Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information [The following information applies to the questions displayed below.] The following financial statements and additional information are reported. IKIBAN INC. Comparative Balance Sheets

Required information

[The following information applies to the questions displayed below.] The following financial statements and additional information are reported.

| IKIBAN INC. Comparative Balance Sheets June 30, 2019 and 2018 | ||||||||

| 2019 | 2018 | |||||||

| Assets | ||||||||

| Cash | $ | 96,100 | $ | 63,000 | ||||

| Accounts receivable, net | 93,500 | 70,000 | ||||||

| Inventory | 82,800 | 115,000 | ||||||

| Prepaid expenses | 6,300 | 9,200 | ||||||

| Total current assets | 278,700 | 257,200 | ||||||

| Equipment | 143,000 | 134,000 | ||||||

| Accum. depreciationEquipment | (36,500 | ) | (18,500 | ) | ||||

| Total assets | $ | 385,200 | $ | 372,700 | ||||

| Liabilities and Equity | ||||||||

| Accounts payable | $ | 44,000 | $ | 58,500 | ||||

| Wages payable | 7,900 | 18,800 | ||||||

| Income taxes payable | 5,300 | 7,600 | ||||||

| Total current liabilities | 57,200 | 84,900 | ||||||

| Notes payable (long term) | 49,000 | 79,000 | ||||||

| Total liabilities | 106,200 | 163,900 | ||||||

| Equity | ||||||||

| Common stock, $5 par value | 258,000 | 179,000 | ||||||

| Retained earnings | 21,000 | 29,800 | ||||||

| Total liabilities and equity | $ | 385,200 | $ | 372,700 | ||||

| IKIBAN INC. Income Statement For Year Ended June 30, 2019 | ||||||

| Sales | $ | 773,000 | ||||

| Cost of goods sold | 430,000 | |||||

| Gross profit | 343,000 | |||||

| Operating expenses | ||||||

| Depreciation expense | $ | 77,600 | ||||

| Other expenses | 86,000 | |||||

| Total operating expenses | 163,600 | |||||

| 179,400 | ||||||

| Other gains (losses) | ||||||

| Gain on sale of equipment | 3,900 | |||||

| Income before taxes | 183,300 | |||||

| Income taxes expense | 45,790 | |||||

| Net income | $ | 137,510 | ||||

Additional Information

- A $30,000 note payable is retired at its $30,000 carrying (book) value in exchange for cash.

- The only changes affecting retained earnings are net income and cash dividends paid.

- New equipment is acquired for $76,600 cash.

- Received cash for the sale of equipment that had cost $67,600, yielding a $3,900 gain.

- Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement.

- All purchases and sales of inventory are on credit.

Required:

