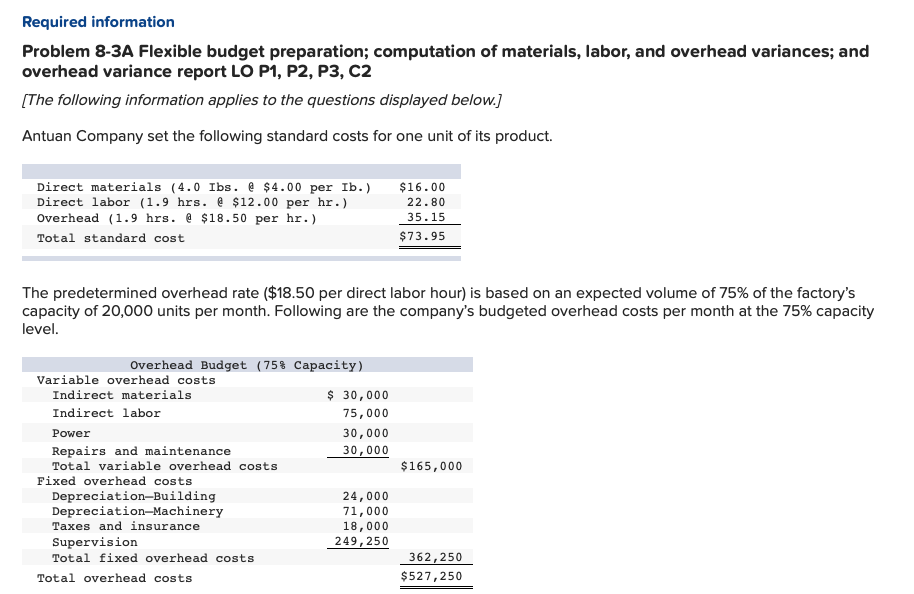

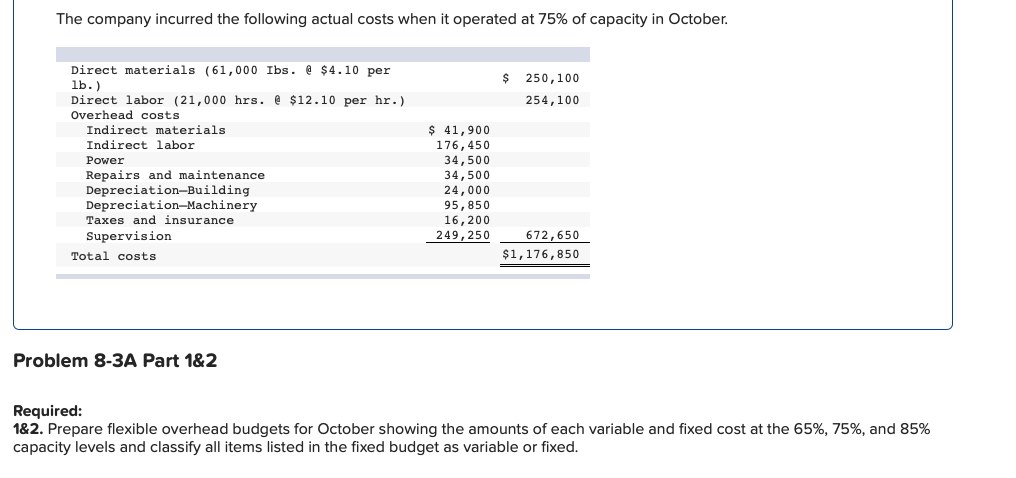

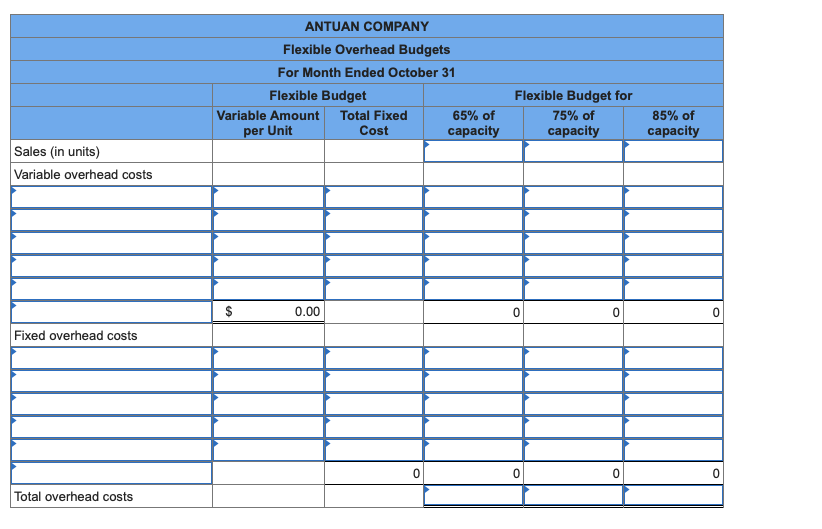

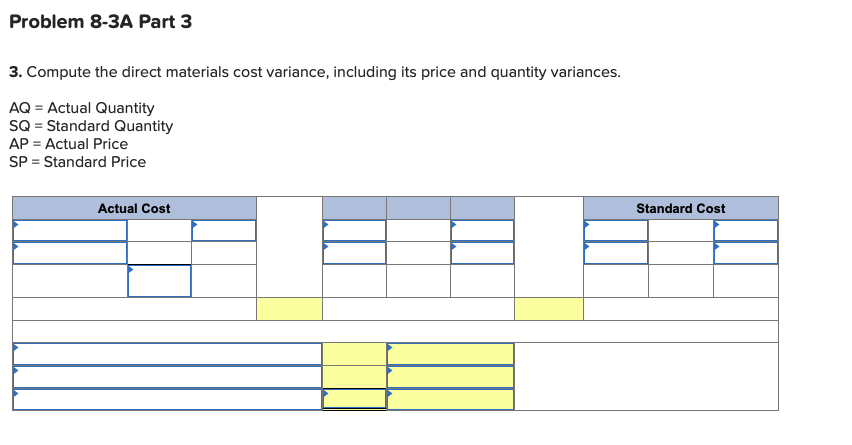

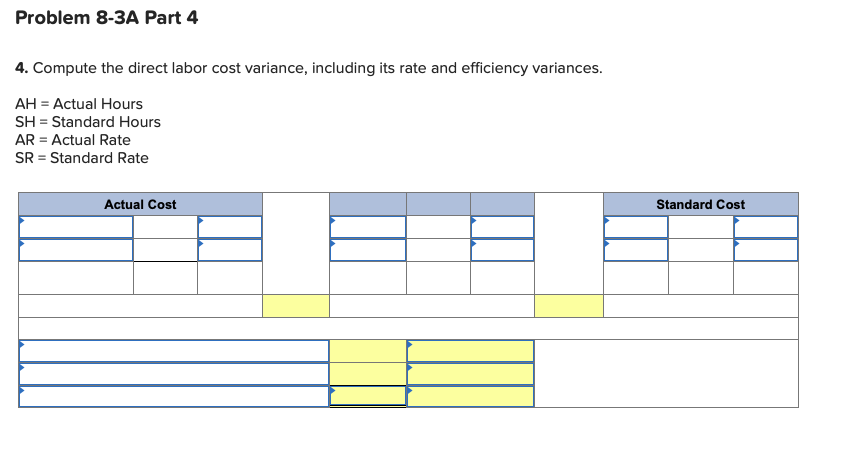

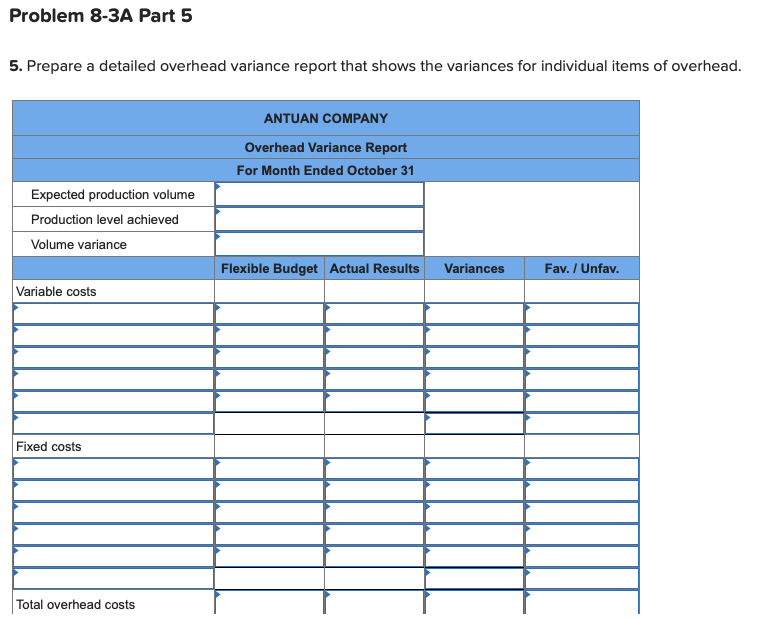

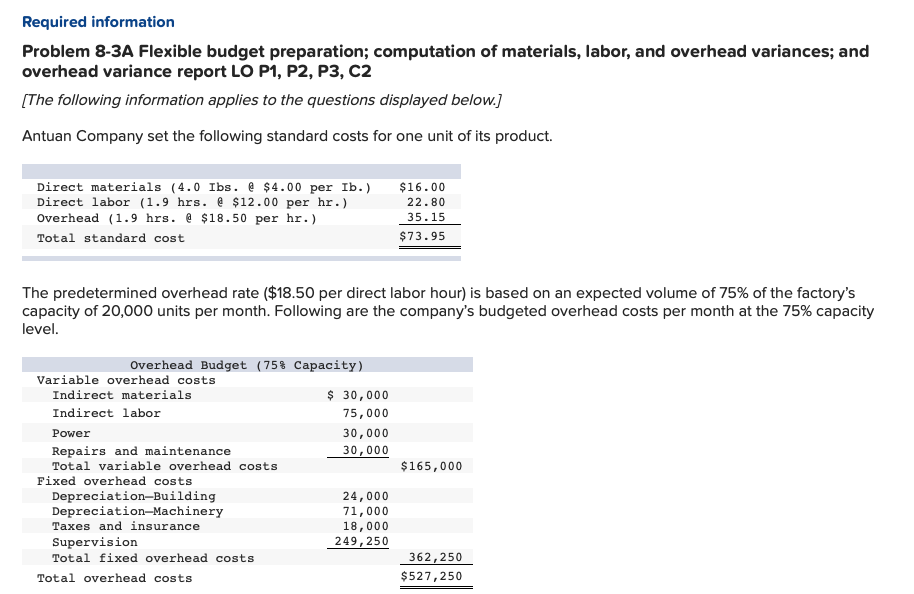

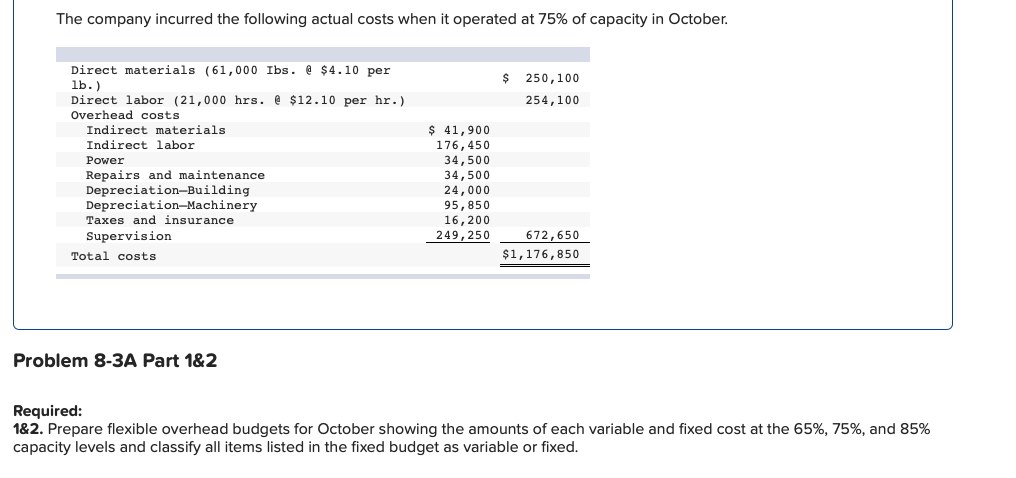

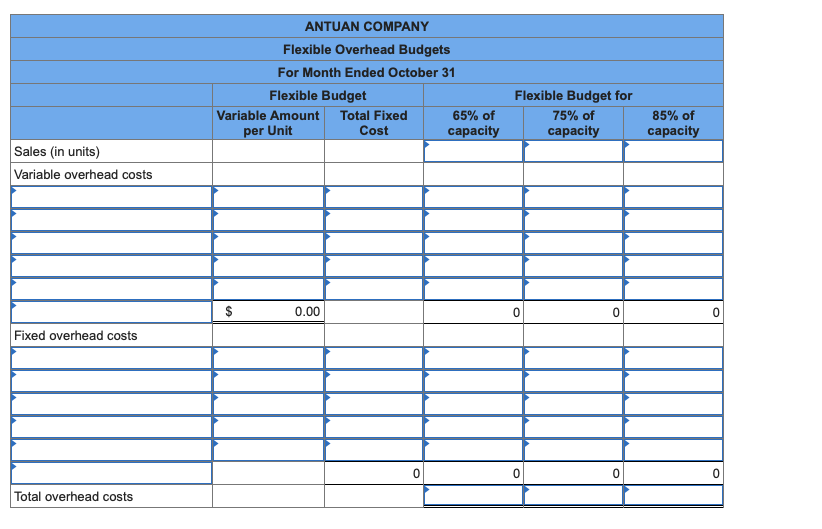

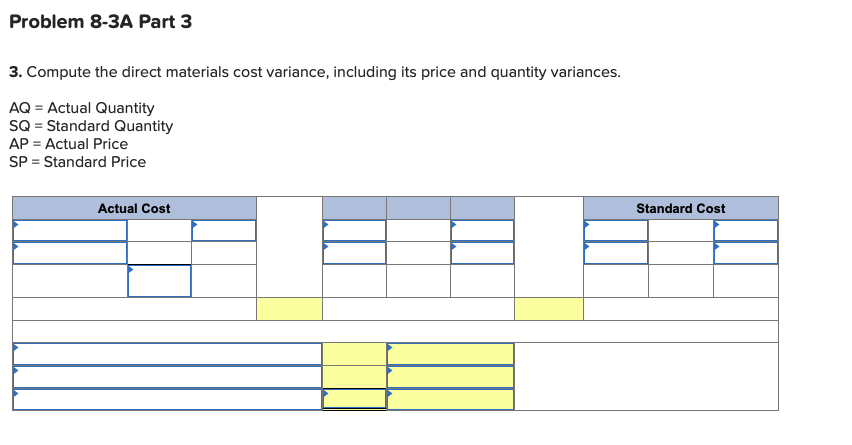

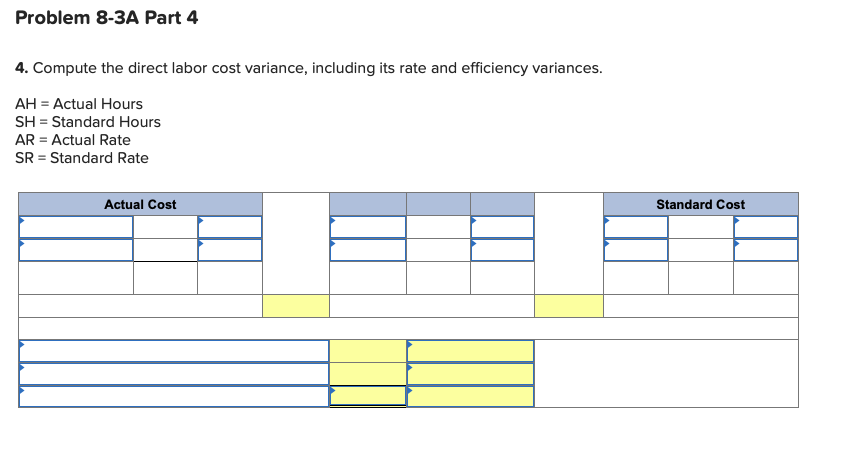

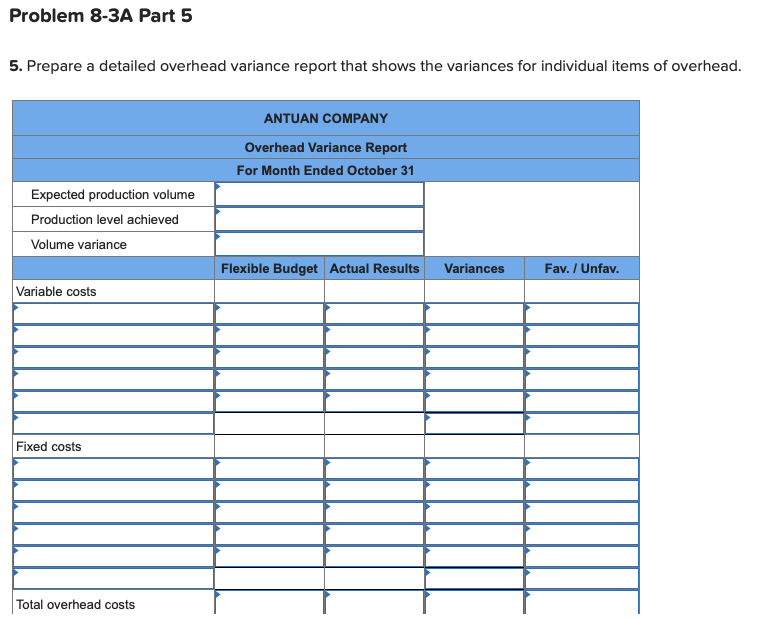

Required information Problem 8-3A Flexible budget preparation; computation of materials, labor, and overhead variances; and overhead variance report LO P1, P2, P3, C2 (The