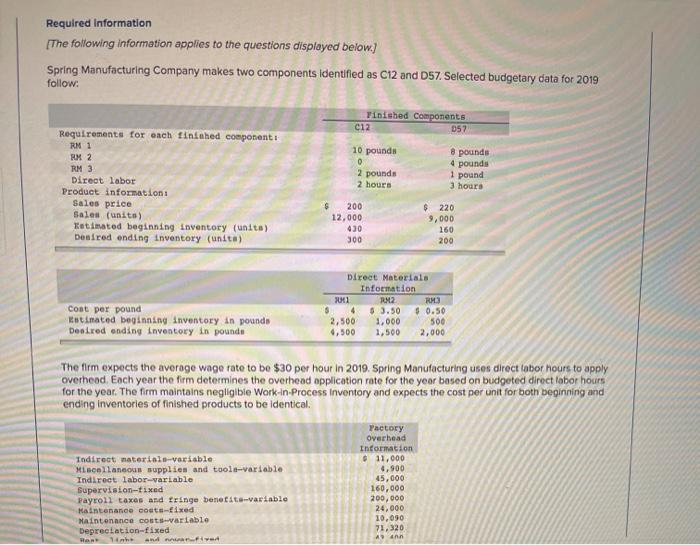

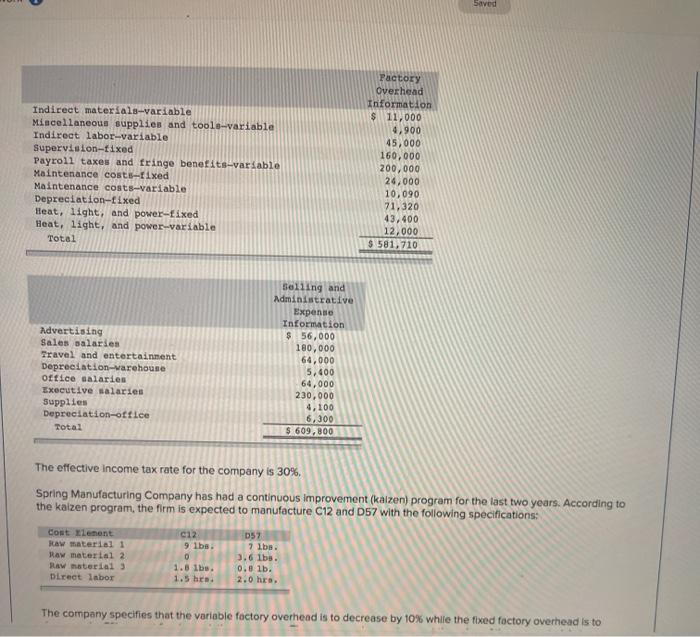

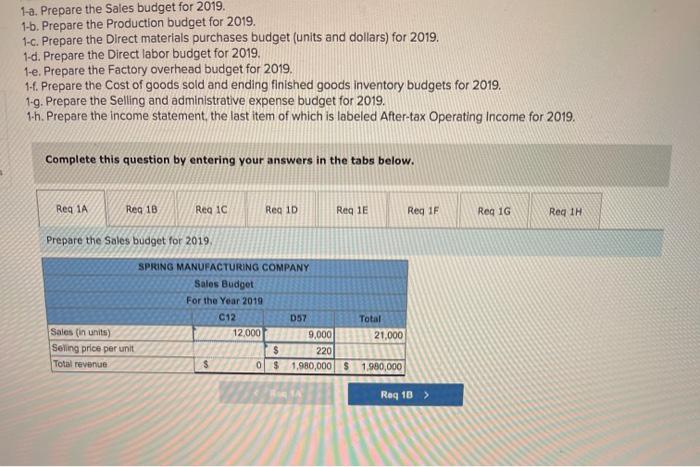

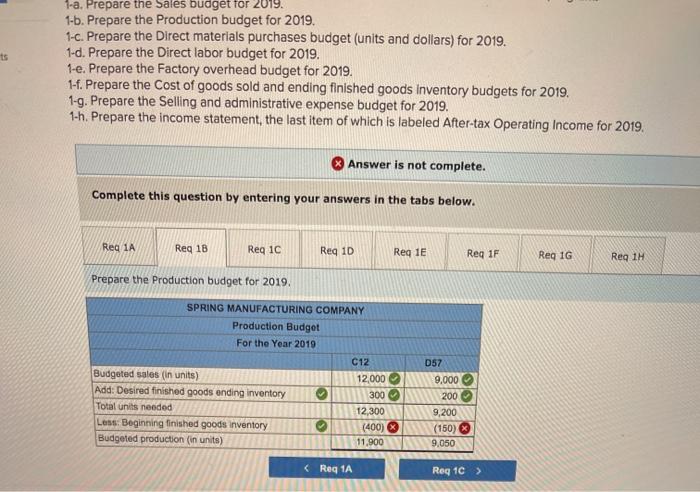

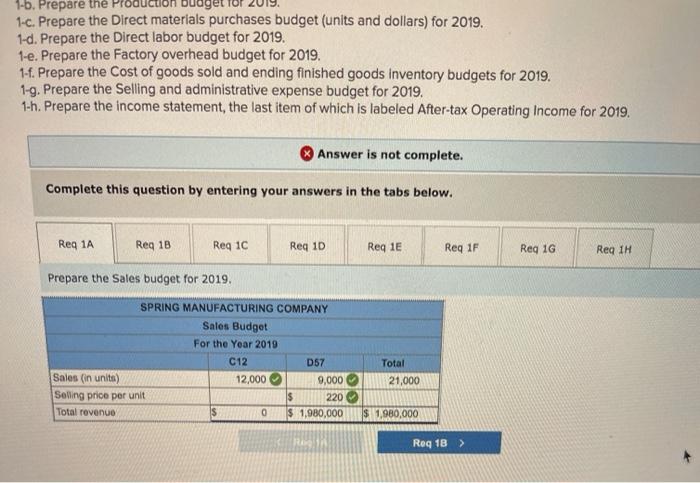

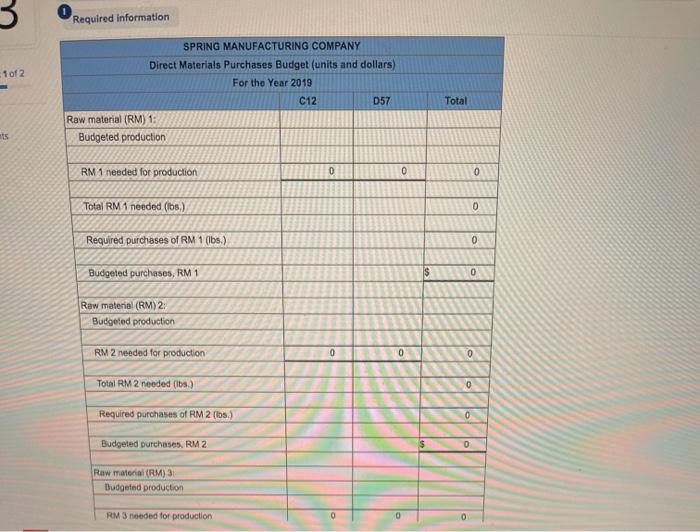

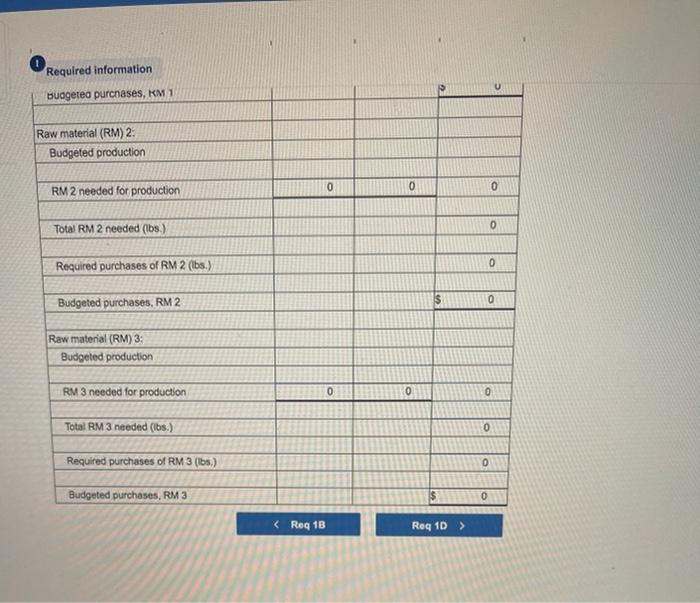

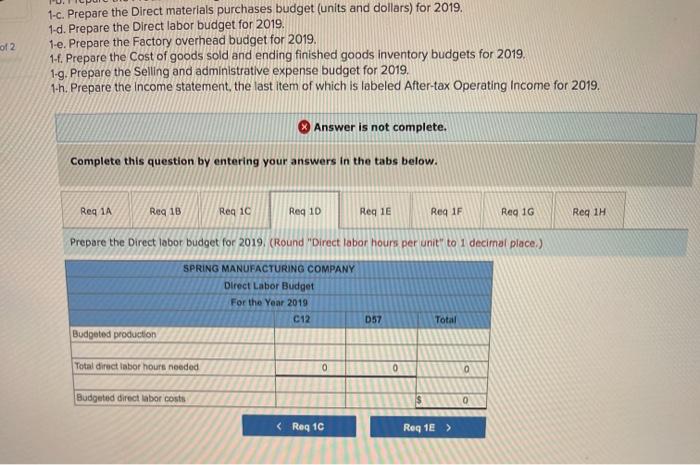

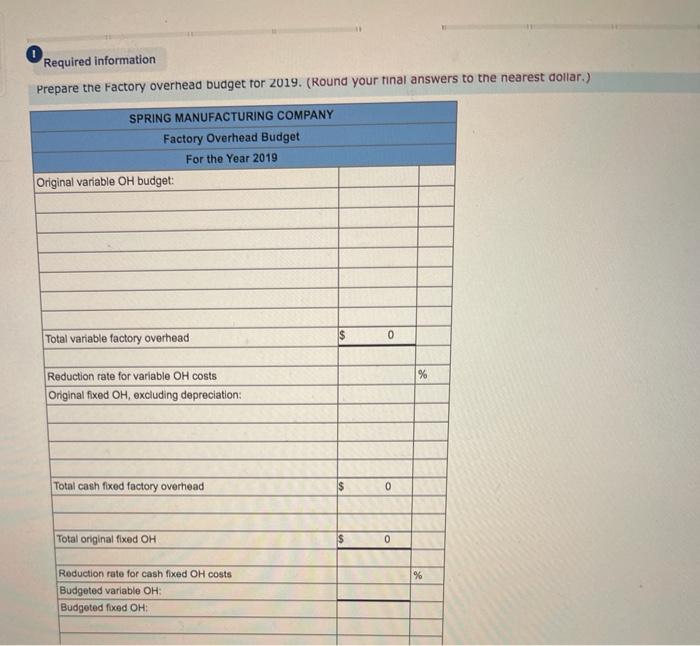

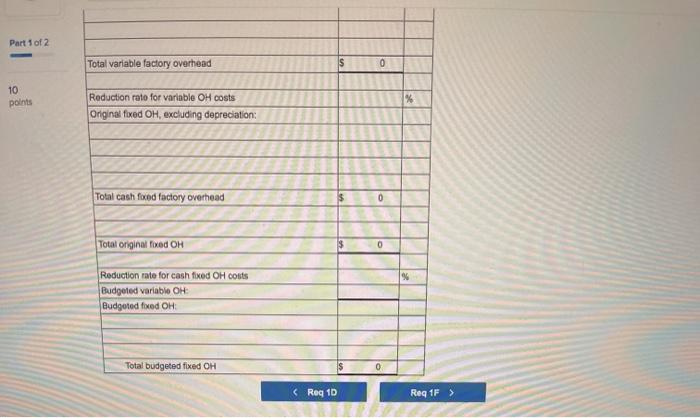

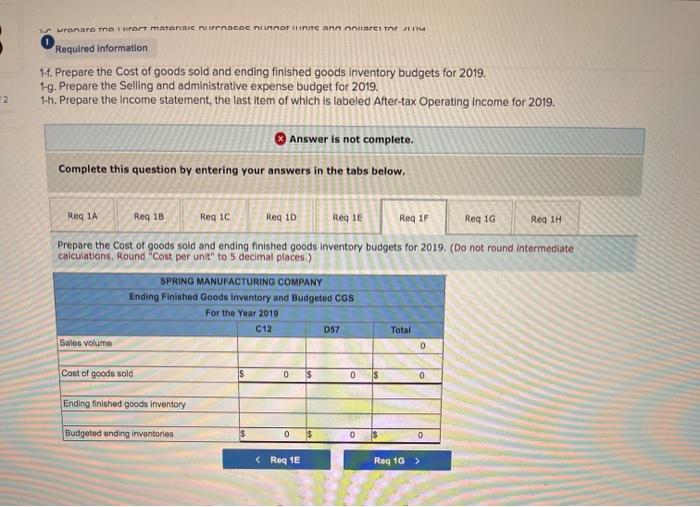

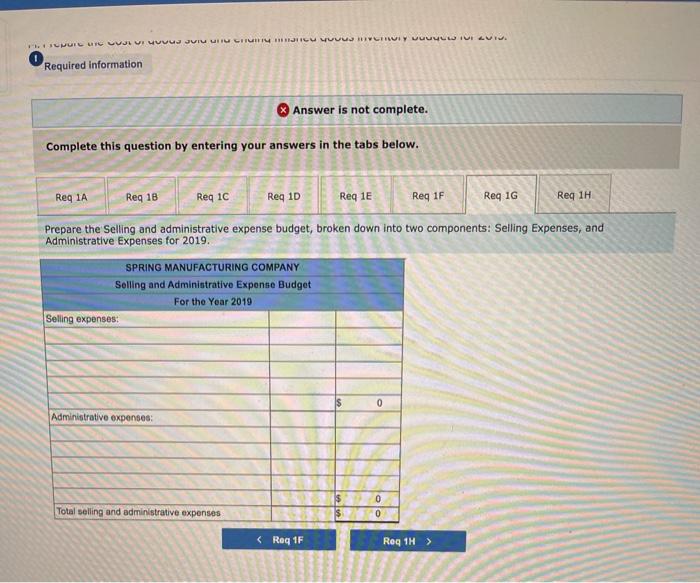

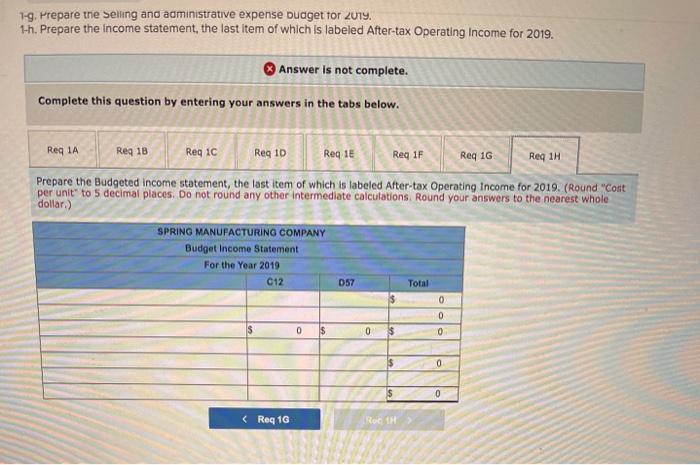

Required Information The following information applies to the questions displayed below.) Spring Manufacturing Company makes two components identified as C12 and D57. Selected budgetary data for 2019 follow: Finished Components C12 057 Requirements for each finished componenti RM 1 RM 2 RM 3 Direct labor Product informations Sales price Sales (units) Estimated beginning inventory (unita) Desired ending inventory (units) 10 pounds 0 2 pounds 2 hours 8 pounds 4 pounds 1 pound 3 hours $ 200 12,000 430 $ 220 9,000 160 200 300 Cont per pound Intimated beginning inventory in pounds Desired ending Inventory in pounds Direct Materials Information 1 RM2 RM3 5 4 $ 3.50 $0.50 2,500 1,000 500 4,500 1,500 2,000 The firm expects the average wage rate to be $30 per hour in 2019. Spring Manufacturing uses direct labor hours to apply overhead. Each year the firm determines the overhead application rate for the year based on budgeted direct labor hours for the year. The firm maintains negligible Work-in-Process Inventory and expects the cost per unit for both beginning and ending inventories of finished products to be identical. Todirect materialo-variable Miscellaneous supplies