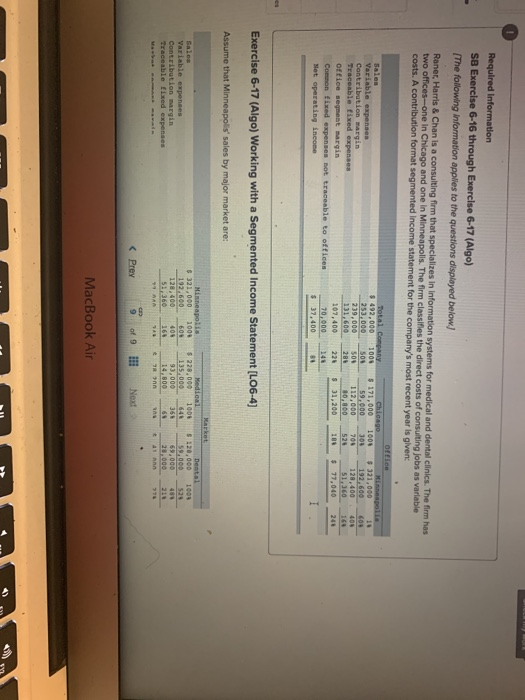

Required Information SB Exercise 6-16 through Exercise 6-17 (Algo) The following information applies to the questions displayed below) Raner, Harris & Chan is a consulting firm that specializes in Information systems for medical and dental clinics. The firm has two offices-one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable costs. A contribution format segmented Income statement for the company's most recent year is given Sales Variable expenses Contribution margin Traceable fixed expenses office segment margin Common fixed expenses not traceable to offices Net operating income Total Company $ 492,000 1004 253,000 500 239,000 500 131,600 280 107,400 226 70,000 148 $ 37,400 RE office Chicago $ 171,000 1000 $ 321,000 59.000 300 192,600 112,000 700 128,400 80.800 528 51,360 $ 31,200 104 $ 77,040 10 603 400 168 248 Exercise 6-17 (Algo) Working with a Segmented Income Statement (L06-4) Assume that Minneapolis' sales by major market are: Sales Variable expenses Contribution margin Traceable fixed expenses Minneapolis $ 321.000 1000 192.600 600 128, 400 408 51,360 168 MAA 14 Market Medical Dental $ 228,000 1008 $ 120,000 1000 135.000 641 59.000 528 93,000 361 69,000 483 14.000 68 20,000 tonn Prey 9 of 9 Next MacBook Air Required Information SB Exercise 6-16 through Exercise 6-17 (Algo) The following information applies to the questions displayed below) Raner, Harris & Chan is a consulting firm that specializes in Information systems for medical and dental clinics. The firm has two offices-one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable costs. A contribution format segmented Income statement for the company's most recent year is given Sales Variable expenses Contribution margin Traceable fixed expenses office segment margin Common fixed expenses not traceable to offices Net operating income Total Company $ 492,000 1004 253,000 500 239,000 500 131,600 280 107,400 226 70,000 148 $ 37,400 RE office Chicago $ 171,000 1000 $ 321,000 59.000 300 192,600 112,000 700 128,400 80.800 528 51,360 $ 31,200 104 $ 77,040 10 603 400 168 248 Exercise 6-17 (Algo) Working with a Segmented Income Statement (L06-4) Assume that Minneapolis' sales by major market are: Sales Variable expenses Contribution margin Traceable fixed expenses Minneapolis $ 321.000 1000 192.600 600 128, 400 408 51,360 168 MAA 14 Market Medical Dental $ 228,000 1008 $ 120,000 1000 135.000 641 59.000 528 93,000 361 69,000 483 14.000 68 20,000 tonn Prey 9 of 9 Next MacBook Air