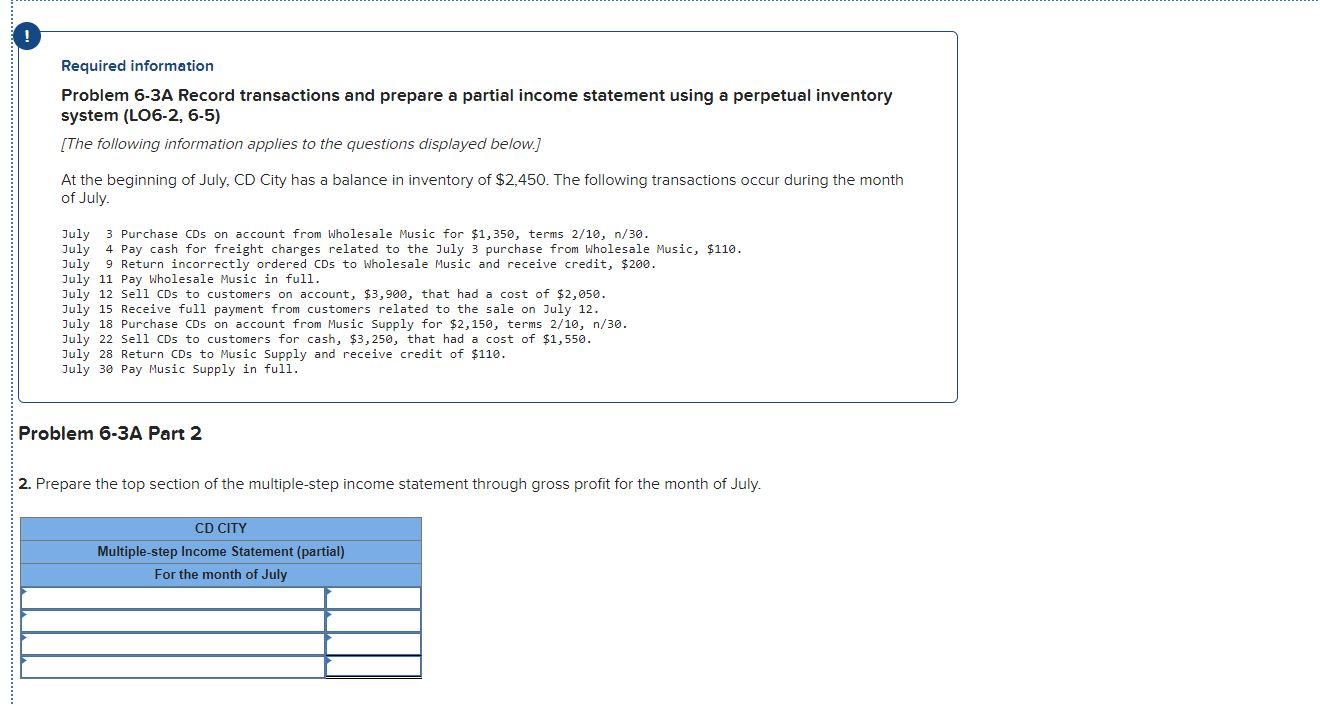

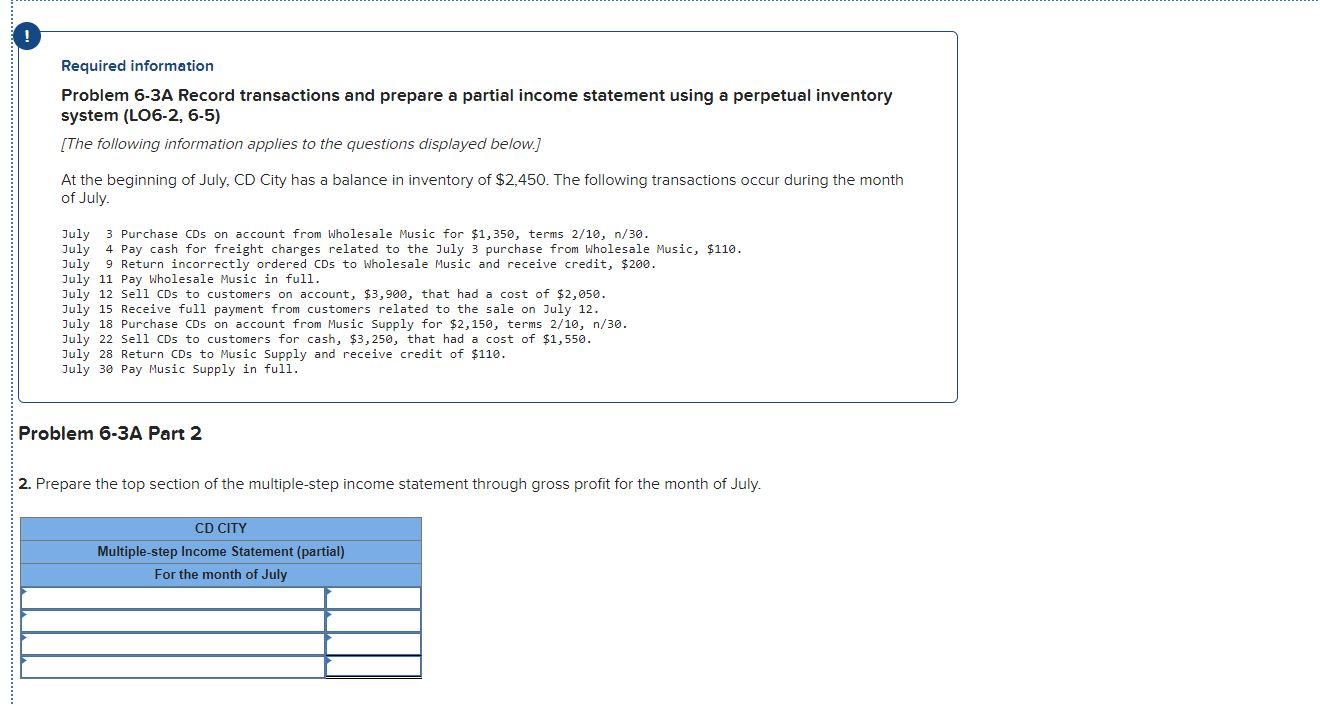

Required information Problem 6-3A Record transactions and prepare a partial income statement using a perpetual inventory system (LO6-2, 6-5) [The following information applies to the questions displayed below.] At the beginning of July, CD City has a balance in inventory of $2,450. The following transactions occur during the month of July. July 3 Purchase CDs on account from Wholesale Music for $1,350, terms 2/10, n/30. July 4 Pay cash for freight charges related to the July 3 purchase from Wholesale Music, $110. July 9 Return incorrectly ordered CDs to Wholesale Music and receive credit, $200. July 11 Pay Wholesale Music in full. July 12 Sell CDs to customers on account, $3,900, that had a cost of $2,050. July 15 Receive full payment from customers related to the sale on July 12. July 18 Purchase CDs on account from Music Supply for $2,150, terms 2/10, n/30. July 22 Sell CDs to customers for cash, $3,250, that had a cost of $1,550. July 28 Return CDs to Music Supply and receive credit of $110. July 30 Pay Music Supply in full. Problem 6-3A Part 1 Required: 1. Assuming that CD City uses a perpetual inventory system, record the transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field.) Required information Problem 6-3A Record transactions and prepare a partial income statement using a perpetual inventory system (LO6-2, 6-5) [The following information applies to the questions displayed below.] At the beginning of July, CD City has a balance in inventory of $2,450. The following transactions occur during the month of July. July 3 Purchase CDs on account from Wholesale Music for $1,350, terms 2/10, n/30. July 4 Pay cash for freight charges related to the July 3 purchase from Wholesale Music, $110. July 9 Return incorrectly ordered CDs to Wholesale Music and receive credit, $200. July 11 Pay Wholesale Music in full. July 12 Sell CDs to customers on account, $3,900, that had a cost of $2,050. July 15 Receive full payment from customers related to the sale on July 12. July 18 Purchase CDs on account from Music Supply for $2,150, terms 2/10, n/30. July 22 Sell CDs to customers for cash, $3,250, that had a cost of $1,550. July 28 Return CDs to Music Supply and receive credit of $110. July 30 Pay Music Supply in full. Problem 6-3A Part 2 2. Prepare the top section of the multiple-step income statement through gross profit for the month of July. CD CITY Multiple-step Income Statement (partial) For the month of July