and tools-variable Indirect labor-variable Supervision-fixed Payroll taxes and fringe benesta variable Haintenance costs-fixed Maintenance costs variable Depreciation-fixed FA Factory Overhead Information 11,000 4,900 45,000 160,000 200,000 24,000 10,090 71,320 Ann Saved Indirect materials-variable Miscellaneous supplies and tools-variable Indirect labor-variable Supervision-fixed Payroll taxes and fringe benefits-variable Maintenance costs fixed Maintenance costs-variable Depreciation-fixed Heat, light, and power-fixed Heat, light, and power-variable Total Pactory Overhead Information $ 11,000 4,900 45,000 160,000 200,000 24,000 10,090 71,320 43.400 12,000 $ 581, 710 Advertising Sales salaries Travel and entertainment Depreciation-warehouse office salaries Executive salaries Supplies Depreciation-office Total Selling and Administrative Expenso Information $ 56,000 180,000 64,000 5,400 64,000 230,000 4,100 6,300 $ 609,800 The effective income tax rate for the company is 30%, Spring Manufacturing Company has had a continuous improvement (kaizen) program for the last two years. According to the kaizen program, the firm is expected to manufacture C12 and D57 with the following specifications: 057 cost Element Raw material 1 Raw material 2 Raw material 3 Direct labor C12 9 lbs. 0 1.8 lbs. 1.5 hrs 7 Ibe. 3.6 lbs. 0.8 lb. 2.0 hrs. The company specifies that the variable factory overhead is to decrease by 10% while the fixed foctory overhead is to 1-a. Prepare the Sales budget for 2019. 1-b. Prepare the Production budget for 2019. 1-c. Prepare the Direct materials purchases budget (units and dollars) for 2019. 