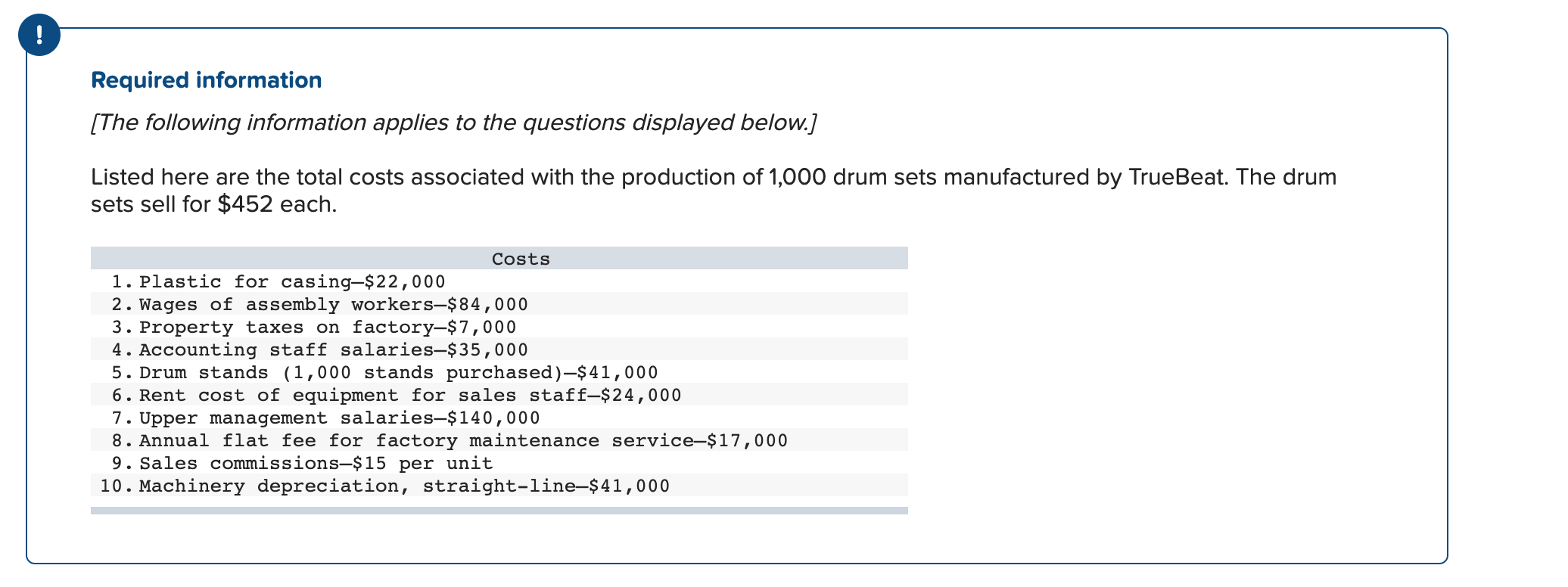

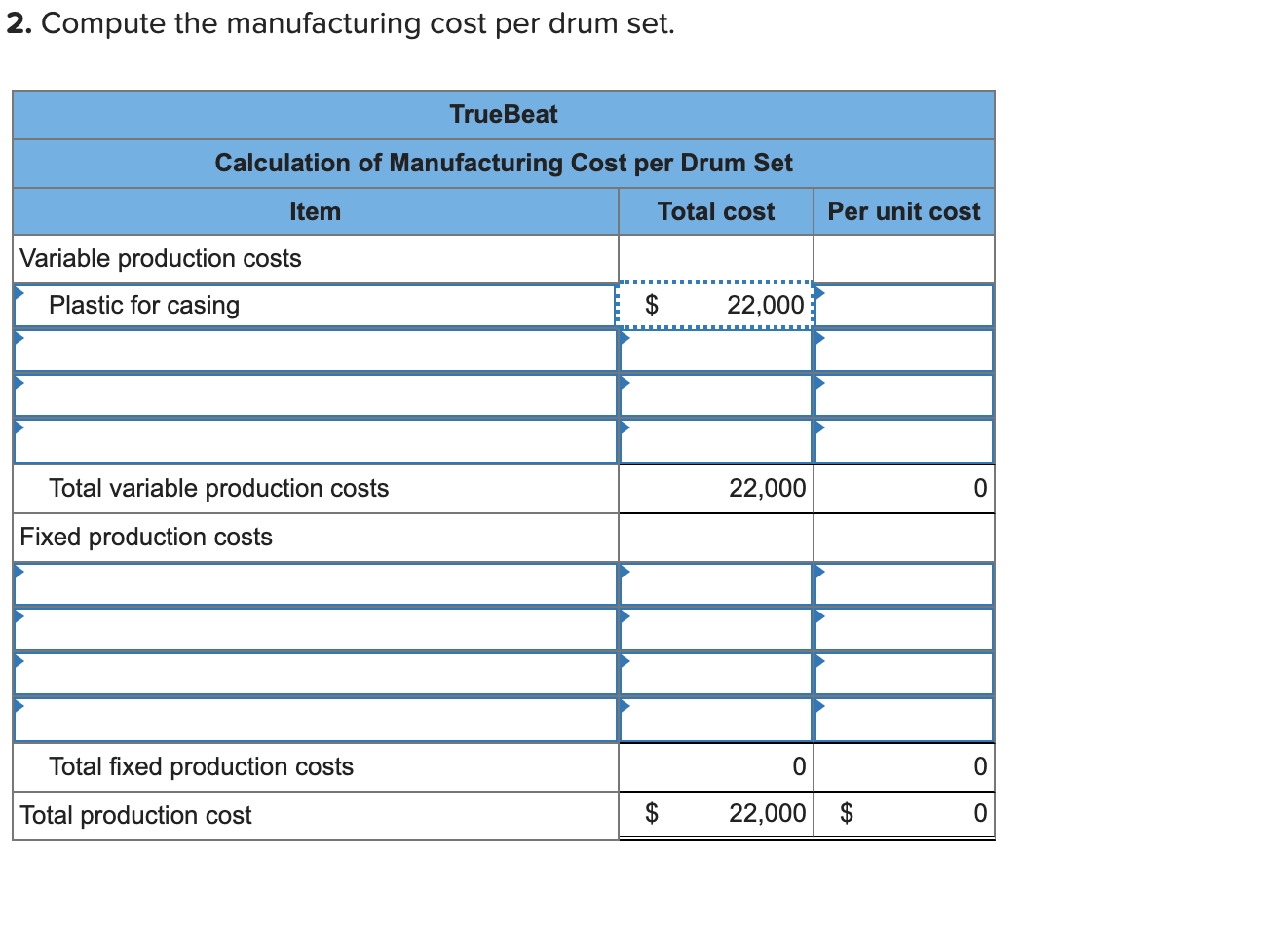

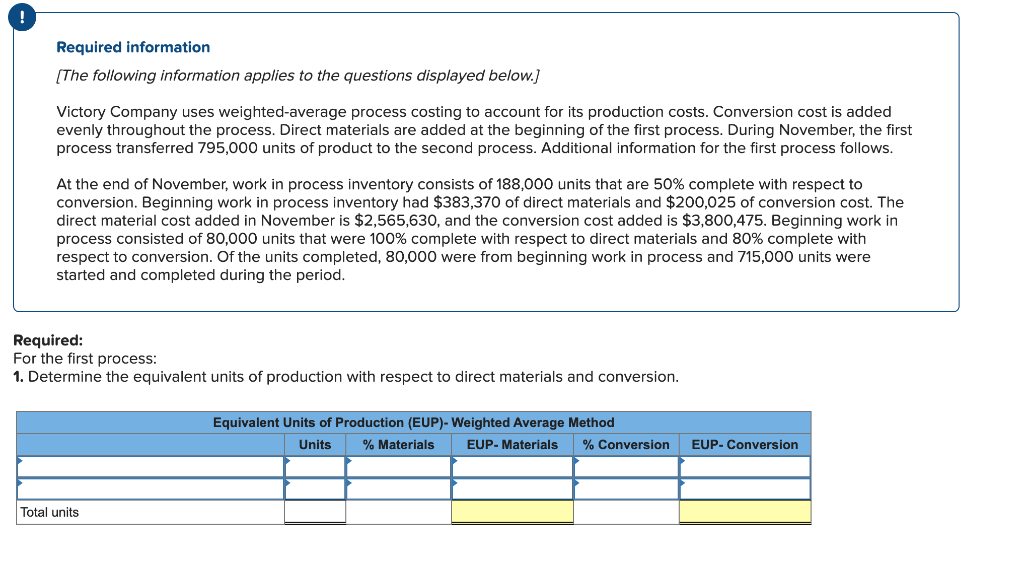

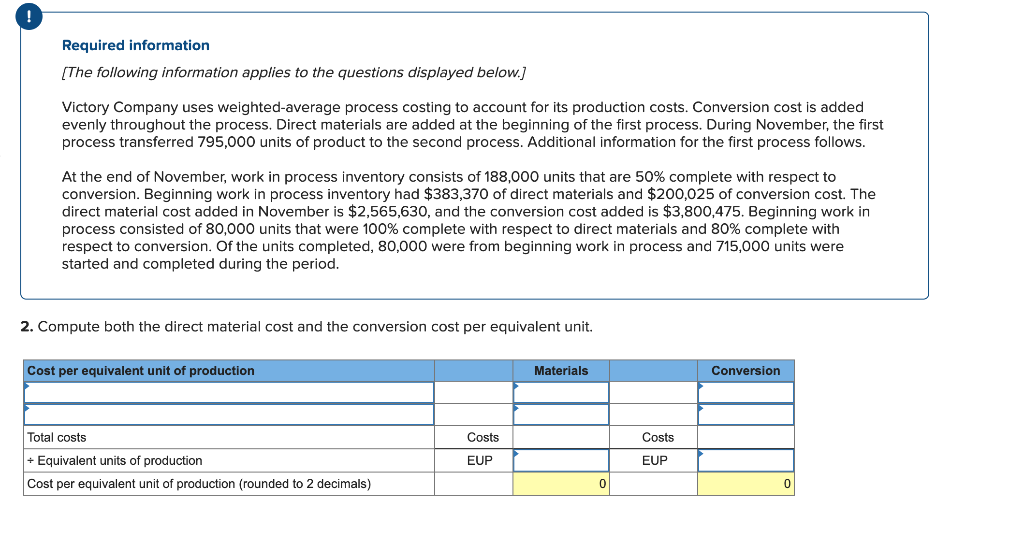

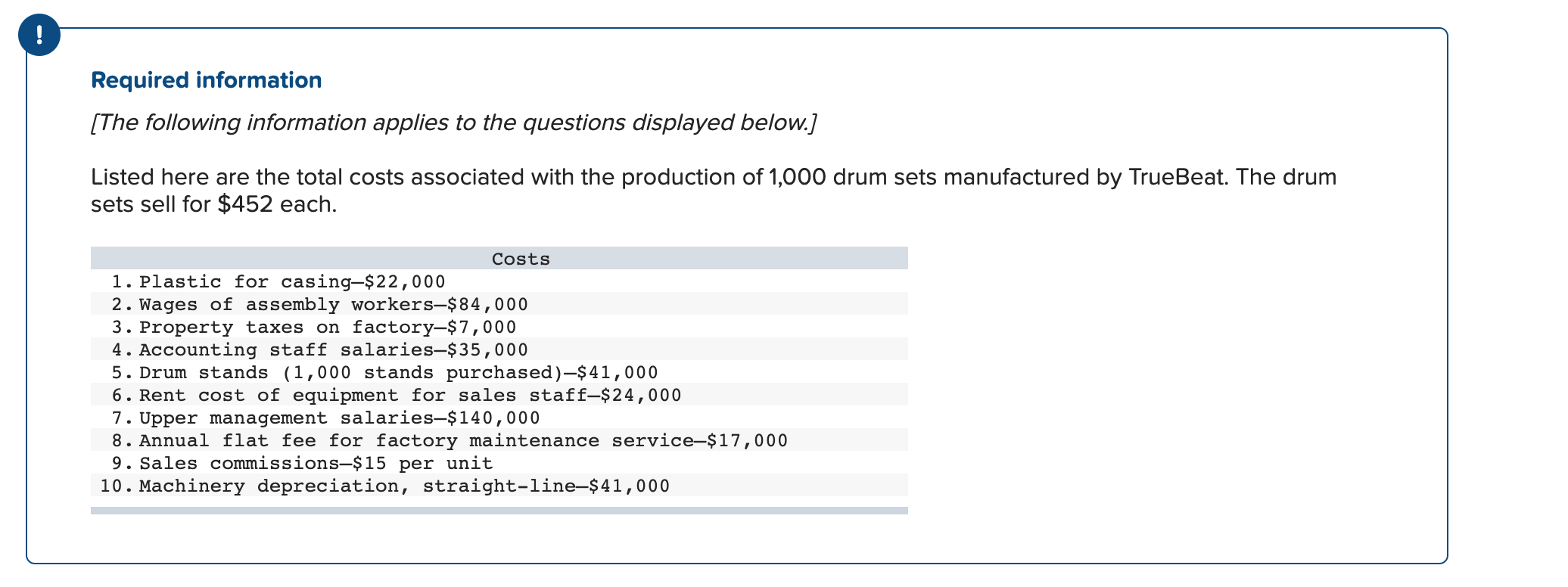

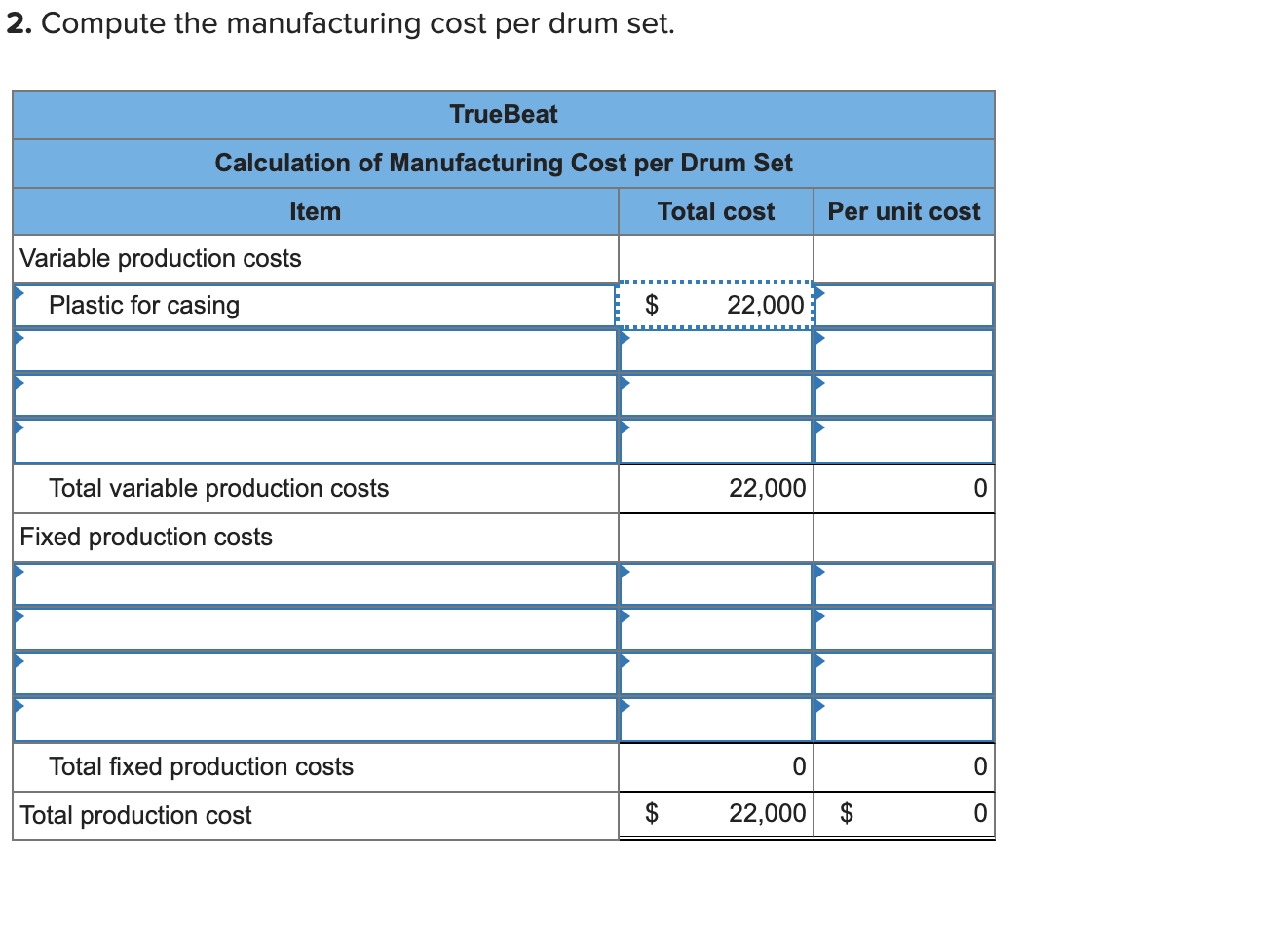

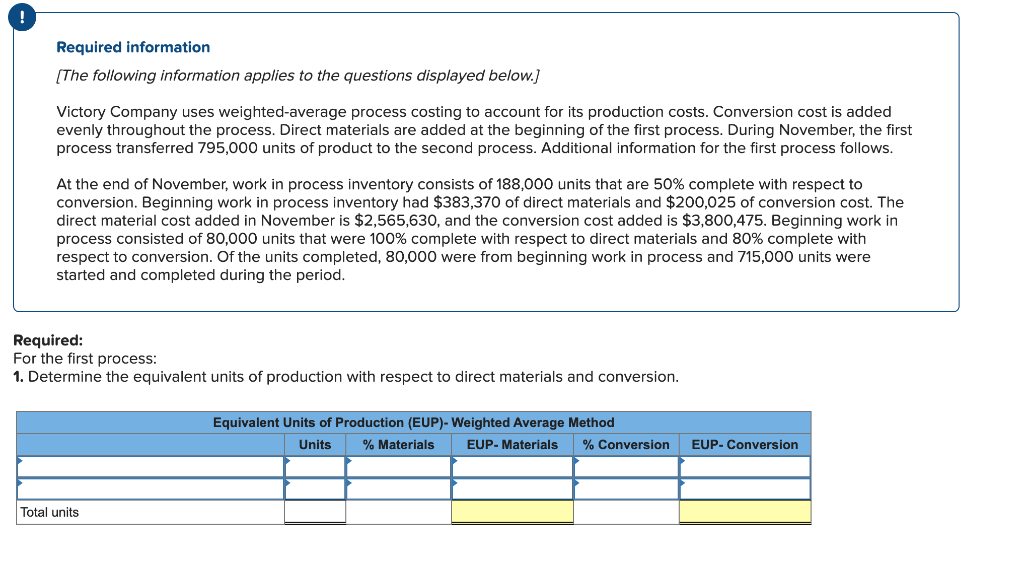

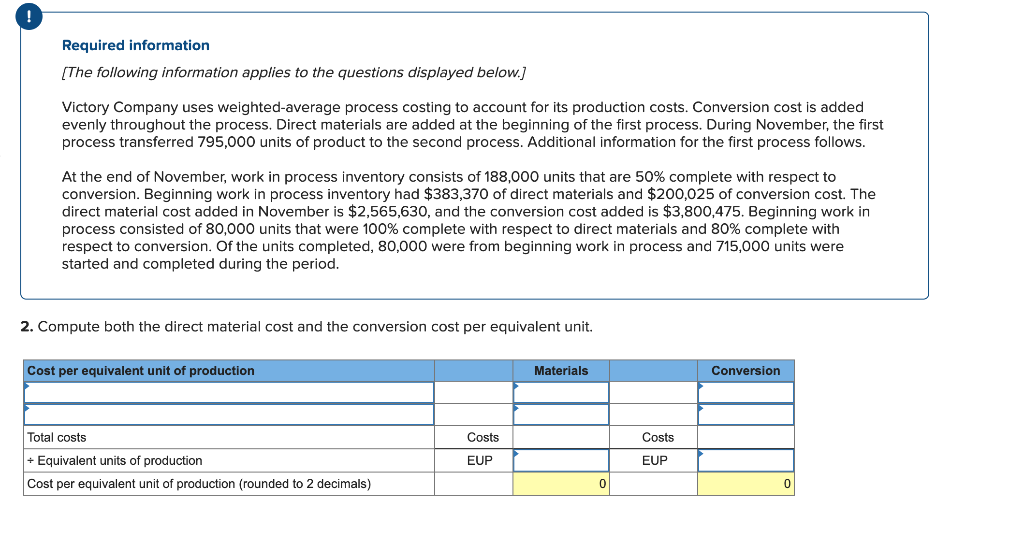

! Required information (The following information applies to the questions displayed below.] Listed here are the total costs associated with the production of 1,000 drum sets manufactured by TrueBeat. The drum sets sell for $452 each. Costs 1. Plastic for casing-$22,000 2. Wages of assembly workers-$84,000 3. Property taxes on