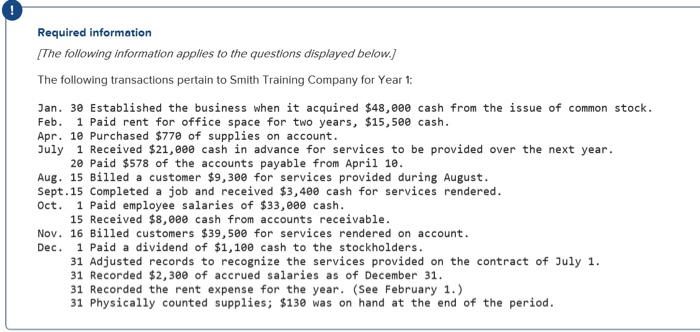

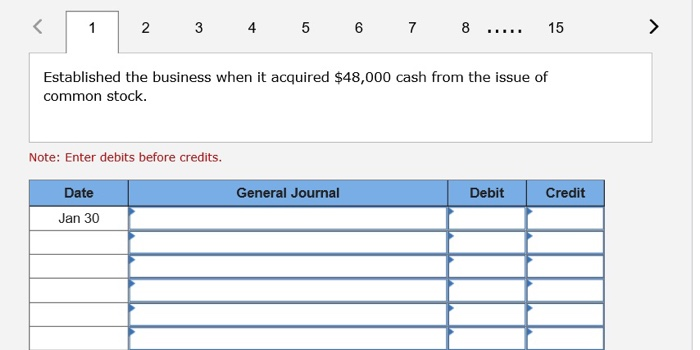

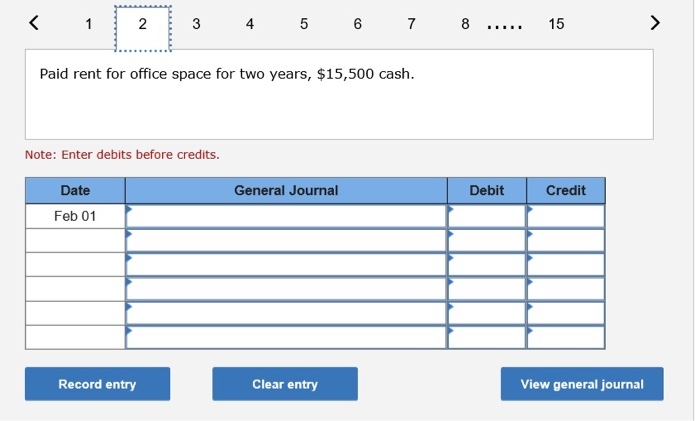

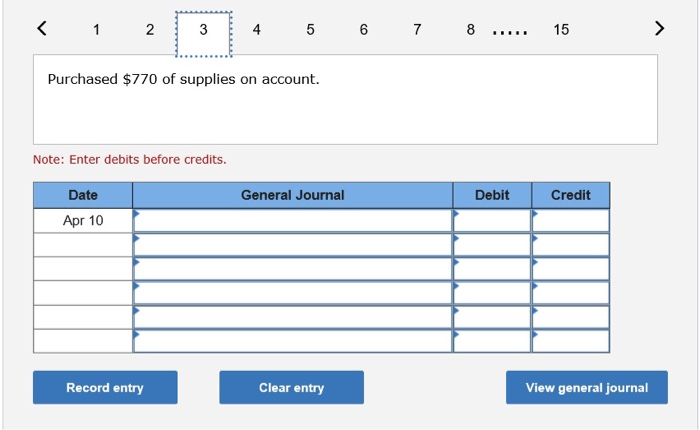

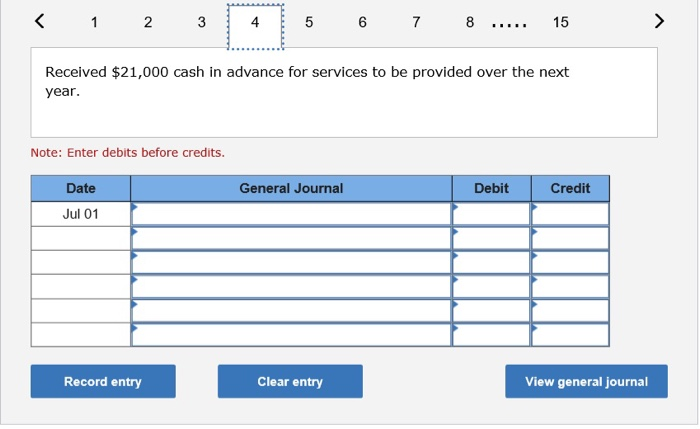

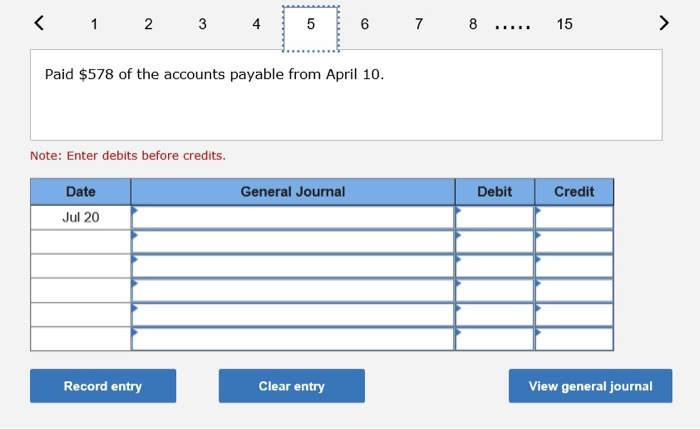

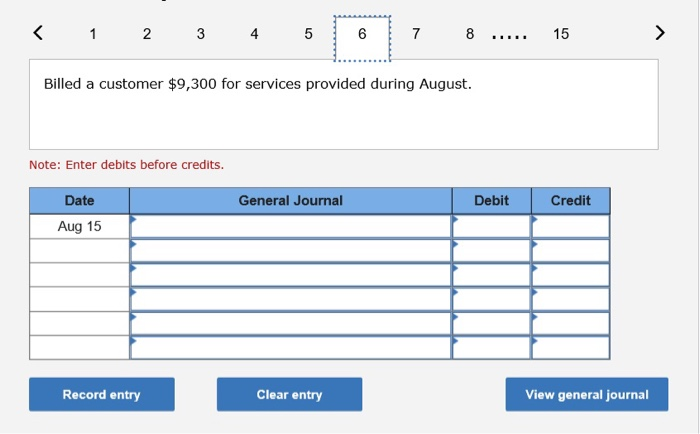

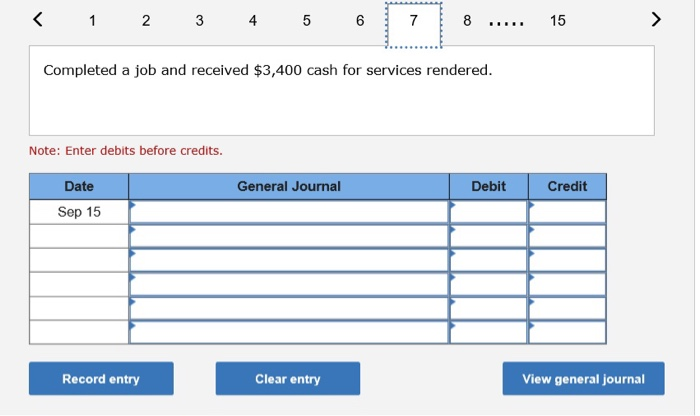

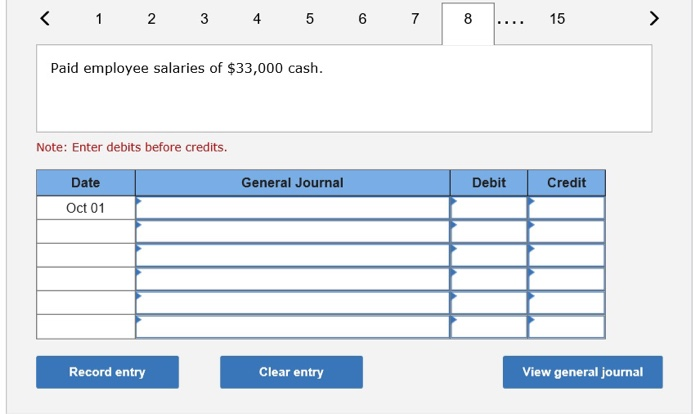

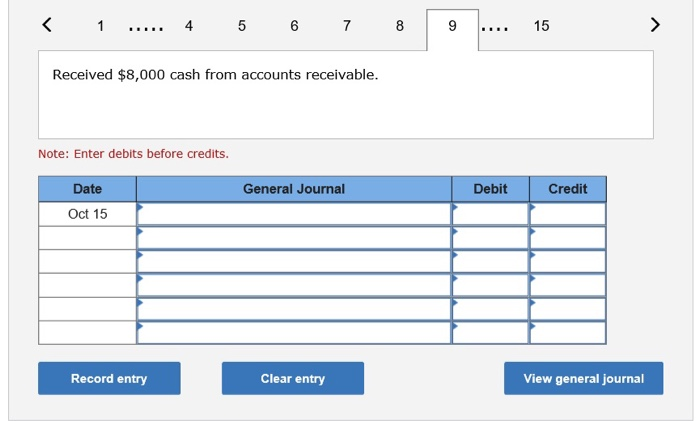

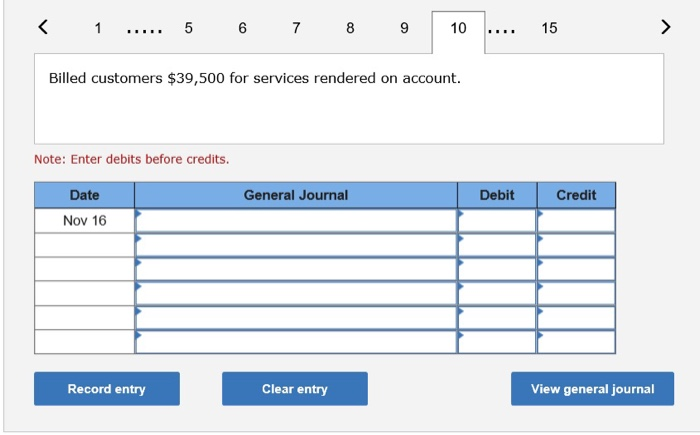

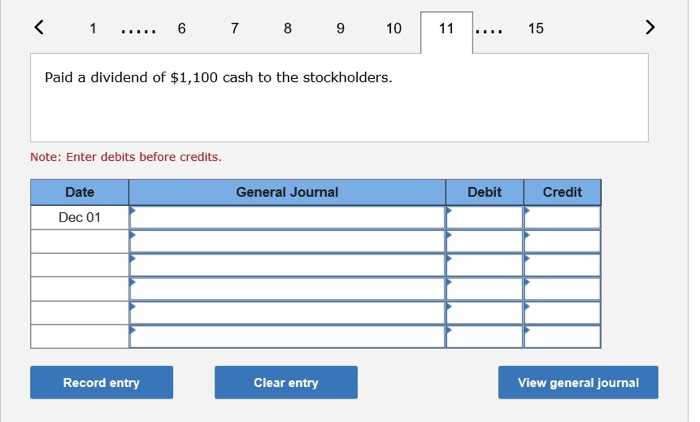

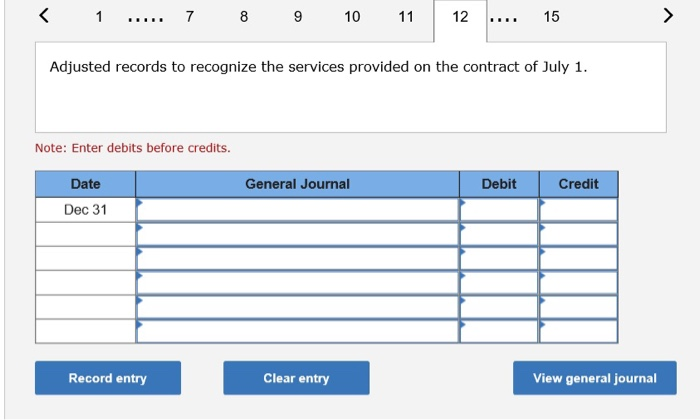

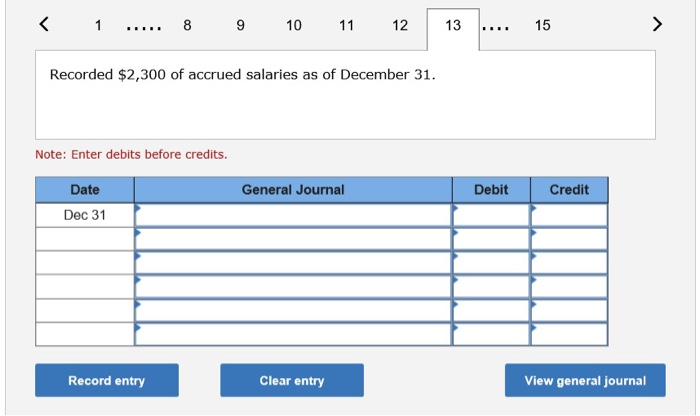

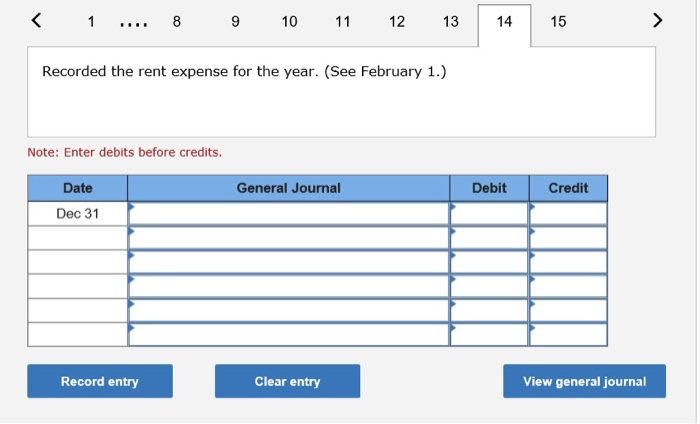

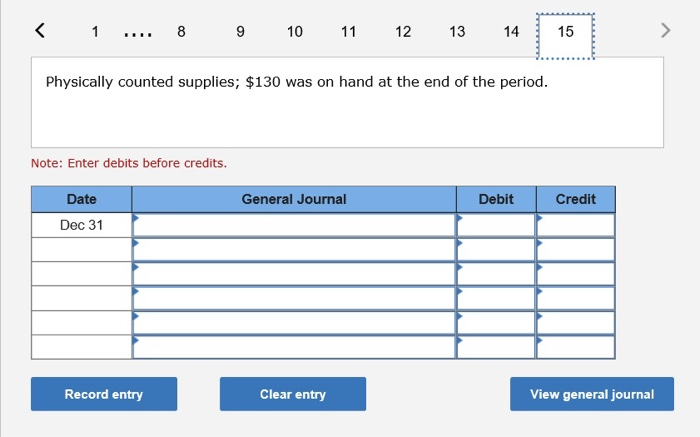

