Answered step by step

Verified Expert Solution

Question

1 Approved Answer

! Required information [The following information applies to the questions displayed below.) On January 1, Year 1, Brown Co. borrowed cash from First Bank by

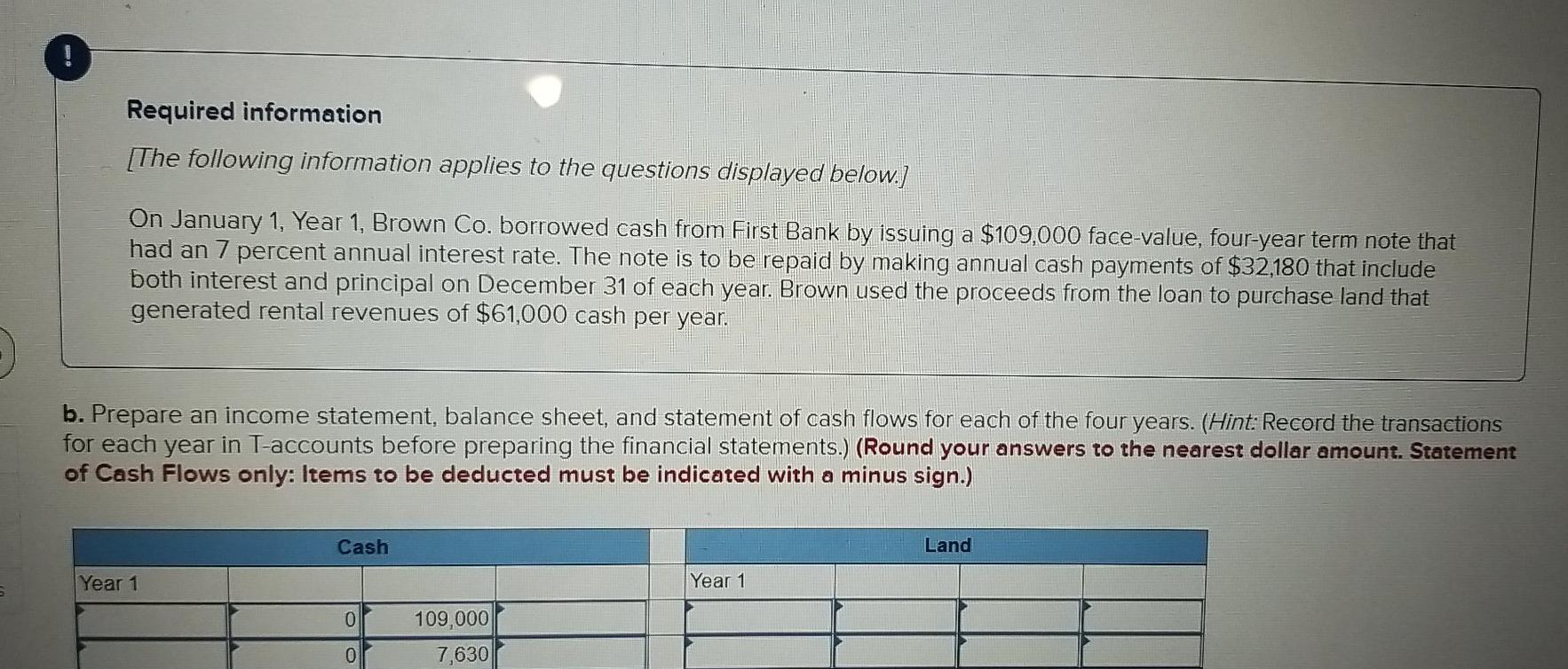

! Required information [The following information applies to the questions displayed below.) On January 1, Year 1, Brown Co. borrowed cash from First Bank by issuing a $109,000 face-value, four-year term note that had an 7 percent annual interest rate. The note is to be repaid by making annual cash payments of $32,180 that include both interest and principal on December 31 of each year. Brown used the proceeds from the loan to purchase land that generated rental revenues of $61,000 cash per year. b. Prepare an income statement, balance sheet, and statement of cash flows for each of the four years. (Hint: Record the transactions for each year in T-accounts before preparing the financial statements.) (Round your answers to the nearest dollar amount. Statement of Cash Flows only: Items to be deducted must be indicated with a minus sign.) Cash Land Year 1 Year 1 0 109,000 0 7,630

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started