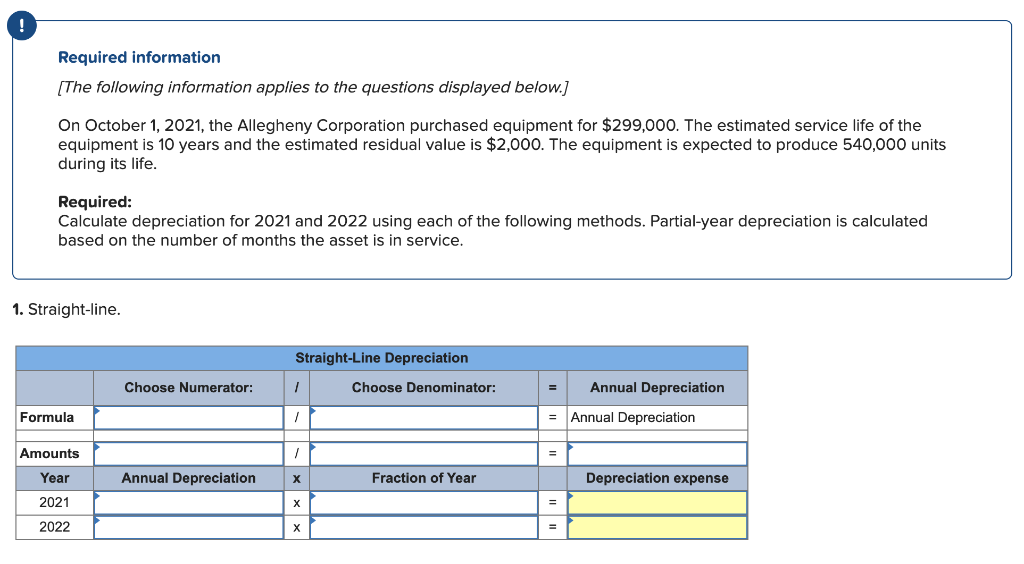

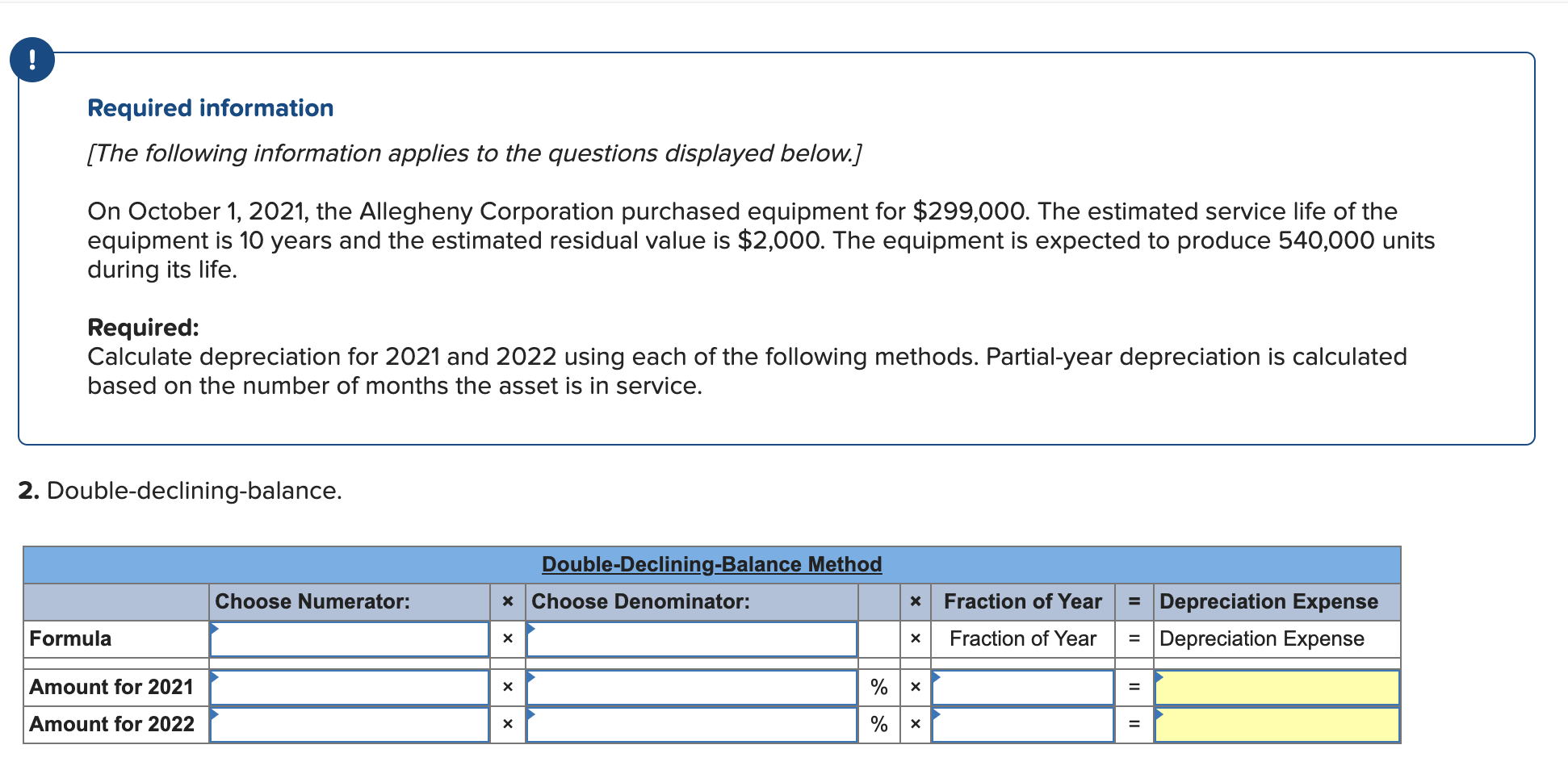

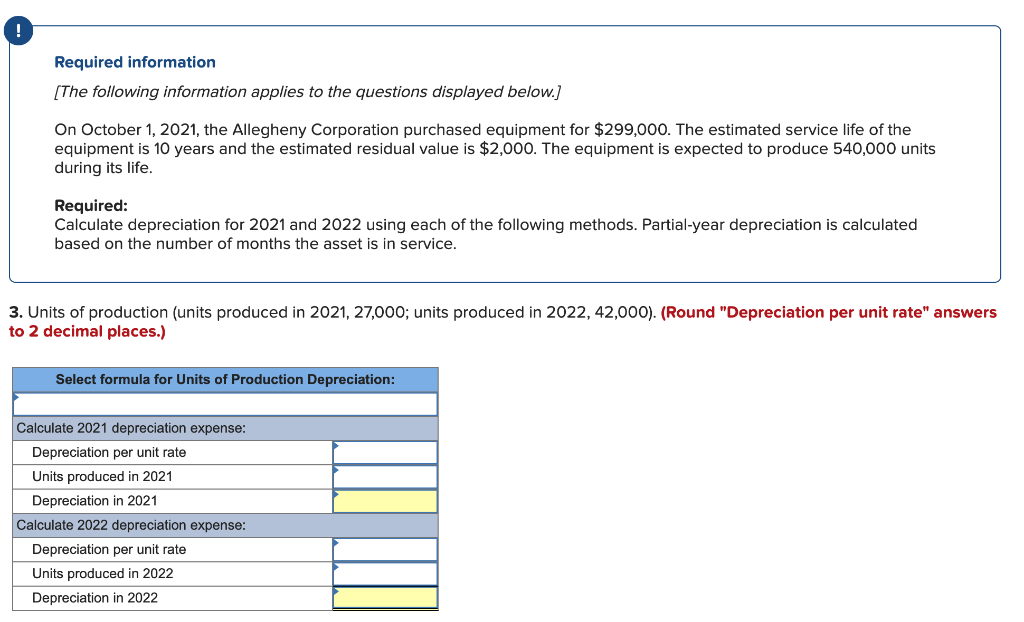

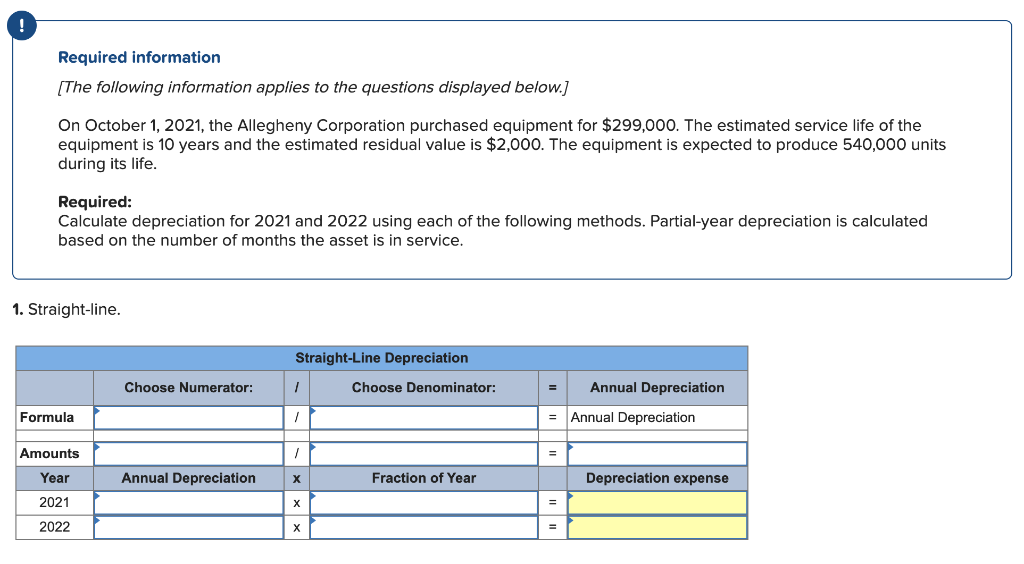

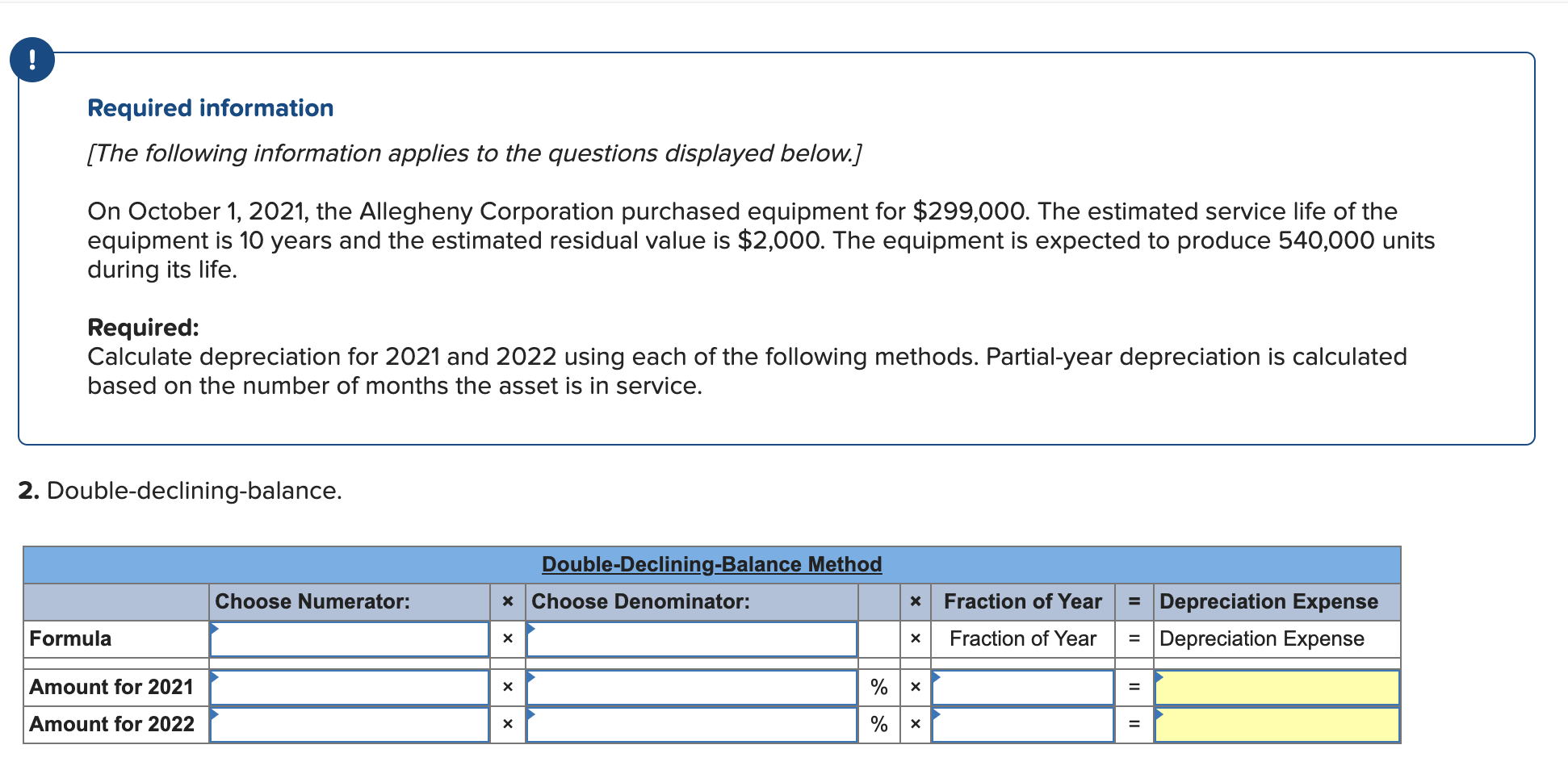

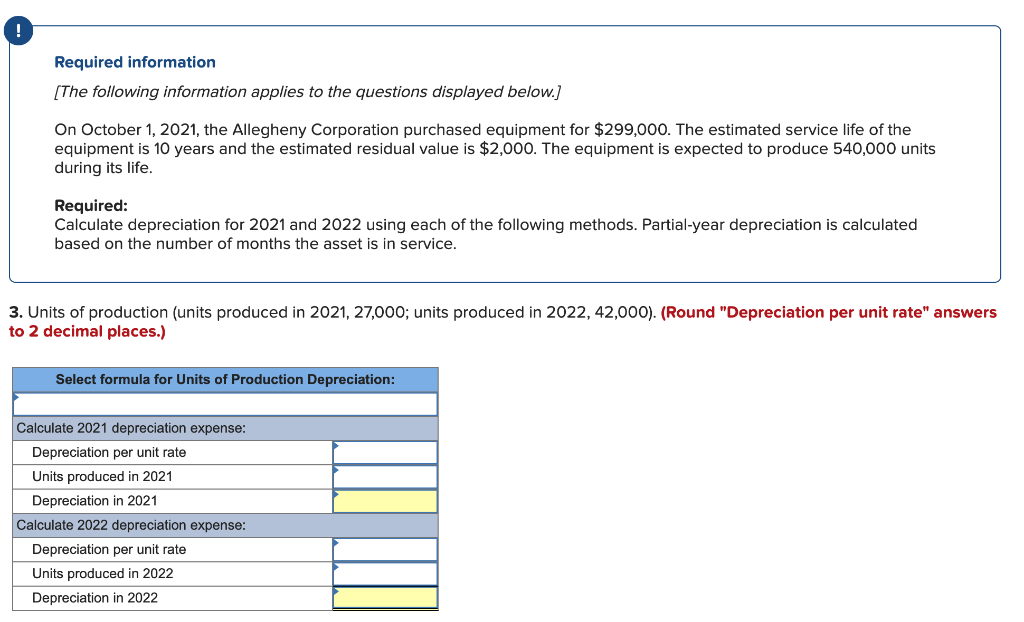

Required information (The following information applies to the questions displayed below.) On October 1, 2021, the Allegheny Corporation purchased equipment for $299,000. The estimated service life of the equipment is 10 years and the estimated residual value is $2,000. The equipment is expected to produce 540,000 units during its life. Required: Calculate depreciation for 2021 and 2022 using each of the following methods. Partial-year depreciation is calculated based on the number of months the asset is in service. 