Required information

Skip to question

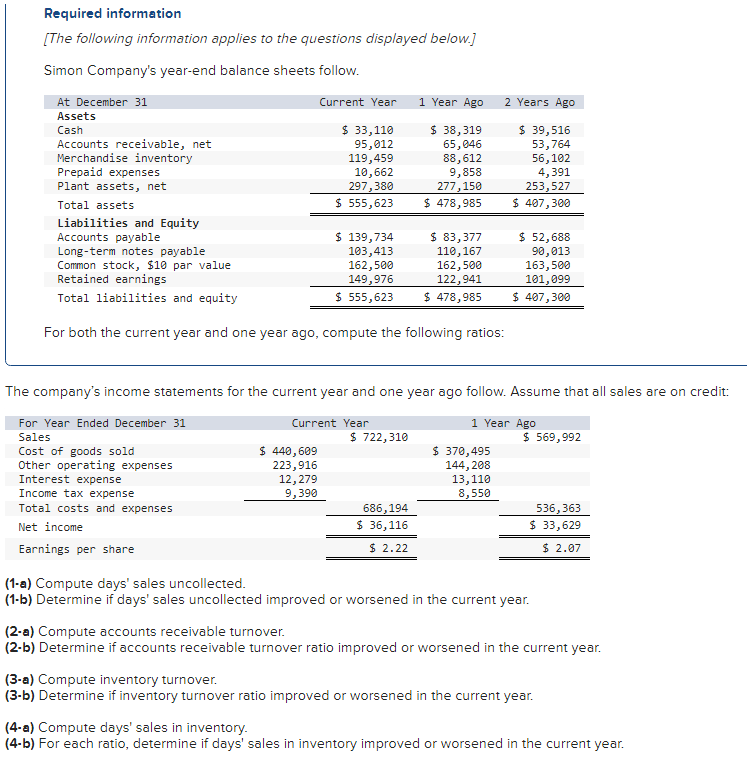

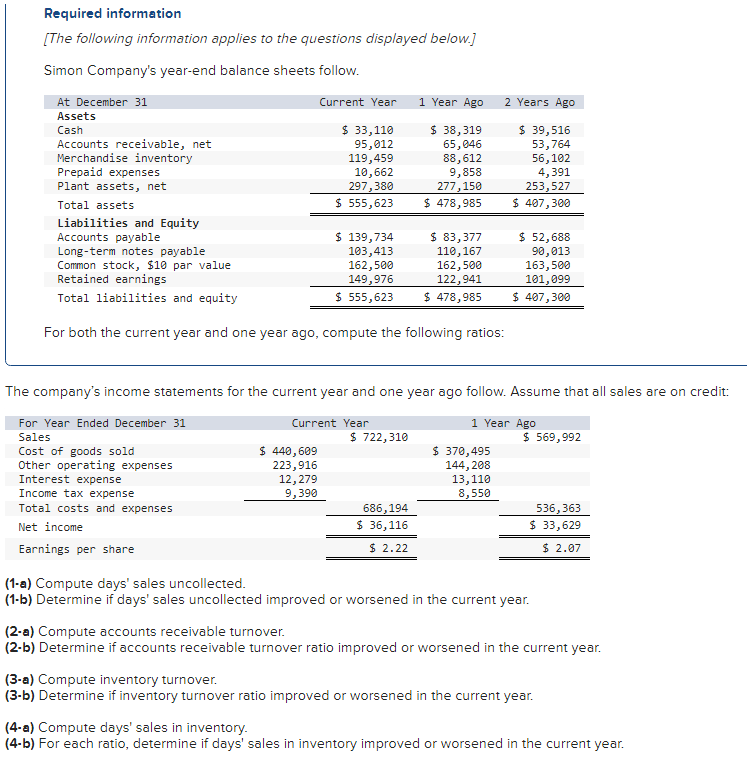

[The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow.

