Required information

Problem 6-1A Perpetual: Alternative cost flows LO P1

[The following information applies to the questions displayed below.] Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March.

| | Date | Activities | Units Acquired at Cost | Units Sold at Retail |

| | Mar. | 1 | | Beginning inventory | | 150 | units | @ $52.00 per unit | | | | |

| | Mar. | 5 | | Purchase | | 250 | units | @ $57.00 per unit | | | | |

| | Mar. | 9 | | Sales | | | | | | 310 | units | @ $87.00 per unit |

| | Mar. | 18 | | Purchase | | 110 | units | @ $62.00 per unit | | | | |

| | Mar. | 25 | | Purchase | | 200 | units | @ $64.00 per unit | | | | |

| | Mar. | 29 | | Sales | | | | | | 180 | units | @ $97.00 per unit |

| | | | | Totals | | 710 | units | | | 490 | units | |

| |

Problem 6-1A Part 3

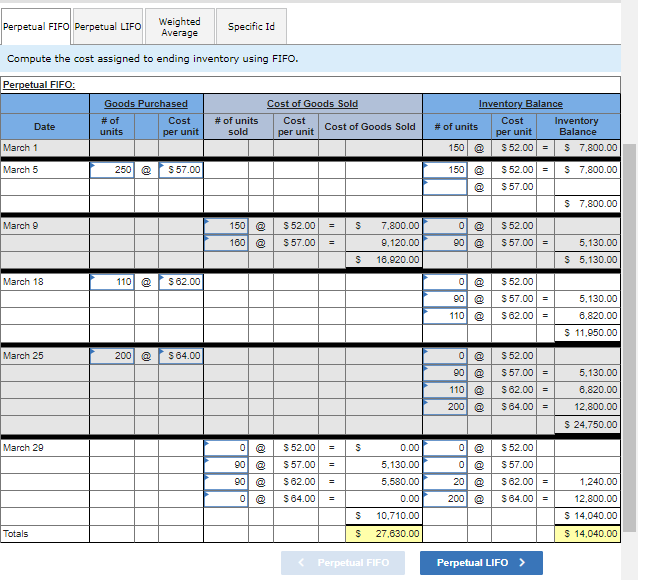

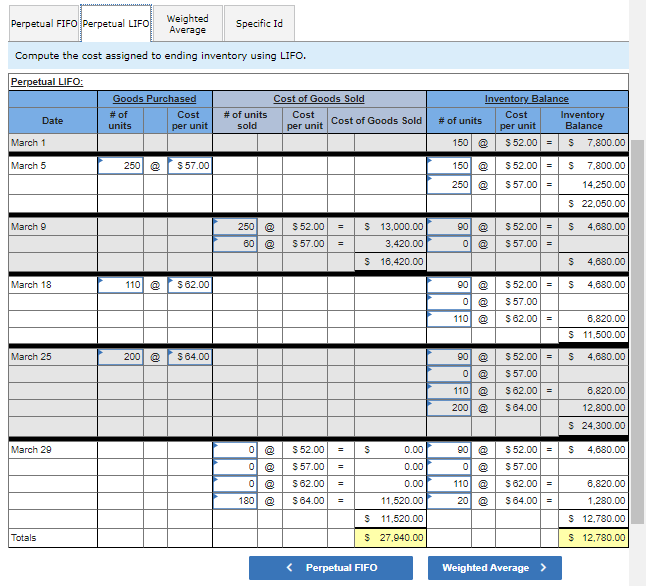

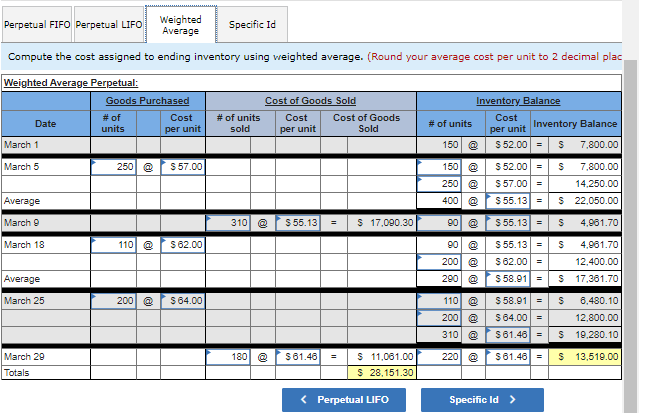

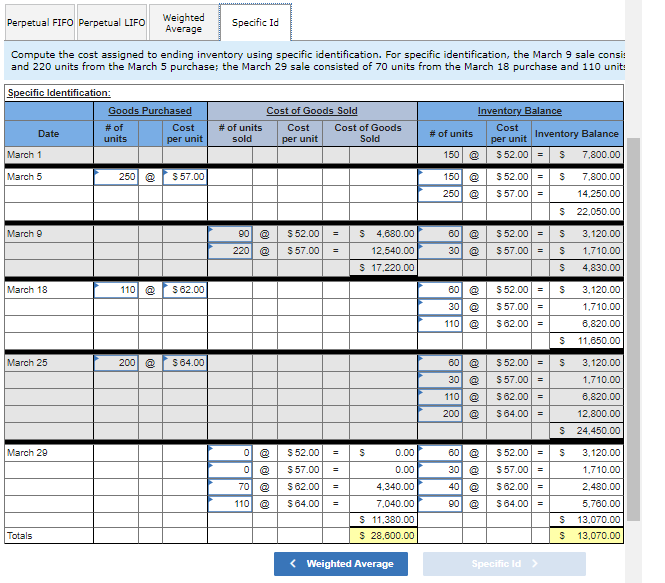

