Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required Information Problem 3-47 (LO 3-5) (Static) [The following Information applies to the questions displayed below.] Buckley, an Individual, began business two years ago

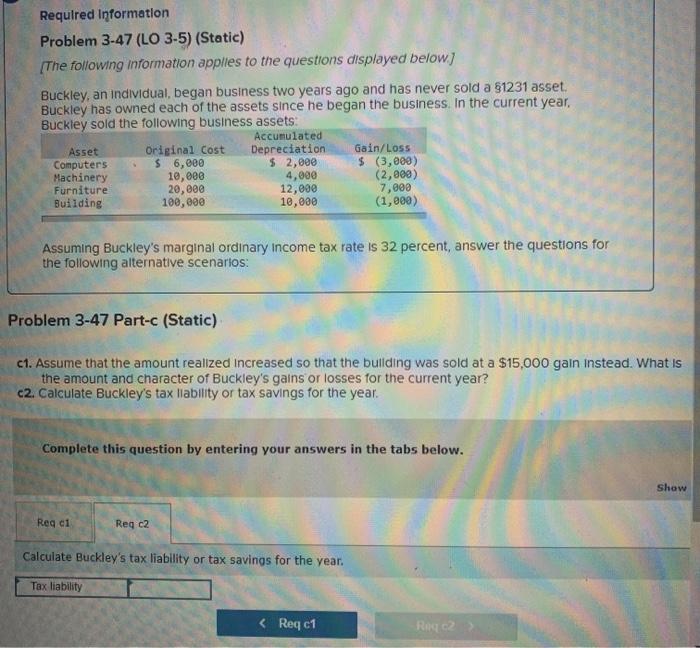

Required Information Problem 3-47 (LO 3-5) (Static) [The following Information applies to the questions displayed below.] Buckley, an Individual, began business two years ago and has never sold a 1231 asset. Buckley has owned each of the assets since he began the business. In the current year, Buckley sold the following business assets: Asset Computers Machinery Furniture Building Original Cost $ 6,000 10,000 20,000 100,000 Accumulated Depreciation $ 2,000 Gain/Loss $ (3,000) 4,000 (2,000) 12,000 10,000 7,000 (1,000) Assuming Buckley's marginal ordinary Income tax rate is 32 percent, answer the questions for the following alternative scenarios: Problem 3-47 Part-c (Static) c1. Assume that the amount realized Increased so that the building was sold at a $15,000 gain instead. What is the amount and character of Buckley's gains or losses for the current year? c2. Calculate Buckley's tax liability or tax savings for the year. Complete this question by entering your answers in the tabs below. Req ci Req c2 Calculate Buckley's tax liability or tax savings for the year. Tax liability

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started