| At December 31 | Current Year | 1 Year Ago | 2 Years Ago |

| Assets | | | |

| Cash | $ 33,110 | $ 38,319 | $ 39,516 |

| Accounts receivable, net | 95,012 | 65,046 | 53,764 |

| Merchandise inventory | 119,459 | 88,612 | 56,102 |

| Prepaid expenses | 10,662 | 9,858 | 4,391 |

| Plant assets, net | 297,380 | 277,150 | 253,527 |

| Total assets | $ 555,623 | $ 478,985 | $ 407,300 |

| Liabilities and Equity | | | |

| Accounts payable | $ 139,734 | $ 83,377 | $ 52,688 |

| Long-term notes payable | 103,413 | 110,167 | 90,013 |

| Common stock, $10 par value | 162,500 | 162,500 | 163,500 |

| Retained earnings | 149,976 | 122,941 | 101,099 |

| Total liabilities and equity | $ 555,623 | $ 478,985 | $ 407,300 |

For both the current year and one year ago, compute the following ratios:

The companys income statements for the current year and one year ago follow. Assume that all sales are on credit:

| For Year Ended December 31 | Current Year | 1 Year Ago |

| Sales | | $ 722,310 | | $ 569,992 |

| Cost of goods sold | $ 440,609 | | $ 370,495 | |

| Other operating expenses | 223,916 | | 144,208 | |

| Interest expense | 12,279 | | 13,110 | |

| Income tax expense | 9,390 | | 8,550 | |

| Total costs and expenses | | 686,194 | | 536,363 |

| Net income | | $ 36,116 | | $ 33,629 |

| Earnings per share | | $ 2.22 | | $ 2.07 |

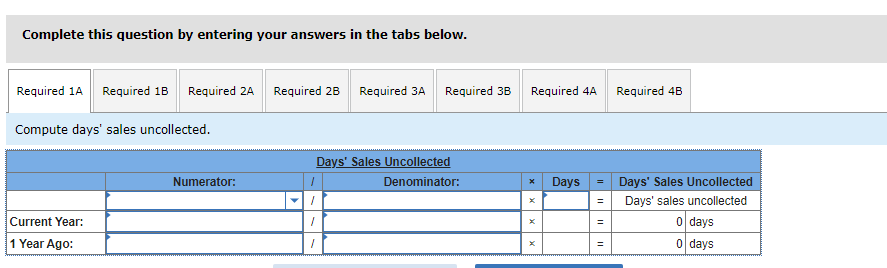

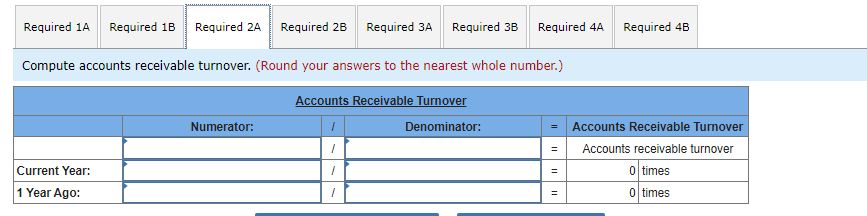

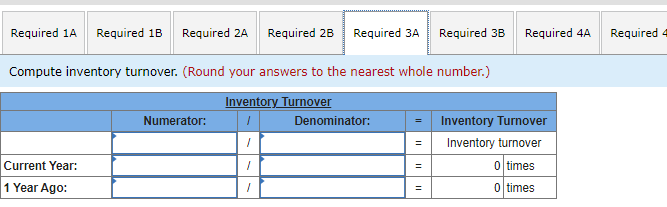

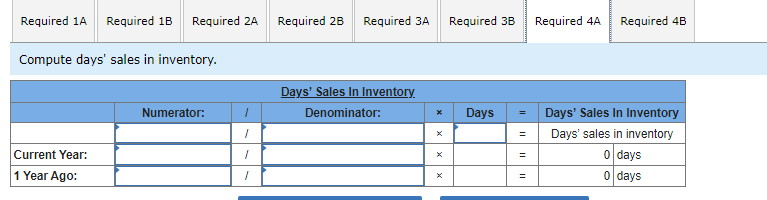

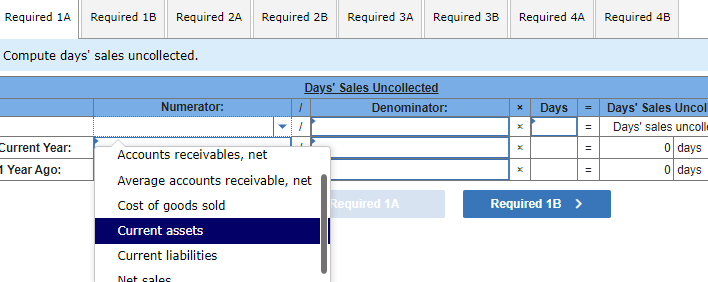

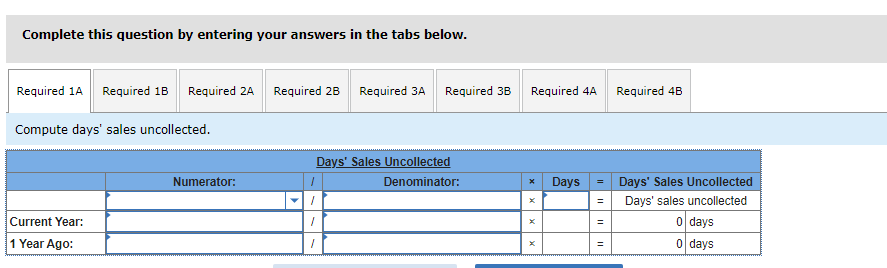

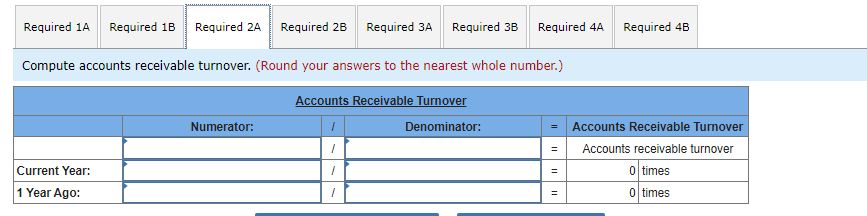

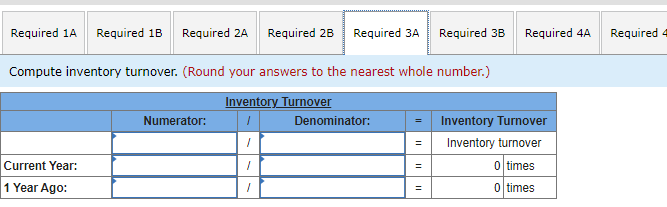

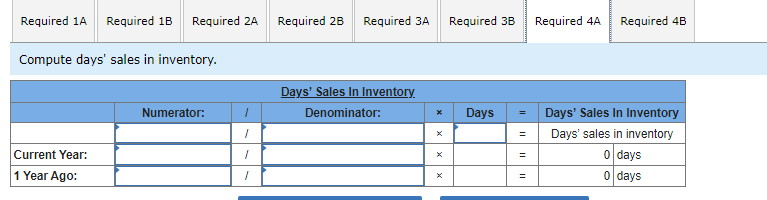

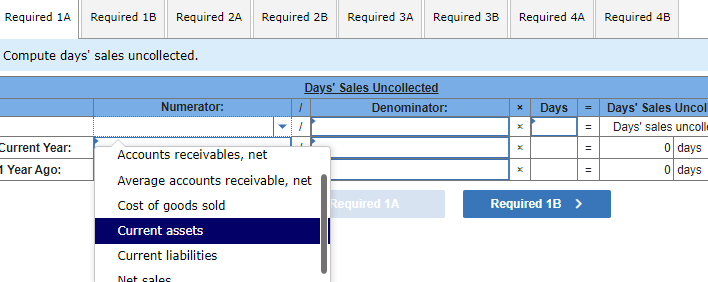

