Question

Required information Problem 3-57 Comprehensive Job-Order Costing Problem (LO 3-2, 3-4, 3-5, 3-6) Skip to question [The following information applies to the questions displayed below.]

Required information

Problem 3-57 Comprehensive Job-Order Costing Problem (LO 3-2, 3-4, 3-5, 3-6)

Skip to question

[The following information applies to the questions displayed below.] Scholastic Brass Corporation manufactures brass musical instruments for use by high school students. The company uses a normal costing system, in which manufacturing overhead is applied on the basis of direct-labor hours. The companys budget for the current year included the following predictions.

| Budgeted total manufacturing overhead | $ | 446,600 | |

| Budgeted total direct-labor hours (based on practical capacity) | 20,300 | ||

During March, the firm worked on the following two production jobs: Job number T81, consisting of 76 trombones Job number C40, consisting of 110 cornets The events of March are described as follows:

- One thousand square feet of rolled brass sheet metal was purchased on account for $5,000.

- Three hundred pounds of brass tubing was purchased on account for $3,000.

- The following requisitions were submitted on March 5: Requisition number 112: 250 square feet of brass sheet metal at $5 per square foot (for Job number T81) Requisition number 113: 1,000 pounds of brass tubing, at $10 per pound (for Job number C40) Requisition number 114: 10 gallons of valve lubricant, at $10 per gallon All brass used in production is treated as direct material. Valve lubricant is an indirect material.

- An analysis of labor time cards revealed the following labor usage for March. Direct labor: Job number T81, 800 hours at $20 per hour Direct labor: Job number C40, 900 hours at $20 per hour Indirect labor: General factory cleanup, $5,000 Indirect labor: Factory supervisory salaries, $8,000

- Depreciation of the factory building and equipment during March amounted to $12,000.

- Rent paid in cash for warehouse space used during March was $1,200.

- Utility costs incurred during March amounted to $2,000. The invoices for these costs were received, but the bills were not paid in March.

- March property taxes on the factory were paid in cash, $2,200.

- The insurance cost covering factory operations for the month of March was $3,100. The insurance policy had been prepaid.

- The costs of salaries and fringe benefits for sales and administrative personnel paid in cash during March amounted to $7,000.

- Depreciation on administrative office equipment and space amounted to $5,000.

- Other selling and administrative expenses paid in cash during March amounted to $1,000.

- Job number T81 was completed on March 20.

- Half of the trombones in Job number T81 were sold on account during March for $700 each.

The March 1 balances in selected accounts are as follows:

| Cash | $ | 10,000 | |

| Accounts Receivable | 21,000 | ||

| Prepaid Insurance | 5,000 | ||

| Raw-Material Inventory | 149,000 | ||

| Manufacturing Supplies Inventory | 400 | ||

| Work-in-Process Inventory | 91,000 | ||

| Finished-Goods Inventory | 220,000 | ||

| Accumulated Depreciation: Buildings and Equipment | 102,000 | ||

| Accounts Payable | 11,000 | ||

| Wages Payable | 8,000 | ||

Problem 3-57 Part 5

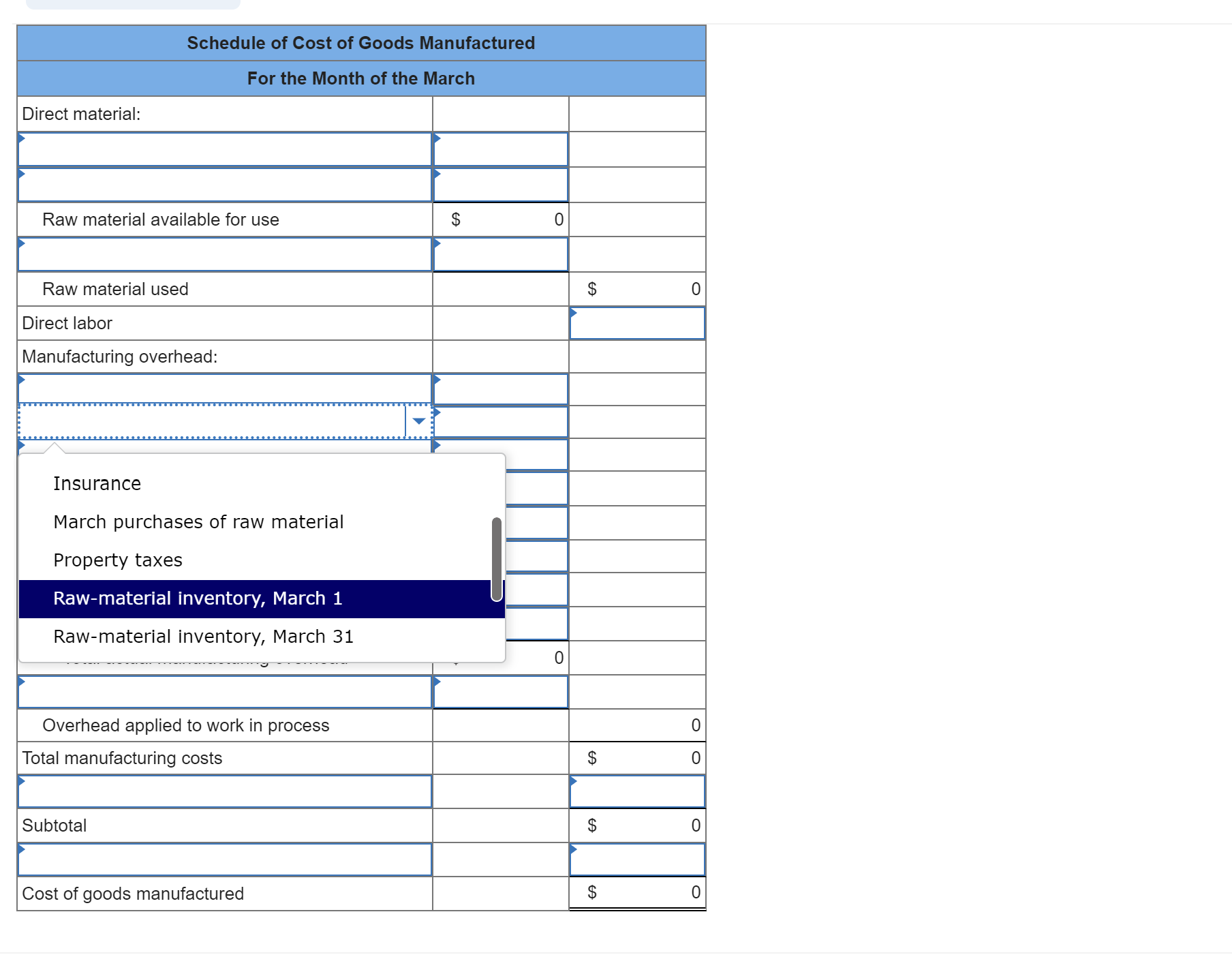

5. Prepare a schedule of cost of goods manufactured for March.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started