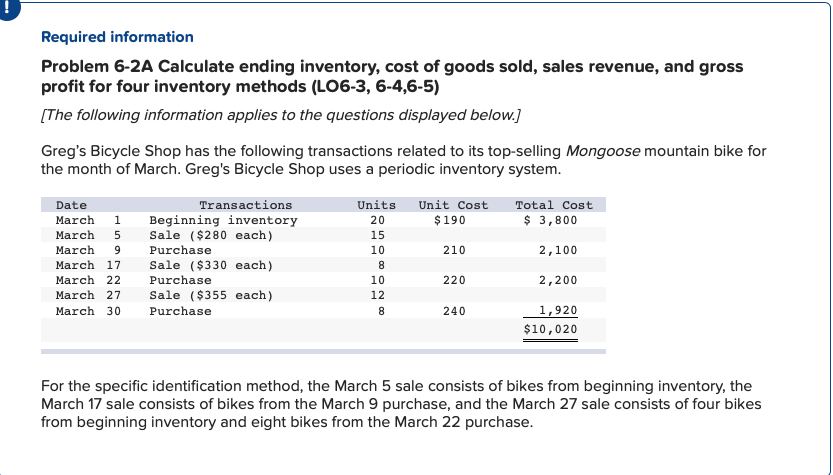

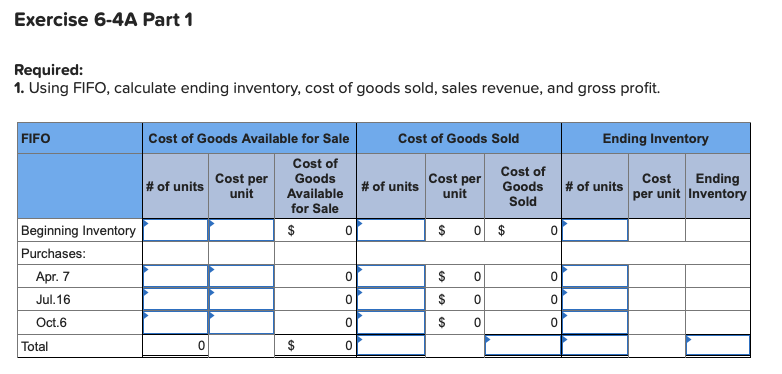

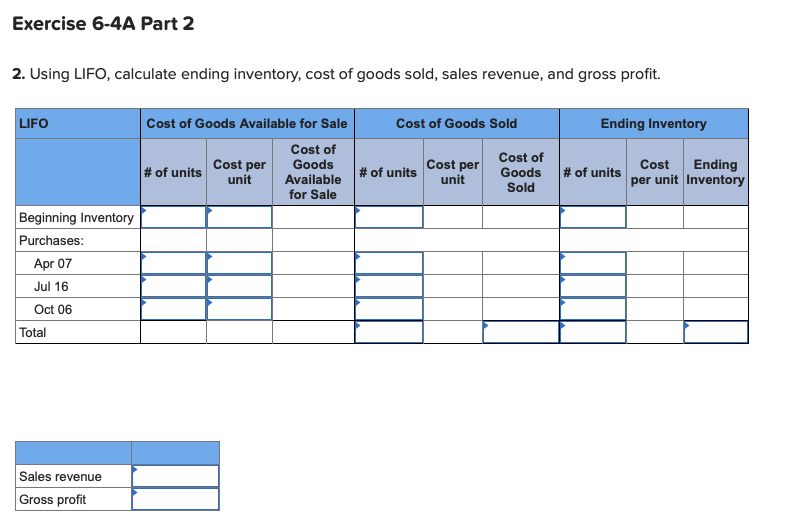

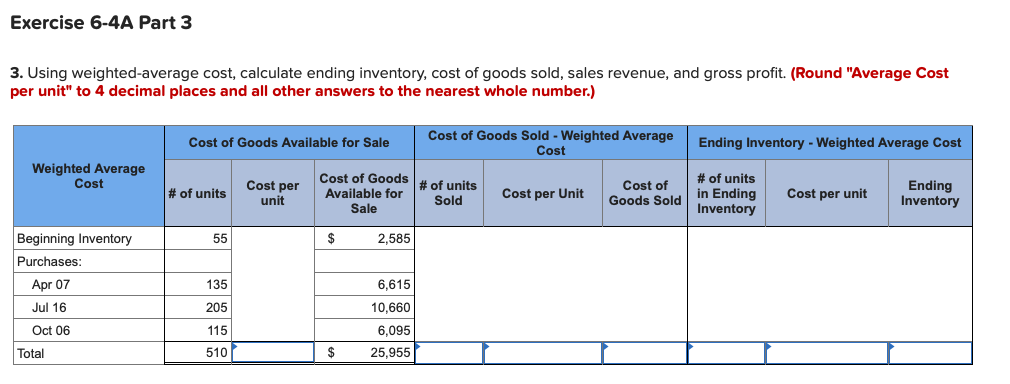

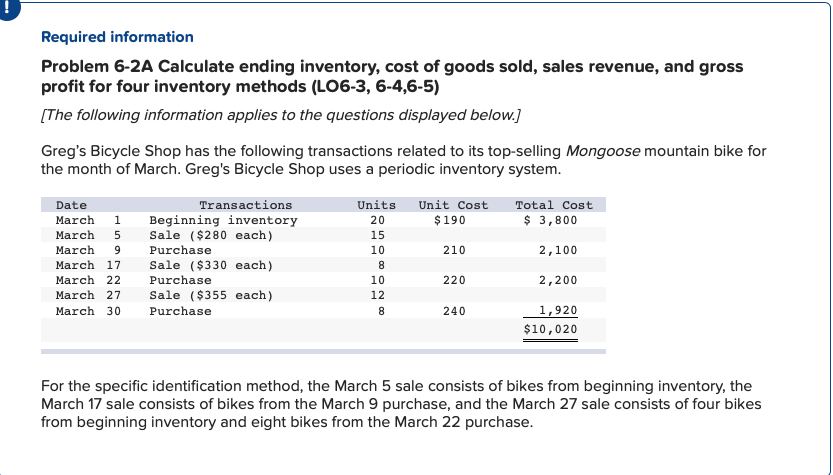

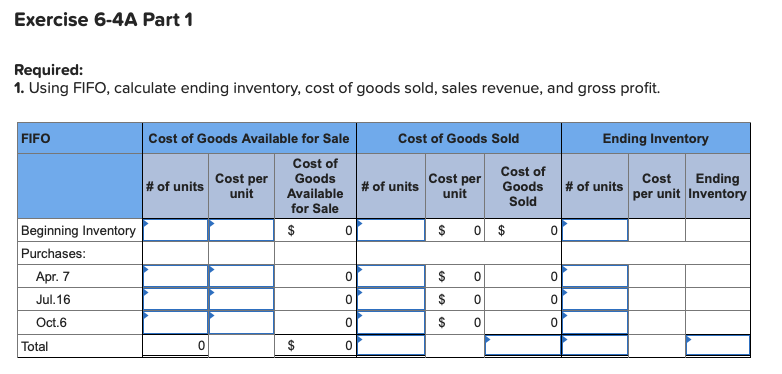

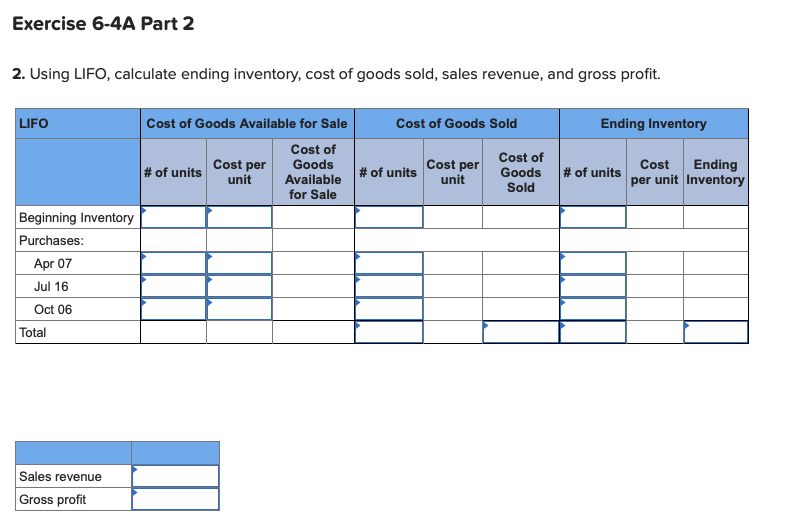

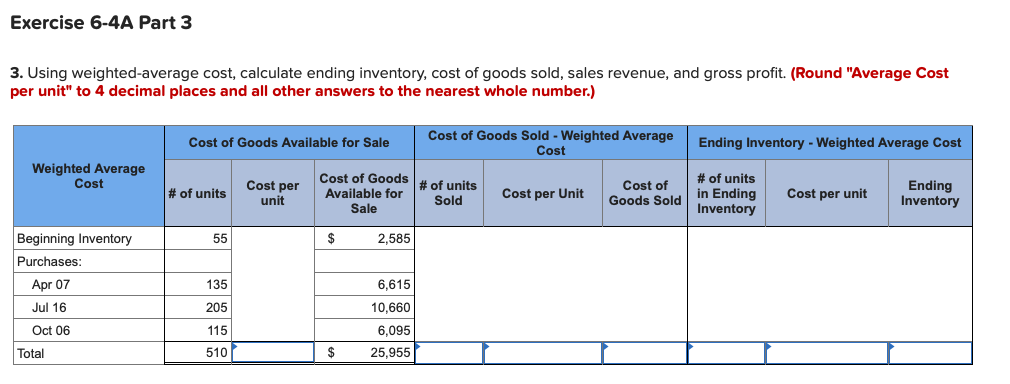

Required information Problem 6-2A Calculate ending inventory, cost of goods sold, sales revenue, and gross profit for four inventory methods (L06-3, 6-4,6-5) [The following information applies to the questions displayed below.) Greg's Bicycle Shop has the following transactions related to its top-selling Mongoose mountain bike for the month of March. Greg's Bicycle Shop uses a periodic inventory system. Unit Cost $190 Total Cost $ 3,800 210 Date March 1 March 5 March 9 March 17 March 22 March 27 March 30 2,100 Transactions Beginning inventory Sale $280 each) Purchase Sale $330 each) Purchase