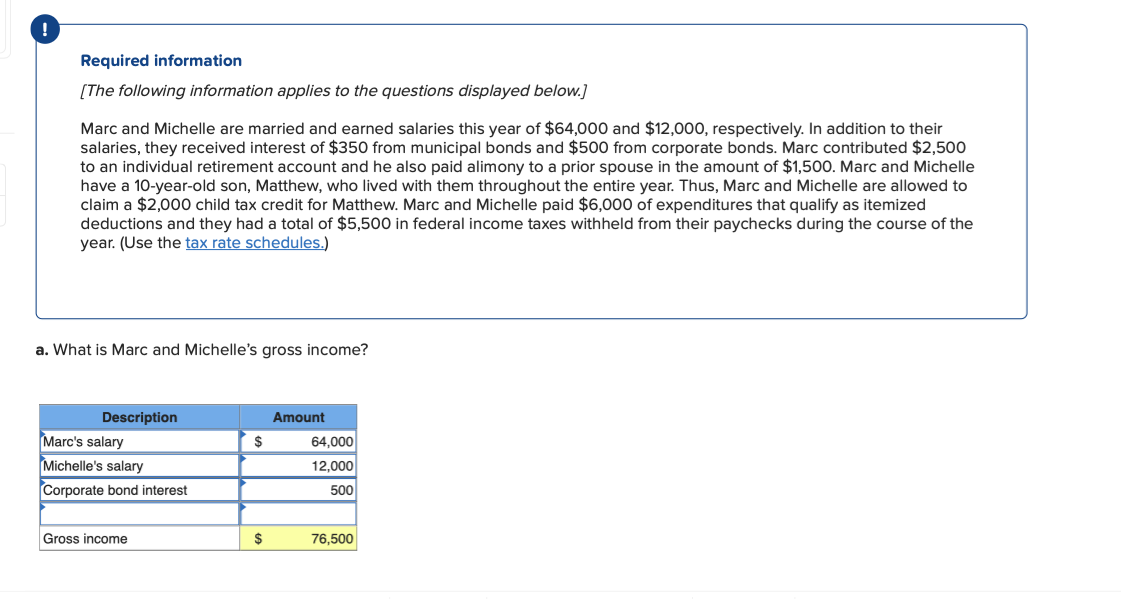

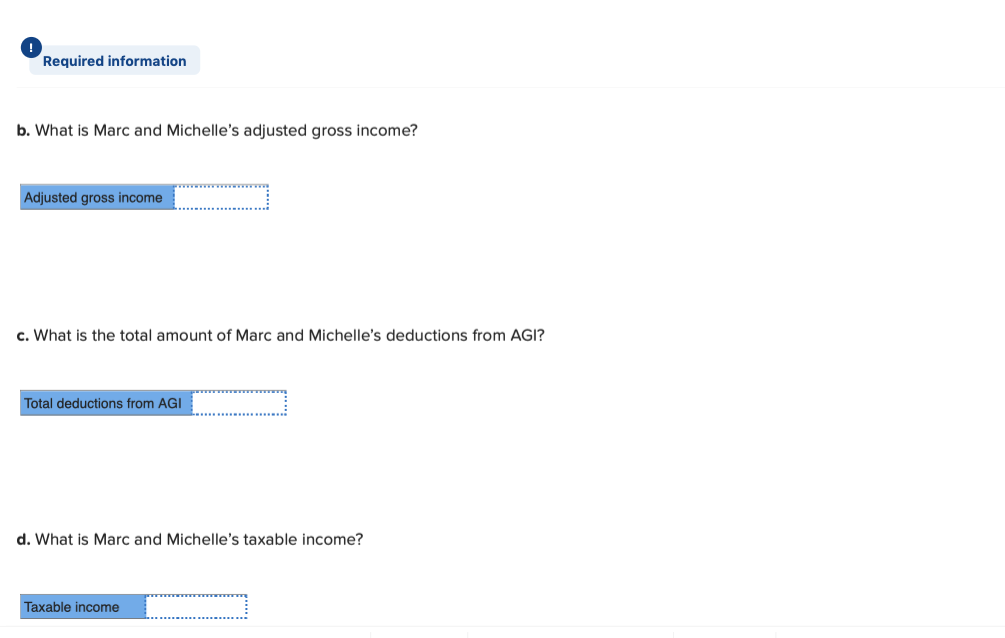

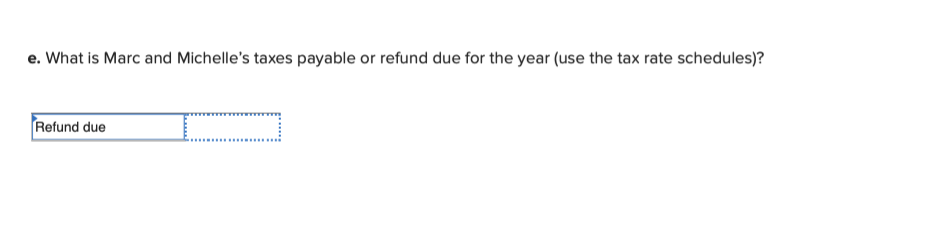

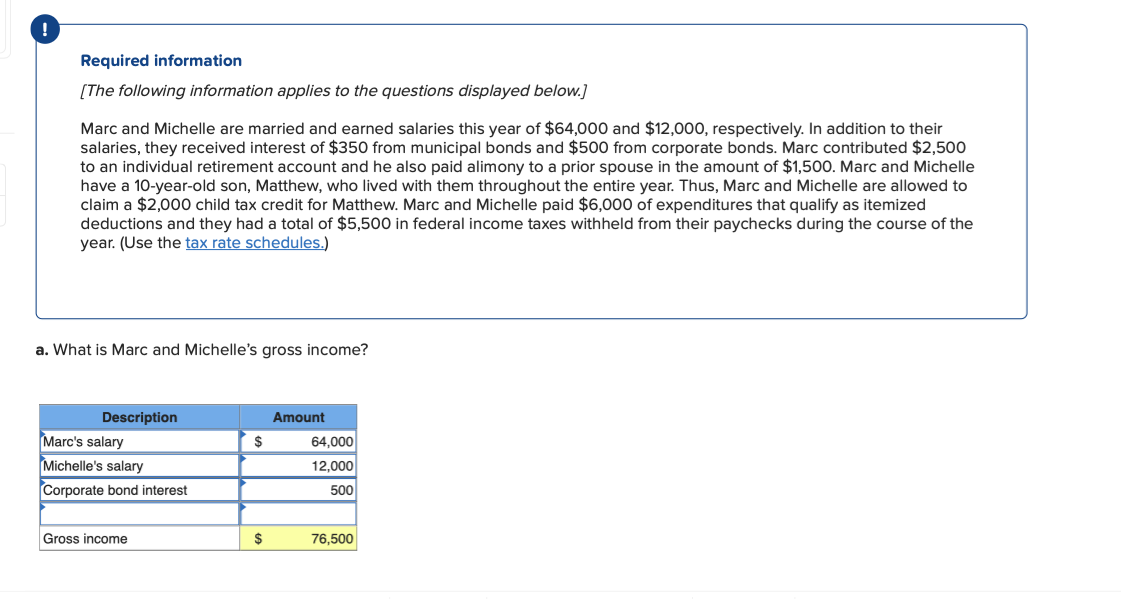

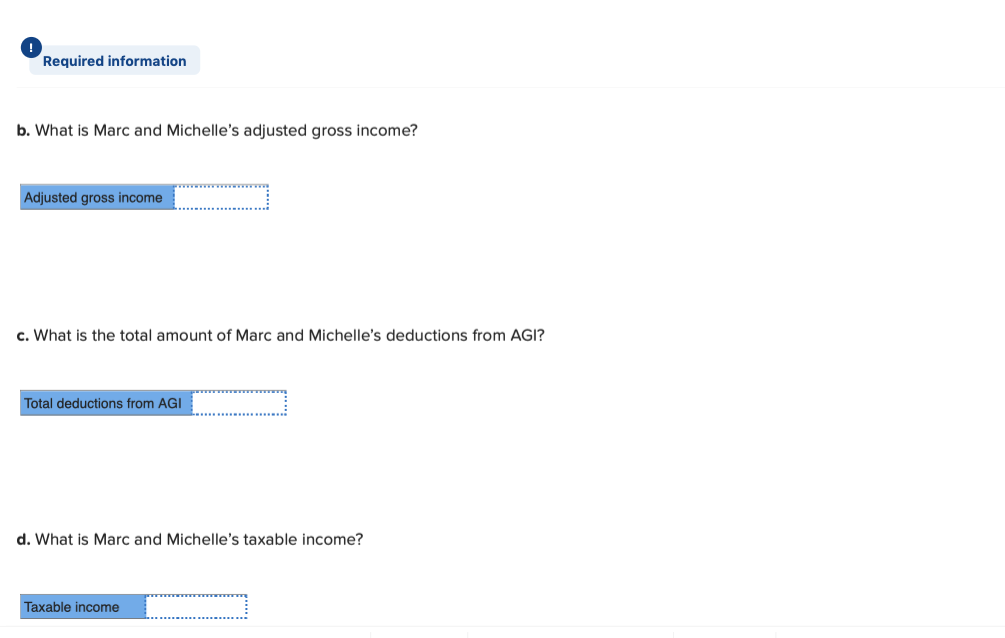

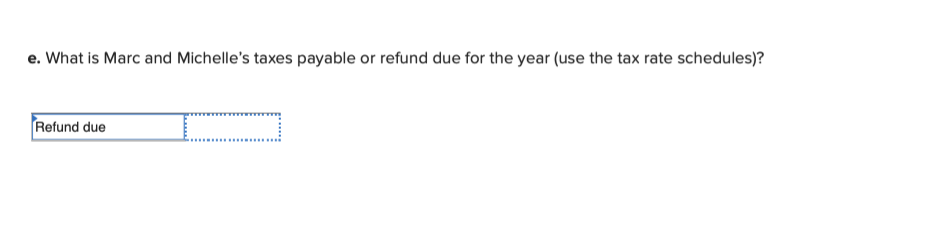

! Required information [The following information applies to the questions displayed below.) Marc and Michelle are married and earned salaries this year of $64,000 and $12,000, respectively. In addition to their salaries, they received interest of $350 from municipal bonds and $500 from corporate bonds. Marc contributed $2,500 to an individual retirement account and he also paid alimony to a prior spouse in the amount of $1,500. Marc and Michelle have a 10-year-old son, Matthew, who lived with them throughout the entire year. Thus, Marc and Michelle are allowed to claim a $2,000 child tax credit for Matthew. Marc and Michelle paid $6,000 of expenditures that qualify as itemized deductions and they had a total of $5,500 in federal income taxes withheld from their paychecks during the course of the year. (Use the tax rate schedules.) a. What is Marc and Michelle's gross income? Amount 64,000 $ Description Marc's salary Michelle's salary Corporate bond interest 12,000 500 Gross income $ 76,500 Required information b. What is Marc and Michelle's adjusted gross income? Adjusted gross income c. What is the total amount of Marc and Michelle's deductions from AGI? Total deductions from AGI d. What is Marc and Michelle's taxable income? Taxable income e. What is Marc and Michelle's taxes payable or refund due for the year (use the tax rate schedules)? Refund due 2018 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over: The tax is: $ 0 $ 9,525 10% of taxable income $ 9,525 $ 38,700 $952.50 plus 12% of the excess over $9,525 $ 38,700 $ 82,500 $4,453.50 plus 22% of the excess over $38,700 $ 82,500 $157,500 $14,089.50 plus 24% of the excess over $82,500 $157,500 $200,000 $32,089.50 plus 32% of the excess over $157,500 $200,000 $500,000 $45,689.50 plus 35% of the excess over $200,000 $500,000 $150,689.50 plus 37% of the excess over $500,000 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: $ 0 $ 19,050 10% of taxable income $ 19,050 $ 77,400 $1,905 plus 12% of the excess over $19,050 $ 77,400 $165,000 $8,907 plus 22% of the excess over $77,400 $165,000 $315,000 $28,179 plus 24% of the excess over $165,000 $315,000 $400,000 $64,179 plus 32% of the excess over $315,000 $400,000 $600,000 $91,379 plus 35% of the excess over $400,000 $600,000 $161,379 plus 37% of the excess over $600,000 Schedule Z-Head of Household If taxable income is over: But not over: The tax is: $ 0 $ 13,600 10% of taxable income $ 13,600 $ 51,800 $1,360 plus 12% of the excess over $13,600 $ 51,800 $ 82,500 $5,944 plus 22% of the excess over $51,800 $ 82,500 $157,500 $12,698 plus 24% of the excess over $82,500 $157,500 $200,000 $30,698 plus 32% of the excess over $157,500 $200,000 $500,000 $44,298 plus 35% of the excess over $200,000 $500,000 $149,298 plus 37% of the excess over $500,000 Schedule Y-2-Married Filing Separately If taxable income is over: But not over: The tax is: $ 0 $ 9,525 10% of taxable income $ 9,525 $ 38,700 $952.50 plus 12% of the excess over $9,525 $ 38,700 $ 82,500 $4,453.50 plus 22% of the excess over $38,700 $ 82,500 $157,500 $14,089.50 plus 24% of the excess over $82,500 $157,500 $200,000 $32,089.50 plus 32% of the excess over $157,500 $200,000 $300,000 $45,689.50 plus 35% of the excess over $200,000 $300,000 $80,689.50 plus 37% of the excess over $300,000 Complete pages 1 and 2 of Marc and Michelle's Form 1040. Marc and Michelle's address is 19010 N.W. 135th Street, Miami, FL 33054. Social security