1. Straight-line. Straight-Line Depreciation Choose Numerator: 1 Choose Denominator: = Annual Depreciation Formula Annual Depreciation Amounts Year Annual Depreciation Fraction of Year Depreciation expense 2021 2022 ! Required information [The following information applies to the questions displayed below.] On October 1, 2021, the Allegheny Corporation purchased equipment for $299,000. The estimated service life of the equipment is 10 years and the estimated residual value is $2,000. The equipment is expected to produce 540,000 units during its life. Required: Calculate depreciation for 2021 and 2022 using each of the following methods. Partial-year depreciation is calculated based on the number of months the asset is in service. 2. Double-declining-balance. Double-Declining-Balance Method * Choose Denominator: Choose Numerator: X Fraction of Year = Depreciation Expense Depreciation Expense Formula x Fraction of Year = Amount for 2021 X % = Amount for 2022 X % Required information [The following information applies to the questions displayed below. On October 1, 2021, the Allegheny Corporation purchased equipment for $299,000. The estimated service life of the equipment is 10 years and the estimated residual value is $2,000. The equipment is expected to produce 540,000 units during its life. Required: Calculate depreciation for 2021 and 2022 using each of the following methods. Partial-year depreciation is calculated based on the number of months the asset is in service. 3. Units of production (units produced in 2021, 27,000; units produced in 2022, 42,000). (Round "Depreciation per unit rate" answers to 2 decimal places.) Select formula for Units of Production Depreciation: Calculate 2021 depreciation expense: Depreciation per unit rate Units produced in 2021 Depreciation in 2021 Calculate 2022 depreciation expense: Depreciation per unit rate Units produced in 2022 Depreciation in 2022