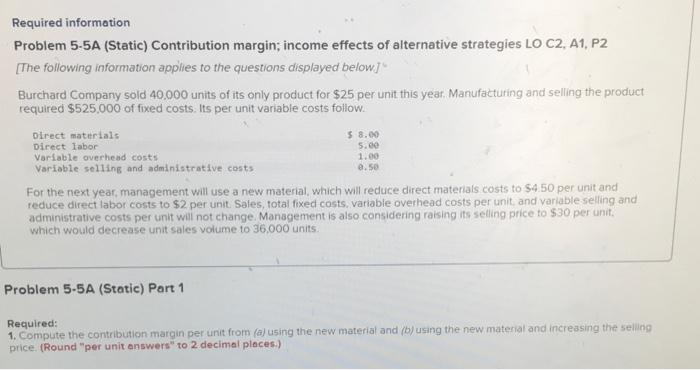

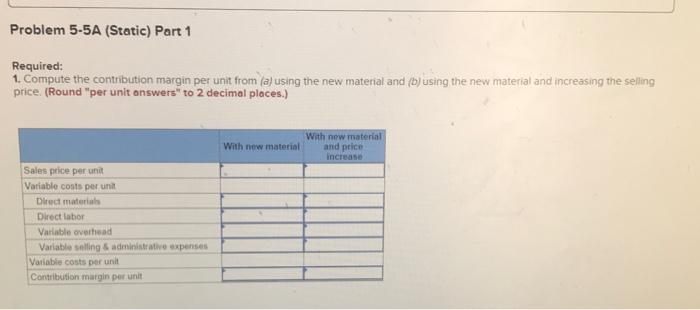

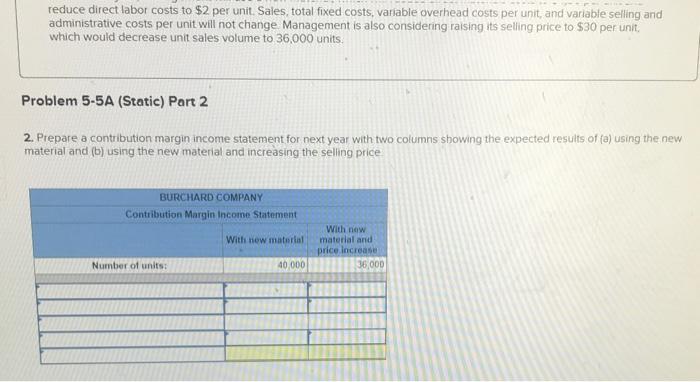

Required information Problem 5-5A (Static) Contribution margin; income effects of alternative strategies LO C2, A1, P2 [The following information applies to the questions displayed below] Burchard Company sold 40.000 units of its only product for $25 per unit this year, Manufacturing and selling the product required $525,000 of fixed costs. Its per unit variable costs follow. Direct materials Direct labor Variable overhead costs Variable selling and administrative costs For the next year, management will use a new material, which will reduce direct materials costs to $4.50 per unit and reduce direct labor costs to $2 per unit. Sales, total fixed costs, variable overhead costs per unit and variable selling and administrative costs per unit will not change Management is also considering raising its selling price to $30 per unit. which would decrease unit sales volume to 36,000 units. $ 8.00 5.00 1.00 a.se Problem 5.5A (Static) Part 1 Required: 1. Compute the contribution margin per unit from (a) using the new material and (b) using the new material and increasing the selling price (Round "per unit answers to 2 decimal places.) Problem 5-5A (Static) Part 1 Required: 1. Compute the contribution margin per unit from (2) using the new material and (b) using the new material and increasing the selling price (Round "per unit answers" to 2 decimal places.) With new material with new material and price increase Sales price per unit Variable costs per unit Direct materials Direct labor Variable overhead Variable selling administrative expenses Variable costs per unit Contribution margin per unit reduce direct labor costs to $2 per unit. Sales, total fixed costs, variable overhead costs per unit, and variable selling and administrative costs per unit will not change Management is also considering raising its selling price to $30 per unit which would decrease unit sales volume to 36,000 units. Problem 5-5A (Static) Part 2 2. Prepare a contribution margin income statement for next year with two columns showing the expected results of fa) using the new material and (b) using the new material and increasing the selling price BURCHARD COMPANY Contribution Margin Income Statement With new material With now material and price Increase 36.000 Number of units: 40.000