numbers: Michelle Taxpayer: 222-33-4444 Marc Taxpayer: 111-22-3333 Matthew Taxpayer: 333-44-5555 (Input all the values as positive numbers. Enter any non-financial information, (e.g. Names, Addresses, social security numbers) EXACTLY as they appear in any given information or Problem Statement. Use 2018 tax laws.) 1040 for a couple Married Filing Jointly. 1040 PG 1 1040 PG 2 Page 1 of Form 1040. Use provided information and follow instructions on form. Form 1040 2018 Department of the Treasury - Internal Revenue Service (99) U.S. Individual Income Tax Return Single Married filing jointly OMB No. 1545-0074 Head of household Filing status: Married filing separately IRS Use Only . Do not write in Qualifying widow(er) Your social security ni Your first name and initial Last name ICA SAVU W Page 2 of Form 1040. Some information does not carry over from Page 1. Page 2 1 1 2b 3b 4b 5b 6 0 71 8 9 Form 1040 (2018) 1 Wages, salaries, tips, etc. Attach Form(s) W-2 2a Tax-exempt interest 2a b Taxable interest Attach Form(s) W-2. b Ordinary dividends Also attach Form(s) W- 3a Qualified dividends b 2G and 1099-R if tax 4a IRAs, pensions, and annuities 4a b Taxable amount was withheld. 5a Social security benefits 5a b Taxable amount 6 Total income. Add lines 1 through 5. Add any amount from Schedule 1, line 22 Standard Deduction for- 7 Adjusted gross income. If you have no adjustments to income, enter the amount from line 6; otherwise, subtract Schedule 1, Single or Married filing line 36, from line 6 separately, $12,000 8 ( 8 Standard deduction or itemized deductions (from Schedule A) 9 Qualified business income deduction (see instructions) 10 Taxable income. Subtract lines 8 and 9 from line 7. If zero or less, enter-O- Married filing jointly or Qualifying widow(er). 