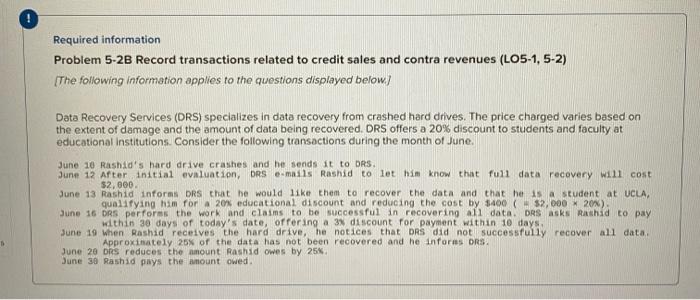

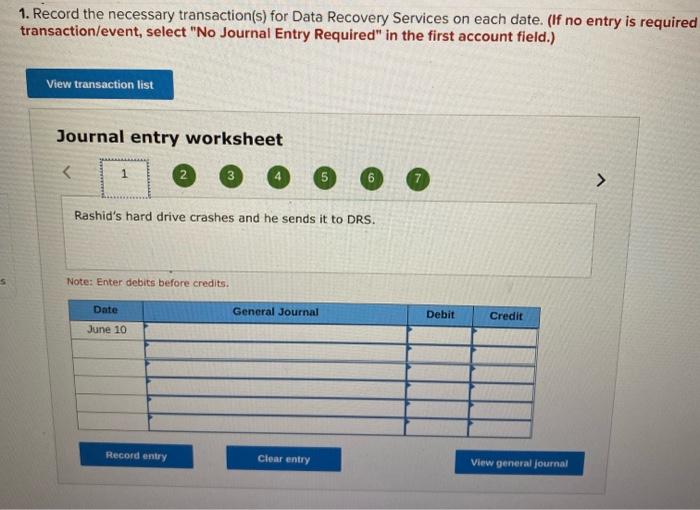

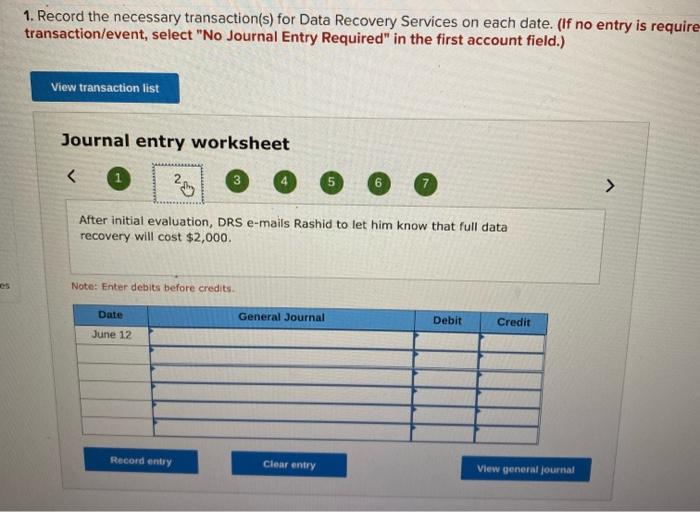

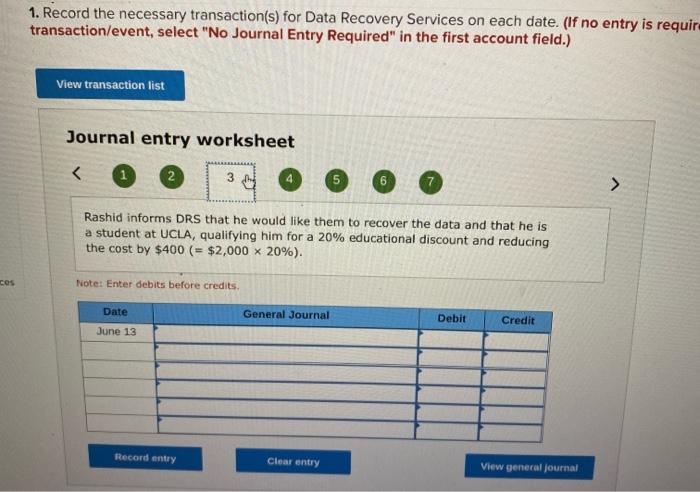

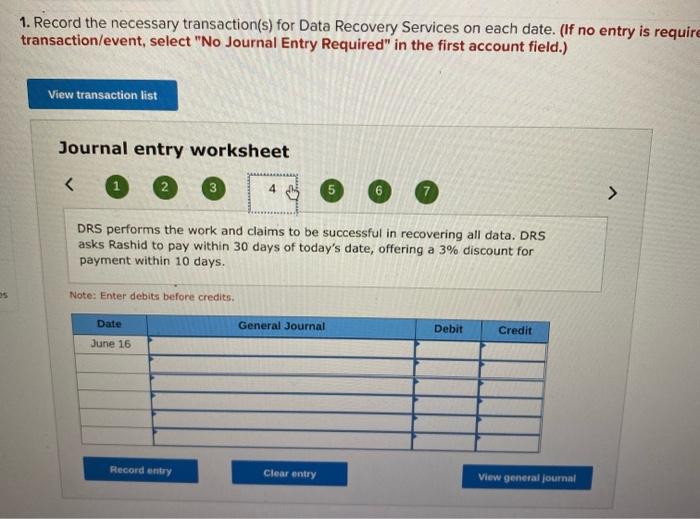

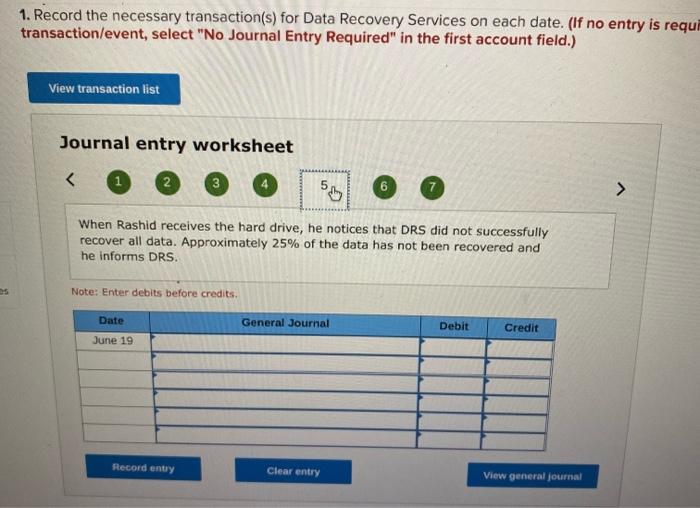

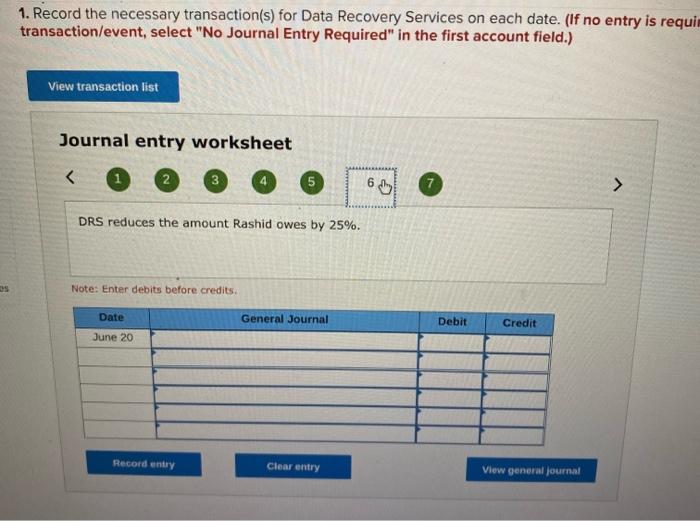

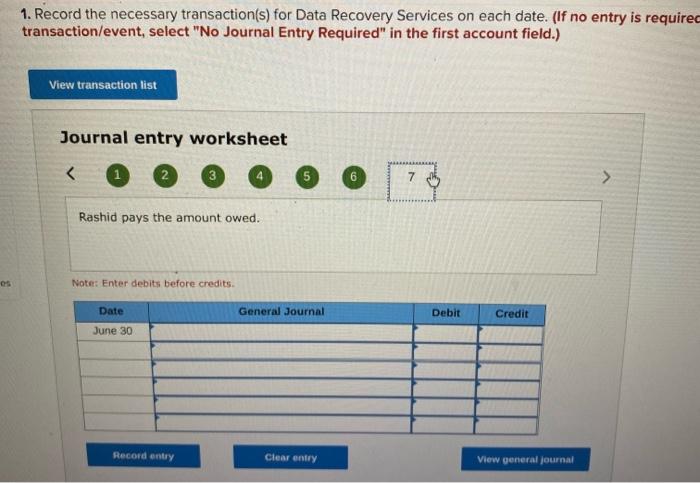

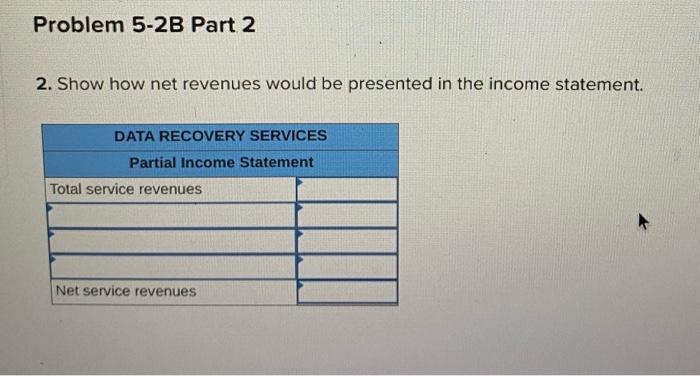

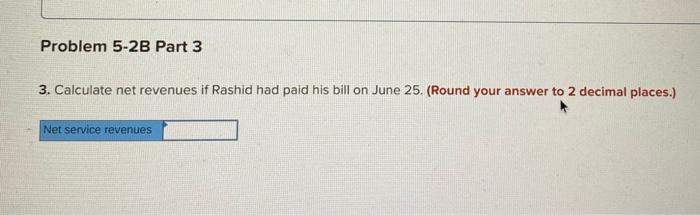

Required information Problem 5-2B Record transactions related to credit sales and contra revenues ( LO5-1, 5-2) [The following information applies to the questions displayed below.] Data Recovery Services (DRS) specializes in data recovery from crashed hard drives. The price charged varies based on the extent of damage and the amount of data being recovered. DRS offers a 20% discount to students and faculty at educational institutions. Consider the following transactions during the month of June. June 10 Rashid's hard drive crashes and the sends it to Des. June 12 After initial evaluation, DRS e-mails Rashid to let him know that funl data recovery will cost 52,800 June 13 Rashid informs DRS that he would like them to recover the data and that he is a student at ucLa, qualifying ham for a 20 educational discount and reducing the cost by $400(=$2, peo 200). June 16 bRs perforss the work and clasms to be successful in