Answered step by step

Verified Expert Solution

Question

1 Approved Answer

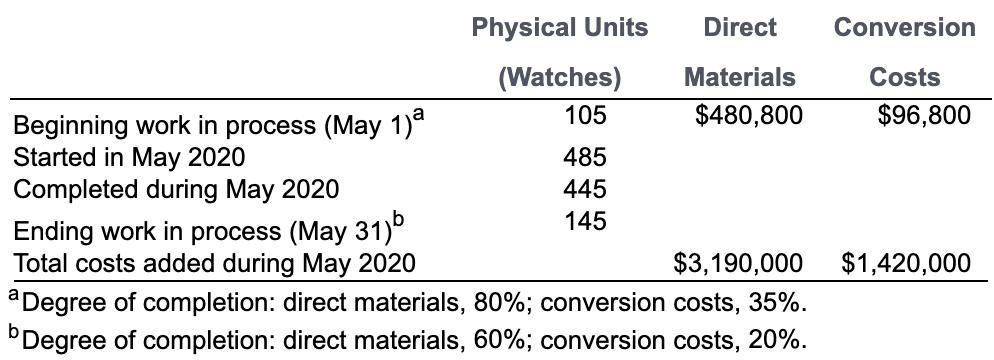

Beginning work in process (May 1) a Started in May 2020 Completed during May 2020 Ending work in process (May 31) b Total costs

