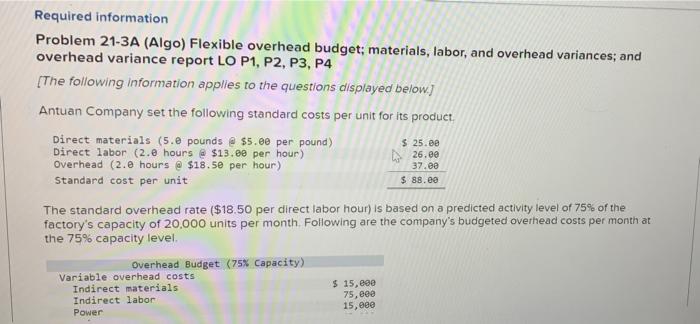

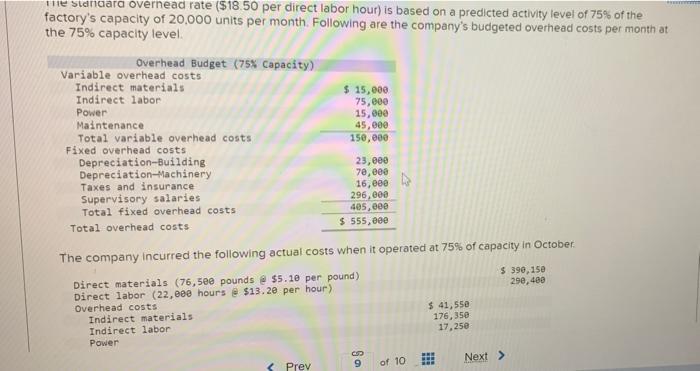

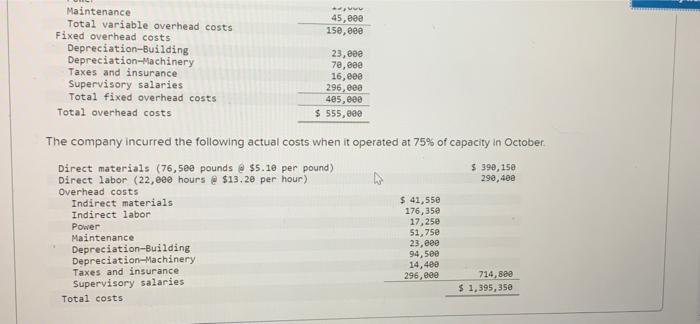

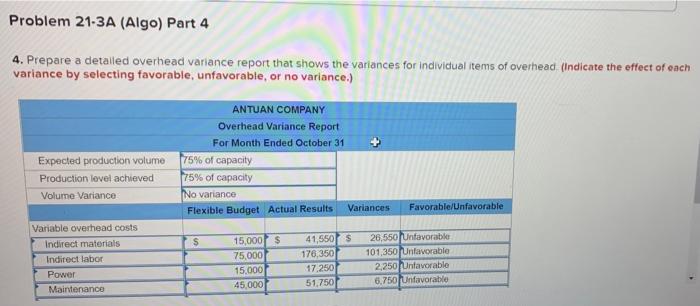

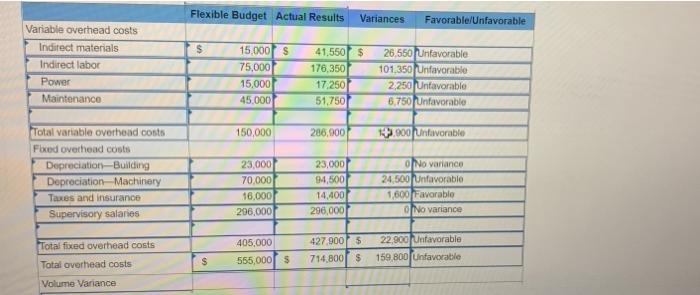

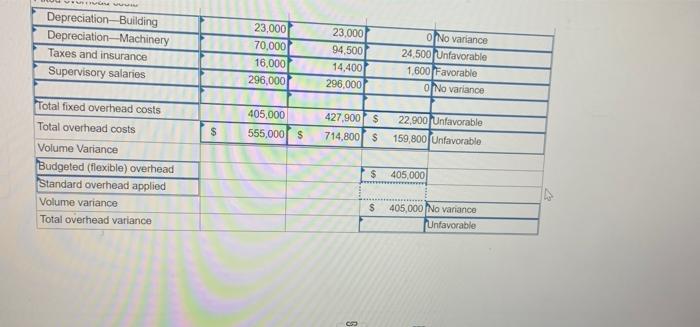

Required information Problem 21-3A (Algo) Flexible overhead budget; materials, labor, and overhead variances; and overhead variance report LO P1, P2, P3, P4 [The following information applies to the questions displayed below] Antuan Company set the following standard costs per unit for its product Direct materials (5.2 pounds @ $5.00 per pound) Direct labor (2.0 hours @ $13.00 per hour) Overhead (2.0 hours @ $18.5e per hour) Standard cost per unit $ 88.00 The standard overhead rate ($18.50 per direct labor hour) is based on a predicted activity level of 75% of the factory's capacity of 20,000 units per month Following are the company's budgeted overhead costs per month at the 75% capacity level Overhead Budget (75% Capacity) $ 25.00 26.00 37.ee Variable overhead costs Indirect materials Indirect labor Power $ 15,eee 75, eee 15,000 The standara overnead rate ($18.50 per direct labor hour) is based on a predicted activity level of 75% of the factory's capacity of 20.000 units per month. Following are the company's budgeted overhead costs per month at the 75% capacity level. Overhead Budget (75% Capacity) Variable overhead costs Indirect materials $ 15,000 Indirect labor 75,000 Power 15,000 Maintenance 45,000 Total variable overhead costs 150,000 Fixed overhead costs Depreciation-Building 23, een Depreciation-Machinery 70,000 Taxes and insurance 16, ese Supervisory salaries 296, eee Total fixed overhead costs 405,000 $ 555,000 Total overhead costs The company incurred the following actual costs when it operated at 75% of capacity in October $ 390,150 290, 480 Direct materials (76,500 pounds @ $5.10 per pound) Direct labor (22,eee hours $13.20 per hour) Overhead costs Indirect materials Indirect labor Power $ 41,550 176,350 17.250 Sa 9 of 10 Maintenance Total variable overhead costs 45,000 Fixed overhead costs 150,000 Depreciation-Building Depreciation-Machinery 23, eee 78,888 Taxes and insurance 16, Supervisory salaries 296, eee Total fixed overhead costs 405, eee Total overhead costs $ 555,000 The company incurred the