Answered step by step

Verified Expert Solution

Question

1 Approved Answer

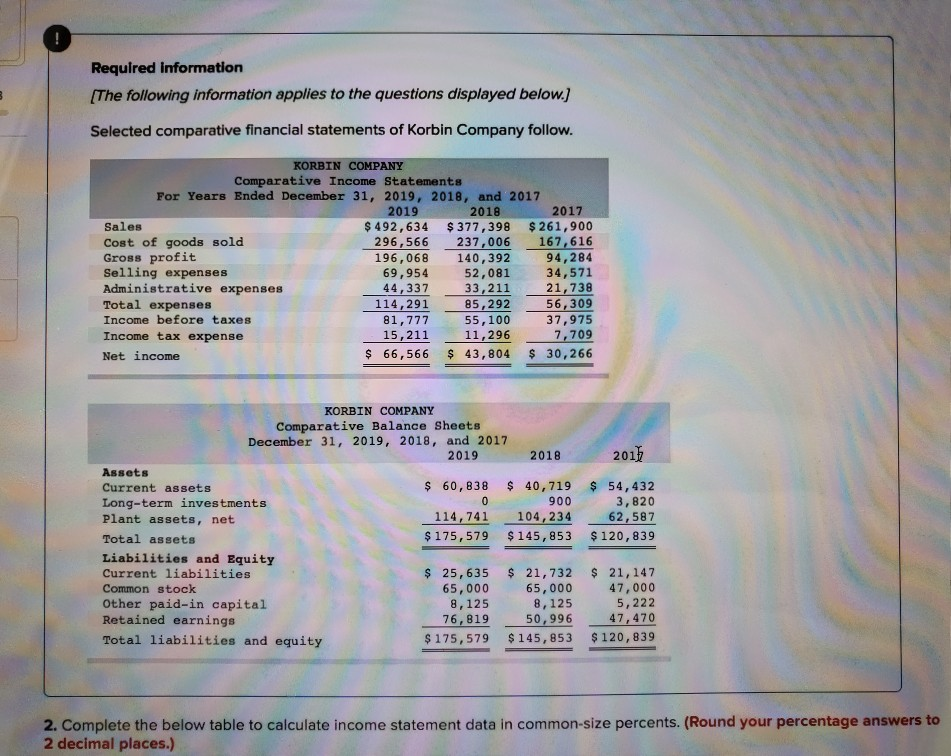

! Required information (The following information applies to the questions displayed below.) Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements

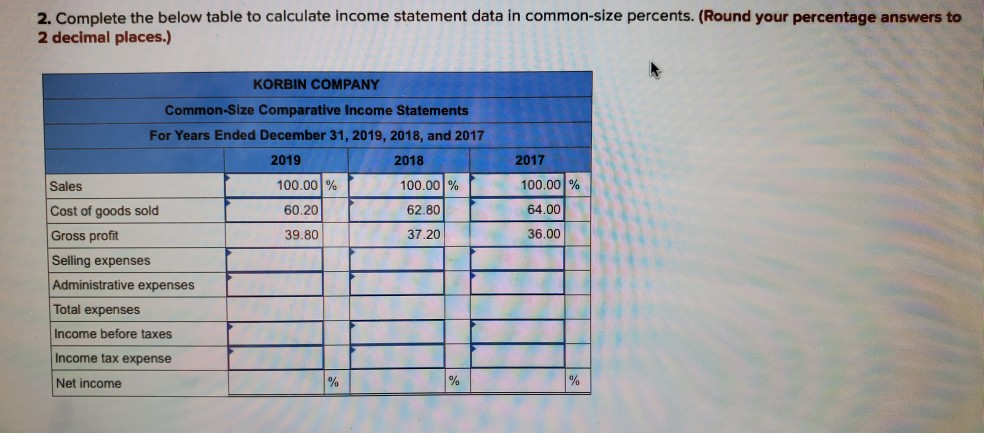

! Required information (The following information applies to the questions displayed below.) Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31, 2019, 2018, and 2017 2019 2018 2017 Sales $ 492,634 $377,398 $ 261,900 Cost of goods sold 296,566 237,006 167,616 Gross profit 196,068 140,392 94,284 Selling expenses 69,954 52,081 34,571 Administrative expenses 44,337 33,211 21,738 Total expenses 114,291 85,292 56,309 Income before taxes 81,777 55,100 37,975 Income tax expense 15,211 11,296 7,709 Net income $ 66,566 $ 43,804 $ 30,266 2013 KORBIN COMPANY Comparative Balance Sheets December 31, 2019, 2018, and 2017 2019 2018 Assets Current assets $ 60,838 $ 40,719 Long-term investments 0 900 Plant assets, net 114,741 104,234 Total assets $ 175,579 $ 145,853 Liabilities and Equity Current liabilities $ 25,635 $ 21,732 Common stock 65,000 65,000 Other paid-in capital 8,125 8,125 Retained earnings 76,819 50,996 Total liabilities and equity $ 175, 579 $ 145,853 $ 54,432 3,820 62,587 $ 120,839 $ 21, 147 47,000 5,222 47, 470 $ 120,839 2. Complete the below table to calculate income statement data in common-size percents. (Round your percentage answers to 2 decimal places.) 2. Complete the below table to calculate income statement data in common-size percents. (Round your percentage answers to 2 decimal places.) 2017 KORBIN COMPANY Common-Size Comparative Income Statements For Years Ended December 31, 2019, 2018, and 2017 2019 2018 Sales 100.00% 100.00% Cost of goods sold 60.20 62.80 Gross profit 39.80 37.20 Selling expenses Administrative expenses 100.00% 64.00 36.00 Total expenses Income before taxes Income tax expense Net income % 1% %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started