Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information [ The following information applies to the questions displayed below. ] Lab Insight: Apply the same steps in Lab 9 . 5 Excel

Required information

The following information applies to the questions displayed below.

Lab Insight: Apply the same steps in Lab Excel to the Alt Lab Data.xIsx dataset.

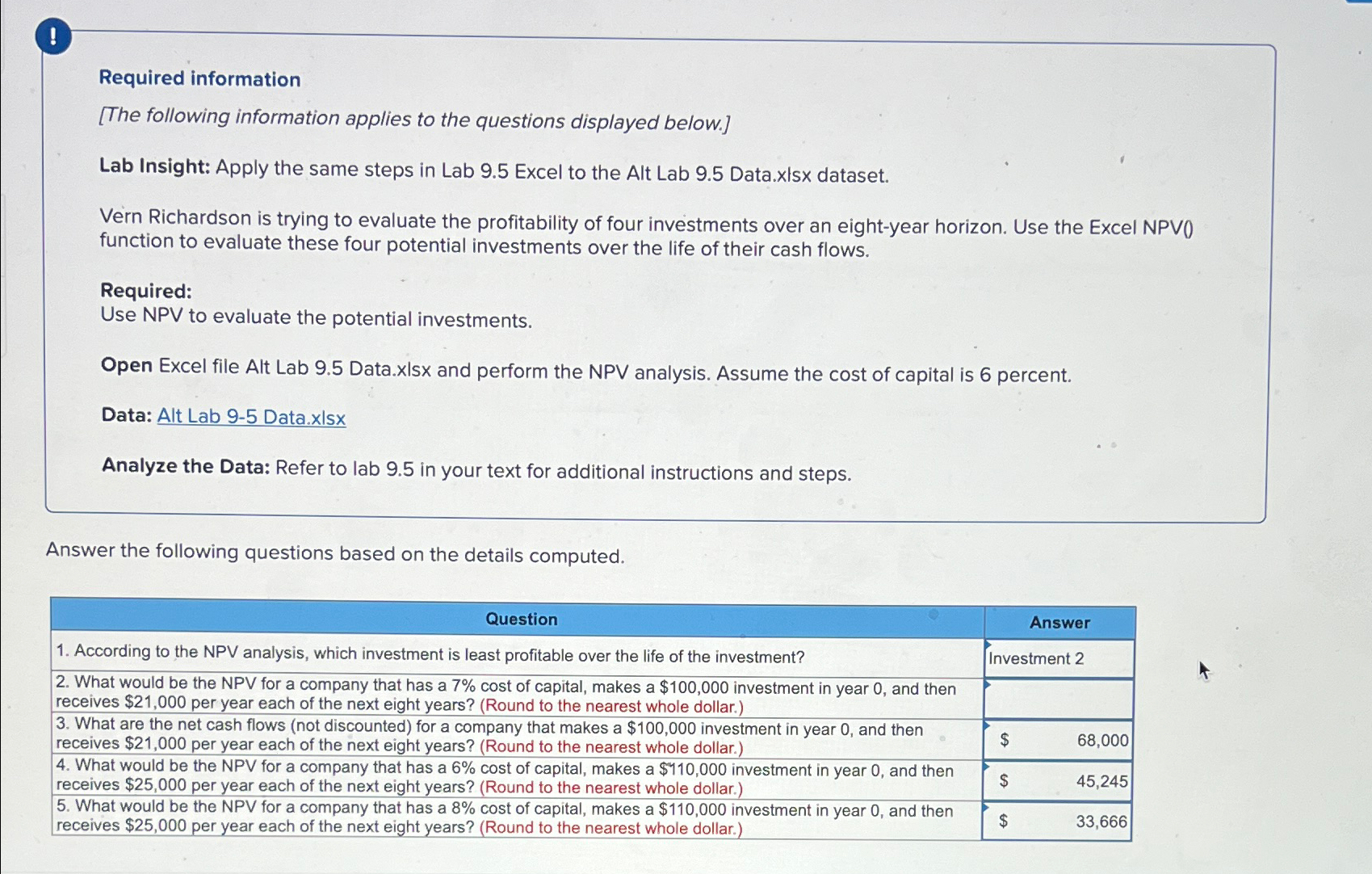

Vern Richardson is trying to evaluate the profitability of four investments over an eightyear horizon. Use the Excel NPV function to evaluate these four potential investments over the life of their cash flows.

Required:

Use NPV to evaluate the potential investments.

Open Excel file Alt Lab Data.xlsx and perform the NPV analysis. Assume the cost of capital is percent.

Data: Alt Lab Data.xIsx

Analyze the Data: Refer to lab in your text for additional instructions and steps.

Answer the following questions based on the details computed.

tableQuestionAnswer According to the NPV analysis, which investment is least profitable over the life of the investment?,Investment table What would be the NPV for a company that has a cost of capital, makes a $ investment in year and thenreceives $ per year each of the next eight years? Round to the nearest whole dollar.table What are the net cash flows not discounted for a company that makes a $ investment in year and thenreceives $ per year each of the next eight years? Round to the nearest whole dollar.$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started