Question

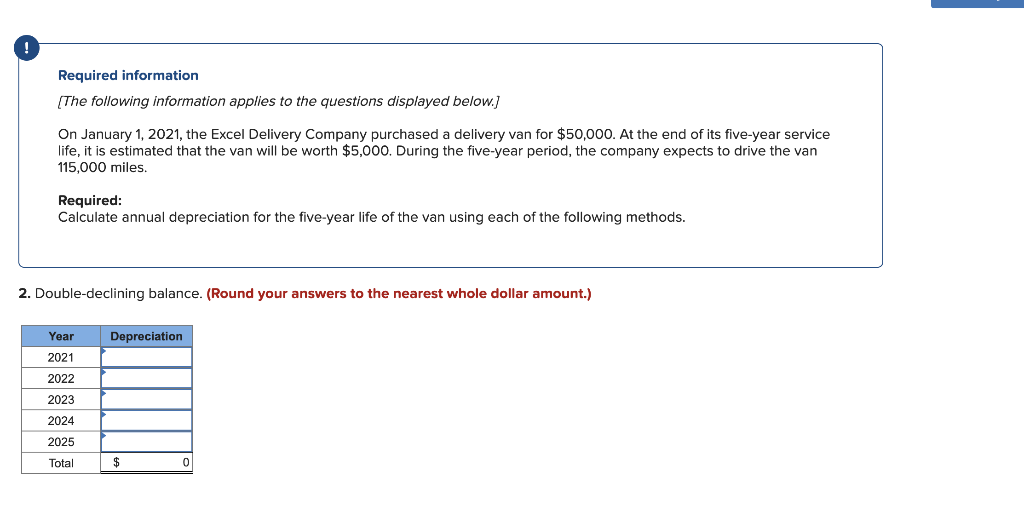

Required information Skip to question [The following information applies to the questions displayed below.] On January 1, 2021, the Excel Delivery Company purchased a delivery

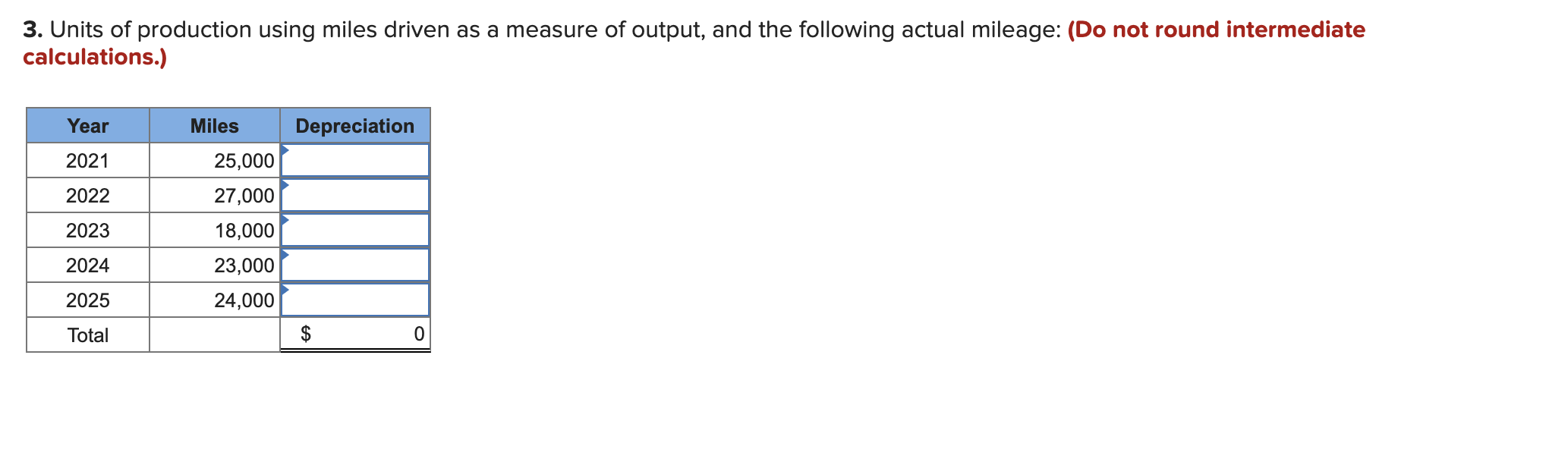

Required information Skip to question [The following information applies to the questions displayed below.] On January 1, 2021, the Excel Delivery Company purchased a delivery van for $50,000. At the end of its five-year service life, it is estimated that the van will be worth $5,000. During the five-year period, the company expects to drive the van 115,000 miles. Required: Calculate annual depreciation for the five-year life of the van using each of the following methods. rev: 05_15_2019_QC_CS-168776, 11_22_2019_QC_CS-191707 3. Units of production using miles driven as a measure of output, and the following actual mileage: (Do not round intermediate calculations.)

Required information Skip to question [The following information applies to the questions displayed below.] On January 1, 2021, the Excel Delivery Company purchased a delivery van for $50,000. At the end of its five-year service life, it is estimated that the van will be worth $5,000. During the five-year period, the company expects to drive the van 115,000 miles. Required: Calculate annual depreciation for the five-year life of the van using each of the following methods. rev: 05_15_2019_QC_CS-168776, 11_22_2019_QC_CS-191707 3. Units of production using miles driven as a measure of output, and the following actual mileage: (Do not round intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started