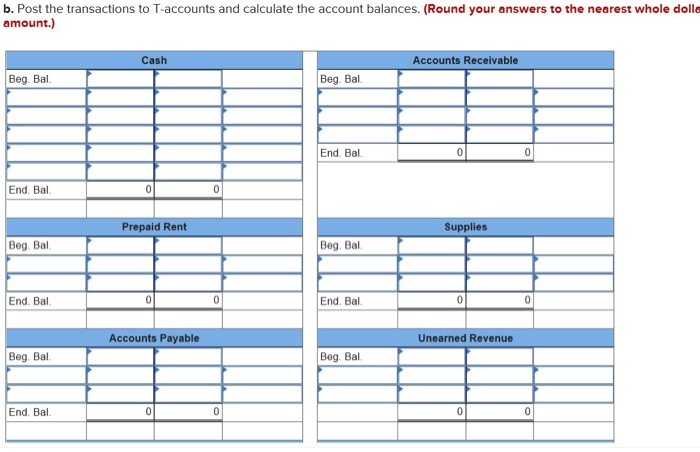

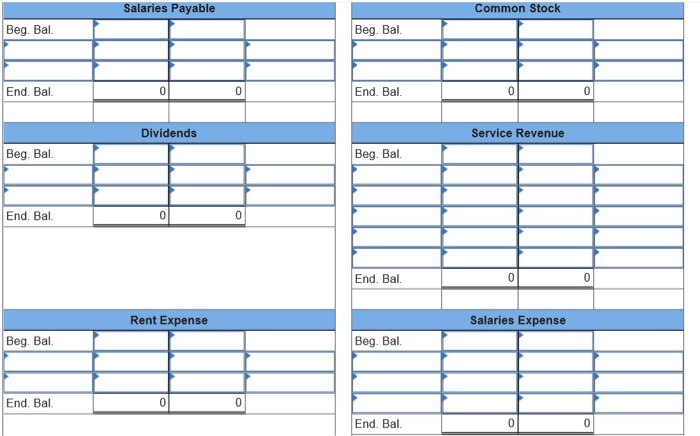

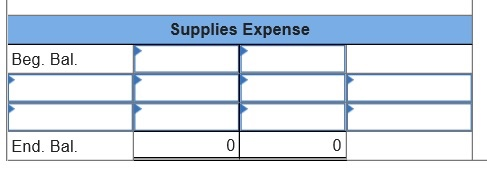

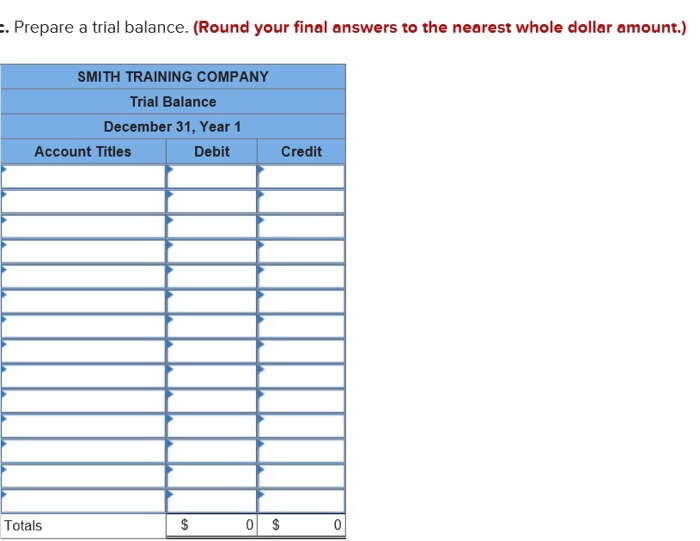

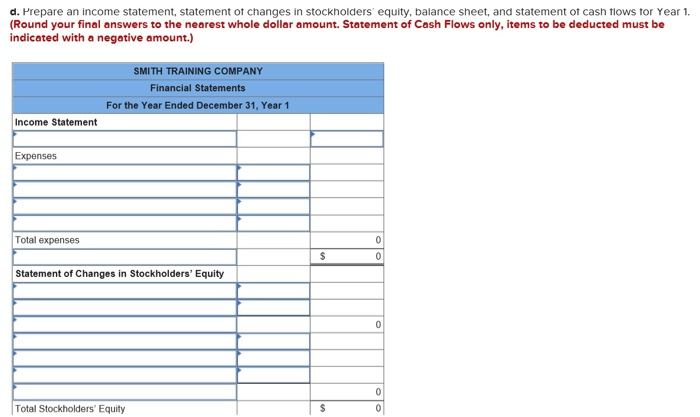

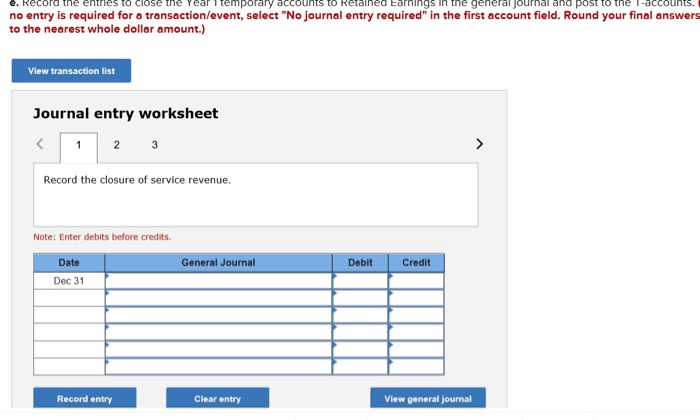

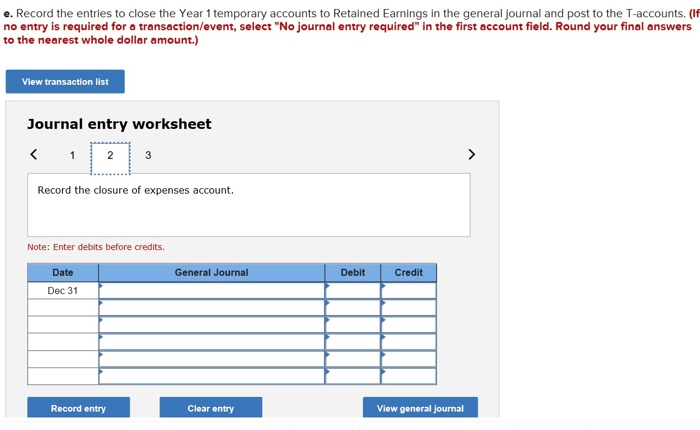

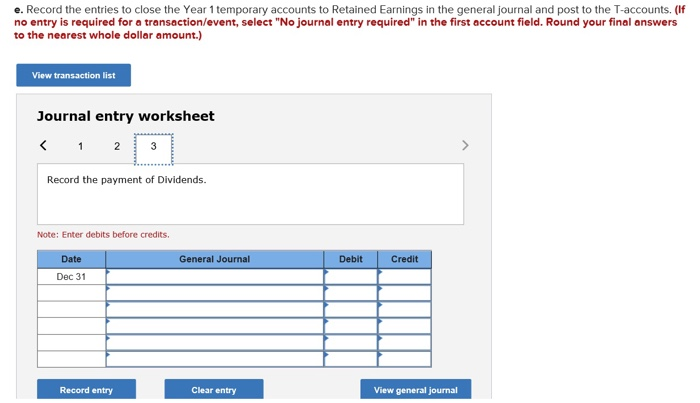

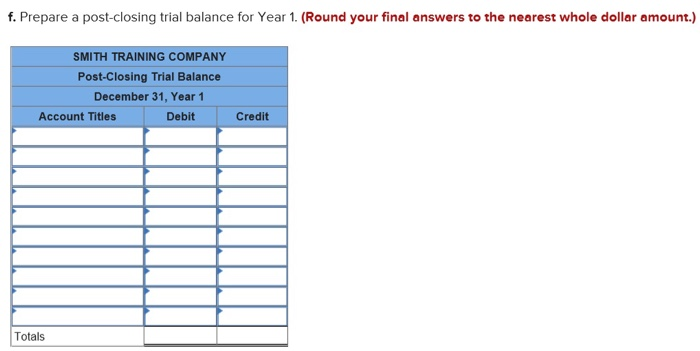

Required information The following information applies to the questions displayed below The following transactions pertain to Smith Training Company for Year 1: Jan. 30 Established the business when it acquired $48,0ee cash from the issue of common stock Feb. 1 Paid rent for office space for two years, $15,500 