following actual costs when it operated at 75% of capacity in October Direct materials (76,500 pounds @ $5.10 per pound) $ 390,150 Direct labor (22,000 hours @ $13.20 per hour) 298,400 Overhead costs Indirect materials $ 41,550 Indirect labor 176, 350 Power 17,250 Maintenance 51,750 23,000 Depreciation-Building Depreciation Machinery 94,500 14,489 Taxes and insurance 296,000 714,880 Supervisory salaries $ 1,395, 350 Total costs Problem 21-3A (Algo) Part 4 4. Prepare a detailed overhead variance report that shows the variances for individual items of overhead (Indicate the effect of each variance by selecting favorable, unfavorable, or no variance.) Expected production volume Production level achieved Volume Variance ANTUAN COMPANY Overhead Variance Report For Month Ended October 31 75% of capacity 75% of capacity No variance Flexible Budget Actual Results Variances Favorable/Unfavorable $ Variable overhead costs Indirect materials Indirect labor Power Maintenance 15,000 $ 75,000 15.000 45,000 41,550 $ 176,350 17.250 51,750 26,550 unfavorable 101,350 Unfavorable 2,250 Unfavorable 6.750 Unfavorable Flexible Budget Actual Results Variances Favorable/Unfavorable Variable overhead costs Indirect materials Indirect labor Power Maintenance 15,000 $ 75,000 15,000 45,000 41,550 $ 176,350 17.250 51,750 26.550 unfavorable 101.350 Unfavorable 2,250 Unfavorable 6,750 Unfavorable 150,000 286,900 3,000 Univorable Total variable overhead costs Fored overhead costs Depreciation Building Depreciation Machinery Taxes and insurance Supervisory salarios 23,000 70,000 16,000 296.000 23,000 94,500 14,4001 296,000 O No variance 24,500 Unfavorable 1,600 Favorable No variance Total fixed overhead costs Total overhead costs 405,000 555,000 $ 42790015 714,800 $ 22,900 unfavorable 159 800/Unfavorable S Volume Variance WA Depreciation-Building Depreciation-Machinery Taxes and insurance Supervisory salaries 23,000 70.000 16.000 296,000 23,000 94,500 14.400 296,000 OnNo variance 24.500 Unfavorable 1.600 Favorable No variance $ 405,000 555,000 $ 427,900 $ 714,800 $ 22,900 Unfavorable 159,800 Unfavorable Total fixed overhead costs Total overhead costs Volume Variance Budgeted (flexible) overhead Standard overhead applied Volume variance Total overhead variance $ 405,000 S 405,000 No variance (Unfavorable