Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information Problem 7-5A (Algo) Determine depreciation under three methods (LO7-4) [The following information applies fo the questions displayed beion,] University Car Wash purchased new

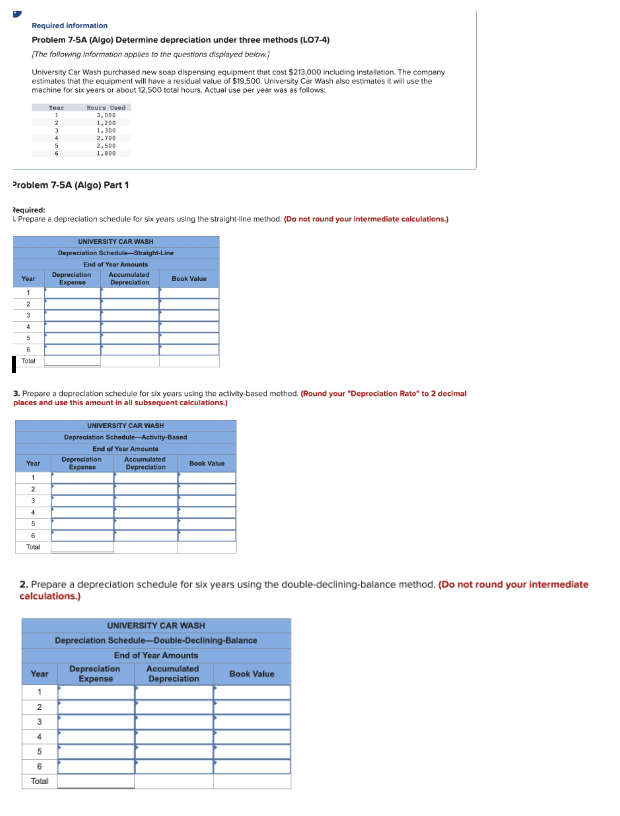

Required information Problem 7-5A (Algo) Determine depreciation under three methods (LO7-4) [The following information applies fo the questions displayed beion,] University Car Wash purchased new soap dispensing equipment that cost $213,000 including instalation. The comperry estimates that the equipment will have a residual value of $19.500. University Car Wash also estimates if will use the machine for six years or about 12,500 total hours. Actual use per year was as follows: Troblem 7-5A (Algo) Part 1 Sequired: L. Prepare a depreciation schedule for six years using the straight-line method. (Do not round your intermediate calculations.) 3. Prepare a depreclation schedule for slix years using the activity-based mothod. (Round your "Depreclation Bate" to 2 decimal places and use this amount in all subsequent calculations.] 2. Prepare a depreciation schedule for six years using the double-declining-balance method. (Do not round your intermediate calculations.)

Required information Problem 7-5A (Algo) Determine depreciation under three methods (LO7-4) [The following information applies fo the questions displayed beion,] University Car Wash purchased new soap dispensing equipment that cost $213,000 including instalation. The comperry estimates that the equipment will have a residual value of $19.500. University Car Wash also estimates if will use the machine for six years or about 12,500 total hours. Actual use per year was as follows: Troblem 7-5A (Algo) Part 1 Sequired: L. Prepare a depreciation schedule for six years using the straight-line method. (Do not round your intermediate calculations.) 3. Prepare a depreclation schedule for slix years using the activity-based mothod. (Round your "Depreclation Bate" to 2 decimal places and use this amount in all subsequent calculations.] 2. Prepare a depreciation schedule for six years using the double-declining-balance method. (Do not round your intermediate calculations.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started