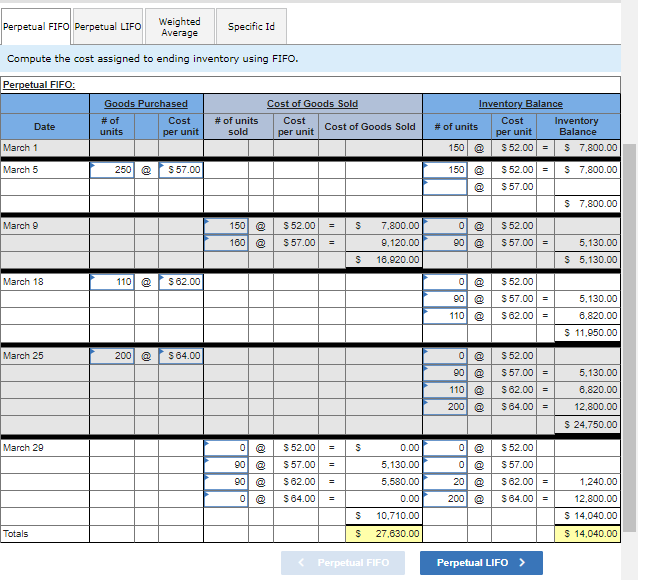

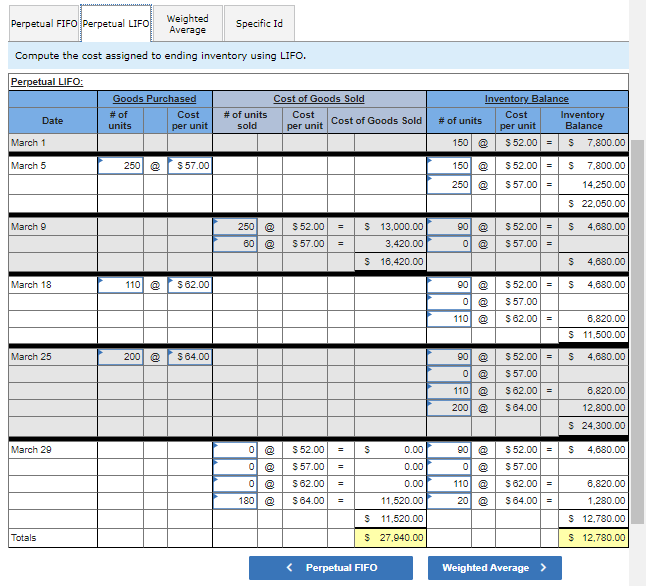

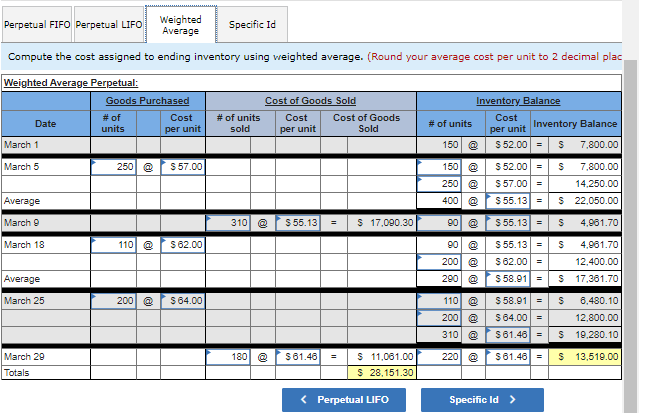

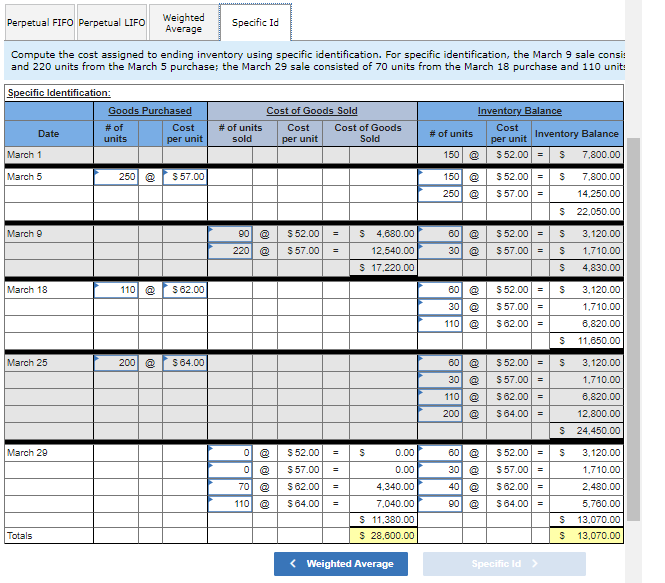

3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. For specific identification, the March 9 sale consisted of 90 units from beginning inventory and 220 units from the March 5 purchase; the March 29 sale consisted of 70 units from the March 18 purchase and 110 units from the March 25 purchase.