following information applies to the questions displayed below.) Antuan Company set the following standard costs for one unit of its product. Direct materials (4.0 Ibs. @ $4.00 per Ib.) Direct labor (1.9 hrs. @ $12.00 per hr.) Overhead (1.9 hrs. @ $18.50 per hr.) Total standard cost $16.00 22.80 35.15 $73.95 The predetermined overhead rate ($18.50 per direct labor hour) is based on an expected volume of 75% of the factory's capacity of 20,000 units per month. Following are the company's budgeted overhead costs per month at the 75% capacity level. Overhead Budget (759 Capacity) Variable overhead costs Indirect materials $ 30,000 Indirect labor 75,000 Power 30,000 Repairs and maintenance 30,000 Total variable overhead costs Fixed overhead costs Depreciation-Building 24,000 Depreciation-Machinery 71,000 Taxes and insurance 18,000 Supervision 249, 250 Total fixed overhead costs Total overhead costs $ 165,000 362,250 $527,250 The company incurred the following actual costs when it operated at 75% of capacity in October. $ 250,100 254,100 Direct materials (61,000 Ibs. @ $4.10 per lb.) Direct labor (21,000 hrs. @ $12.10 per hr.) Overhead costs Indirect materials Indirect labor Power Repairs and maintenance Depreciation Building Depreciation-Machinery Taxes and insurance Supervision Total costs $ 41,900 176, 450 34,500 34,500 24,000 95,850 