Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information Problem 5 - 6 7 ( LO 5 - 3 ) ( Algo ) [ The following information applies to the questions displayed

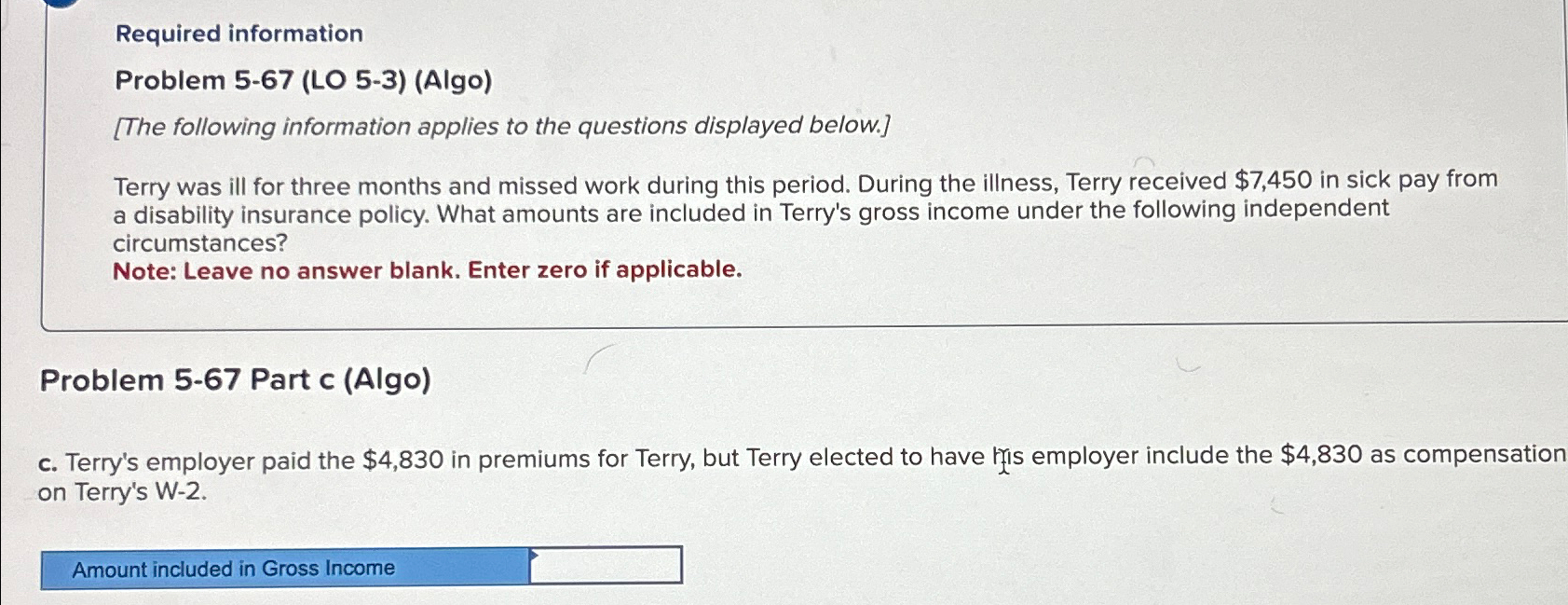

Required information

Problem LO Algo

The following information applies to the questions displayed below.

Terry was ill for three months and missed work during this period. During the illness, Terry received $ in sick pay from a disability insurance policy. What amounts are included in Terry's gross income under the following independent circumstances?

Note: Leave no answer blank. Enter zero if applicable.

Problem Part c Algo

c Terry's employer paid the $ in premiums for Terry, but Terry elected to have Fis employer include the $ as compensation on Terry's W

Amount included in Gross Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started