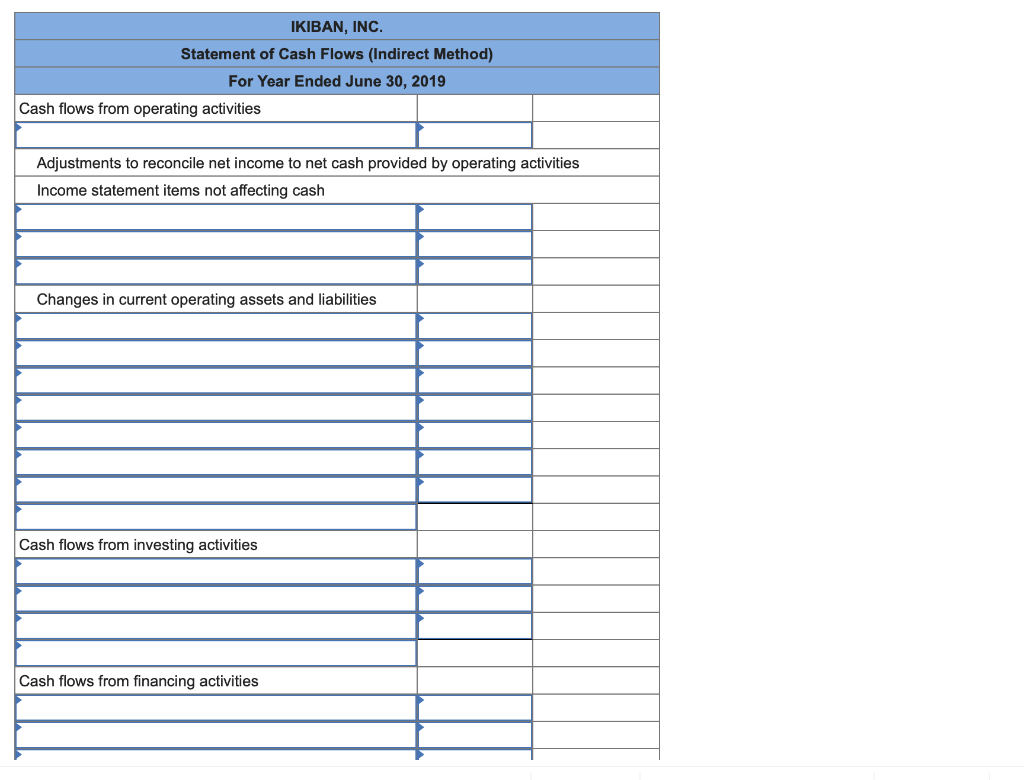

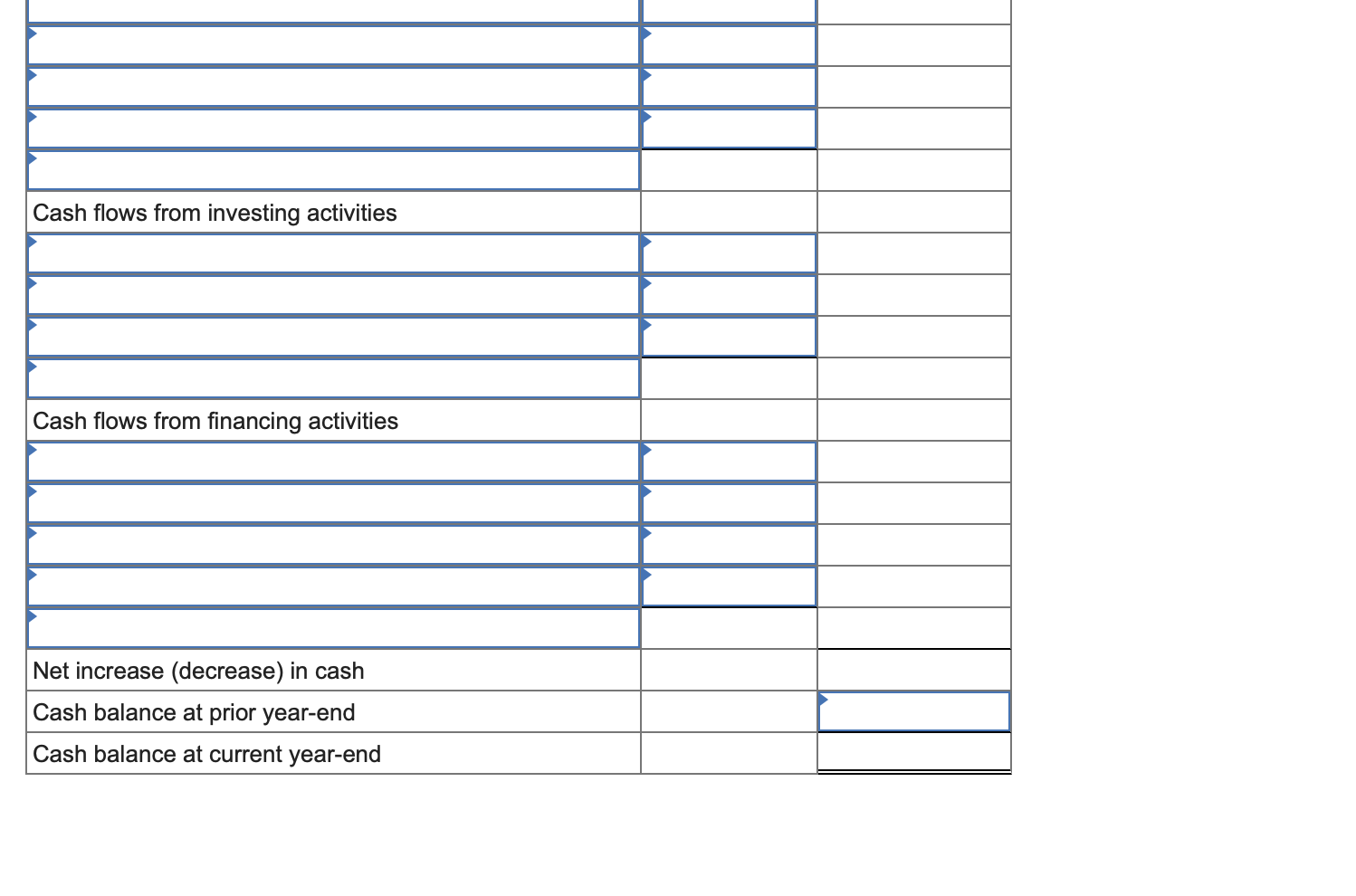

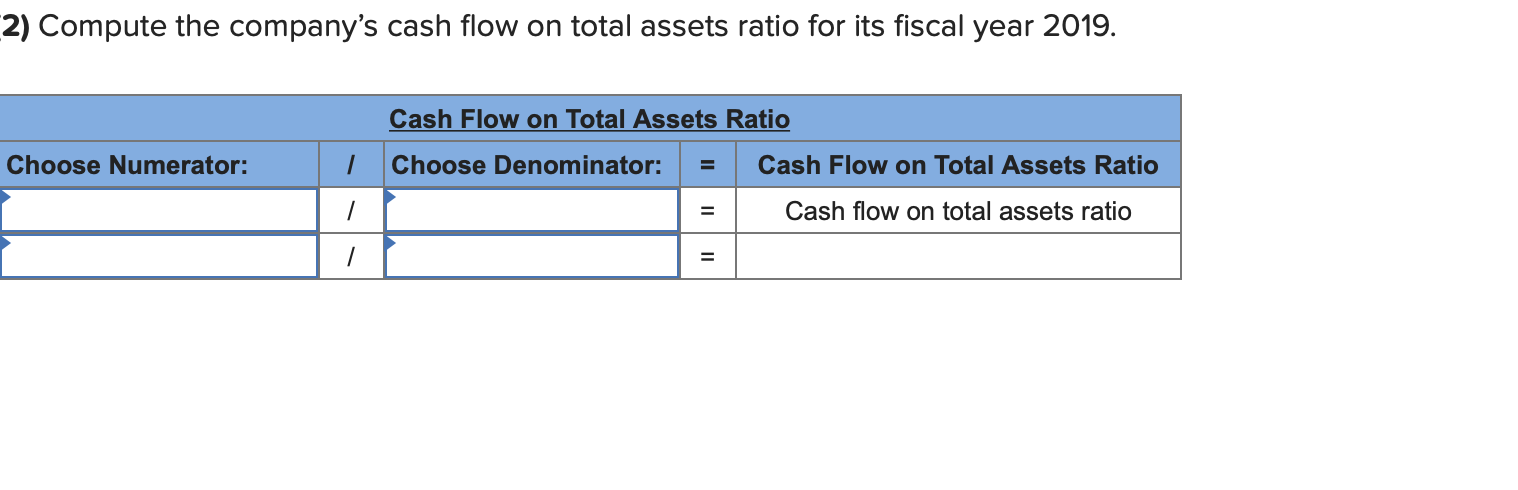

(1) Prepare a statement of cash flows using the indirect method for the year ended June 30, 2019. (Amounts to be deducted should be indicated with a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started