Question

Required information Return on Invested Capital (ROIC) is a profitability ratio that measures how effective the firm is at generating a return for investors who

Required information

Return on Invested Capital (ROIC) is a profitability ratio that measures how effective the firm is at generating a return for investors who have provided capital (bondholders and stockholders). The ROIC calculation answers three questions: How tax efficient is the firm? How effective are the firms operations? How intensively does the firm use capital? Comparing the answers to these questions between firms can help you understand why one firm is more profitable than another and where that profitability is coming from.

In the following, Apples ROIC is compared to Microsofts. The income statement and balance sheet are provided for both firms. While the ROIC calculation for Microsoft is completed below, you have to complete the calculation for Apple by supplying the correct income statement and balance sheet information. As you fill in this information, the components of Apples ROIC will be calculated along with some supporting ratios. Use these subcomponents and supporting ratios to compare Apple and Microsofts performance. Where does Apples advantage come from?

This activity demonstrates the calculation of ROIC and the comparison of firm performance, supporting Learning Objective 5-1 and 5-2.

Instructions

Use the income statement and balance sheet information for Apple to fill in the missing items in the calculation of Apples ROIC and supporting ratios. Once filled in correctly, compare Apples performance to that of Microsoft. Where does Apple have an advantage? Where does Microsoft have an advantage?

