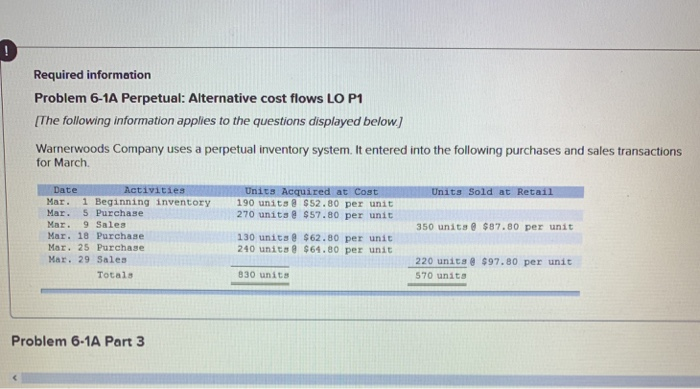

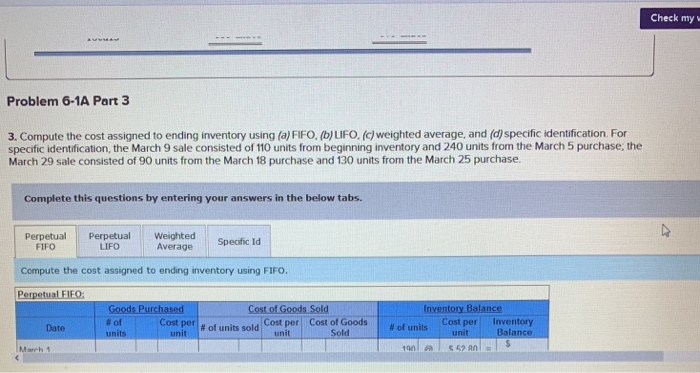

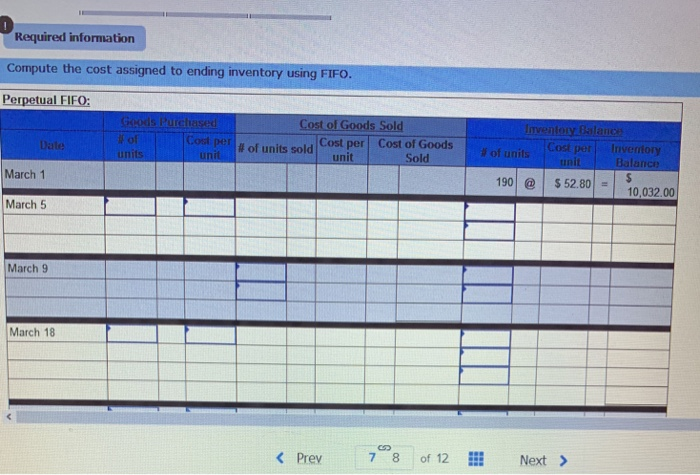

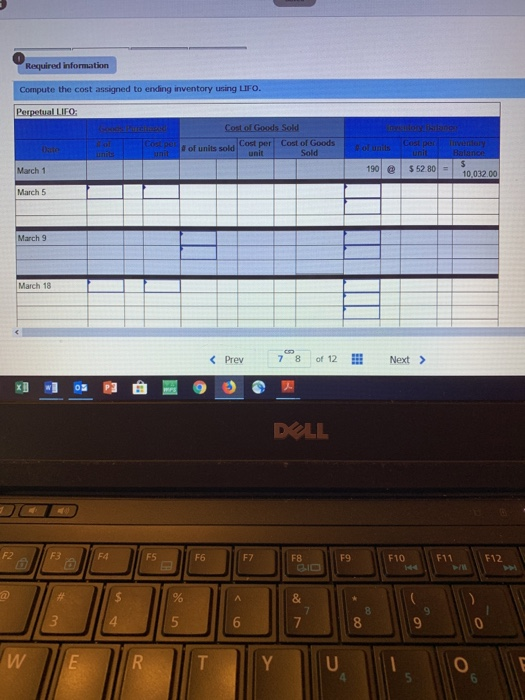

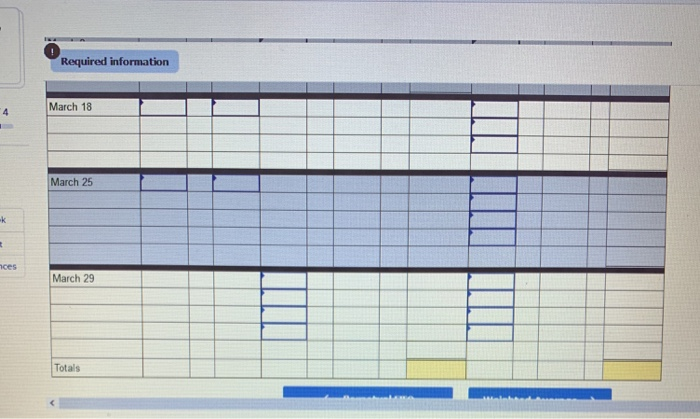

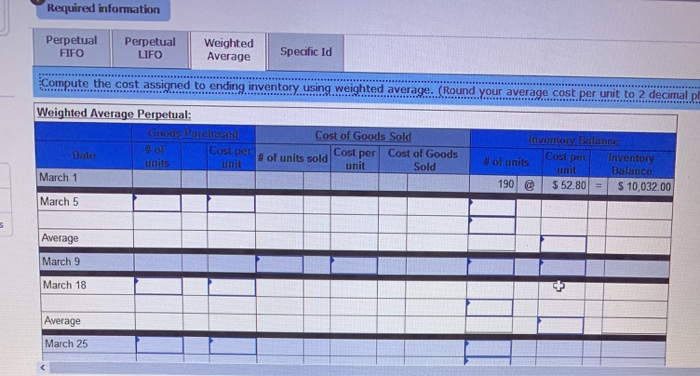

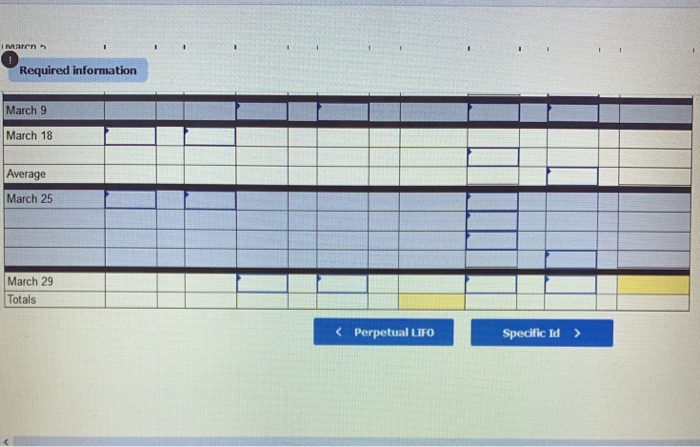

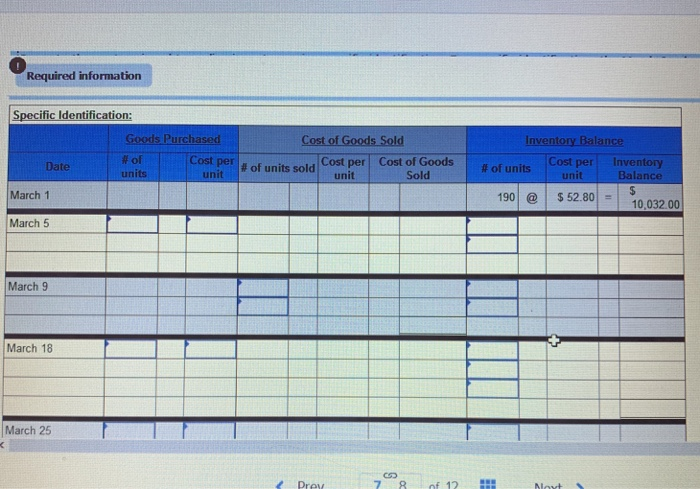

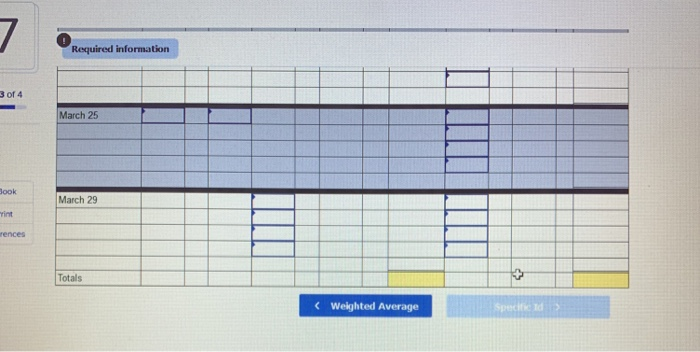

Required information Problem 6-1A Perpetual: Alternative cost flows LO P1 [The following information applies to the questions displayed below] Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March qu Mar. 1 Beginning inventory 190 units S52.80 per unit Mar. 5 Purchase Mar. 9 Sales Mar. 18 Purchase Mar. 25 Purchase Mar. 29 Sales 270 unit $57.80 per unit 350 units $87.80 per unit 130 units $62.80 per unit 240 units $64.80 per unit 220 unics $97.80 per unit Totals 830 units 570 units Problem 6-1A Part 3 Check myv Problem 