1-d. Prepare the Direct labor budget for 2019, 1-e. Prepare the Factory overhead budget for 2019, 1-6. Prepare the cost of goods sold and ending finished goods inventory budgets for 2019. 1-9. Prepare the Selling and administrative expense budget for 2019. 1 h. Prepare the income statement, the last item of which is labeled After-tax Operating Income for 2019. Complete this question by entering your answers in the tabs below. Req 1A Reg 1B Reg 1C Reg 10 Reg 1E Reg 1F Reg 1G Req IH Prepare the Sales budget for 2019 SPRING MANUFACTURING COMPANY Sales Budget For the Year 2019 C12 D57 Total Sales (in units) 12.000 9,000 21,000 Selling price per unit $ 220 Total revenue $ 0 $ 1,980,000 $ 1.980,000 Reg 10 > ts 1-a. Prepare the sales budget for 2019. 1-b. Prepare the Production budget for 2019. 1-C. Prepare the Direct materials purchases budget (units and dollars) for 2019. 1-d. Prepare the Direct labor budget for 2019. 1-e. Prepare the Factory overhead budget for 2019. 1-f. Prepare the cost of goods sold and ending finished goods Inventory budgets for 2019. 1-9. Prepare the Selling and administrative expense budget for 2019. 1-h. Prepare the income statement, the last item of which is labeled After-tax Operating Income for 2019. Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1A Reg 18 Req 1C Reg 10 Req 1E Req 1F Reg 1G Reg 1H Prepare the Production budget for 2019, SPRING MANUFACTURING COMPANY Production Budget For the Year 2019 C12 Budgeted sales (in units) 12,000 Add: Desired finished goods ending inventory Total units needed 12,300 Less: Beginning finished goods inventory (400) Budgeted production (in units) 11.900 300 D57 9,000 200 9,200 (150) 9,050 duction ou 1-b. Prepare the 1-c. Prepare the Direct materials purchases budget (units and dollars) for 2019. 1-d. Prepare the Direct labor budget for 2019. 