Question

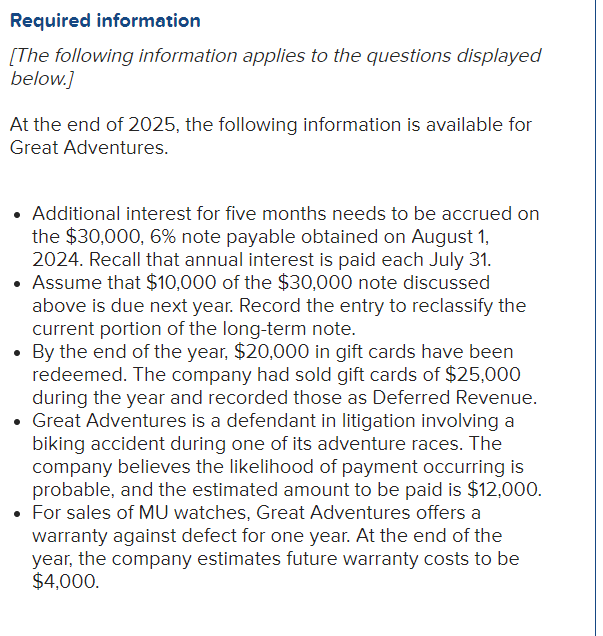

Required information [The following information applies to the questions displayed below.] At the end of 2025, the following information is available for Great Adventures. Additional

Required information

[The following information applies to the questions displayed below.]

At the end of 2025, the following information is available for Great Adventures.

Additional interest for five months needs to be accrued on the $30,000, 6% note payable obtained on August 1, 2024. Recall that annual interest is paid each July 31.

Assume that $10,000 of the $30,000 note discussed above is due next year. Record the entry to reclassify the current portion of the long-term note.

By the end of the year, $20,000 in gift cards have been redeemed. The company had sold gift cards of $25,000 during the year and recorded those as Deferred Revenue.

Great Adventures is a defendant in litigation involving a biking accident during one of its adventure races. The company believes the likelihood of payment occurring is probable, and the estimated amount to be paid is $12,000.

For sales of MU watches, Great Adventures offers a warranty against defect for one year. At the end of the year, the company estimates future warranty costs to be $4,000.

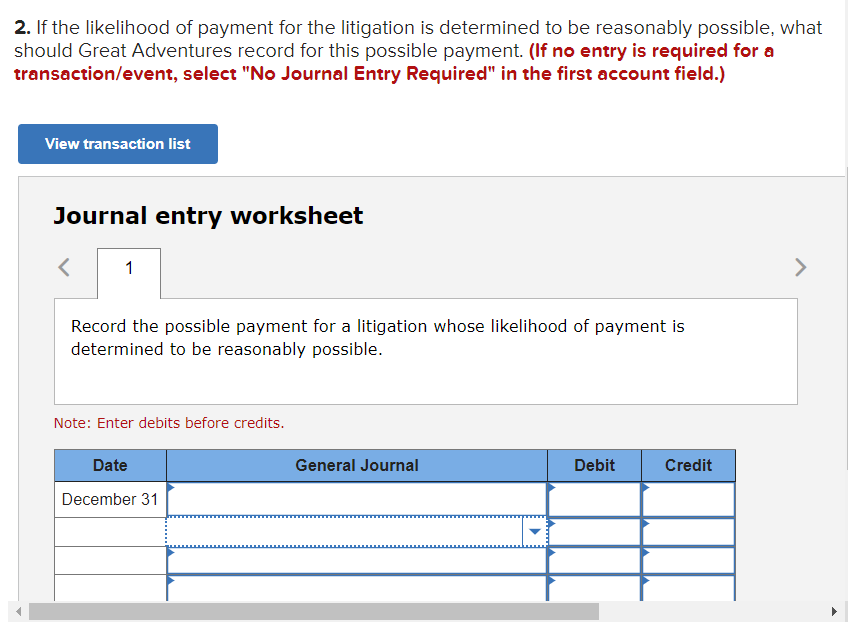

2. If the likelihood of payment for the litigation is determined to be reasonably possible, what should Great Adventures record for this possible payment. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started