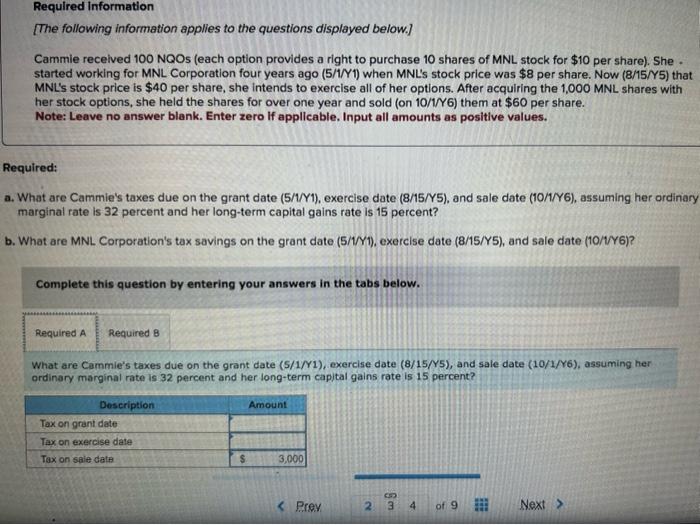

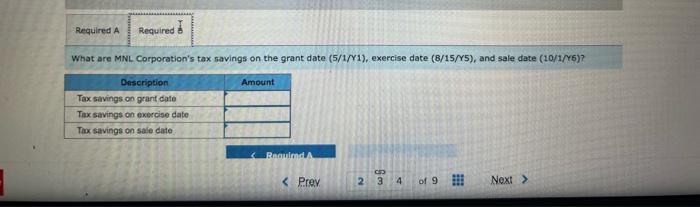

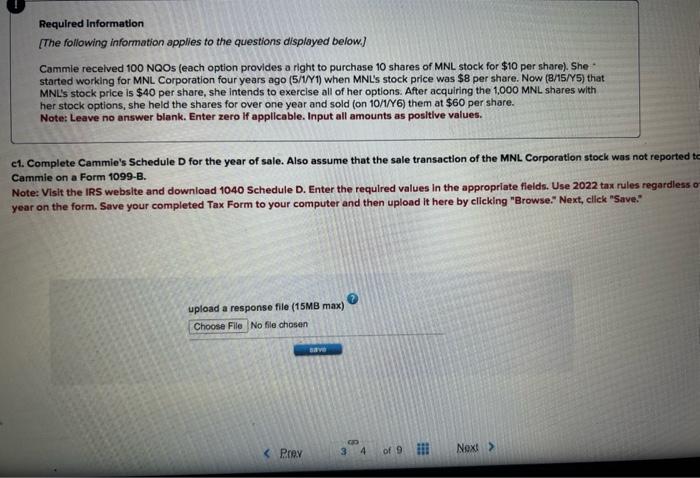

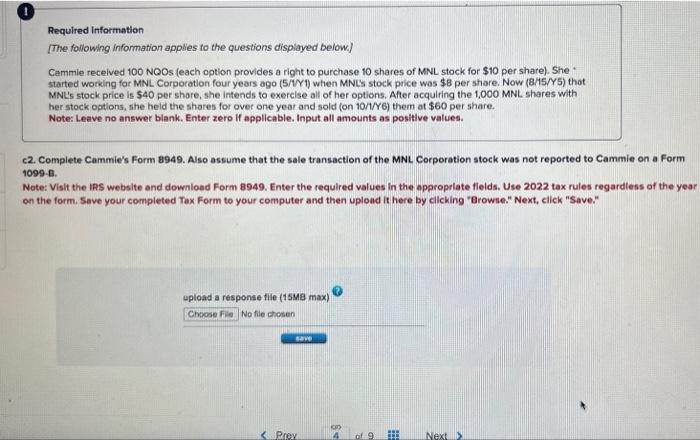

Required Information [The following information applies to the questions displayed below.] Cammie recelved 100 NQOs (each option provides a right to purchase 10 shares of MNL stock for $10 per share). She . started working for MNL Corporation four years ago (5/1/Y1) when MNL's stock price was $8 per share. Now (8/15/Y5) that MNL's stock price is $40 per share, she intends to exercise all of her options. After acquiring the 1,000 MNL shares with her stock options, she held the shares for over one year and sold (on 10/1M 6 ) them at $60 per share. Note: Leave no answer blank. Enter zero If applicable. Input all amounts as positive values. rquired: What are Cammie's taxes due on the grant date (5/1/Y1), exercise date (8/15/Y5), and sale date (10/1/Y6), assuming her ordinary marginal rate is 32 percent and her long-term capital gains rate is 15 percent? What are MNL Corporation's tax savings on the grant date (5/1/Y1), exercise date (8/15/Y5), and sale date (10/1/Y6)? Complete this question by entering your answers in the tabs below. What are Cammie's taxes due on the grant date (5/1/Y1), exercise date (8/15/Y5), and sale date (10/1/Y6), assuming her ordinary marginal rate is 32 percent and her long-term capital gains rate is 15 percent? What are MNL Corporation's tax savings on the grant date (5/1//1), exercise date (8/15//5), and sale date (10/1//6) ? Required Information [The following information applles to the questions displayed below.] Cammle recelved 100 NQOs (each option provides a right to purchase 10 shares of MNL stock for $10 per share). She started working for MNL. Corporation four years ago (5/1/11) when MNL's stock price was $8 per share. Now (8/15/Y5) that MNL's stock price is $40 per share, she intends to exercise all of her options. After acquiring the 1,000 MNL shares with her stock options, she held the shares for over one year and sold (on 10/1/Y6) them at $60 per share. Note: Leave no answer blank. Enter zero if applicable. Input all amounts as positive values. c1. Complete Cammie's Schedule D for the year of sale. Also assume that the sale transaction of the MNL Corporation stock was not reported Cammie on a Form 1099-B. Note: Visit the IRS website and download 1040 Schedule D. Enter the required values in the appropriate flelds. Use 2022 tax rules regardless year on the form. Save your completed Tax Form to your computer and then upload it here by clicking "Browse." Next, cllck "Save." upload a response file (15MB max) Required Information [The following information applies to the questions dispiayed below.] Cammie received 100 NQOs (each option provides a right to purchase to shares of MNL stock for $10 per share). She * started working for MNL Corporation four years ago (5/1//1) when MNLs stock price was \$8 per share. Now (8/15/Y5) that MNL's stock price is 540 per share, she intends to exercise all of her options. After acquiring the 1,000 MNL shares with her stock options, she heid the shares for over one year and sold (on 10///Y6) them at $60 per share. Note: Leave no answer blank. Enter zero If applicable. Input all amounts as positive values. c2. Complete Cammie's Form 8949. Also assume that the sale transaction of the MNL. Corporation stock was not reported to Cammie on a Form 1099 . B. Note: Visht the IRS webslte and downloed Form 8949. Enter the required values in tha approprlate flelds. Use 2022 tax rules regardless of the year on the form. Save your completed Tax Form to your computer and then upload it here by cllcking "Browsie." Next, click "Save." upload a response file (15M8 max)