Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information [ The following information applies to the questions displayed below. ] Padma needs a new truck to help her expand Padma's Plumbing Palace.

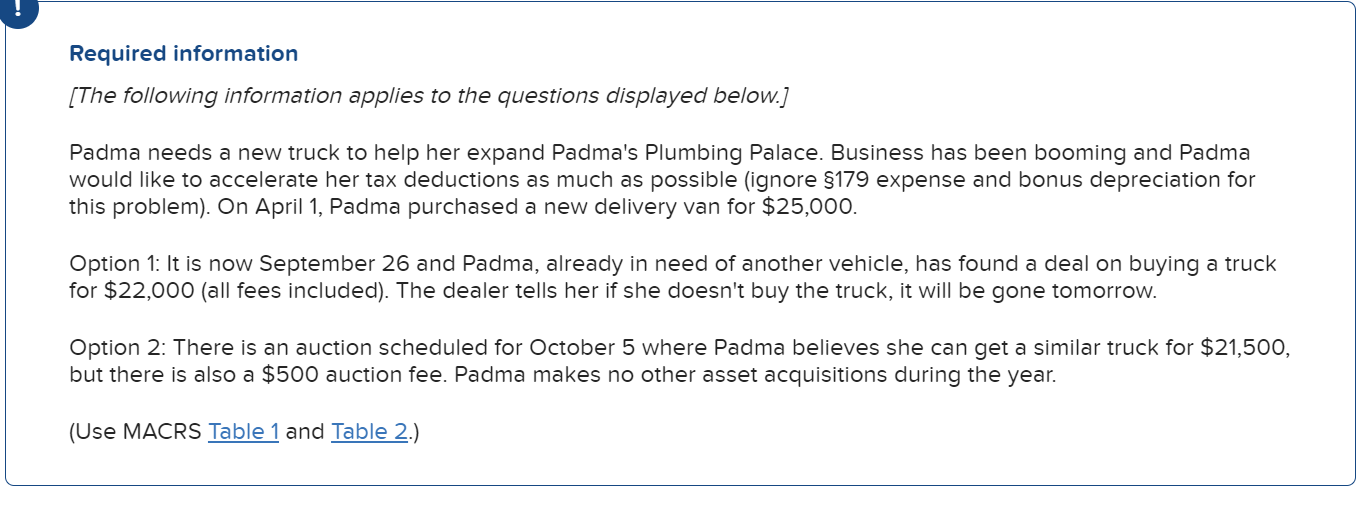

Required information

The following information applies to the questions displayed below.

Padma needs a new truck to help her expand Padma's Plumbing Palace. Business has been booming and Padma

would like to accelerate her tax deductions as much as possible ignore $ expense and bonus depreciation for

this problem On April Padma purchased a new delivery van for $

Option : It is now September and Padma, already in need of another vehicle, has found a deal on buying a truck

for $all fees included The dealer tells her if she doesn't buy the truck, it will be gone tomorrow.

Option : There is an auction scheduled for October where Padma believes she can get a similar truck for $

but there is also a $ auction fee. Padma makes no other asset acquisitions during the year.

Use MACRS Table and Table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started