP- Labor EUP- Overhead Overhead Total units Cost per equivalent unit of production Materials Labor Overhead Total costs Costs Costs Costs EUP EUP EUP + Equivalent units of production Cost per equivalent unit of production (rounded to 2 decimals) Total costs accounted for: Beginning Inventory Cost: Cost to complete beginning inventory EUP Cost per EUP Total cost Direct materials I I Direct labor Factory overhead Total cost to complete beginning inventory Total cost of units in beginning inventory Cost of units started and completed EUP Cost per EUP Total cost Direct materials Direct labor Factory overhead Total cost of units started and completed Total cost of units transferred out EUP Cost per EUP Total cost Costs of ending goods in process Direct materials Direct labor Costs of ending goods in process EUP Cost per EUP Total cost Direct materials Direct labor Factory overhead Total cost of ending goods in process Total costs accounted for