recovering all data. DRs asks Rashid to pay within 30 days of today's date, offering a 34 discount for payment within 10 days. June 19 when Rashid receives the hard drive, he notices that DRs did not successfully recover all data. Apgroxinately 25K of the data has not been recovered and he inforas ors. June 20 Ders reduces the amount fashid owes by 25%. June 30 Rashid pays the anount owed. 1. Record the necessary transaction(s) for Data Recovery Services on each date. (If no entry is required transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 3 (4) (5) 6 (7) Rashid's hard drive crashes and he sends it to DRS. Note: Enter debits before credits. 1. Record the necessary transaction(s) for Data Recovery Services on each date. (If no entry is require transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet (4) (5) 6 ( After initial evaluation, DRS e-mails Rashid to let him know that full data recovery will cost $2,000. Note: Enter debits before credits. 1. Record the necessary transaction(s) for Data Recovery Services on each date. (If no entry is requir transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 7. Rashid informs DRS that he would like them to recover the data and that he is a student at UCLA, qualifying him for a 20% educational discount and reducing the cost by $400(=$2,00020%). Note: Enter debits before credits. 1. Record the necessary transaction(s) for Data Recovery Services on each date. (If no entry is requir transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 1 7 DRS performs the work and claims to be successful in recovering all data. DRS asks Rashid to pay within 30 days of today's date, offering a 3% discount for payment within 10 days. Note: Enter debits before credits. 1. Record the necessary transaction(s) for Data Recovery Services on each date. (If no entry is requ transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet (1) 2 When Rashid receives the hard drive, he notices that DRS did not successfully recover all data. Approximately 25% of the data has not been recovered and he informs DRS. Note: Enter debits before credits. 1. Record the necessary transaction(s) for Data Recovery Services on each date. (If no entry is requi transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet (1) (2) 3 DRS reduces the amount Rashid owes by 25%. Note: Enter debits before credits. 1. Record the necessary transaction(s) for Data Recovery Services on each date. (If no entry is require transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 2. Show how net revenues would be presented in the income statement. 3. Calculate net revenues if Rashid had paid his bill on June 25 . (Round your answer to 2 decimal places.)