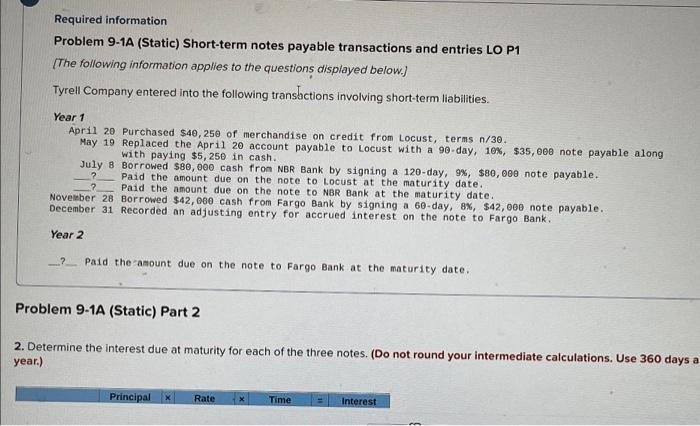

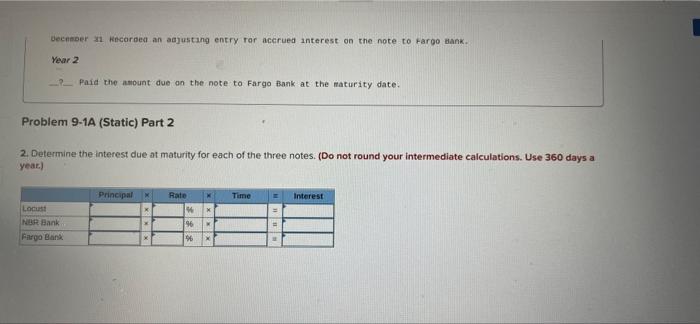

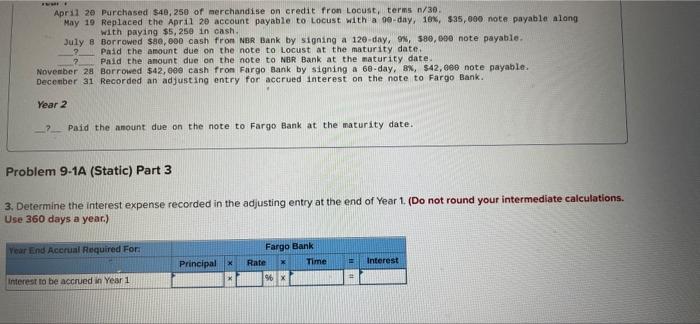

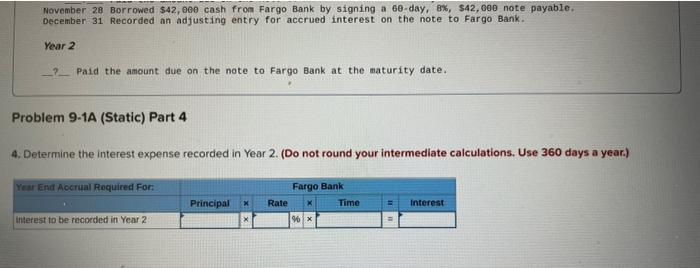

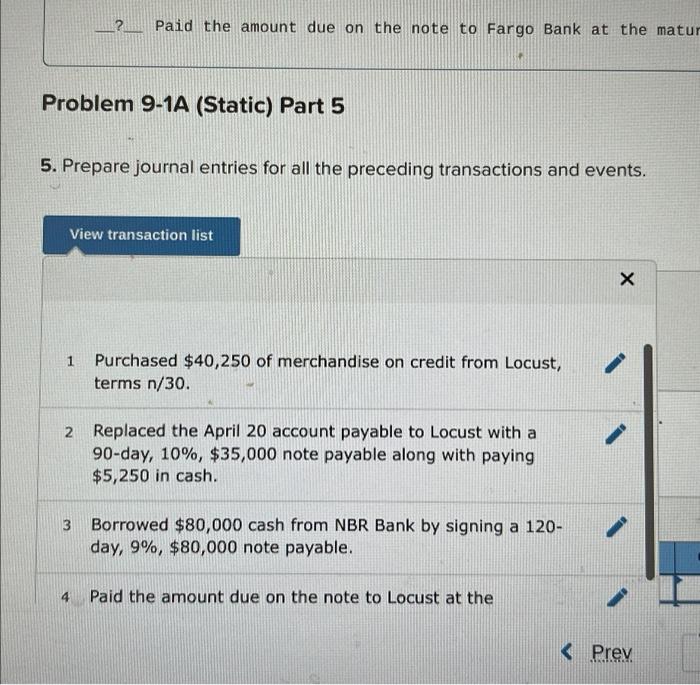

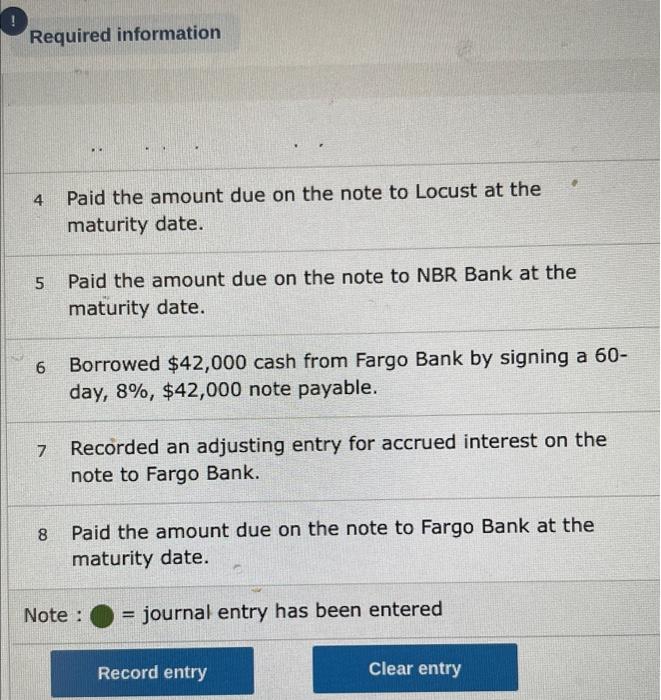

Required information Problem 9-1A (Static) Short-term notes payable transactions and entries LO P1 [The following information applies to the questions displayed below.) Tyrell Company entered into the following transactions involving short-term liabilities. Year 1 April 20 Purchased $40, 250 of merchandise on credit from Locust, terms n/30. May 19 Replaced the April 20 account payable to Locust with a 90-day, 10%, $35,000 note payable along with paying $5,250 in cash. July 8 Borrowed $80,000 cash from NBR Bank by signing a 120-day, 9%, $80,000 note payable. Paid the amount due on the note to locust at the maturity date. ? Paid the amount due on the note to NBR Bank at the maturity date. November 28 Borrowed $42,000 cash from Fargo Bank by signing a 60-day, 8%, $42,000 note payable. December 31 Recorded an adjusting entry for accrued interest on the note to Fargo Bank, Year 2 2 _..? Paid the amount due on the note to Fargo Bank at the maturity date. Problem 9-1A (Static) Part 2 2. Determine the interest due at maturity for each of the three notes. (Do not round your intermediate calculations. Use 360 days a year.) Principal Rate Time Interest December 1 Hecorded an adjusting entry for accrued interest on the note to Fargo Bank Year 2 ? Paid the amount due on the note to Fargo Bank at the maturity date. Problem 9-1A (Static) Part 2 2. Determine the interest due at maturity for each of the three notes. (Do not round your intermediate calculations. Use 360 days a year.) Principal Rate M Time Interest X Locust NB Bank Fargo Bank 196 % April 20 Purchased $40, 250 of merchandise on credit from Locust, terms n/30 May 19 Replaced the April 20 