(1-a) Compute days' sales uncollected. (1-b) Determine if days' sales uncollected improved or worsened in the current year. (2-a) Compute accounts receivable turnover. (2-b) Determine if accounts receivable turnover ratio improved or worsened in the current year. (3-a) Compute inventory turnover. (3-b) Determine if inventory turnover ratio improved or worsened in the current year. (4-a) Compute days' sales in inventory. (4-b) For each ratio, determine if days' sales in inventory improved or worsened in the current year.

Required information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. Current Year 1 Year Ago 2 Years Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity $ 33, 110 95,012 119,459 10,662 297,380 $ 555,623 $ 38,319 65,046 88,612 9,858 277,150 $ 478,985 $ 39,516 53,764 56,102 4,391 253,527 $ 407,300 $ 139,734 103,413 162,500 149,976 $ 555, 623 $ 83,377 110,167 162,500 122,941 $ 478,985 $ 52,688 90,013 163,500 101,099 $ 407,300 For both the current year and one year ago, compute the following ratios: The company's income statements for the current year and one year ago follow. Assume that all sales are on credit: For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Earnings per share Current Year $ 722,310 $ 440,609 223,916 12,279 9,390 686,194 $ 36,116 1 Year Ago $ 569,992 $ 370,495 144,208 13, 110 8,550 536, 363 $ 33,629 $ 2.07 $ 2.22 (1-a) Compute days' sales uncollected. (1-6) Determine if days' sales uncollected improved or worsened in the current year. (2-a) Compute accounts receivable turnover. (2-b) Determine if accounts receivable turnover ratio improved or worsened in the current year. (3-a) Compute inventory turnover. (3-6) Determine if inventory turnover ratio improved or worsened in the current year. (4-a) Compute days' sales in inventory. (4-6) For each ratio, determine if days' sales in inventory improved or worsened in the current year. Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2A Required 2B Required 3A Required 3B Required 4A Required 4B Compute days' sales uncollected. Numerator: Days = Days' Sales Uncollected 1 Denominator: 1 1 Days' Sales Uncollected Days' sales uncollected 0 days 0 days X Current Year: 1 Year Ago: 1 11 Required 1A Required 1B Required 2A Required 2B Required 3A Required 3B Required 4A Required 4B Compute accounts receivable turnover. (Round your answers to the nearest whole number.) Numerator: Accounts Receivable Turnover 1 Denominator: 1 Accounts Receivable Turnover Accounts receivable turnover 11 Current Year: o times 1 Year Ago: 0 times Required 1A Required 1B Required 2A Required 2B Required 3A Required 3B Required 4A Required Compute inventory turnover. (Round your answers to the nearest whole number.) Inventory Turnover Numerator: Denominator: Inventory Turnover Inventory turnover 1 Current Year: 11 0 times 1 Year Ago: 11 0 times Required 1A Required 1B Required 2A Required 2B Required 3A Required 3B Required 4A Required 4B Compute days' sales in inventory. Days' Sales In Inventory Denominator: Numerator: Days Days' Sales In Inventory Days' sales in inventory 0 days 0 days 1 II Current Year: 1 Year Ago: = Required 1A Required 18 Required 2A Required 2B Required 3A Required 3B Required 4A Required 4B Compute days' sales uncollected. Days' Sales Uncollected 1 Denominator: Numerator: Days II 1 11 Days' Sales Uncol Days' sales uncolla 0 days 0 days Current Year: 1 Year Ago: Accounts receivables, net Average accounts receivable, net Cost of goods sold Current assets Current liabilities Required 1A Required 1B > Net cales