cash Apr. 10 Purchased $770 of supplies on account. July 1 Received $21,e00 cash in advance for services to be provided over the next year. 20 Paid $578 of the accounts payable from April 1e Aug. 15 Billed a customer $9,300 for services provided during August Sept.15 Completed a job and received $3,400 cash for services rendered Oct. 1 Paid employee salaries of $33,000 cash 15 Received $8,0e cash from accounts receivable Nov. 16 Billed customers $39,500 for services rendered on account. Dec. 1 Paid a dividend of $1,100 cash to the stockholders 31 Adjusted records to recognize the services provided on the contract of July 1 31 Recorded $2,300 of accrued salaries as of December 31 31 Recorded the rent expense for the year. (See February 1.) 31 Physically counted supplies; $130 was on hand at the end of the period K1 23 4 5 6 78 15 Established the business when it acquired $48,000 cash from the issue of common stock Note: Enter debits before credits. Date General Journal Debit Credit Jan 30 K1 2 3 4 5 678 15 Paid rent for office space for two years, $15,500 cash. Note: Enter debits before credits. Date General Journal Debit Credit Feb 01 Record entry Clear entry View general journal K1 2 3 4 5 6 78 15 Purchased $770 of supplies on account. Note: Enter debits before credits. Dane General Journal Debit Credit Apr 10 Record entry Clear entry View general journal K23 45 678 15 Received $21,000 cash in advance for services to be provided over the next year. Note: Enter debits before credits. Date General Journal Debit Credit Jul 01 Record entry Clear entry View general journal K1 23 45 6 78 15 Paid $578 of the accounts payable from April 10. Note: Enter debits before credits. Date General Journal Debit Credit Jul 20 Record entry Clear entry View general journal K1 23 4 5678 15 Billed a customer $9,300 for services provided during August. Note: Enter debits before credits. Date General Journal Debit Credit Aug 15 Record entry Clear entry View general journal Completed a job and received $3,400 cash for services rendered. Note: Enter debits before credits. Date General Journal Debit Credit Sep 15 Record entry Clear entry View general journal 2 4 6 7 8 15 Paid employee salaries of $33,000 cash. Note: Enter debits before credits. Date General Journal Debit Credit Oct 01 Record entry Clear entry View general journal 4 7 Received $8,000 cash from accounts receivable. Note: Enter debits before credits. Date General Journal Debit Credit Oct 15 Record entry Clear entry View general journal K1 5 678910.... 15 Billed customers $39,500 for services rendered on account. Note: Enter debits before credits. Debit Credit Date General Journal Nov 16 Clear entry View general journal Record entry