16,200 249, 250 672,650 $1,176,850 Problem 8-3A Part 1&2 Required: 182. Prepare flexible overhead budgets for October showing the amounts of each variable and fixed cost at the 65%, 75%, and 85% capacity levels and classify all items listed in the fixed budget as variable or fixed. ANTUAN COMPANY Flexible Overhead Budgets For Month Ended October 31 Flexible Budget Variable Amount Total Fixed 65% of per Unit Cost capacity Flexible Budget for 75% of capacity 85% of capacity Sales (in units) Variable overhead costs $ 0.00 Fixed overhead costs Total overhead costs Problem 8-3A Part 3 3. Compute the direct materials cost variance, including its price and quantity variances. AQ = Actual Quantity SQ = Standard Quantity AP = Actual Price SP = Standard Price Actual Cost Standard Cost Problem 8-3A Part 4 4. Compute the direct labor cost variance, including its rate and efficiency variances. AH = Actual Hours SH = Standard Hours AR = Actual Rate SR = Standard Rate Actual Cost Standard Cost Problem 8-3A Part 5 5. Prepare a detailed overhead variance report that shows the variances for individual items of overhead. ANTUAN COMPANY Overhead Variance Report For Month Ended October 31 Expected production volume Production level achieved Volume variance Flexible Budget Actual Results Variances Fav. / Unfav. Variable costs Fixed costs Total overhead costs