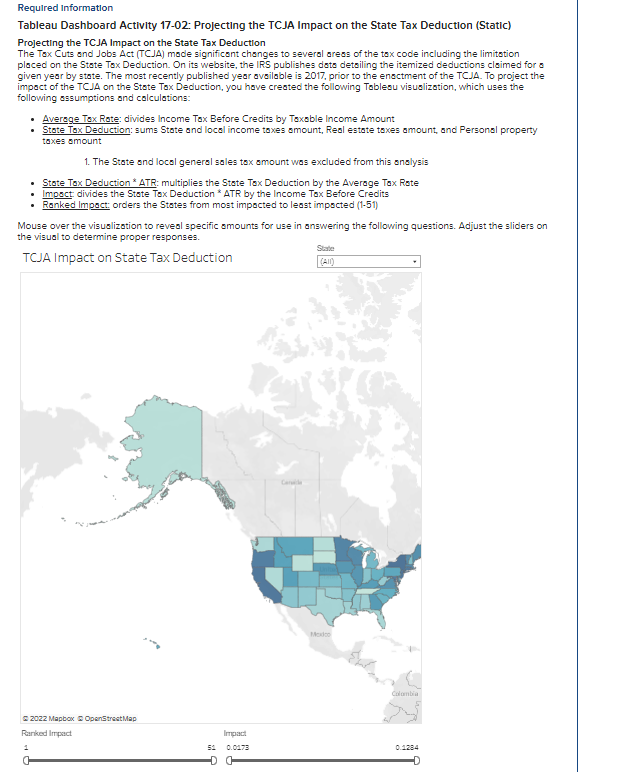

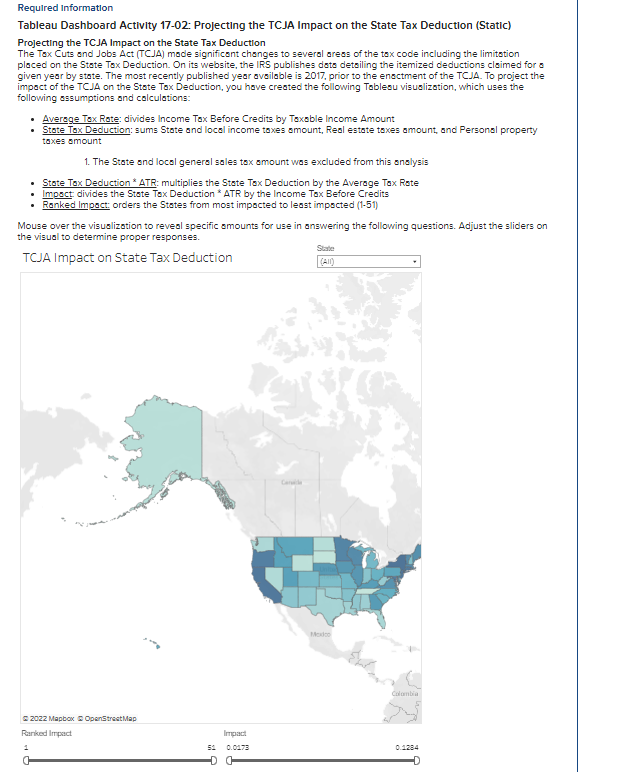

Required Information Tableau Dashboard Activity 17-02: Projecting the TCJA Impact on the State Tax Deductlon (Static) Projecting the TCJA Impact on the State Tax Deduction The Tax Cuts and Jobs Act (TCJA) made significant changes to several aress of the tox code including the limitetion placed on the State Tax Deduction. On its website, the IRS publishes data detailing the itemized deductions claimed for a given year by state. The most recently published year available is 2017 , prior to the enactment of the TCJA. To project the impoct of the TCJA on the State Tox Deduction, you have created the following Toblesu visualization, which uses the following sasumptions and calculations: - Average Tax Rate: divides Income Tox Before Credits by Taxsble Income Amount - State Tax Deduction: sums State and local income taxes amount, Real estate toxes amount, and Personal property 1. The State and local general sales tox amount was excluded from this analysis - State Tax Deduction * ATR: multiplies the State Tax Deduction by the Average Tax Rate - Impact divides the State Tex Deduction * ATR by the Income Tox Before Credits - Ranked Impact: orders the States from most impocted to least impocted (1-51) Mouse over the visuslization to reveal specific smounts for use in answering the following questions. Adjust the sliders on the visual to determine proper responses. Projecting the TCJA Impact on the State Tax Deduction - Part 2 (Static) Required Information Tableau Dashboard Activity 17-02: Projecting the TCJA Impact on the State Tax Deductlon (Static) Projecting the TCJA Impact on the State Tax Deduction The Tax Cuts and Jobs Act (TCJA) made significant changes to several aress of the tox code including the limitetion placed on the State Tax Deduction. On its website, the IRS publishes data detailing the itemized deductions claimed for a given year by state. The most recently published year available is 2017 , prior to the enactment of the TCJA. To project the impoct of the TCJA on the State Tox Deduction, you have created the following Toblesu visualization, which uses the following sasumptions and calculations: - Average Tax Rate: divides Income Tox Before Credits by Taxsble Income Amount - State Tax Deduction: sums State and local income taxes amount, Real estate toxes amount, and Personal property 1. The State and local general sales tox amount was excluded from this analysis - State Tax Deduction * ATR: multiplies the State Tax Deduction by the Average Tax Rate - Impact divides the State Tex Deduction * ATR by the Income Tox Before Credits - Ranked Impact: orders the States from most impocted to least impocted (1-51) Mouse over the visuslization to reveal specific smounts for use in answering the following questions. Adjust the sliders on the visual to determine proper responses. Projecting the TCJA Impact on the State Tax Deduction - Part 2 (Static)