factory-$7,000 4. Accounting staff salaries,$35,000 5. Drum stands (1,000 stands purchased)-$41,000 6. Rent cost of equipment for sales staff-$24,000 7. Upper management salaries-$140,000 8. Annual flat fee for factory maintenance service-$17,000 9. Sales commissions$15 per unit 10. Machinery depreciation, straight-line-$41,000 2. Compute the manufacturing cost per drum set. True Beat Calculation of Manufacturing Cost per Drum Set Item Total cost Per unit cost Variable production costs Plastic for casing $ 22,000 Total variable production costs 22,000 0 Fixed production costs Total fixed production costs 0 0 Total production cost $ 22,000 $ 0 Required information (The following information applies to the questions displayed below.] Victory Company uses weighted-average process costing to account for its production costs. Conversion cost is added evenly throughout the process. Direct materials are added at the beginning of the first process. During November, the first process transferred 795,000 units of product to the second process. Additional information for the first process follows. At the end of November, work in process inventory consists of 188,000 units that are 50% complete with respect to conversion. Beginning work in process inventory had $383,370 of direct materials and $200,025 of conversion cost. The direct material cost added in November is $2,565,630, and the conversion cost added is $3,800,475. Beginning work in process consisted of 80,000 units that were 100% complete with respect to direct materials and 80% complete with respect to conversion. Of the units completed, 80,000 were from beginning work in process and 715,000 units were started and completed during the period. Required: For the first process: 1. Determine the equivalent units of production with respect to direct materials and conversion. Equivalent Units of Production (EUP)-Weighted Average Method Units % Materials EUP- Materials % Conversion EUP-Conversion Total units Required information [The following information applies to the questions displayed below.] Victory Company uses weighted average process costing to account for its production costs. Conversion cost is added evenly throughout the process. Direct materials are added at the beginning of the first process. During November, the first process transferred 795,000 units of product to the second process. Additional information for the first process follows. At the end of November, work in process inventory consists of 188,000 units that are 50% complete with respect to conversion. Beginning work in process inventory had $383,370 of direct materials and $200,025 of conversion cost. The direct material cost added in November is $2,565,630, and the conversion cost added is $3,800,475. Beginning work in process consisted of 80,000 units that were 100% complete with respect to direct materials and 80% complete with respect to conversion. Of the units completed, 80,000 were from beginning work in process and 715,000 units were started and completed during the period. 2. Compute both the direct material cost and the conversion cost per equivalent unit. Cost per equivalent unit of production Materials Conversion Costs Total costs + Equivalent units of production Cost per equivalent unit of production (rounded to 2 decimals) Costs EUP EUP 0