Answered step by step

Verified Expert Solution

Question

1 Approved Answer

! Required information [The following information applies to the questions displayed below.] In Year 1, Company A acquired Company B for $464 million, of

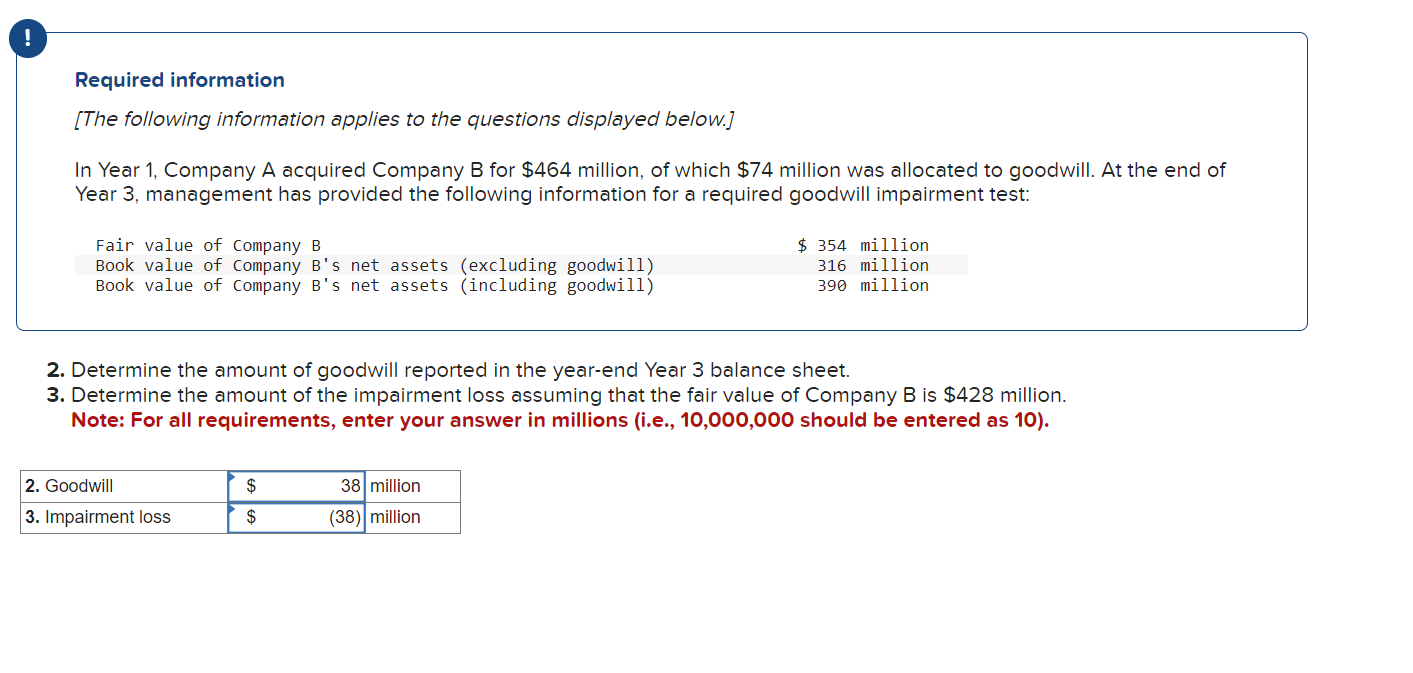

! Required information [The following information applies to the questions displayed below.] In Year 1, Company A acquired Company B for $464 million, of which $74 million was allocated to goodwill. At the end of Year 3, management has provided the following information for a required goodwill impairment test: Fair value of Company B Book value of Company B's net assets (excluding goodwill) Book value of Company B's net assets (including goodwill) $ 354 million 316 million 390 million 2. Determine the amount of goodwill reported in the year-end Year 3 balance sheet. 3. Determine the amount of the impairment loss assuming that the fair value of Company B is $428 million. Note: For all requirements, enter your answer in millions (i.e., 10,000,000 should be entered as 10). 2. Goodwill $ 38 million 3. Impairment loss $ (38) million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the amount of goodwill reported in the yearend Year 3 balance sheet we need to subtract ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started