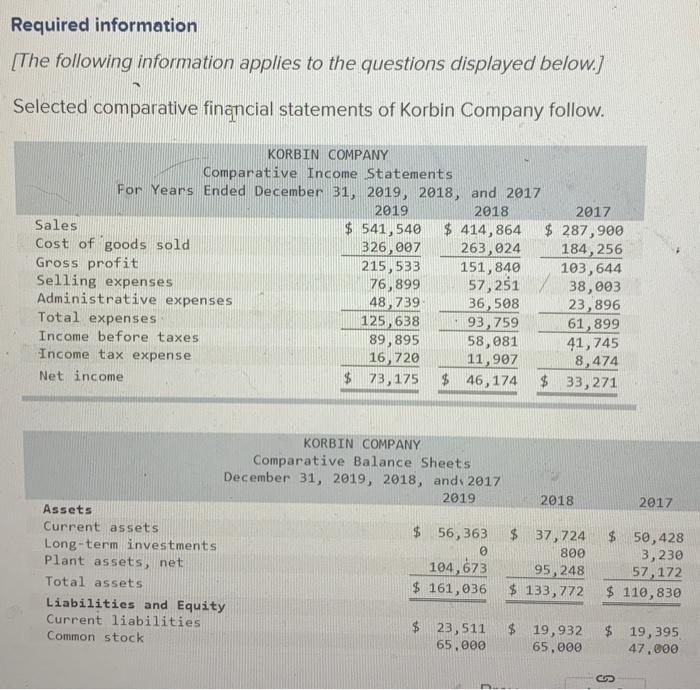

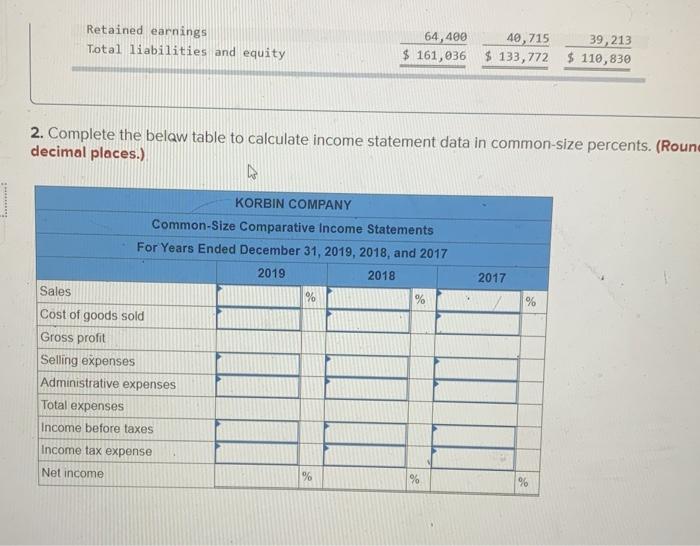

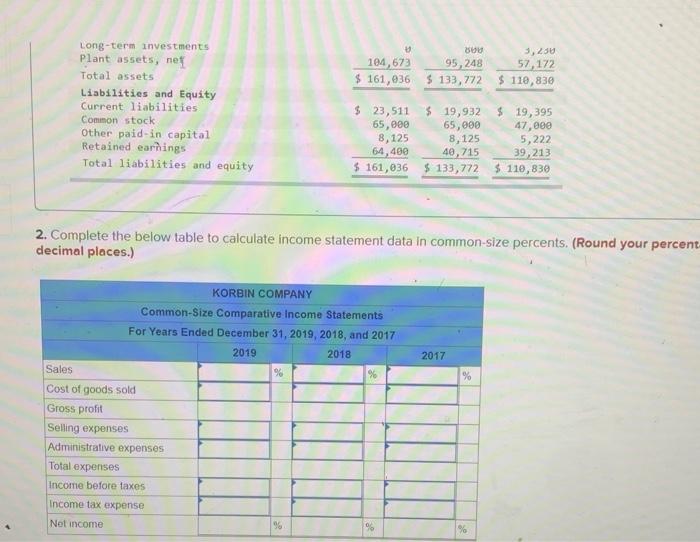

Required information [The following information applies to the questions displayed below.] Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31, 2019, 2018, and 2017 2019 2018 2017 Sales $ 541,540 $ 414,864 $ 287,90 Cost of goods sold 326, 007 263,024 184, 256 Gross profit 215,533 151,840 103,644 Selling expenses 76,899 57,251 38,003 Administrative expenses 48,739 36,508 23, 896 Total expenses 125,638 93,759 61,899 Income before taxes 89,895 58,081 41,745 Income tax expense 16, 720 11,907 8,474 Net income $ 73, 175 $ 46,174 $ 33,271 + 2018 2017 KORBIN COMPANY Comparative Balance Sheets December 31, 2019, 2018, and 2017 2019 Assets Current assets $ 56, 363 Long-term investments Plant assets, net Total assets $ 161,036 Liabilities and Equity Current liabilities $ 23,511 Common stock 65.000 104,673 $ 37,724 800 95,248 $ 133,772 $ 50,428 3,230 57,172 $ 110,830 $ 19,932 65,000 $ 19,395 47.000 Retained earnings Total liabilities and equity 64,400 161,036 40,715 39, 213 133,772 $ 110,830 2. Complete the below table to calculate income statement data in common-size percents. (Roune decimal places.) T... KORBIN COMPANY Common-Size Comparative Income Statements For Years Ended December 31, 2019, 2018, and 2017 2019 2018 2017 Sales % Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income % 9 BU 3,250 104,673 95,248 57,172 $ 161,036 $ 133,772 $ 110,830 Long-term investments Plant assets, nef Total assets Liabilities and Equity Current liabilities Common stock Other paid in capital Retained earnings Total liabilities and equity $ 23,511 $ 19,932 65,000 65,000 8,125 8,125 64,400 40,715 $ 161,036 $ 133,772 $ 19,395 47,290 5,222 39,213 $ 110,830 2. Complete the below table to calculate income statement data in common-size percents. (Round your percent decimal places.) 2017 % KORBIN COMPANY Common-Size Comparative Income Statements For Years Ended December 31, 2019, 2018, and 2017 2019 2018 Sales % Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Not income 9 % de