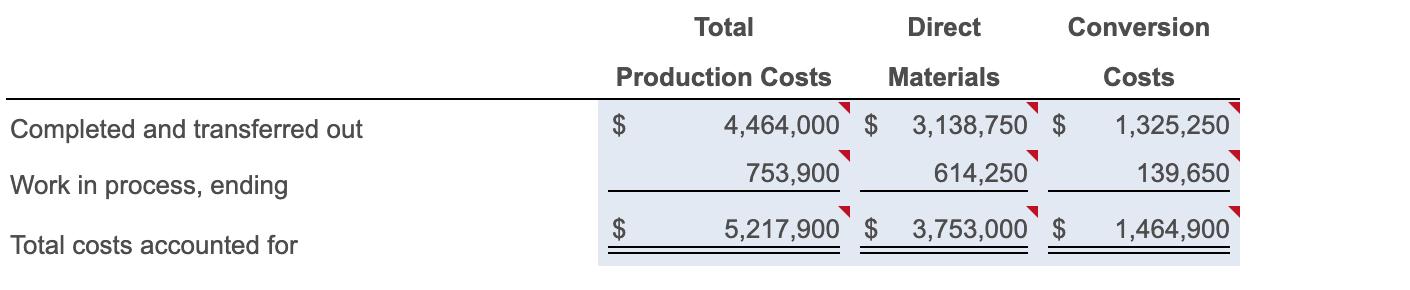

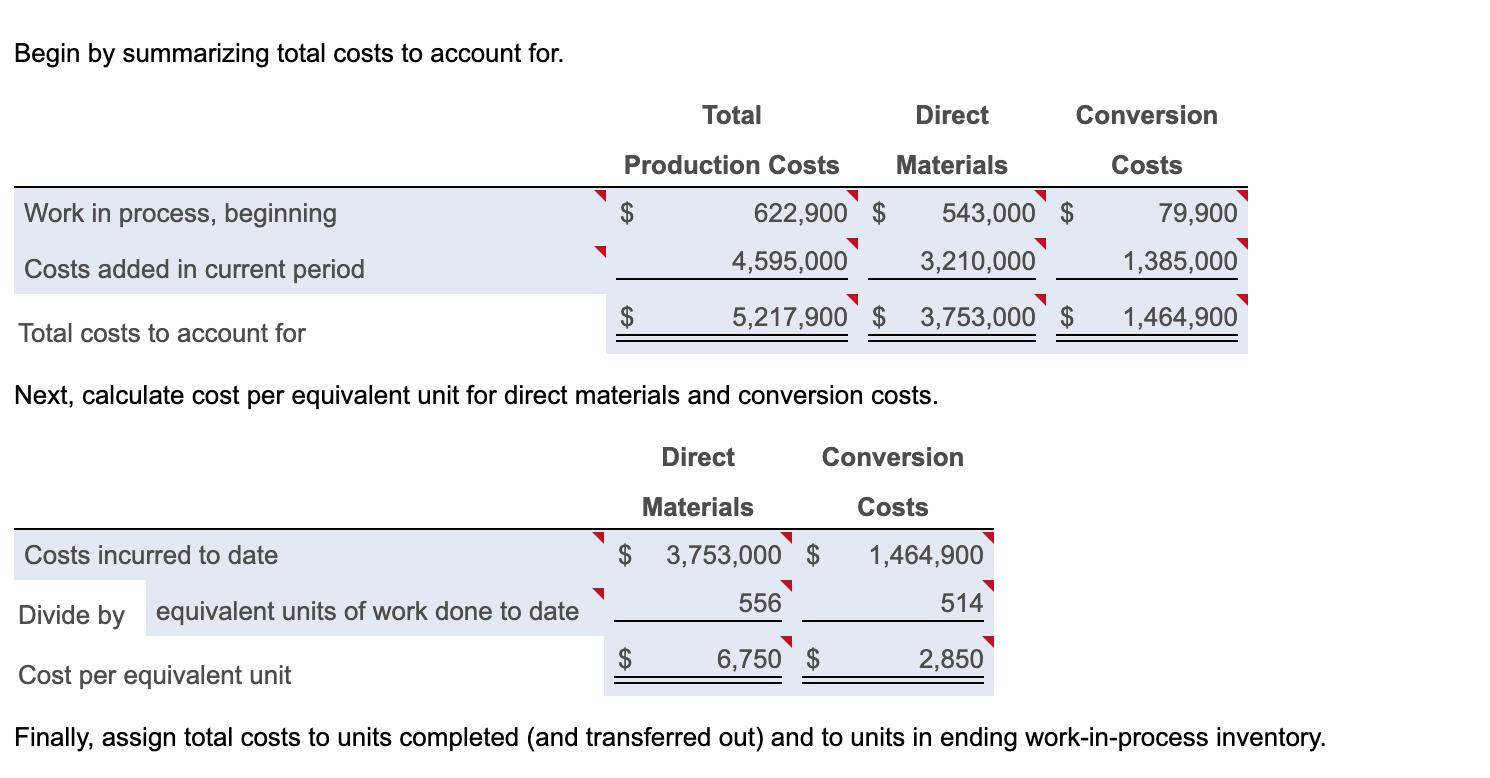

Beginning work in process (May 1) a Started in May 2020 Completed during May 2020 Ending work in process (May 31) b Total costs added during May 2020 Physical Units Direct Conversion (Watches) Materials Costs 105 $480,800 $96,800 485 445 145 $3,190,000 aDegree of completion: direct materials, 80%; conversion costs, 35%. b Degree of completion: direct materials, 60%; conversion costs, 20%. $1,420,000 Completed and transferred out Work in process, ending Total costs accounted for Total Production Costs $ 4,464,000 $ 3,138,750 $ Direct Conversion Materials Costs 1,325,250 L 753,900 614,250 139,650 $ 5,217,900 $ 3,753,000 $ 1,464,900 Begin by summarizing total costs to account for. Work in process, beginning Costs added in current period Total costs to account for Total Production Costs Direct Conversion Materials Costs 622,900 $ 543,000 $ 79,900 4,595,000 3,210,000 1,385,000 5,217,900 $ 3,753,000 $ 1,464,900 Next, calculate cost per equivalent unit for direct materials and conversion costs. Direct Materials Conversion Costs Costs incurred to date $ 3,753,000 $ 1,464,900 Divide by equivalent units of work done to date 556 514 6,750 $ 2,850 Cost per equivalent unit Finally, assign total costs to units completed (and transferred out) and to units in ending work-in-process inventory.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the information provided here are the required questions and their answers 1 What is the to...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started