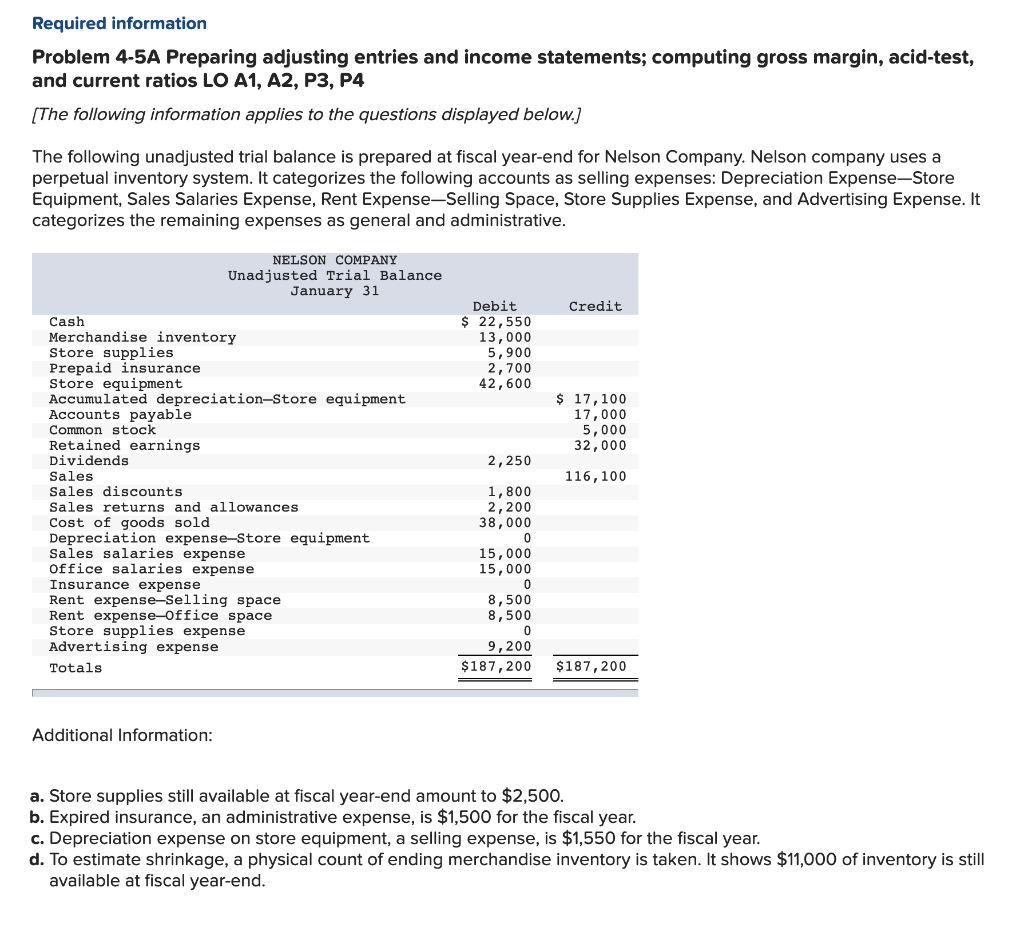

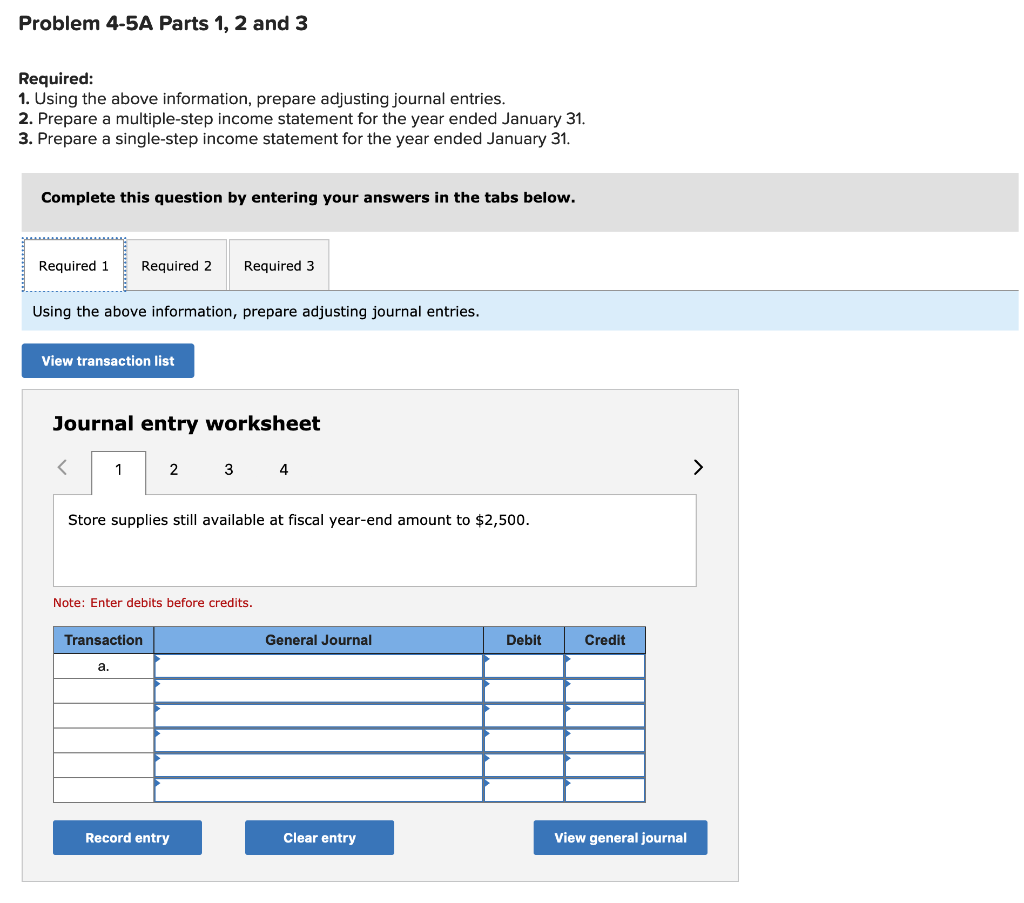

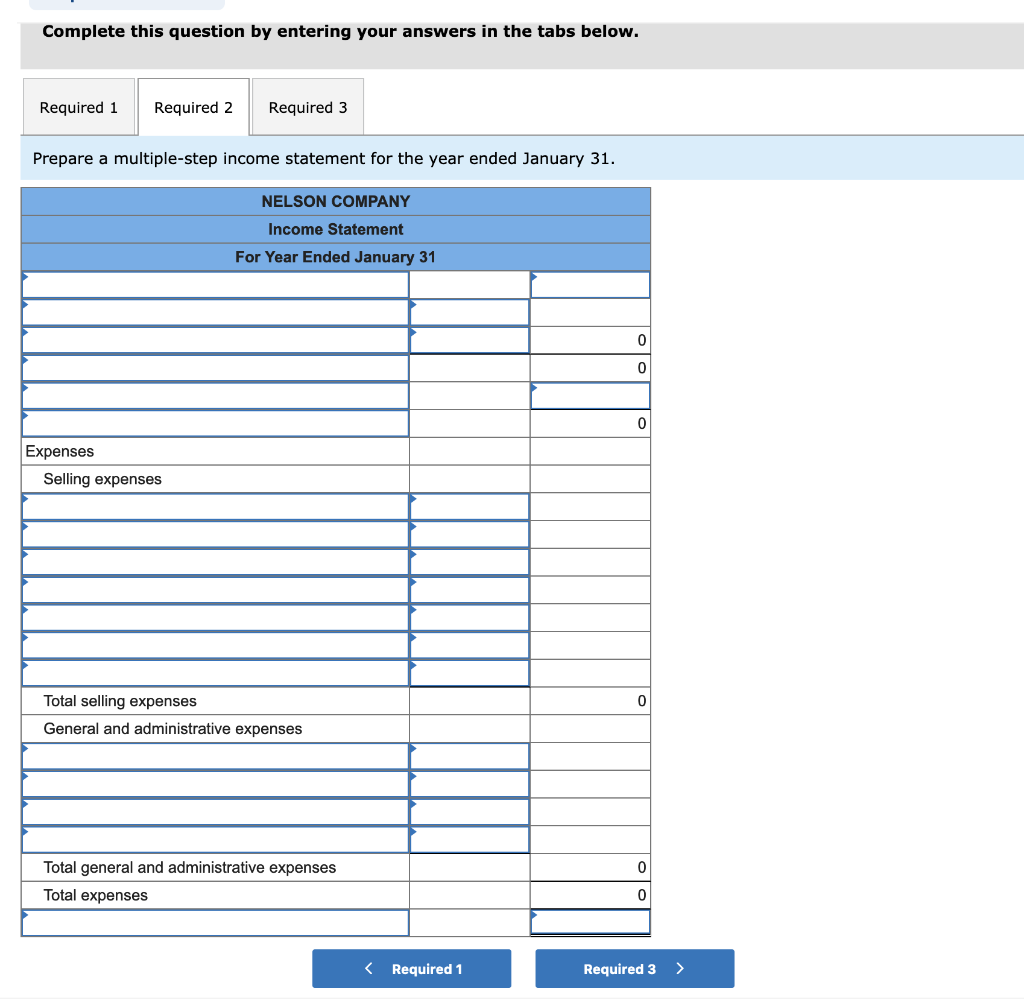

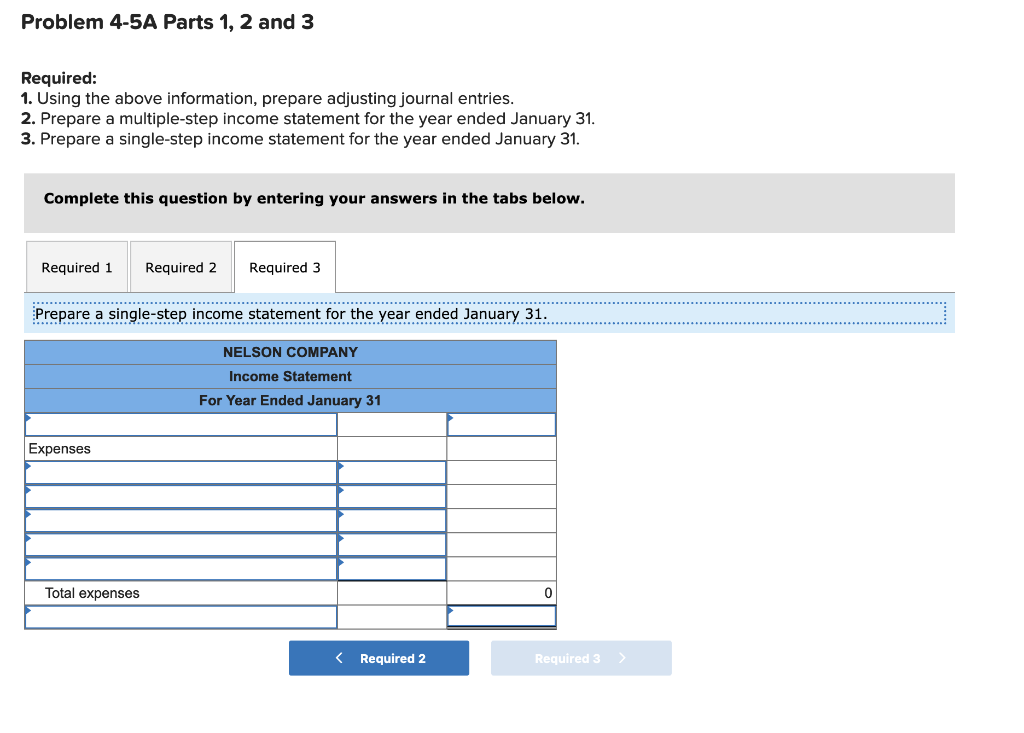

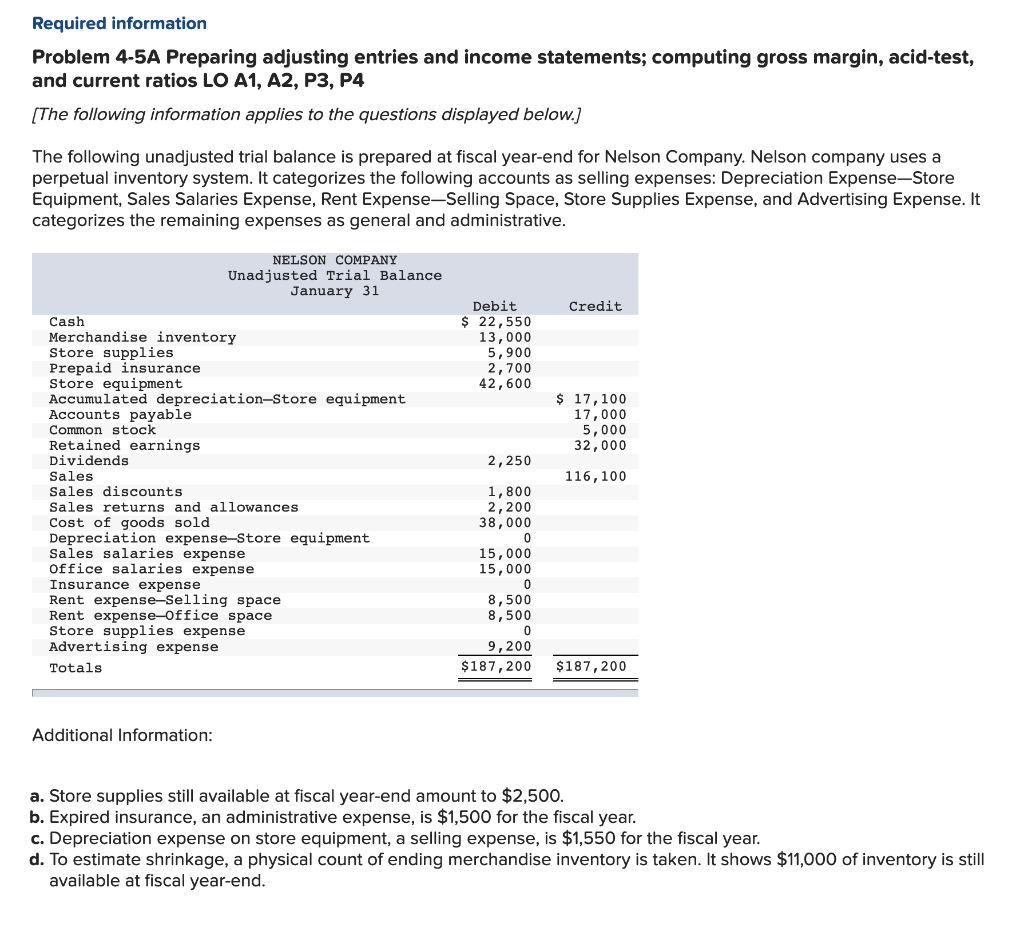

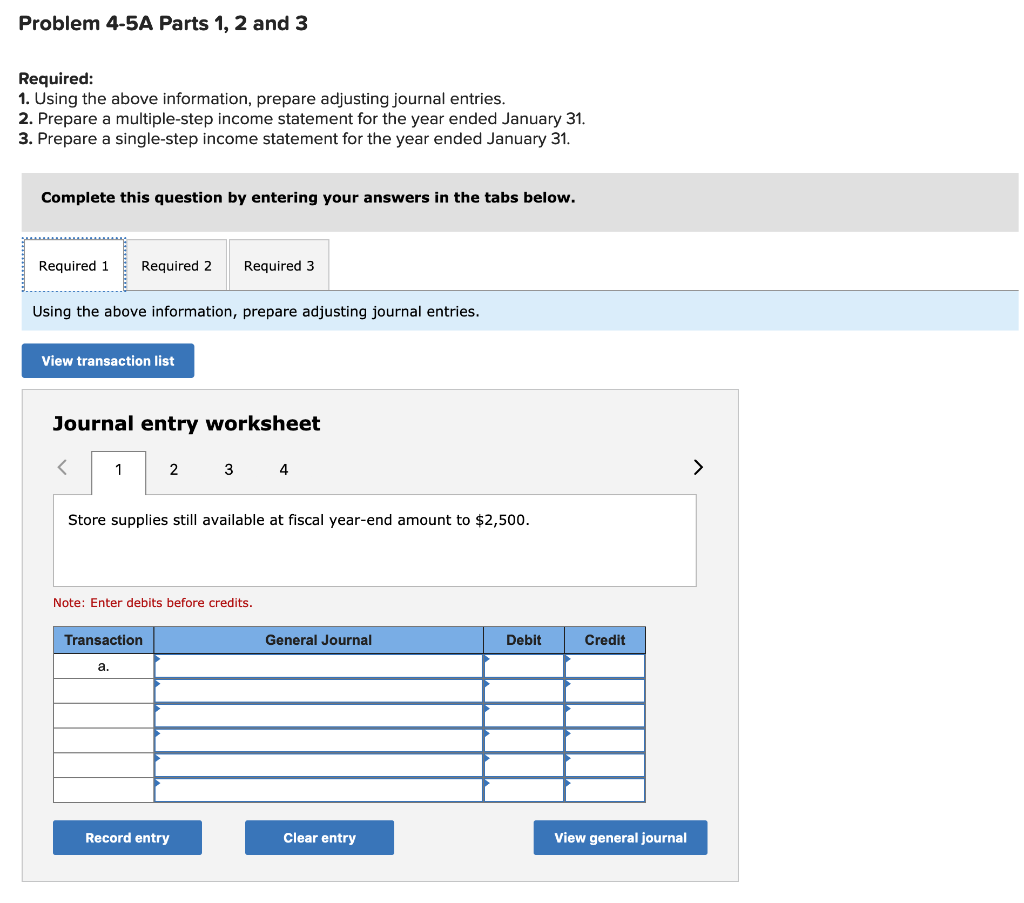

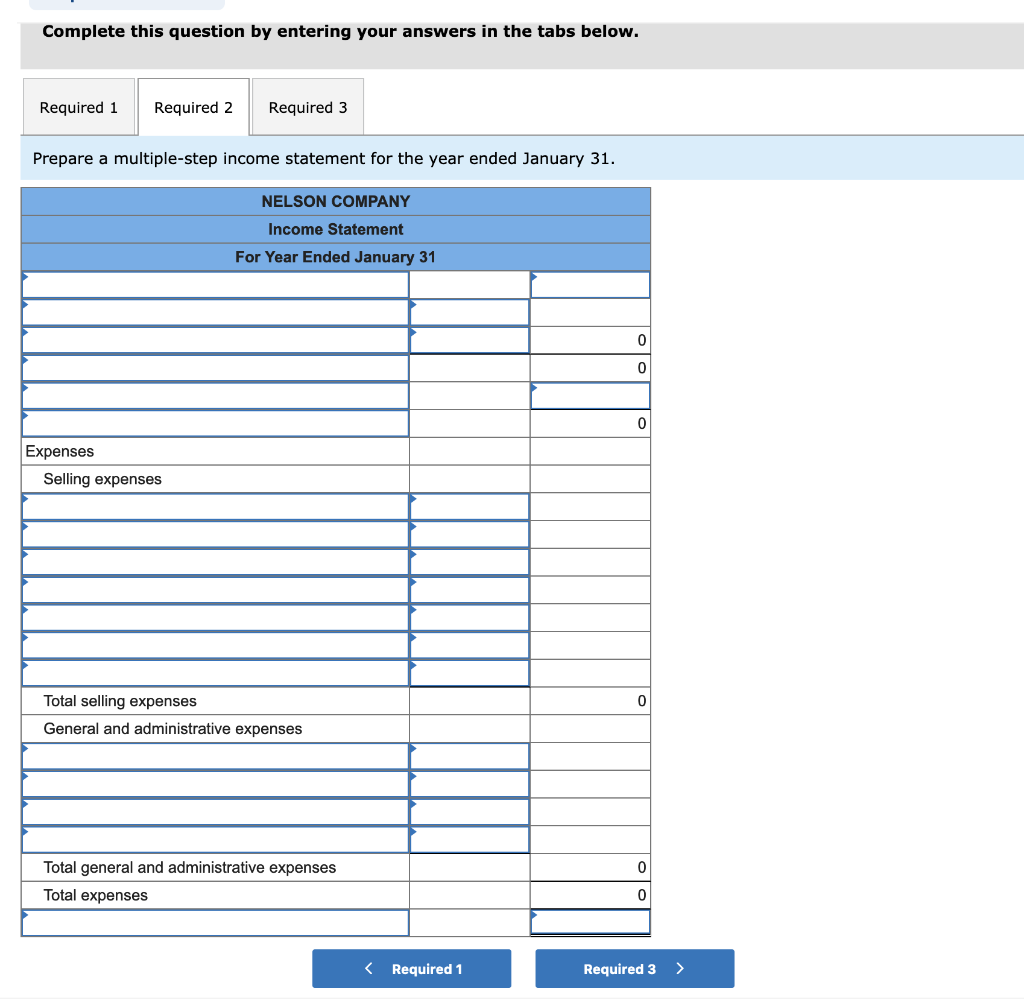

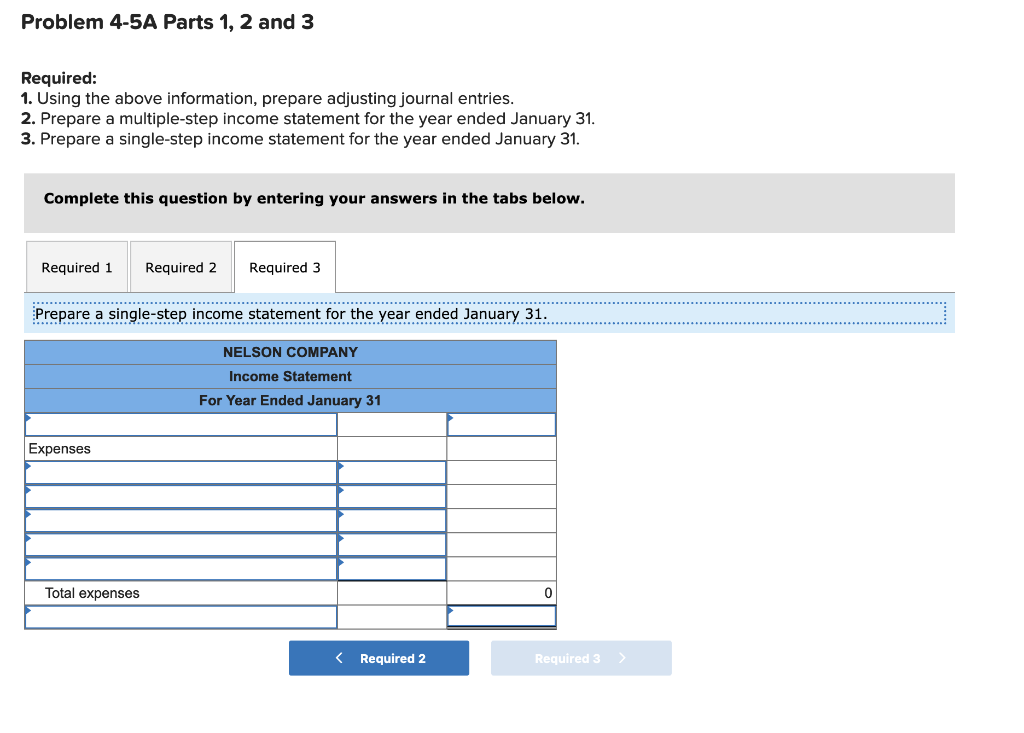

Required information Problem 4-5A Preparing adjusting entries and income statements; computing gross margin, acid-test, and current ratios LO A1, A2, P3, P4 (The following information applies to the questions displayed below.) The