6-1A Part 3 3. Compute the cost assigned to ending inventory using (a) FIFO. (b)LIFO. (c)weighted average, and (d)specific identification. For specific identification, the March 9 sale consisted of 110 units from beginning inventory and 240 units from the March 5 purchase, the March 29 sale consisted of 90 units from the March 18 purchase and 130 units from the March 25 purchase. Complete this questions by entering your answers in the below tabs. Perpetual Perpetual Weighted FIFO Compute the cost assigned to ending inventory using FIFo Perpetual EIEO: LIFO Average Speofic Id Goods Purchased #of # of units sold Cost per l Cost of Goods unit Cost per| Date #Of units Cost per Inventory Sold March 1 Required information Compute the cost assigned to ending inventory using FIFO. Perpetual FIFO: Cost of Goods Sold Cost pet # of units unitof units sold Costper Cost of Goods Sold unit 190 @ | $52.801 = | 10,032.00 March 1 March 5 March 9 March 18 Required information f 4 March 18 March 25 ok ces March 29 Totals Required information Compute the cost assigned to endling inventory ucing LIFo Perpetual LIFO Cost of Goods Sold 0 of units sold Cost per Cost of Goods 190$ 52.80 10.032.00 March 1 March 5 March 9 March 18

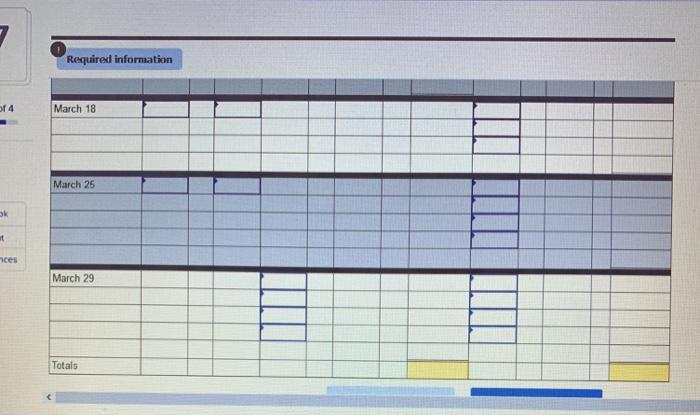

DOLL F6 F7 F8 F9 F10 F11 F12 6 W UE Required information March 18 March 25 March 29 Totals Required information Perpetual Perpetual Weighted LIFO AverageSpeafic Id FIFO Compute the cost assi to ending inventory using weighted average. (Round your average cost.per unit to 2 decimal p Weighted Average Perpetual: Cost of Goods Sold Cost per nof units sold Cost per Cost of Goods Sold unit March 1 190 $ 52.80$ 10,032.00 March 5 Average March 9 March 18 Average March 25 Required information March 9 March 18 Average March 25 March 29 Totals