1-e. Prepare the Factory overhead budget for 2019. 1-f. Prepare the cost of goods sold and ending finished goods inventory budgets for 2019. 1-9. Prepare the Selling and administrative expense budget for 2019. 1-h. Prepare the income statement, the last item of which is labeled After-tax Operating Income for 2019. Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1A Reg 1B Reg 1C Req 1D Reg 1E Req 1F Reg 1G Req IH Prepare the Sales budget for 2019. SPRING MANUFACTURING COMPANY Sales Budget For the Year 2010 C12 D57 Sales (in units) 12,000 9,000 Selling price per unit $ 220 Total revenue $ 0 $ 1,980,000 Total 21,000 S 1,980,000 RO Req 18 > Required information 1 of 2 SPRING MANUFACTURING COMPANY Direct Materials Purchases Budget (units and dollars) For the Year 2019 C12 D57 Raw material (RM) 1: Budgeted production Total RM 1 needed for production 0 0 0 Total RM 1 needed (lbs.) 0 Required purchases of RM 1 (lbs) 0 Budgeted purchases, RM 1 0 Raw material (RM) 2: Budgeted production RM 2 needed for production 0 0 0 Total RM 2 needed (lbs) 0 Required purchases of RM 2 (los) 0 Budgeted purchases. RM 2 0 Raw material (RM) 31 Budgeted production RM 3 needed for production 0 0 Required information c buageteo purchases, KM 1 Raw material (RM) 2: Budgeted production 0 0 0 RM 2 needed for production Total RM 2 needed (lbs.) 0 Required purchases of RM 2 (lbs.) 0 $ 0 Budgeted purchases, RM 2 Raw material (RM) 3: Budgeted production RM 3 needed for production 0 0 Total RM 3 needed (lbs.) 0 Required purchases of RM 3 (lbs) 0 Budgeted purchases, RM 3 of 2 1-c. Prepare the Direct materials purchases budget (units and dollars) for 2019. 1-d. Prepare the Direct labor budget for 2019. 