Sale $355 each) Purchase Units 20 15 10 8 10 12 8 220 2,200 240 1,920 $10,020 For the specific identification method, the March 5 sale consists of bikes from beginning inventory, the March 17 sale consists of bikes from the March 9 purchase, and the March 27 sale consists of four bikes from beginning inventory and eight bikes from the March 22 purchase. Exercise 6-4A Part 1 Required: 1. Using FIFO, calculate ending inventory, cost of goods sold, sales revenue, and gross profit. FIFO Cost of Goods Sold Ending Inventory Cost of Goods Available for Sale Cost of Cost per Goods # of units unit Available for Sale $ 0 Cost per # of units unit Cost of Goods Sold # of units Cost Ending per unit Inventory $ 0 $ 0 Beginning Inventory Purchases: Apr. 7 Jul. 16 Oct.6 0 $ 0 0 0 $ 0 0 0 $ 0 Total 0 $ 0 Exercise 6-4A Part 2 2. Using LIFO, calculate ending inventory, cost of goods sold, sales revenue, and gross profit. Cost of Goods Sold Ending Inventory Cost per # of units unit Cost of Goods Sold # of units Cost Ending per unit Inventory LIFO Cost of Goods Available for Sale Cost of # of units Cost per Goods unit Available for Sale Beginning Inventory Purchases: Apr 07 Jul 16 Oct 06 Total Sales revenue Gross profit Exercise 6-4A Part 3 3. Using weighted-average cost, calculate ending inventory, cost of goods sold, sales revenue, and gross profit. (Round "Average Cost per unit" to 4 decimal places and all other answers to the nearest whole number.) Cost of Goods Available for Sale Cost of Goods Sold - Weighted Average Cost Ending Inventory - Weighted Average Cost Weighted Average Cost Cost per # of units Cost of Goods Available for Sale of units Sold Cost of Goods Sold unit Cost per Unit # of units in Ending Inventory Cost per unit Ending Inventory 55 $ 2,585 135 6,615 Beginning Inventory Purchases: Apr 07 Jul 16 Oct 06 Total 10,660 205 115 510 6,095 25,955 $