Perpetual FIFO Perpetual LIFO Weighted Average Specific Id Compute the cost assigned to ending inventory using FIFO. Perpetual FIFO: Goods Purchased # of Cost units per unit Cost of Goods Sold Cost Cost of Goods Sold # of units sold Date Inventory Balance Cost Inventory # of units Balance 150 S52.00 S 7,800.00 per unit per unit March 1 March 5 250 @ S 57.00 150 @ @ @ @ $ 7.800.00 S52.00 = S 57.00 S 7,800.00 March 9 150 @ s " S52.00 S 57.00 0 @ 90 @ 7.800.00 9,120.00 16.920.00 $ 52.00 $57.00 = 1001 @ = 5,130.00 $ 5,130.00 S March 18 110 $ 62.00 0 @ 90 @ 110 @ S52.00 S 57.00 = $ 62.00 = 5,130.00 6.820.00 $ 11,950.00 March 25 200 @ $ 64.00 0 @ 90 @ 1101 @ 2001 @ S52.00 S 57.00 = S 62.00 = S 64.00 = 5,130.00 8.820.00 12.800.00 $ 24,750.00 March 20 S 0.00 0 @ 0 @ 90 @ 90 @ $ 52.00 S 57.00 S62.00 $64.00 5,130.00 5.580.00 0.00 0 @ 20 @ 2001 @ S 52.00 S 57.00 $ 62.00 = $ 64.00 = 1.240.00 12,800.00 S 10.710.00 27.630.00 $ 14,040.00 $ 14,040.00 Totals S Perpetual FIFO Perpetual LIFO > Perpetual FIFO Perpetual LIFO Weighted Average Specific Id Compute the cost assigned to ending inventory using LIFO. Perpetual LIFO: Goods Purchased # of Cost units per unit Cost of Goods Sold Cost Cost of Goods Sold # of units sold Date Inventory Balance Cost # of units Inventory per unit Balance 150 @ $ 52.00 = S 7,800.00 per unit March 1 March 5 250 @ S 57.00 150| @ S52.00 S 7,800.00 250 m $57.00 = 14,250.00 $ 22,050.00 March 9 = S 4.680.00 250 60 @ S52.00 S 57.00 $ 13,000.00 3,420.00 $ 16,420.00 90 @ 0 @ S52.00 = S 57.00 = = S 4.680.00 March 18 110 @ $ 62.00 S 4.680.00 90 @ 0 @ S52.00 = $57.00 $ 62.00 = 1101 6.820.00 S 11.500.00 March 25 200 S 64.00 S 4.680.00 90 @ 0 @ 1101 200 m S52.00 = $57.00 S 62.00 = $ 64.00 6.820.00 12,800.00 S 24,300.00 March 29 S 0.00 S 52.00 = S 4.680.00 0 @ 0 0.00 S52.00 S 57.00 S62.00 $ 64.00 90 @ 0 @ 110 @ 20 @ 0.00 0 @ 180 @ S 57.00 $ 62.00 = S 64.00 = 11.520.00 $ 11,520.00 8,820.00 1.280.00 $ 12,780.00 Totals $ 27.940.00 $ 12,780.00 Perpetual FIFO Perpetual LIFO Weighted Average Specific Id Compute the cost assigned to ending inventory using weighted average. (Round your average cost per unit to 2 decimal plac Weighted Average Perpetual: Goods Purchased # of Cost Date units March 1 Cost of Goods Sold # of units Cost Cost of Goods sold Sold Inventory Balance Cost # of units Inventory Balance per unit per unit per unit 150 @ S52.00 = S 7,800.00 March 5 250 @ S 57.00 150 @ 250 400 $ 52.00 = S 57.00 = $ 55.13 = S 7.800.00 14,250.00 $ 22,050.00 Average March 9 3101 @ S 55.13 $ 17,090.30 90 @ $55.13 = s 4.961.70 March 18 110 @ S 62.00 90 @ 2001 290 S 55.13 = $ 62.00 = S 58.91 = S 4.981.70 12,400.00 $ 17.361.70 Average March 25 200 @ S 64.00 110 @ = S 6.480.10 S 58.91 $ 64.00 = S61.46 200 @ 310 12,800.00 $ 19,280.10 180 @ S61.46 220 @ S61.46 = $ 13,519.00 March 29 Totals $ 11,081.00 $ 28,151.30 Perpetual FIFO Perpetual LIFO Weighted Average Specific Id Compute the cost assigned to ending inventory using specific identification. For specific identification, the March 9 sale consi: and 220 units from the March 5 purchase; the March 29 sale consisted of 70 units from the March 18 purchase and 110 unit: Specific Identification: Goods Purchased Cost of Goods Sold Inventory Balance #of Cost Date Cost # of units Cost of Goods Cost units sold # of units Sold per unit Inventory Balance per unit March 1 150 @ S52.00 = S 7.800.00 March 5 250 @ S 57.00 S 52.00 = S 7.800.00 250 @ S 57.00 = 14,250.00 $ 22,050.00 per unit 150 @ March S 90 @ 220 @ S52.00 S 57.00 $ 4,680.00 12,540.00 S 17,220.00 60 @ 30 @ S 52.00 = S 57.00 = s 3,120.00 1.710.00 4,830.00 S March 18 110 @ $ 62.00 S 601 @ 30 @ 110 @ S52.00 = $57.00 = $ 62.00 = 3.120.00 1.710.00 6.820.00 11.650.00 S March 25 200 @ S 64.00 s 3.120.00 60 @ 30 @ 110 @ 2001 @ S 52.00 = $57.00 = S 62.00 = $ 64.00 = 1.710.00 6.820.00 12,800.00 24,450.00 con March 29 S 0.00 0.00 = 0 @ 0 @ 70 @ 110 @ $ 52.00 S 57.00 $ 62.00 $64.00 60 @ 301 @ 40 @ 901 @ S52.00 = S 57.00 = S 62.00 = $ 64.00 = = 4,340.00 3,120.00 1.710.00 2.480.00 5.760.00 13.070.00 13.070.00 7.040.00 S 11,380.00 $ 28,600.00 S Totals S