11 a Tax (see inst.) (check if any from: 1. Form(s) 8814 2. Form 4972 $24,000 3. b Add any amount from Schedule 2 and check here Head of household, 12 a Child tax credit/credit for other dependents $18,000 b Add any amount from Schedule 3 and check here 13 Subtract line 12 from line 11. If zero or less, enter-O- 14 Other taxes. Attach Schedule 4 15 Total tax. Add lines 13 and 14 If you checked any box under Standard deduction, 16 Federal income tax withheld from Forms W-2 and 1099 see instructions. 17 Refundable credits: a EIC (see inst.) ( b Sch. 8812 10 0 11 12 13 0 14 15 0 16 Required information 0 2. Form 4972 11 12 13 0 14 15 0 16 Qualifying widow(er), 11 a Tax (see inst.) (check if any from: 1. Form(s) 8814 $24,000 3. b Add any amount from Schedule 2 and check here Head of household, 12 a Child tax credit/credit for other dependents $18,000 b Add any amount from Schedule 3 and check here 13 Subtract line 12 from line 11. If zero or less, enter-O- 14 Other taxes. Attach Schedule 4 If you checked any box 15 Total tax. Add lines 13 and 14 under Standard deduction, 16 Federal income tax withheld from Forms W-2 and 1099 see instructions. 17 Refundable credits: a EIC (see inst.) b Sch. 88121 c Form 8863 d Add any amount from Schedule 5 18 Add lines 16 and 17. These are your total payments. Refund 19 If line 18 is more than line 15, subtract line 15 from line 18. This is the amount you overpaid 20a Amount of line 19 you want refunded to you. If Form 8888 is attached, check here Direct deposit? See b Routing number c Type: Checking instructions. d Account number 21 Amount of line 19 you want applied to your 2019 estimated tax 21 Amount You Owe 22 Amount you owe. Subtract line 18 from line 15. For details on how to pay, see instructions 23 Estimated tax penalty (see instructions) 23 Go to www.irs.gov/Form 1040 for instructions and the latest information. 17 18 0 19 0 20a Savings 22 Form 1040 (2018)