account payable to Locust with a 90-day, 10%, $35,000 note payable along with paying $5,250 in cash. July e Borrowed $80,000 cash from NDR Bank by signing a 120 day, 9, 580,000 note payable. Paid the amount due on the note to Locust at the maturity date. Paid the amount due on the note to NBR Bank at the maturity date. November 28 Borrowed $42,000 cash from Fargo Bank by signing a 60 day, 8%, $42, 000 note payable. December 31 Recorded an adjusting entry for accrued interest on the note to Fargo Bank Year 2 _7_Paid the anount due on the note to Fargo Bank at the maturity date. Problem 9-1A (Static) Part 3 3. Determine the interest expense recorded in the adjusting entry at the end of Year 1. (Do not round your intermediate calculations. Use 360 days a year.) Year End Accrual Required for Fargo Bank x Rate Time Principal Interest Interest to be accrued in Year 1 96 x November 28 Borrowed $42,000 cash from Fargo Bank by signing a 60-day, 8%, $42, 000 note payable. December 31 Recorded an adjusting entry for accrued interest on the note to Fargo Bank. Year 2 ___ Paid the amount due on the note to Fargo Bank at the maturity date. Problem 9-1A (Static) Part 4 4. Determine the interest expense recorded in Year 2. (Do not round your intermediate calculations. Use 360 days a year.) Year End Accrual Required for Fargo Bank Rate Principal X Time Interest interest to be recorded in Year 2 9 X Paid the amount due on the note to Fargo Bank at the matur Problem 9-1A (Static) Part 5 5. Prepare journal entries for all the preceding transactions and events. View transaction list 1 Purchased $40,250 of merchandise on credit from Locust, terms n/30. 2 Replaced the April 20 account payable to Locust with a 90-day, 10%, $35,000 note payable along with paying $5,250 in cash. 3 Borrowed $80,000 cash from NBR Bank by signing a 120- day, 9%, $80,000 note payable. 4 Paid the amount due on the note to Locust at the