Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information [ The following information applies to the questions displayed below. ] Although Hank is retired, he is an excellent handyman and often works

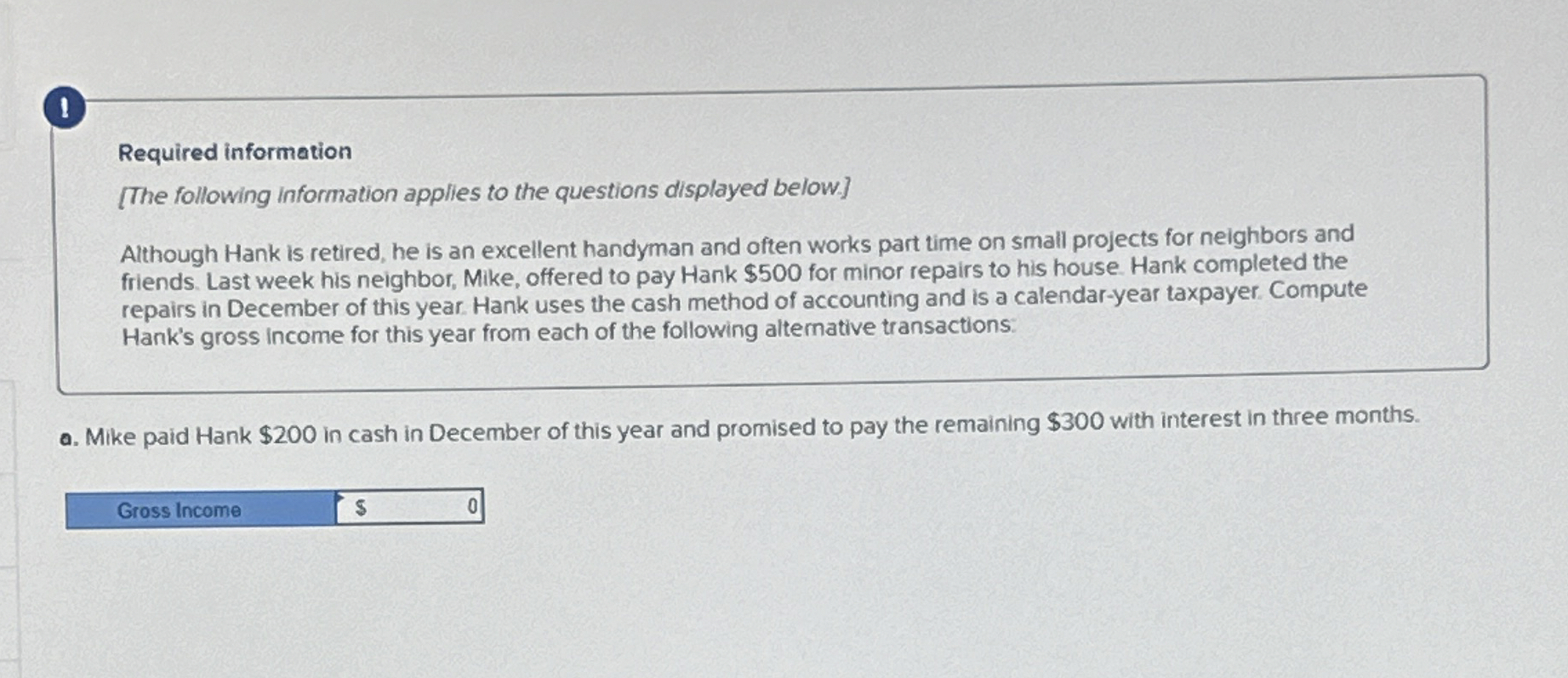

Required information

The following information applies to the questions displayed below.

Although Hank is retired, he is an excellent handyman and often works part time on small projects for neighbors and

friends. Last week his neighbor, Mike, offered to pay Hank $ for minor repairs to his house. Hank completed the

repairs in December of this year. Hank uses the cash method of accounting and is a calendaryear taxpayer. Compute

Hank's gross income for this year from each of the following alternative transactions:

a Mike paid Hank $ in cash in December of this year and promised to pay the remaining $ with interest in three months.

Gross Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started