1-e. Prepare the Factory overhead budget for 2019. 1-f. Prepare the Cost of goods sold and ending finished goods Inventory budgets for 2019, 1-9. Prepare the Selling and administrative expense budget for 2019, 1-h. Prepare the income statement, the last item of which is labeled After-tax Operating Income for 2019. Answer is not complete. Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Req 10 Reg 1D Req 1E Reg IF Reg 16 Reg 1H Prepare the Direct labor budget for 2019. (Round "Direct labor hours per unit" to 1 decimal place) SPRING MANUFACTURING COMPANY Direct Labor Budget For the Year 2019 C12 D57 Total Budgeted production Total direct labor hours needed 0 0 0 Budgeted direct labor costs 0 O Required information Prepare the Factory overhead budget for 2019. (Round your final answers to the nearest dollar.) SPRING MANUFACTURING COMPANY Factory Overhead Budget For the Year 2019 Original variable OH budget: 0 Total variable factory overhead Reduction rate for variable OH costs Original fixed OH, excluding depreciation: Total cash fixed factory overhead $ 0 Total original fixed OH 0 % Roduction rate for cash fixed OH costs Budgeted variable OH: Budgeted fixed OH Part 1 of 2 Total variable factory overhead IS 0 10 points % Reduction rate for variable OH costs Original fixed OH, excluding depreciation: Total cash foxed factory overhead 0 Total original foxed OH 0 % Reduction rate for cash fixed OH costs Budgeted variable OH Budgeted foxed OH Total budgeted fixed OH 0 wronaro to urart materia narracac ninnar mine ann notarei tnr in Required information 1-4. Prepare the cost of goods sold and ending finished goods inventory budgets for 2019. 1-9. Prepare the Selling and administrative expense budget for 2019. 