| Apple Inc | Microsoft Corporation | |||

| Income Statement | FYE Sept, 27 2014 (000) | FYE June 30 2015 (000) | ||

| Net sales | 182,795,000 | 93,580,000 | ||

| Cost of sales | 112,258,000 | 33,038,000 | ||

| Gross margin | 70,537,000 | 60,542,000 | ||

| Research & development expense | 6,041,000 | 12,046,000 | ||

| Selling, general & admin expense | 11,993,000 | 20,324,000 | ||

| Total operating expenses | 10,011,000 | |||

| Operating expenses | 18,034,000 | 42,381,000 | ||

| Operating margin | 52,503,000 | 18,161,000 | ||

| Interest & dividend income | 1,795,000 | 766,000 | ||

| Interest expense | 384,000 | 781,000 | ||

| Other Income / Expense | -431,000 | 361,000 | ||

| Total Other income | 980,000 | 346,000 | ||

| Earnings before taxes | 53,483,000 | 18,507,000 | ||

| Provision for taxes | 13,973,000 | 6,314,000 | ||

| Net income (loss) | 39,510,000 | 12,193,000 | ||

|

| ||||

| Apple Inc | Microsoft Corporation | |||

| Balance sheet | FYE Sept, 27 2014 (000) | FYE June 30 2015 (000) | ||

| Cash & cash equivalents | 13,844,000 | 5,595,000 | ||

| Short-term marketable securities | 11,233,000 | 90,931,000 | ||

| Accounts receivable | 17,460,000 | 17,908,000 | ||

| Components | 471,000 | 1,100,000 | ||

| Finished goods | 1,640,000 | 1,600,000 | ||

| Inventories | 2,111,000 | 2,902,000 | ||

| Other Current Assets | 21,772,000 | 4,676,000 | ||

| Total current assets | 68,531,000 | 124,712,000 | ||

| 130,162,000 | 12,053,000 | |||

| Long-term marketable securities | 20,624,000 | 14,731,000 | ||

| Fixed Assets: PP&E (net) | 12,522,000 | 24,727,000 | ||

| Other assets | 163,308,000 | 51,511,000 | ||

| Long term assets | 231,839,000 | 176,223,000 | ||

| Total assets | 30,196,000 | 6,591,000 | ||

| Accounts payable | 33,252,000 | 43,267,000 | ||

| Other Current liabilities | 63,448,000 | 49,858,000 | ||

| Total current liabilities | 28,987,000 | |||

| Long-term debt | 3,031,000 | 278,080,000 | ||

| Deferred revenue - non-current | 20,259,000 | 2,095,000 | ||

| Deferred tax liabilities | 4,567,000 | 2,835,000 | ||

| Other non-current liabilities | 13,544,000 | |||

| Long Term liabilities | 56,844,000 | 46,282,000 | ||

| Total liabilities | 120,292,000 | 96,140,000 | ||

| Common stock | 23,313,000 | 68,465,000 | ||

| Retained earnings | 87,152,000 | 9,096,000 | ||

| Unrecognized gain on securities | 1,082,000 | 2,522,000 | ||

| Total shareholders' equity | 111,547,000 | 80,083,000 | ||

| Total liabilities + shareholders equity | 231,839,000 | 176,223,000 | ||

|

| ||||

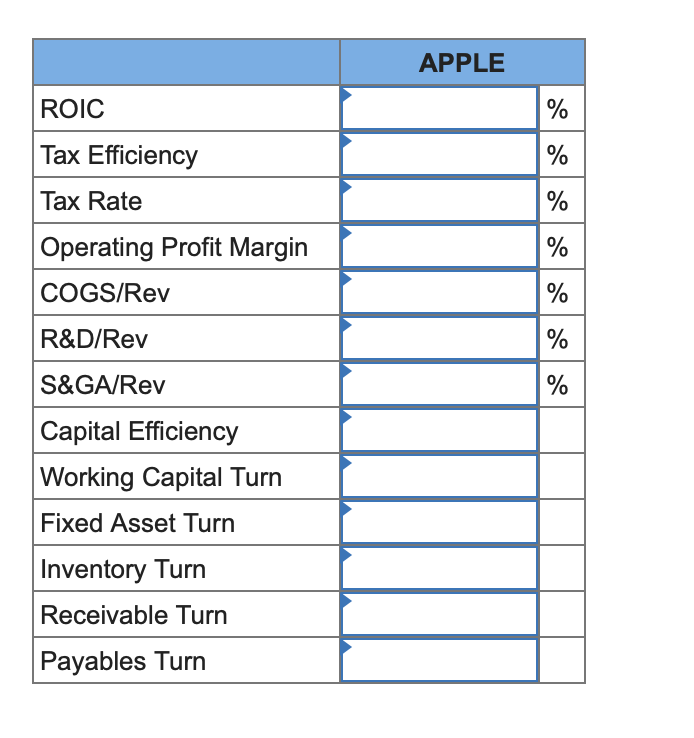

Calculate the Apples ROIC and supporting ratios. (Enter your responses rounded to two decimal places.)

Required information

Return on Invested Capital (ROIC) is a profitability ratio that measures how effective the firm is at generating a return for investors who have provided capital (bondholders and stockholders). The ROIC calculation answers three questions: How tax efficient is the firm? How effective are the firms operations? How intensively does the firm use capital? Comparing the answers to these questions between firms can help you understand why one firm is more profitable than another and where that profitability is coming from.

In the following, Apples ROIC is compared to Microsofts. The income statement and balance sheet are provided for both firms. While the ROIC calculation for Microsoft is completed below, you have to complete the calculation for Apple by supplying the correct income statement and balance sheet information. As you fill in this information, the components of Apples ROIC will be calculated along with some supporting ratios. Use these subcomponents and supporting ratios to compare Apple and Microsofts performance. Where does Apples advantage come from?

This activity demonstrates the calculation of ROIC and the comparison of firm performance, supporting Learning Objective 5-1 and 5-2.

Instructions

Use the income statement and balance sheet information for Apple to fill in the missing items in the calculation of Apples ROIC and supporting ratios. Once filled in correctly, compare Apples performance to that of Microsoft. Where does Apple have an advantage? Where does Microsoft have an advantage?

| Apple Inc | Microsoft Corporation | |||

| Income Statement | FYE Sept, 27 2014 (000) | FYE June 30 2015 (000) | ||

| Net sales | 182,795,000 | 93,580,000 | ||

| Cost of sales | 112,258,000 | 33,038,000 | ||

| Gross margin | 70,537,000 | 60,542,000 | ||

| Research & development expense | 6,041,000 | 12,046,000 | ||

| Selling, general & admin expense | 11,993,000 | 20,324,000 | ||

| Total operating expenses | 10,011,000 | |||

| Operating expenses | 18,034,000 | 42,381,000 | ||

| Operating margin | 52,503,000 | 18,161,000 | ||

| Interest & dividend income | 1,795,000 | 766,000 | ||

| Interest expense | 384,000 | 781,000 | ||

| Other Income / Expense | -431,000 | 361,000 | ||

| Total Other income | 980,000 | 346,000 | ||

| Earnings before taxes | 53,483,000 | 18,507,000 | ||

| Provision for taxes | 13,973,000 | 6,314,000 | ||

| Net income (loss) | 39,510,000 | 12,193,000 | ||

|

| ||||

| Apple Inc | Microsoft Corporation | |||

| Balance sheet | FYE Sept, 27 2014 (000) | FYE June 30 2015 (000) | ||

| Cash & cash equivalents | 13,844,000 | 5,595,000 | ||

| Short-term marketable securities | 11,233,000 | 90,931,000 | ||

| Accounts receivable | 17,460,000 | 17,908,000 | ||

| Components | 471,000 | 1,100,000 | ||

| Finished goods | 1,640,000 | 1,600,000 | ||

| Inventories | 2,111,000 | 2,902,000 | ||

| Other Current Assets | 21,772,000 | 4,676,000 | ||

| Total current assets | 68,531,000 | 124,712,000 | ||

| 130,162,000 | 12,053,000 | |||

| Long-term marketable securities | 20,624,000 | 14,731,000 | ||

| Fixed Assets: PP&E (net) | 12,522,000 | 24,727,000 | ||

| Other assets | 163,308,000 | 51,511,000 | ||

| Long term assets | 231,839,000 | 176,223,000 | ||

| Total assets | 30,196,000 | 6,591,000 | ||

| Accounts payable | 33,252,000 | 43,267,000 | ||

| Other Current liabilities | 63,448,000 | 49,858,000 | ||

| Total current liabilities | 28,987,000 | |||

| Long-term debt | 3,031,000 | 278,080,000 | ||

| Deferred revenue - non-current | 20,259,000 | 2,095,000 | ||

| Deferred tax liabilities | 4,567,000 | 2,835,000 | ||

| Other non-current liabilities | 13,544,000 | |||

| Long Term liabilities | 56,844,000 | 46,282,000 | ||

| Total liabilities | 120,292,000 | 96,140,000 | ||

| Common stock | 23,313,000 | 68,465,000 | ||

| Retained earnings | 87,152,000 | 9,096,000 | ||

| Unrecognized gain on securities | 1,082,000 | 2,522,000 | ||

| Total shareholders' equity | 111,547,000 | 80,083,000 | ||

| Total liabilities + shareholders equity | 231,839,000 | 176,223,000 | ||

|

| ||||

Calculate the Apples ROIC and supporting ratios. (Enter your responses rounded to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started