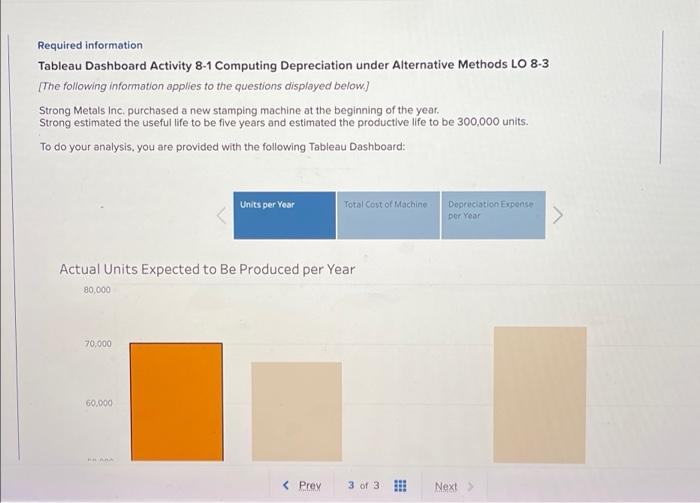

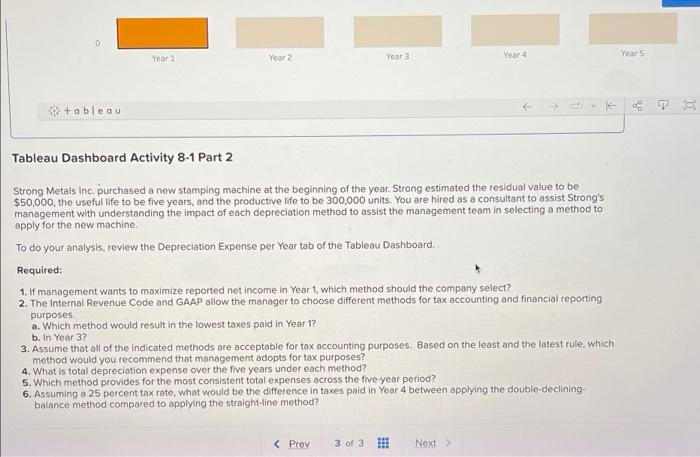

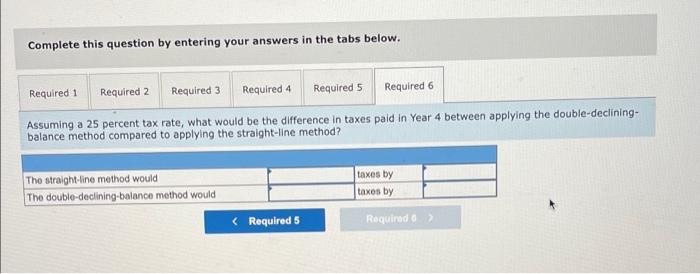

Required information Tableau Dashboard Activity 8-1 Computing Depreciation under Alternative Methods LO 8-3 The following information applies to the questions displayed below.) Strong Metals Inc. purchased a new stamping machine at the beginning of the year. Strong estimated the useful life to be five years and estimated the productive life to be 300,000 units. To do your analysis, you are provided with the following Tableau Dashboard: Units per Year Total cost of Machine Depreciation Expense per Year > Actual Units Expected to Be Produced per Year 80,000 70.000 60.000 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Requirekt 4 Required 5 Required 6 What is total depreciation expense over the five years under each method? Straight-line method: Double-declining balance method: Units-of-production method: Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 os Assume that all of the Indicated methods are acceptable for tax accounting purposes. Based on the least and the latest rule, which method would you recommend that management adopts for tax purposes? Method (Required 2 Required 4 > 00:35 Complete this question by entering your answers in the tabs below. ped Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 bok nt The Internal Revenue Code and GAAP allow the manager to choose different methods for tax accounting and financial reporting purposes. a. Which method would result in the lowest taxes paid in Year 1? b. In Year 3? Ences Show less a. Which method would result in the lowest taxes paid in Year 1? b. In Year 3? Required information 3. Assume that all of the indicated methods are acceptable for tax accounting purposes. Based on the least and the latest rule, whic method would you recommend that management adopts for tax purposes? 4. What is total depreciation expense over the five years under each method? 5. Which method provides for the most consistent total expenses across the five-year period? 6. Assuming a 25 percent tax rate, what would be the difference in taxes paid in Year 4 between applying the double-declining- balance method compared to applying the straight-line method? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 to maximize reported net income in Year 1, which method should the company select? If manage WE Method Required 1 Required 2 > Required information Tableau Dashboard Activity 8-1 Computing Depreciation under Alternative Methods LO 8-3 The following information applies to the questions displayed below.) Strong Metals Inc. purchased a new stamping machine at the beginning of the year. Strong estimated the useful life to be five years and estimated the productive life to be 300,000 units. To do your analysis, you are provided with the following Tableau Dashboard: Units per Year Total cost of Machine Depreciation Expense per Year > Actual Units Expected to Be Produced per Year 80,000 70.000 60.000 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Requirekt 4 Required 5 Required 6 What is total depreciation expense over the five years under each method? Straight-line method: Double-declining balance method: Units-of-production method: Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 os Assume that all of the Indicated methods are acceptable for tax accounting purposes. Based on the least and the latest rule, which method would you recommend that management adopts for tax purposes? Method (Required 2 Required 4 > 00:35 Complete this question by entering your answers in the tabs below. ped Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 bok nt The Internal Revenue Code and GAAP allow the manager to choose different methods for tax accounting and financial reporting purposes. a. Which method would result in the lowest taxes paid in Year 1? b. In Year 3? Ences Show less a. Which method would result in the lowest taxes paid in Year 1? b. In Year 3? Required information 3. Assume that all of the indicated methods are acceptable for tax accounting purposes. Based on the least and the latest rule, whic method would you recommend that management adopts for tax purposes? 4. What is total depreciation expense over the five years under each method? 5. Which method provides for the most consistent total expenses across the five-year period? 6. Assuming a 25 percent tax rate, what would be the difference in taxes paid in Year 4 between applying the double-declining- balance method compared to applying the straight-line method? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 to maximize reported net income in Year 1, which method should the company select? If manage WE Method Required 1 Required 2 >