1-h. Prepare the income statement, the last item of which is labeled After-tax Operating Income for 2019, 2 Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Reg 10 Reg 10 Req 1E RAQ IF Reg 1G Reg 1H Prepare the cost of goods sold and ending finished goods inventory budgets for 2019. (Do not round Intermediate calculations, Round "Cost per unit" to 5 decimal places.) SPRING MANUFACTURING COMPANY Ending Finished Goods Inventory and Budgeted CGS For the Year 2010 D57 C12 Total Sales volume 0 Cost of goods sold $ 0 Is 0 Ending finished goods inventory Budgeted ending inventorien 0 $ 0 0 1. MUILU UVJLI MUUUJ JUIU UTU CHHICU MUUJFHUI JUUIUI Required information Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1A Reg 1B Reg 10 Req 1D Reg 1E Reg 1F Req 1G Reg 1H Prepare the Selling and administrative expense budget, broken down into two components: Selling Expenses, and Administrative Expenses for 2019. SPRING MANUFACTURING COMPANY Selling and Administrative Expense Budget For the Year 2019 Selling expenses: 0 Administrative expenses Total selling and administrative expenses 0 0 $ 1-9. Prepare the Seling and administrative expense budget for 2014. 1-h. Prepare the income statement, the last item of which is labeled After-tax Operating Income for 2019. Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 1C Req 1D Req1E Reg 1F Req 16 Req 1H Prepare the Budgeted Income statement, the last item of which is labeled After-tax Operating Income for 2019. (Round "Cost per unit to 5 decimal places. Do not round any other intermediate calculations Round your answers to the nearest whole dollar.) SPRING MANUFACTURING COMPANY Budget Income Statement For the Year 2019 C12 057 Total 0 0 0 0 $ 0 $ 0 0 2 Roc