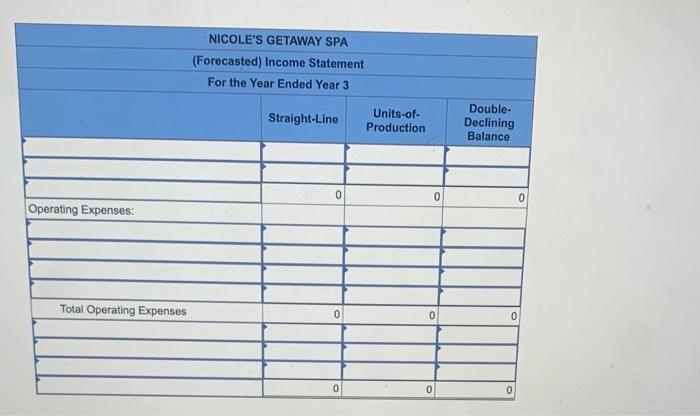

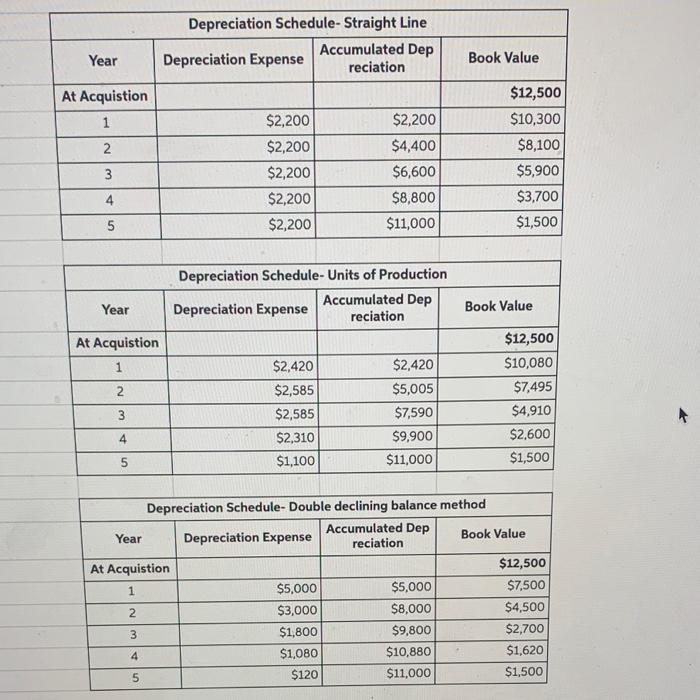

Required information [The following information applies to the questions displayed below.] Nicole's Getaway Spa (NGS) purchased a hydrotherapy tub system to add to the wellness programs at NGS. The machine was purchased at the beginning of the year at a cost of $12,500. The estimated useful life was five years and the residual value was $1,500. Assume that the estimated productive life of the machine is 10,000 hours. Expected annual production was year 1,2,200 hours; year 2, 2,350 hours; year 3,2,350 hours; year 4,2,100 hours; and year 5,1,000 hours. Assume NGS sold the hydrotherapy tub system for $3,750 at the end of year 3 . The following amounts were forecast for year 3 : Sales Revenues $49,000; Cost of Goods Sold $38,000; Other Operating Expenses $4,900; and Interest Expense $1,000. Create an income statement for year 3 for each of the different depreciation methods, ending at Income before Income Tax Expense. (Don't forget to include a loss or gain on disposal for each method.). (Do not round intermediate calculations. Any losses should be indicated with a minus sign. Round your answers to the nearest dollar amount.) NICOLE'S GETAWAY SPA (Forecasted) Income Statement For the Year Ended Year 3 \begin{tabular}{|c|r|r|r|} \hline \multicolumn{4}{|c|}{ Depreciation Schedule- Straight Line } \\ \hline Year & Depreciation Expense & AccumulatedDepreciation & Book Value \\ \hline At Acquistion & & & $12,500 \\ \hline 1 & $2,200 & $2,200 & $10,300 \\ \hline 2 & $2,200 & $4,400 & $8,100 \\ \hline 3 & $2,200 & $6,600 & $5,900 \\ \hline 4 & $2,200 & $8,800 & $3,700 \\ \hline 5 & $2,200 & $11,000 & $1,500 \\ \hline \end{tabular} \begin{tabular}{|c|r|r|r|} \hline \multicolumn{4}{|c|}{ Depreciation Schedule- Units of Production } \\ \hline Year & Depreciation Expense & AccumulatedDepreciation & \multicolumn{1}{c|}{ Book Value } \\ \hline At Acquistion & & & $12,500 \\ \hline 1 & $2,420 & $2,420 & $10,080 \\ \hline 2 & $2,585 & $5,005 & $7,495 \\ \hline 3 & $2,585 & $7,590 & $4,910 \\ \hline 4 & $2,310 & $9,900 & $2,600 \\ \hline 5 & $1,100 & $11,000 & $1,500 \\ \hline \end{tabular} \begin{tabular}{|c|r|r|r|} \hline \multicolumn{4}{|c|}{ Depreciation Schedule- Double declining balance method } \\ \hline Year & Depreciation Expense & AccumulatedDepreciation & \multicolumn{1}{c|}{ Book Value } \\ \hline At Acquistion & & & $12,500 \\ \hline 1 & $5,000 & $5,000 & $7,500 \\ \hline 2 & $3,000 & $8,000 & $4,500 \\ \hline 3 & $1,800 & $9,800 & $2,700 \\ \hline 4 & $1,080 & $10,880 & $1,620 \\ \hline 5 & $120 & $11,000 & $1,500 \\ \hline \end{tabular}