following unadjusted trial balance is prepared at fiscal year-end for Nelson Company. Nelson company uses a perpetual inventory system. It categorizes the following accounts as selling expenses: Depreciation Expense-Store Equipment, Sales Salaries Expense, Rent Expense-Selling Space, Store Supplies Expense, and Advertising Expense. It categorizes the remaining expenses as general and administrative. NELSON COMPANY Unadjusted Trial Balance January 31 Credit Debit $ 22,550 13,000 5,900 2,700 42,600 $ 17,100 17,000 5,000 32,000 2,250 116,100 Cash Merchandise inventory Store supplies Prepaid insurance Store equipment Accumulated depreciation-store equipment Accounts payable Common stock Retained earnings Dividends Sales Sales discounts Sales returns and allowances Cost of goods sold Depreciation expense-Store equipment Sales salaries expense Office salaries Insurance expense Rent expense-Selling space Rent expense-Office space Store supplies expense Advertising expense Totals 1,800 2,200 38,000 0 15,000 15,000 expense 8,500 8,500 0 9, 200 $187,200 $187,200 Additional Information: a. Store supplies still available at fiscal year-end amount to $2,500. b. Expired insurance, an administrative expense, is $1,500 for the fiscal year. c. Depreciation expense on store equipment, a selling expense, is $1,550 for the fiscal year. d. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $11,000 of inventory is still available at fiscal year-end. Problem 4-5A Parts 1, 2 and 3 Required: 1. Using the above information, prepare adjusting journal entries. 2. Prepare a multiple-step income statement for the year ended January 31. 3. Prepare a single-step income statement for the year ended January 31. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Using the above information, prepare adjusting journal entries. View transaction list Journal entry worksheet Store supplies still available at fiscal year-end amount to $2,500. Note: Enter debits before credits. Transaction General Journal Debit Credit a Record entry Clear entry View general journal Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a multiple-step income statement for the year ended January 31. NELSON COMPANY Income Statement For Year Ended January 31 0 0 0 Expenses Selling expenses 0 Total selling expenses General and administrative expenses 0 Total general and administrative expenses Total expenses 0 Problem 4-5A Parts 1, 2 and 3 Required: 1. Using the above information, prepare adjusting journal entries. 2. Prepare a multiple-step income statement for the year ended January 31. 3. Prepare a single-step income statement for the year ended January 31. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a single-step income statement for the year ended January 31. NELSON COMPANY Income Statement For Year Ended January 31 Expenses Total expenses 0